Prefilled Syringes Market Size, Share & Industry Analysis, By Material (Glass and Plastic), By Closing System (Staked Needle System, Luer Cone System, and Luer Lock Form System), By Product (Complete Syringe Set and Components & Accessories), By Application (Cancer, Rheumatoid Arthritis, Diabetes, and Others), By Design (Single-chamber, Double-chamber, and Multiple-chamber), By End-user (Pharmaceutical & Biotechnology Companies, Contract Research & Manufacturing Organizations, and Others), and Regional Forecast, 2026-2034

Prefilled Syringes Market Size

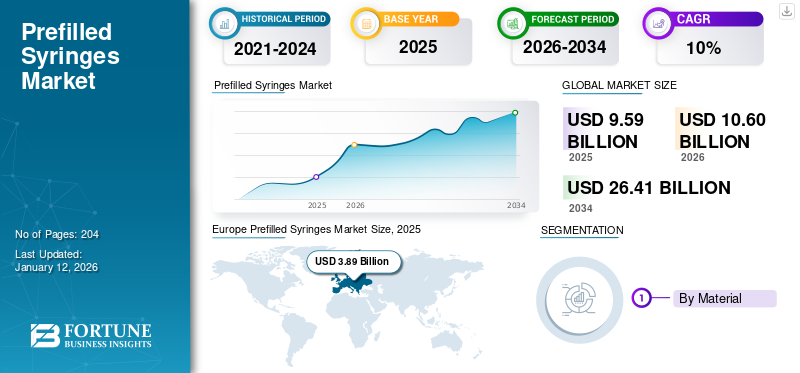

The global prefilled syringes market size was USD 9.59 billion in 2025. The market is projected to grow from USD 10.6 billion in 2026 to USD 26.41 billion by 2034, exhibiting a CAGR of 12.1% during the forecast period. Europe dominated the prefilled syringes market, holding a 40.6% market share in 2025.

A prefilled syringe is a container for drug delivery designed for drug administration on parenteral routes. There are several advantages associated with these syringes. For example, to reduce the likelihood of contamination, prevent loss of discharged drugs, remove drug discharge, and ensure rapid drug guarantees in emergencies or when it is easy to use. Due to the advantages mentioned above, pharmaceutical companies consider it one of the most effective means of providing a wide range of injectable drugs, including biological and non-biological data.

The burden of chronic conditions such as cancer, diabetes, etc., has been growing significantly. According to the International Agency for Research on Cancer (IARC), by 2040, the global burden of cancer is expected to grow to 27.5 million new cases. According to the American Autoimmune Related Diseases Association Inc. (AARDA), about 50 million Americans suffer from autoimmune disorders currently. The growing burden of chronic conditions has been fueling the demand for effective drugs with advanced administration devices for regular and convenient administration. This factor has been fueling the global prefilled syringes market growth.

BD, Gerresheimer AG, and SCHOTT Pharma are among the major market players focusing on partnership and collaboration to enhance their product offerings.

Global Prefilled Syringes Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 9.59 billion

- 2026 Market Size: USD 10.6 billion

- 2034 Forecast Market Size: USD 26.41 billion

- CAGR: 12.1% from 2026–2034

Market Share:

- Region: Europe dominated the market with a 40.6% share in 2025. This is due to the increasing number of patients using biologics for chronic diseases and the strong adoption of advanced, self-injection drug delivery methods in the region.

- By Application: Rheumatoid Arthritis held the largest market share in 2024. The segment's dominance is driven by the growing prevalence of the disease and an increasing focus from pharmaceutical companies on launching treatments for rheumatoid arthritis in prefilled syringe formats.

Key Country Highlights:

- Japan: As a key country in the fast-growing Asia Pacific region, Japan is seeing market growth due to a rising patient population, increasing usage of prefilled syringes, and a growing number of contract manufacturing organizations outsourcing their packaging and filling services.

- United States: The market is fueled by a high prevalence of autoimmune disorders, affecting about 50 million Americans, and a growing burden of chronic conditions. The U.S. FDA's approval of new biologic products in prefilled syringes, such as treatments for rheumatoid arthritis, is also a major growth driver.

- China: Growth is supported by a rapidly expanding patient population and a significant increase in contract manufacturing activities, including the launch of new drug facilities with the capacity to produce millions of prefilled syringes annually.

- Europe: The market is advanced by the presence of key players engaged in continuous innovation, such as the launch of prefilled syringes with integrated RFID technology in Germany to optimize hospital inventory management. The region's well-established healthcare systems also support the high adoption of these advanced drug delivery devices.

Market Dynamics

Market Drivers

Increasing Demand for Biologics, Biosimilars, and Vaccines to Influence the Market Growth

The growing preference for prefilled syringes for administering biologics and biosimilar products has been observed among healthcare providers and product development scientists owing to their advantages, such as improved convenience, dose accuracy, and self-administration. It also helps to save the costs associated with overfilling.

Moreover, growing research and development activities and an increasing number of new biologic product approvals in prefilled syringe form will likely drive the demand for prefilled syringes.

- In March 2025, ANI Pharmaceuticals, Inc. announced that the U.S. Food and Drug Administration (FDA) approved purified Cortrophin Gel in a prefilled syringe.

Therefore, the increasing demand for prefilled syringes due to the factors mentioned above is expected to fuel the market growth during the forecast period.

Growing Emphasis on Safety From Needlestick Injuries to Provide Favorable Conditions for the Growth of the Market

Healthcare providers such as nurses, doctors, operators, lab technicians, etc. suffer from needle stick injuries associated with the administration of dosage form through parenteral routes such as intravenous or subcutaneous.

This increases the risk of getting infected with life-threatening diseases such as human immunodeficiency virus (HIV) and other infectious diseases. Thus, exposure of healthcare practitioners to bloodborne pathogens causing infectious diseases as a result of injuries due to needle stick is a significant public health concern.

- For instance, as per the study published by the Dove Medical Press Ltd. in November 2023, in a tertiary care hospital located in Somalia, a country in East Africa, around 52.4% of the nurses, 22.3% of cleaners, 18.5% of physicians, 6.9% of the technicians suffered from needlesticks and sharps injury during the study period.

Therefore, growing emphasis on safety from needlestick injuries to healthcare providers is expected to drive the demand for prefilled syringes in the forecast period.

Market Restraints

Complex Manufacturing Process and Product Recalls to Hamper Market Growth

Prefilled syringes are becoming an increasingly attractive option for complex biotechnology products. However, various product recalls due to certain impurities or leakage in the syringes restrict the market growth during the forecast period.

- In May 2023, Sun Pharma recalled over 24,000 prefilled syringes of generic medication in the U.S. due to impurities found in these syringes.

- In July 2022, Nephron Pharmaceuticals Corporation, a U.S.-based company, recalled 20 prefilled syringes containing medicine such as ketamine, epinephrine, and oxytocin. The reason for the recall was a lack of assurance of sterility. Similarly, in March 2022, Adamis Pharmaceuticals Corporation announced the voluntary recall of SYMJEPI (epinephrine) Injection 0.15 mg (0.15 mg/0.3 mL) and 0.3 mg (0.3 mg/0.3 mL). SYMJEPI is a pre-filled single-dose syringe that witnesses clogging needles that obstructed the proper drug dispensing.

Thus, strict regulatory requirements, manufacturing complexity, and rising recall of these products are major restraining factors for the market's growth.

Market Opportunities

Increasing Focus of the Market Players on the Development of Technologically Advanced Products

Prefilled syringes are introduced into the market as an advanced delivery system for injectable drugs. Since its introduction, continuous improvement in syringe designs and component quality has been witnessed due to manufacturers' strong focus on developing user-friendly, advanced products.

- In January 2025, SCHOTT Pharma announced the launch of SCHOTT TOPPAC infuse polymer syringes, with an aim to improve safety, efficacy, and sustainability in healthcare.

Market players have been focusing on investing in the research and development of prefilled syringes to launch high-quality syringes with improved performance. This factor is expected to create huge market growth opportunities in the forecast period.

Market Challenges

Gaps in the Manufacturing Capacity are Expected to Act as a Challenge for the Market Growth

The difficulties small and mid-sized pharmaceutical companies face in securing a reliable, large-scale syringe production act as a challenge for market growth.

Regulatory and Inspection Barriers Limit the Market Growth

Stringent regulatory scenario causing delayed and expensive product launch processes also limits the development and launch of new products.

High Cost of Prefilled Syringes Limits Their Adoption among the Population

The high cost of these devices and the presence of alternative products are restricting their adoption, thereby challenging market growth.

Download Free sample to learn more about this report.

PREFILLED SYRINGES MARKET TRENDS

Shift from Glass to Polymeric Materials

The prefillable syringes market industry is experiencing a shift from glass to polymeric materials such as Cyclo-Olefin-Polymer (COP) due to the various advantages offered by COP, such as a high degree of break resistance, glass-like transparency, and very low oxygen permeation compared to other plastics.

Moreover, these polymers offer advantages such as high chemical stability and design flexibility.

Increased investments to develop more stable resins have been witnessed in the market over the last few years.

Surge in the Demand for Homecare Treatment Options

Increased focus on self-injection and home-based treatment is significantly expanding the use of these syringes for chronic disease management.

Increasing Demand for Dual Chamber Settings

Dual-chamber syringes are gaining popularity for lyophilized and combination drugs, particularly in North America and Europe.

Increasing Adoption of Advanced Technology for New Product Development

Advancements like glass-plastic hybrid barrels, smart safety caps, and temperature-resistant materials drive product innovation.

SEGMENTATION ANALYSIS

By Material

Advantages Associated with the Glass Syringes is Responsible for the Segment's Dominance

Based on material, the market is segmented into glass and plastic.

The glass segment is expected to acquire 75.84% of the market share in 2026. Glass has remained the preferred choice of many pharmaceutical drug manufacturers for biological products, as the property of the glass material prevents the interaction between drug compounds and water vapor & oxygen. Such advantages associated with the glass injections are responsible for the segment's growth.

The plastic segment is anticipated to grow with a CAGR of 11.5% during the forecast period due to key players developing plastic syringes and producing technological innovations offering advantages over glass syringes.

- For instance, in May 2022, ApiJect Systems, Corp. raised USD 111.0 million in a private investment round by Royalty Pharma and Jefferies Financial. The fund aimed to develop ApiJect's blow-fill-seal (BFS) plastic profiled injection system and other "general working capital" purposes.

By Closing System

Increasing Adoption of Staked Needle System During Medical Emergencies is Responsible for the Segment's Dominance

By the closing system, the market is segmented into the staked needle system, Luer lock form system, and Luer cone system.

The staked needle system is likely to capture 42.5% of the market share in 2024 and is expected to grow at the fastest CAGR during the forecast period. The growing adoption of staked needle systems by healthcare providers during medical emergencies, due to various benefits such as simplified steps for the user and fewer chances of error during the drug administration, is responsible for the segment's dominance.

The luer lock form system is expected to grow at the significant CAGR of 11.5% during the forecast period. These devices are vastly used for vaccine administration. Therefore, the increasing demand for vaccines with easy and safe administration is responsible for the segment's growth.

By Product

Increasing Demand for Complete Syringe Lead the Segment to Hold Lion's Share in Global Market

Based on product, the market is segmented into complete syringe set and components & accessories.

Among products, the complete syringe set segment captured a significant share of the market by 85.09% in 2026 owing to the growing demand for these products for effective drug delivery and rising demand for self-injectable delivery systems among patients.

- For instance, in January 2023, Wirthwein Medical launched a complete syringe set with prefillable plastic syringes with a Luer-lock connection.

The components & accessories segment is expected to witness moderate growth in the market in the forthcoming years. This is attributed to the lower demand among drug manufacturing companies for independent components for pre-filled injections compared to the complete set.

To know how our report can help streamline your business, Speak to Analyst

By Application

Rheumatoid Arthritis Led Due To Growing Prevelance Of The Disease

Based on application, the market is segmented into cancer, rheumatoid arthritis, diabetes, and others.

The rheumatoid arthritis segment is likely to hold 52.74% of the market share in 2026. The segment's dominance is attributed to the disease's growing prevalence and the increasing focus of pharmaceutical companies on launching drugs indicated for rheumatoid arthritis treatment in prefilled syringes.

Moreover, the cancer segment is expected to grow at the fastest CAGR of 11.7% during the forecast period. The segment's growth is attributed to the availability and rising awareness regarding cancer treatment through syringes of drugs such as pegfilgrastim or filgrastim, which help the body recover white blood cells after chemotherapy or stem cell transplant.

- For instance, Neulasta, a brand of Amgen Inc. and is available in a prefilled syringe used after chemotherapy to recover WBC.

By Design

Increasing Approval of Single Chamber Prefilled Syringes to Capture the Largest Market Share

Based on design, the market is segmented into single-chamber, double-chamber, and multiple-chamber. Among them, the single-chamber segment is projected to capture a significant share of 73.2% in the market and is likely to exhibit a significant CAGR during the forecast period.

- For instance, in September 2022, Otsuka Pharmaceutical Co., Ltd. and H. LUNDBECK A/S received the USFDA acceptance for NDA for Aripiprazole to treat Schizophrenia and Bipolar I Disorder in Adults. Aripiprazole is a long-acting injectable, provided in a single-chamber-type pre-filled syringe.

Moreover, the growing technological innovations and shifts in preference from single-chamber syringes to a double-chamber system are likely to enhance the demand for the double-chamber system during the forecast period. Double-chamber syringes are highly efficient for storing biological components that cannot retain their stability for a longer period. Also, the growing penetration of lyophilized drugs worldwide is likely to surge the demand for these syringes during the forecast period. The segment is expected to exhibit a CAGR of 10.4% during the forecast period.

By End-User

Growing Interest in Injectables is leading the Pharmaceutical & Biotechnology Companies Segment to Dominate the Market

Based on end-user, the market is categorized into pharmaceutical & biotechnology companies, contract research & manufacturing organizations, and others.

Among end user, the pharmaceutical & biotechnology companies segment is likely to capture a major share of 55.47% in the global market in 2026. The fast-expanding pharmaceutical companies across the globe are majorly engaged in biologics, vaccines, and biosimilars. These companies have increased their demand for new drug delivery systems, such as syringes, prescribed with a unit dose of medication for better patient compliance.

Moreover, the rising number of early-stage, along with government-funded biotech players are focusing on drug discovery and development, which is likely to boost the demand for syringes for the effective delivery of drugs. The rise in demand for innovative injectable drug delivery systems is expected to boost the pharmaceutical & biotechnology companies' segment growth during the forecast period.

The contract research & manufacturing organizations segment is likely to expand at a significant CAGR of 11.6% during the forecast period due to innovative technologies offering filling services.

Prefilled Syringes Market Regional Outlook

Geographically, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe

Europe Prefilled Syringes Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the global market and generated a revenue of USD 4.32 billion in 2026, and in 2025, the regional market value was USD 3.89 billion. The increasing number of patients using biologics as treatment options for chronic diseases and the strong adoption of advanced delivery methods for self-injection of drugs are the major factors likely to boost the demand in Europe. In addition, the presence of key players engaged in developing pre-fillable syringes in Europe is likely to boost market growth.

- In November 2022, Schreiner Group and SCHOTT Pharma launched a pre-filled syringe with RFID. This enabled optimized processes in hospital inventory management.

Moreover, the market in Germany is expected to grow significantly due to the country's increasing usage of biologics and favorable reimbursement models. The market size in U.K. is expected to be USD 0.45 billion in 2026. On the other hand, the Germany market size is estimated to be USD 1.22 billion in 2026 and France is likely to be USD 0.77 billion in 2025.

North America

North America is likely to hold the second-largest market share after Europe, owing to the rise in several chronic diseases, such as diabetes and rheumatoid arthritis, which is likely to enhance the demand for prolonged drug administration at an accurate dosage. The region is expected to hit USD 3.43 billion in 2025 as the second-largest market with a CAGR of 9.6% during the forecast period. Increasing product launches and the growing presence of leading players with strong distribution networks are likely to boost market growth in North America.

U.S.

U.S. dominated the North America market and generated a revenue of USD 3.03 billion in 2024. The market in the U.S. is expected to grow significantly during the forecast period. The growth is attributed to the improved healthcare infrastructure and increased healthcare spending of the population in the country. This combined with increasing preference towards self-administration of drugs through subcutaneous route among patient population is further propelling the demand for prefilled syringes. The U.S. market size is likely to be USD 3.86 billion in 2026.

Asia Pacific

The Asia Pacific prefilled syringes market is likely to be the third-largest market with a value of USD 1.62 billion in 2026 and witness a fast-paced growth during the forecast period, majorly owing to the increasing prevalence of chronic and lifestyle diseases, rising usage of these syringes, and rapidly growing patient population. Moreover, the rising awareness regarding innovations in these syringes and significant growth in contract manufacturing companies outsourcing packaging & filling services are likely to play a pivotal role in boosting the market growth in the region. The market in China is expected to be USD 0.50 billion in 2026, whereas India is likely to be USD 0.15 billion and Japan is projected to hit USD 0.55 billion in 2026.

Latin America and the Middle East & Africa

Latin America is likely to be the fourth-largest market with a value of USD 0.34 billion in 2026 and the Middle East & Africa regions are likely to experience slow growth in this market due to lower awareness about innovative products and slow market penetration. Saudi Arabia is expected to hit USD 0.13 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Strong Product Offerings by Key Players to Propel Market Growth

Becton Dickinson and Company (B.D.), Gerresheimer AG, SCHOTT AG, and West Pharmaceutical Services Inc. accounted for most of the global prefilled syringes market share in 2024. These players are likely to continue their dominance and generate significant revenue in the forthcoming years. Dominance is attributable to the robust research activities and continuous investments in innovative product development to launch a cost-effective and highly effective parenteral drug delivery system.

- For instance, in May 2023, SCHOTT AG launched pre-filled polymer syringes for deep-cold drugs with an aim to strengthen its product portfolio.

Moreover, a strong focus on strategic partnerships with other key market players is likely to support expanding their footprints in the global market. For instance, in May 2022, B.D. announced its collaboration with Mitsubishi Gas Chemical Company, to investigate the potential uses of Oxycapt technology developed by Mitsubishi Gas Chemical Company for the development of prefilled syringes.

LIST OF KEY MARKET PLAYERS PROFILED IN THIS REPORT

- BD (U.S.)

- SCHOTT Pharma (Germany)

- Gerresheimer AG (Germany)

- West Pharmaceutical Services, Inc. (U.S.)

- Nipro Group Companies (Japan)

- AptarGroup, Inc. (U.S.)

- Terumo Corporation (Japan)

- Ypsomed AG (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- December 2024: Gerresheimer AG announced the expansion of its production capacity in Skopje, North Macedonia, with a new production hall for syringes.

- September 2024: BD announced the capacity expansion of the Neopak Glass Prefillable Syringe platform to serve the growing market for biologic therapies.

- December 2022 – Fresenius Kabi AG received the U.S. FDA approval for biosimilar Idacio (adalimumab) for the treatment of chronic autoimmune diseases. The drug is available in a self-administered pre-filled syringe combined with a self-administered pre-filled pen.

- September 2022: BD launched a next-gen prefillable vaccine syringe for efficient vaccine delivery. This helped the company to increase its brand presence.

- June 2022: WuXi Biologics, a global contract research, development, and manufacturing organization (CRDMO), launched the operation of its new drug facility DP5 with an aim to manufacture 17 million units of pre-filled syringes each year.

REPORT COVERAGE

The global prefilled syringes market report provides detailed information regarding various insights into the market. Some of them are growth drivers, restraints, competitive landscape, regional analysis, and challenges. It further offers an analytical depiction of the market trends and estimations to illustrate the forthcoming investment opportunities. The market is quantitatively analyzed from 2019-2032 to provide the financial competency of the market. The information gathered in the report has been taken from several primary and secondary sources.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.1% from 2026-2034 |

|

Unit |

Value (USD billion) |

| Segmentation |

By Material

|

|

By Closing System

|

|

|

By Product

|

|

|

By Application

|

|

|

By Design

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 9.59 billion in 2025 to USD 26.41 billion by 2034.

In 2025, the Europe market stood at USD 1.48 billion.

Growing at a CAGR of 12.1%, the market will exhibit steady growth during the forecast period.

The glass segment is expected to be the leading segment by material in this market during the forecast period.

The rising prevalence of chronic disease diseases, increasing demand for biologics as treatment options, growing awareness of advanced products, and product launches are the key factors driving the growth of the market.

BD, Gerresheimer AG, SCHOTT AG, and West Pharmaceutical Services Inc. are the top players in the market

Europe dominated the market share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us