Female Sexual Dysfunction Treatment Market Size, Share & Industry Analysis, By Drug (Flibanserin, Bremelanotide, Ospemifene, Estrogen Therapy, and Others), By Disease (Hypoactive Sexual Desire Disorder (HSDD), Dyspareunia, and Others), By Route of Administration (Oral, Parenteral, and Topical), By Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies, and Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

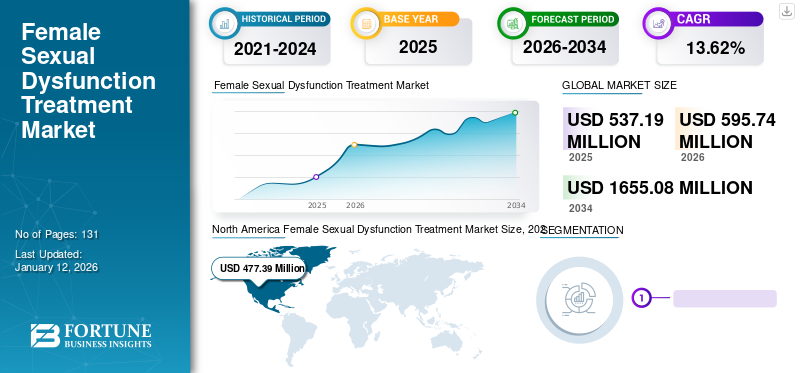

The global female sexual dysfunction treatment market size was valued at USD 537.19 million in 2025 and is projected to grow from USD 595.74 million in 2026 to USD 1,655.08 million by 2034, exhibiting a CAGR of 13.62% during the forecast period. North America dominated the female sexual dysfunction treatment market with a market share of 88.90% in 2025. Moreover, the U.S. female sexual dysfunction treatment market size is projected to grow significantly, reaching an estimated value of USD 782.3 million by 2032, driven by increase in investment in R&D for the development of new drugs.

Sexual dysfunction refers to persistent and recurrent problems with sexual response, desire, or pain associated with personal distress among females. Sexual dysfunction diseases, such as dyspareunia and female sexual arousal disorders, are evident among menopausal women globally owing to a decrease in circulating estrogen concentrations following menopause. Thus, hormonal changes, such as low levels of estrogen and changes in physiological attributes, such as age and depression, increase in the prevalence of sexual dysfunction among females. Moreover, the rising number of chronic disorders, such as cancer, diabetes, or cardiovascular disorders among women, increases the prevalence of these diseases, further boosting the female sexual dysfunction treatment adoption.

- According to data revealed by BioMed Central Ltd in 2021, community-based research estimated that 68% – 86.5% of post-menopausal women suffer from some form of sexual dysfunction, harming their physical and psychological health.

- According to an article published by Arch Endocrinol Metab in 2023, the prevalence of female sexual dysfunction is notably higher among women with different chronic conditions, such as diabetes mellitus (68%), hypertension (14% to 90%), and malignant diseases (78%).

Moreover, the rising incidence of gynaecological conditions, such as vulvovaginal atrophy infections, or vaginismus, and the surge in consumption of medications, such as antidepressants and anti-hypertensive drugs among post-menopausal women can lead to increased prevalence of sexual dysfunction, further augmenting demand for its diagnosis and treatment in the global market.

- For instance, according to the Journal of the North American Menopause Society in 2020, genitourinary syndrome of menopause (vulvovaginal atrophy) affects approximately 27.0% to 84.0% of post-menopausal women in the U.S.

Thus, a surge in the prevalence of sexual dysfunction disorders among menopausal women and the rise in the adoption of chronic medications will lead to an increase in the need for treatment medications and therapies, further propelling market growth.

Female Sexual Dysfunction Treatment Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 537.19 million

- 2026 Market Size: USD 595.74 million

- 2034 Forecast Market Size: USD 1,655.08 million

- CAGR: 13.62% from 2026–2034

Market Share:

- North America dominated the female sexual dysfunction treatment market, accounting for 88.90% of the global share in 2025. This dominance is largely driven by increasing awareness of women’s health issues, expanded access through telehealth platforms, and robust prescription rates for therapies such as Premarin and Imvexxy in the U.S.

- By drug type, Estrogen Therapy held the largest market share in 2024 due to high prescription rates for treating menopausal symptoms like dyspareunia. The topical and parenteral forms of estrogen therapy are favored for their localized effects, fewer systemic side effects, and widespread availability.

Key Country Highlights:

- Japan: Rising demand for advanced therapies like Imvexxy, approved by Health Canada, is mirrored in Japan’s increasing adoption of vaginal estrogen therapies, aligned with a growing elderly female population and gynecological care advancements.

- United States: Projected to reach USD 782.3 million by 2032, driven by strong R&D investments, growing use of telehealth services for women’s sexual health, and high awareness regarding hypoactive sexual desire disorder (HSDD) and dyspareunia.

- China: Market growth is influenced by a rising focus on post-menopausal health and gradual destigmatization of women’s sexual wellness, which is increasing diagnosis rates and boosting treatment adoption.

- Europe: Supported by regulatory initiatives such as EMA-backed trials (e.g., Freya Pharma’s Lybrido), as well as increasing investment in clinical development, particularly in countries like Germany, the U.K., and the Netherlands.

COVID-19 IMPACT

Decline in Prescriptions Amid COVID-19 Hindered the Market Growth

The COVID-19 pandemic had a substantial impact on this market in 2020. The impact was due to international lockdowns imposed by several governments that restricted or discouraged patients from visiting hospitals, clinics, and other health settings. Similarly, supply restrictions and low availability of pharmaceutical drugs across distribution channels further led to the decline of the market growth in 2020.

- According to data published by Therapeutics MD in 2020, the number of Imvexxy prescriptions by healthcare professionals decreased from 134,000 in the first quarter of the financial year 2020 to 123,300 in Q2 in the U.S.

- As per Amag Pharmaceuticals Inc.'s annual report in 2020, the sales of Intrarosa for the treatment of dyspareunia decreased from USD 21.4 million in 2019 to about USD 13.8 million in 2020, owing to low demand for the product globally.

However, post-COVID-19 pandemic, the resurgence of female patients to hospitals and specialty clinics for female sexual dysfunction treatment propelled the demand for medications in 2021.

Moreover, high strategic initiatives by industry players, such as expanded access to products through telehealth services and online and retail home distribution of medications, augmented the adoption of treatment among women. Moreover, players focus on the expansion of the geographical presence of novel drugs across new regions and commercial licensing of women's health products, further catered to the global market growth in 2020.

- For instance, in September 2020, Searchlight Pharma announced the initiation of commercial activities and the product availability of Addyi (flibanserin) in Canada for the treatment of hypoactive sexual desire disorder (HSDD) in premenopausal women.

Female Sexual Dysfunction Treatment Market Trends

High Focus Toward Hormonal Therapies to Treat Female Sexual Dysfunction Disorders Drive Market Expansion

The surge in the incidence of acute disorders, such as hypoactive sexual desire disorder, genito-pelvic penetration pain disorder (GPPPD), and vaginismus, has led to a rise in the adoption of local estrogen therapies (LET) in the form of conjugated estrogen creams, vaginal tablets, and others. Moreover, the number of hormonal therapies prescribed by healthcare professionals has increased among women owing to the potential increase in lubrication, blood flow, and sensation in vaginal tissues among sexually distressed patients under therapy.

Moreover, the key players in the market have witnessed an increase in sales of their estrogen product portfolio owing to high demand across developed countries, augmenting the growth globally.

- According to data revealed by TherapeuticsMD, Inc., in 2021, the revenue generated with Imvexxy sales in the U.S. increased from USD 27.1 million in 2020 to USD 31.5 million in 2021.

Similarly, potential advantages of the use of estrogen therapy among post-menopausal women, such as ease of administration, low cost, and easy availability across hospitals and retail pharmacies, have driven the adoption of these therapies for the treatment of female sexual dysfunction disorders across health settings.

Also, the rising focus of industry players toward gaining approvals from regulatory agencies for their products across other regions to boost their global presence aids in market growth.

- In February 2022, Duchesnay Inc. announced that Osphena received its regulatory approval from Heath Canada for the treatment of post-menopausal women suffering from vaginal dryness and painful intercourse.

Download Free sample to learn more about this report.

Female Sexual Dysfunction Treatment Market Growth Factors

Surge in Investments for R&D of New Drugs to Augment the Market Growth

The potential side effects associated with hormonal therapies, such as topical estrogen products and testosterone creams for the treatment of dyspareunia and vulvar atrophy, are high. This has led to the demand for new non-estrogen and non-hormonal therapies for female sexual dysfunction treatment across the healthcare settings.

To cater to this, the market players are now emphasizing on clinical trials and the development of new pharmacological treatment drugs in post-menopausal women that are highly potent and have limited adverse systemic events. Moreover, the rising focus of industry players on increasing their manufacturing capacity to boost their sales globally will drive market growth.

- In January 2021, Duchesnay Inc., a women’s health pharmaceutical company, announced a substantial investment of USD 3.0 million at its Blainville, Quebec plant. The addition of a blister packaging line to the production chain for its flagship products, including Osphena, will allow the company to increase its export capacity and optimize its product manufacturing.

Therefore, the surge in research and development by key players and rising government initiatives to introduce new treatment regimens is anticipated to cater to the market growth during the forecast period.

RESTRAINING FACTORS

Low Awareness of Sexual Disorders Among Females to Hamper the Market Growth

The incidence of sexual dysfunction disorders is increasing globally. However, it is a frequently overlooked disease in post-menopausal women. Moreover, the awareness related to sexual dysfunction diseases among women is low as compared to the male population globally.

- According to an investor presentation published by AMAG Pharmaceuticals, Inc., in 2020, about 95.0% of women in the U.S. were not aware of hypoactive sexual desire disorder and other related medical conditions.

Similarly, limited awareness related to hormonal and non-estrogen therapies, such as topical creams and oral drugs among young women, limits the adoption of therapies for these diseases, further hampering market growth. Also, the limited number of visits to healthcare centres for gynaecological disorders such as vulvovaginal atrophy and genital pain, among others, further restricts treatment adoption among women.

- According to research data published by Malaysian Family Physician 2022, among a cohort study of 263 females, the prevalence of female sexual dysfunction disorder among middle-aged women was 69.0%. However, their willingness to seek treatment and follow-up was much lower.

Female Sexual Dysfunction Treatment Market Segmentation Analysis

By Drug Analysis

High Adoption of Estrogen Therapies Among Post-Menopausal Women Propelled Estrogen Therapy Segment Growth

By drug, the market is segmented into flibanserin, bremelanotide, ospemifene, estrogen therapy, and others.

The estrogen therapy segment accounted for the largest market with a share of 59.36% in 2026. The dominance was attributed to the increase in the number of estrogen treatment prescriptions by healthcare professionals among women and the high adoption of this therapy among women for treatment for moderate to severe genitourinary symptoms of menopause.

On the other hand, the others segment is expected to register the highest CAGR during the forecast period. The rising emphasis of key players to expand and strengthen their product portfolio across other geographical regions and the increasing introduction of new non-hormonal therapies will augment the segment growth during 2025-2032.

- In March 2021, Endoceutics Inc. partnered with Lupin Pharma Canada for the commercialization of Intrarosa in Canada. Intrarosa is Endoceutic's flagship product indicated for the treatment of post-menopausal vulvovaginal atrophy.

To know how our report can help streamline your business, Speak to Analyst

By Disease Analysis

Increasing Prevalence of Dyspareunia Among Women to Augment Dyspareunia Segment Growth

Based on disease, the global female sexual dysfunction treatment market is segmented into hypoactive sexual desire disorder (HSDD), dyspareunia, and others.

The dyspareunia segment accounted for the highest share with an 90.81% in 2026. The share was attributed to the increasing prevalence of vulvar and vaginal atrophy leading to dyspareunia among women and the increasing number of clinical trials for the development of novel drugs by industry players for the treatment.

- According to data published by PLOS ONE in April 2023, the prevalence of dyspareunia ranges from 8.0% to 22.0% among women globally.

The hypoactive sexual desire disorder (HSDD) segment is projected to grow at a considerable CAGR during the forecast period. The growth is attributed to increasing awareness of sexual dysfunction disorders among females and rising incidence of psychological ailments such as depression and anxiety associated with low libido across the globe.

By Route of Administration Analysis

Potential Advantages of Parenteral Drug Administration Drives the Parenteral Segment Growth

Based on route of administration, the market is segmented into oral, parenteral, and topical.

The parenteral segment accounted for the highest market with a share of 70.70% in 2026. The highest share was owing to the high advantages of parenteral administration, such as the potential continuity of drug delivery, low systemic side effects, among others. The increasing presence of treatment drugs in the form of vaginal capsules, creams, gels, suppositories and rings in the global market, drives segment growth.

- In August 2020, Knight Therapeutics Inc. and TherapeuticsMD, Inc. announced the approval of IMVEXXY by Health Canada. IMVEXXY is an estradiol softgel vaginal capsule indicated for moderate to severe dyspareunia among post-menopausal women.

The topical segment is expected to grow at the highest market share during the forecast period. Factors such as the increasing shift toward topical administration compared to intravaginal medications among women. The increasing emphasis of key players on the development of novel drugs in the form of topical solutions for female sexual dysfunction treatment are anticipated to propel segment growth during the projected period.

- In March 2021, Daré Bioscience, Inc., and Strategic Science & Technologies, LLC (SST), a novel topical drug delivery company, announced the initiation of the Phase 2b RESPOND clinical study of sildenafil cream for the treatment of female sexual arousal disorder (FSAD).

By Distribution Channel Analysis

Increasing Number of Pharmacies Augmented Segmental Growth for Hospital Pharmacies Globally

By distribution channel, the global female sexual dysfunction treatment market is segmented into hospital pharmacies, drug stores & retail pharmacies, and online pharmacies.

The hospital pharmacies segment held a dominant the market with a share of 65.55% in 2026. The dominant share was owing to increasing hospital visits for the treatment of sexual disorders among women and the extensive availability of therapy drugs across a rising number of hospital pharmacies.

- According to NHS Business Services Authority (NHSBSA) statistics, in 2021, there were 11,600 active community pharmacies in the U.K., and 236 new pharmacies opened during 2020/21. Moreover, as per similar estimates, more than 1.03 billion prescription medicines were dispensed by these pharmacies in 2021.

The drug stores & retail pharmacies segment is anticipated to register growth with the highest CAGR during 2025-2032. Elements, such as the exclusive availability of newly launched medications across retail pharmacies and easy delivery of medications, are expected to bolster segmental growth.

- According to data revealed by Palatin Technologies, Inc., in 2020, vyleesi was only available through a specialty retail pharmacy called KnippeRx in the U.S.

REGIONAL INSIGHTS

Rise in Introduction of Advanced Therapies to Augment North America Market Share

Based on region, the market can be segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America

North America Female Sexual Dysfunction Treatment Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The North American market for sexual dysfunction treatment was valued at USD 477.39 million in 2025 and is anticipated to continue to dominate during the forecast period. The market expansion is driven by the rising adoption of therapies among women in the region. Moreover, the rising number of product licensing agreements among manufacturing players and rising approvals of therapies for new disease indications further boosted the North American market. The U.S. market is projected to reach USD 491.36 billion by 2026.

- In May 2020, Millicent Pharma Limited, a global pharmaceutical company, announced a definitive agreement to acquire the U.S. commercial rights to Intrarosa (prasterone) from AMAG Pharmaceuticals, Inc.

Europe

The European market for female sexual dysfunction treatment is the second most dominant region. It held a significant share due to the robust activities of existing market players toward R&D and clinical studies to develop and commercialize novel therapies among women. The UK market is projected to reach USD 21.86 billion by 2026, while the Germany market is projected to reach USD 15.52 billion by 2026.

- In March 2022, Freya Pharma Solutions received funding of USD 8.5 million from existing and new investors. The new funding will be used to carry out a pivotal phase 3 trial with its therapy Lybrido in 516 patients across Europe.

Asia Pacific

The rising prevalence of chronic diseases, such as vaginismus, among the population drives the market growth in the Asia Pacific region. The region is anticipated to exhibit the highest CAGR during the forecast period due to the increasing awareness of female sexual dysfunction treatment among health professionals across health settings, further propelling market growth. The Japan market is projected to reach USD 3.36 billion by 2026, the China market is projected to reach USD 2.89 billion by 2026, and the India market is projected to reach USD 1.41 billion by 2026.

- According to data published by the Indian Journal of Community Medicine in 2020, the prevalence of sexual dysfunction among women was around 35.0%, and approximately 23.0% had a sexual problem associated with personal or interpersonal distress in India.

Latin America & Middle East & Africa

The Latin American market is anticipated to grow at a considerable pace over the forecast period. The growth is due to the rising disease prevalence amongst the young women population and the rising product portfolio expansion of major players in the region.

The Middle East & Africa region is expected to grow at a moderate CAGR owing to the rising initiatives of regulatory authorities toward product approval for the treatment of female sexual dysfunction.

List of Key Female Sexual Dysfunction Treatment Market Companies

Strong Product Portfolios of Key Players to Boost Their Market Share

The market is consolidated with a few players, including Pfizer Inc., Duchesnay Pharmaceutical Group Inc., and Mayne Pharma Group Limited, accounting for a major share in 2022. Pfizer, Inc., is the leading player with the highest female sexual dysfunction treatment market share in 2022. The company's highest share is attributed to the strong sales of its Premarin product portfolio globally and the high number of Premarin prescriptions given by healthcare care professionals for the treatment of dyspareunia among female patients.

- For instance, according to an investor presentation by Therapeutics MD Inc., in 2020, about 80,000 prescriptions monthly were prescribed with Premarin vaginal cream by health professionals in the U.S.

Other players, including PALATIN, Sprout Pharmaceuticals, Inc., and Millicent Pharma Ltd. (Endoceutics, Inc.), are highly focused on clinical studies and partnerships with industry players to expand their geographical presence, which is expected to drive the growth of the market during the forecast period.

- In August 2023, PALATIN announced a strategic partnership with UpScriptHealth, providing telemedicine services to pharmaceutical and medical technology companies. This agreement will make Vyleesi available to patients through the women's telehealth platform.

LIST OF KEY COMPANIES PROFILED:

- Sprout Pharmaceuticals, Inc. (U.S.)

- Mayne Pharma Group Limited (Australia)

- Duchesnay Pharmaceutical Group Inc. (Canada)

- PALATIN (U.S.)

- Freya Pharma Solutions B.V. (Netherlands)

- Acerus Pharmaceuticals Corporation (Canada)

- Millicent Pharma Ltd. (Endoceutics, Inc.) (Ireland)

- Pfizer Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2023: Mayne Pharma Group Limited announced the completion of the exclusive product licensing transaction with TherapeuticsMD, Inc. Under the exclusive license agreement, Mayne Pharma Group Limited has secured a portfolio of three patent-protected novel women’s health products, including IMVEXXY.

- September 2022: Freya Pharma Solutions received early European Medicines Agency (EMA) scientific advice on its upcoming phase 3 clinical trial to confirm the efficacy of Lybrido in women suffering from FSIAD.

- February 2022: Duchesnay USA Inc. announced the approval of Osphena (ospemifene tablets) from Health Canada as a once-daily prescription treatment who are suffering from vaginal dryness and painful intercourse.

- June 2020: Lawley Pharmaceuticals Pty Ltd., and Tanner Pharma Group announced that they have initiated a global named patient program for AndroFeme 1 testosterone cream for women. The company had appointed Tanner Pharma Group as its exclusive provider in countries outside of Australia, Japan, South Africa, the U.K., and Ireland, where AndroFeme 1 is not commercially available.

- May 2020: Millicent Pharma Limited, a company formed by the Millicent Pharma management team and The Carlyle Group, announced a definitive agreement to acquire the U.S. commercial rights to Intrarosa (prasterone) from AMAG Pharmaceuticals, Inc.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on crucial aspects such as leading players, drug types, and major indications of female sexual dysfunction treatment. Additionally, it offers insights into market trends, key industry developments such as mergers, partnerships, acquisitions, and the impact of COVID-19 on the market. In addition to the factors mentioned above, the report includes the factors that have contributed to the market growth in recent years with a regional analysis of different segments.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Growth Rate |

CAGR of 13.62% from 2026-2034 |

|

Segmentation |

By Drug

|

|

By Disease

|

|

|

By Route of Administration

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size is projected to grow from USD 595.74 million in 2026 to USD 1,655.08 million by 2034.

Registering a CAGR of 13.62%, the market will exhibit steady growth over the forecast period (2026-2034).

By drug, the estrogen therapy segment was the leading segment in the market.

The rising prevalence of female sexual disorders and the increasing launch of advanced female sexual dysfunction treatments by market players across the globe are the key factors driving the market growth.

Pfizer Inc., Duchesnay Pharmaceutical Group Inc., and Mayne Pharma Group Limited are major players in the global market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us