Flocculants Market Size, Share & Industry Analysis, By Type (Natural, Organic, and Inorganic), By End-use Industry (Water & Wastewater Treatment, Oil & Gas, Mining, Pulp & Paper, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

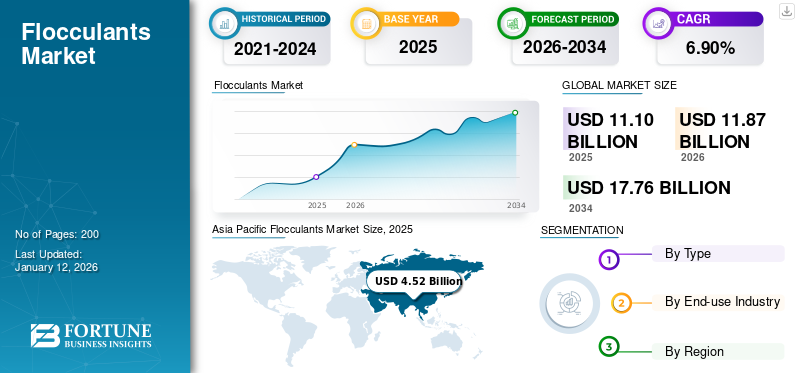

The global flocculants market size was valued at USD 11.1 billion in 2025 and is projected to grow from USD 11.87

billion in 2026 to USD 17.76 billion by 2034, exhibiting a CAGR of 6.90% % during the forecast period. Asia Pacific dominated the flocculants market with a market share of 41% in 2025.

Flocculants are water clarifying agents used to remove suspended solids, pollutants, and organic loads from water. They help expedite the coagulation process, improve sedimentation and maintain the quality of fresh water. Flocculants are mainly used in sewage treatment, water treatment plants, and purification of drinking water. They are also used in civil engineering and biotechnological applications and by breweries and cheesemakers.

The product plays a crucial role in water treatment, mining, and other industries. The need for effective solid-liquid separation drives the demand for flocculants. Factors such as population growth and industrial activities further contribute to market growth. The market’s expansion can also be attributed to the increasing environmental concerns, stringent regulations, and the rising need for water purification.

COVID-19 IMPACT

Temporary Shutdown of Mining & Other Industrial Activities Led To Sudden Decline in Product Demand Affecting Market Growth

The market observed slow growth in 2020 due to the COVID-19 pandemic. The pandemic significantly impacted the market, causing both short-term disruption and long-term shifts in demand. Moreover, the restriction imposed during the lockdown led to a temporary shutdown of industrial activities, affecting sectors such as mining, water treatment and oil & gas, which are key product consumers. This resulted in a sudden decline in demand for these chemicals during the initial phases of the pandemic. Furthermore, the supply chain disruptions and transportation restrictions hampered the procurement of raw materials, affecting production capacities and increasing prices.

Global Flocculants Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 11.1 billion

- 2026 Market Size: USD 11.87 billion

- 2034 Forecast Market Size: USD 17.76 billion

- CAGR: 6.90% from 2026–2034

Market Share:

- Asia Pacific dominated the flocculants market with a 40% share in 2025, driven by rapid industrialization, growing population, and increased demand for clean water and wastewater treatment across China, India, and Southeast Asia.

- By type, the natural segment held the largest market share in 2024, fueled by the rising use of chitosan and starch-based products in diverse industries such as municipal water treatment and textiles.

Key Country Highlights:

- China & India: Rapid industrial growth and urban population expansion are significantly increasing water treatment needs, propelling demand for flocculants across both municipal and industrial sectors.

- United States: Stringent environmental regulations and municipal water quality standards are driving widespread adoption of flocculants in industrial and public water treatment applications.

- Brazil & Argentina: Industrialization and environmental compliance efforts are accelerating the demand for cost-effective wastewater treatment chemicals, particularly in the manufacturing and mining sectors.

- Middle East: As a key hub for oil & gas activities, the region relies heavily on flocculants for treating produced water and improving separation processes, especially in upstream operations.

Flocculants Market Trends

Adoption of Digital Technologies and Automation in Water Treatment Processes

The adoption of digital technologies and automation is significantly influencing the market, particularly in water treatment processes. This integration of technology aims to enhance operational efficiency, optimize resource utilization, and improve overall system performance. Moreover, smart monitoring systems play a crucial role in water treatment plants. These systems continuously collect and analyze real-time data related to water quality, flow rates, and other relevant parameters. This data-driven approach allows for precise control over flocculants dosages, ensuring optimal treatment outcomes. In addition, automation technologies are employed to control and regulate the dosages of the product automatically. This eliminates the need for manual intervention and ensures that the right amount of flocculants is added at the precise moment, improving the overall effectiveness of the treatment process and fueling the flocculants market growth.

Download Free sample to learn more about this report.

Flocculants Market Growth Factors

Rising Number of Industrial Activities Propels the Product Demand, Driving Market Growth

The rising number of industrial activities plays a pivotal role in propelling the demand for flocculants, which are essential chemicals widely used in water treatment processes. As industries expand globally, particularly in sectors such as manufacturing, mining and oil & gas, the generation of wastewater increases significantly. This surge in wastewater, containing various colloids and other suspended particles, necessitates effective treatment methods to meet environmental regulations and sustainability goals. Moreover, many industrial processes produce wastewater that contains pollutants, including heavy metals, chemicals and solid particles. The usage of the product allows the aggregate and formation of larger particles, facilitating their separation from water. This results in clearer water that can be further reused, propelling the demand for the product in industrial processes.

RESTRAINING FACTORS

Availability of Alternatives Reduce the Overall Demand for the Product, Hampering Market Growth

The availability of alternatives for the product significantly impacts the market's growth. Water treatment processes offer various chemical and non-chemical alternatives, influencing the choices made by industries. Coagulants, disinfectants and advanced filtration technologies emerge as notable substitutes for the product, catering to specific water treatment needs. While coagulants work alongside the product in certain cases, offering an alternative path for solid-liquid separation, disinfectants play a role in microbial control. Advanced filtration technologies provide alternative methods for removing impurities without relying on traditional flocculation, hindering market growth.

Flocculants Market Segmentation Analysis

By Type Analysis

Natural Segment Held the Largest Share Owing to Varied Applications

Based on type, the market is segregated into natural, organic, and inorganic.

The natural segment held the major flocculants market share in 2025. It is also the fastest-growing segment in the market. Natural products find diverse applications in the market, playing a crucial role in water treatment processes across various industries. Chitosan, derived from chitin, is used in municipal water treatment to coagulate and flocculate suspended particles and organic matter effectively. Furthermore, starch-based products are utilized in the textile industry for wastewater treatment, aiding in the removal of dyes and suspended solids.

In organic products, polyacrylamides are extensively used in municipal and industrial wastewater treatment to enhance flocculation and sedimentation processes for removing impurities, propelling segment growth.

By End-use Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Water & Wastewater Treatment Segment Dominated Due to Increase Product Usage in Municipal Sewage Treatment

Based on end-user, the market is segmented into water & wastewater treatment, oil & gas, mining, pulp & paper, and others.

The water & wastewater treatment segment is projected to dominate the market with a share of 34.54% in 2026, as industries prioritize efficient solutions to address water pollution and ensure compliance with environmental standards. In municipal wastewater treatment, the product aids in coagulation and settling large suspended particles and solids, facilitating their separation from water. Furthermore, flocculants are leveraged in the textile industry to treat wastewater generated during dyeing and finishing. They help in the removal of colorants and suspended solids, improving the quality of discharged water and propelling the demand for the product in the wastewater management system.

In addition, oil & gas is a significant consumer of flocculants, utilizing these chemicals in various applications to address water treatment challenges associated with exploration, production, refining, and wastewater management. Polyacrylamides (PMAs) are employed to enhance solid-liquid separation in drilling mud, ensuring proper fluid properties and reducing environmental impact.

The pulp & paper industry relies on the product for various water treatment applications. Polyacrylamides are specially used to treat pulp and paper mill wastewater.

FLOCCULANTS MARKET REGIONAL INSIGHTS

By region, the market is divided into the Asia Pacific, Europe, the Middle East & Africa, Latin America, and North America.

Asia Pacific Flocculants Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific registered the largest share of 39.4% in the global market in 2024 and is the fastest-growing region globally. Rapid industrialization in China, India, and Southeast Asia has increased water treatment needs. Moreover, the region's rising population has bolstered the demand for clean water and efficient wastewater treatment. Flocculants aid in separating colloids and other suspended particles, making them essential for water treatment solutions. In addition, the growing emphasis on sustainable and eco-friendly solutions has led to the development of bio-based products, aligning with the Asia Pacific’s environmental priorities. As industries strive for cost-effective and high-performance solutions, the product plays a crucial role in optimizing processes, fueling this region's market growth. The Japan market is projected to reach USD 0.72 billion by 2026, the China market is projected to reach USD 1.78 billion by 2026, and the India market is projected to reach USD 1.01 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America accounted for a significant share of the market in 2024. The water treatment sector primarily propels the robust demand for the product in North America. Municipalities and industries utilize flocculants to remove impurities and suspended particles from water, ensuring compliance with environmental regulations and maintaining water quality standards. Furthermore, the region's stringent environmental regulations play a pivotal role in driving the market growth. The U.S. market is projected to reach USD 2.85 billion by 2026.

Europe

The UK market is projected to reach USD 0.32 billion by 2026, while the Germany market is projected to reach USD 0.39 billion by 2026.

The market is predicted to develop significantly in Latin America during the projected period. Brazil is one of Latin America's most important economies. With the growing industrialization in Brazil and Argentina, there is an increasing need for efficient and cost-effective wastewater treatment solutions, driving the demand for flocculants in this region.

The Middle East & Africa is a major region in the global oil & gas industry. Flocculants find extensive use in treating produced water, enhancing the efficiency of separation processes, which propels their demand in the region.

KEY INDUSTRY PLAYERS

Major Players Are Engaged in Expansion and Research & Development of New Products to Gain a Competitive Edge

The producers in North America and Europe are emphasizing boosting their presence in different nations to strengthen their position in the market and drive their growth. Therefore, a robust regional presence, product offerings, and distribution channels have been developed by leading companies.

Prominent companies are involved in research and development to create superior quality and provide enhanced features. Furthermore, strategic partnerships are being promoted by market players for the improvement of their R&D efforts. In addition, businesses greatly focus on bolstering the service area to increase the market share and accelerate the company's revenues.

List of Top Flocculants Companies:

- Kemira (Finland)

- SOLVAY (Belgium)

- BASF SE (Germany)

- Arkema S.A.(France)

- Feralco AB (Italy)

- Solenis (U.S.)

- Ecolab (U.S.)

- TOAGOSEI CO., LTD. (Japan)

- CHINAFLOC (China)

- KEMSTAR PROCESS SOLUTIONS (India)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: Kemira announced the expansion of its ferric sulfate water treatment chemicals production line in Goole, U.K. The company will expand its capacity to 70000 tons, which will help meet the growing demand for coagulants. Moreover, the new capacity will be operational in 2025.

- October 2023: Solvay announced a reduction in the production capacity of its Torrelavega plant by 300 kilotons per annum. This site will focus on its energy transition plan to provide its local customers with a reduced environmental footprint.

- May 2023: Derypol has invested USD 1.08 million in the installation of a new reactor at their Les Franqueses facilities to expand the production of flocculants. This new reactor will come into service in January 2024 and will help the company to produce more than 5,000 tons of flocculants per year.

- February 2020: BASF SE aimed to introduce sustainable water management at all relevant production sites. These include the company’s Verbund sites and sites in water stress areas.

- April 2019: BASF SE has expanded its production capacity of polyacrylamide powder by 20,000 metric tons per year at its wholly-owned site in Nanjing, China. These anionic polyacrylamide products are used as flocculants in mining and oilfield industries.

REPORT COVERAGE

The research report provides both qualitative and quantitative insights on the product worldwide. Quantitative insights include market sizing in terms of value (USD Billion) across each segment, sub-segment, and region profiled in the scope of study. In addition, it provides market analysis and growth rates of segments, sub-segments, and key counties across each region. On the other hand, qualitative insight covers the elaborative analysis of key market drivers, restraints, growth opportunities, and industry trends related to the market. The competitive landscape section covers detailed company profiling of the key players operating in the industry.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.90% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 11.1 billion in 2025 and is projected to reach USD 17.76 billion by 2034.

Growing at a CAGR of 6.90%, the market is expected to exhibit speedy growth during the forecast period.

By type, the natural segment led the market in 2025.

The strict regulations related to the discharge and disposal of industrial wastewater are anticipated to drive market growth.

Asia Pacific dominated the market by holding the largest share in 2025.

Kemira, SOLVAY, BASF SE, Arkema S.A. and Dow are a few of the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us