Flooring Market Size, Share & Industry Analysis, By Type (Non-Resilient {Ceramic, Wood, Laminate, and Other Non-resilient Flooring}, Resilient {Vinyl (Luxury Vinyl Tiles (LVT), Vinyl Composite Tiles (VCT), Vinyl Sheet Flooring), Rubber, Linoleum, Cork}, and Carpets & Rugs, {Tufted, Woven, and Others}), By End-use (Residential, Commercial, and Industrial), and Regional Forecast, 2026-2034

Flooring Market Size & Competitive Intelligence

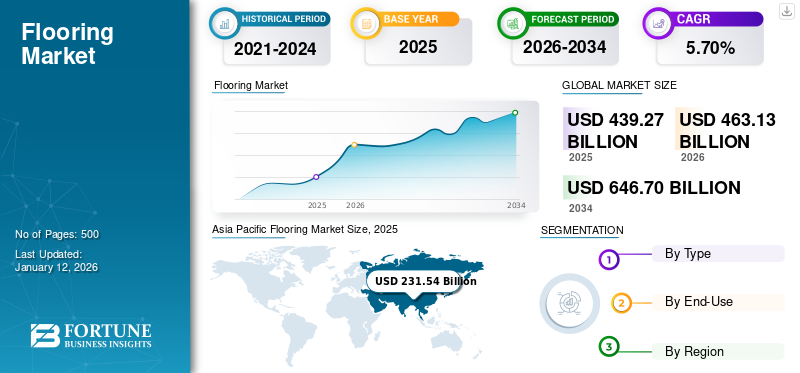

The global flooring market size is projected to grow from USD 463.13 billion in 2026 to USD 646.7 billion by 2034, exhibiting a CAGR of 5.70%. In 2025, the market was valued at USD 439.27 billion. Asia Pacific dominated the flooring market with a market share of 53% in 2025. Moreover, the flooring market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 39.25 billion by 2032.

Flooring is a finishing material applied over a floor or subfloor structure to provide a walking surface. These products offer properties such as resistance to dents, scratches, and moisture, and are easy to clean. Majorly used products include ceramic tiles, carpets, vinyl tiles, and laminates, as they provide a smooth, hard, clean, and attractive surface to the floors. These benefits lead consumers to use floor products while renovating existing and developing new residential and non-residential buildings. Increasing new construction facilities and the surging demand for residential buildings, healthcare facilities, and commercial amenities drive market growth.

The COVID-19 pandemic severely impacted the construction industry globally, disrupting the market. Government restrictions on the transportation of materials caused a shortage of raw flooring materials. However, government investments to construct and enhance medical infrastructure served as the key trend for market recovery after the pandemic.

Global Flooring Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 439.27 billion

- 2026 Market Size: USD 463.13 billion

- 2034 Forecast Market Size: USD 646.7 billion

- CAGR: 5.70% from 2026–2034

Market Share:

- Asia Pacific dominated the flooring market with a 53% share in 2025, driven by rapid urbanization, industrialization, and rising investments in construction across China, India, and Southeast Asia.

- In the United States, the flooring market is projected to reach USD 39.25 billion by 2032, supported by demand for luxury housing, renovation activities, and advanced flooring materials.

Regional Insights:

- Asia Pacific: USD 231.54 billion in 2025; Led by China and India; high demand from infrastructure and residential construction

- North America: Rising home renovation and interior design investments; growing healthcare construction

- Europe: Growth from luxury living spaces; vinyl and ceramics adoption

- South America: Increasing remodeling activities in multi-story housing

- Middle East & Africa: Boosted by government-funded education, healthcare, and recreation projects

Flooring Market Trends

Manufacturing of Sustainable Products to Present Lucrative Opportunities

Sustainable products produced from recycled materials are emerging trends in the market. For instance, the demand for recycled and natural carpets has increased over time owing to the product’s cost-effectiveness and support of the green manufacturing initiatives implemented by the governments of the U.S. and the U.K. On the other hand, manufacturers of Luxury Vinyl Tiles (LVT), a vinyl sheet covering for the floors, Vinyl Composite Tiles (VCT), and rubber focus on reducing the Volatile Organic Compounds (VOC) content in the product. The VOCs contaminate the indoor environment, distressing human health. Hence, decreasing VOC content would raise the product’s sustainability. For instance, in November 2022, Tarkett S.A. introduced its renowned Johnsonite brand of products. The brand's adherence to product circularity, stringent material health, climate requirements, renewable energy, water stewardship, and social fairness criteria provides a competitive advantage to the company.

Moreover, using the latest technology, companies may create new systems and processes to reuse product waste. Manufacturing products from waste will augment the company’s profitability and also benefit the environment. Further, increasing consumer preference for sustainable products will surge the market growth.

Increasing Advancement in the Luxury Vinyl Tile and Waterproof Flooring Development to Propel Market Growth

The major key trends influencing market growth are development and innovation in luxury vinyl tile and waterproofing flooring. The rising advancement in manufacturing processes has led to the creation of LVT products. Such innovation closely mimics the appearance of natural materials, such as wood and stone, while offering enhanced durability and affordability. The rise of waterproof flooring options, driven by consumer demand for moisture-resistant solutions, has revolutionized the market, particularly in areas prone to water exposure, such as bathrooms and kitchens. This technological innovation has expanded the range of available flooring options. As a result, providing consumers with greater flexibility and choices to suit their specific needs and preferences.

Design trends and lifestyle influences are crucial in shaping the overall market. The minimalist and Scandinavian design, characterized by clean lines, light colors, and natural materials, has influenced flooring choices. Moreover, the increasing integration of smart home technology has further led to the emergence of smart flooring solutions embedded with sensors, heating elements, and connecting features. These innovative products cater to the growing demand for enhanced comfort, convenience, and energy efficiency in modern living spaces. Hence, such innovation will increase market growth in the coming years.

Download Free sample to learn more about this report.

Flooring Market Growth Factors

Rapid Increase in Building & Construction Industry is Anticipated to Drive Market Growth

The rising global population is surging the demand for residential and non-residential construction. During the initial stages of 2023, the global population crossed eight billion, expected to double by the end of 2050. The rising urbanization and population have created enormous opportunities for the construction industry. This has increased demand for floor tiles, hardwood floors, and carpets & rugs owing to their wide use in construction structures. These products are used based on their requirements. For instance, hardwood floors are preferred in residential buildings as they deliver the utmost strength, a decorative touch, and a long life span.

People in developing countries, such as China, India, and other ASEAN countries, have substantially improved their living standards and house purchasing power. Over the past few decades, these aspects have driven the demand for modern surface coverings, including carpets and rugs. Enhanced spending and the untapped regional construction industry will lead to the initiation of new construction and infrastructure projects during the forecast period.

Additionally, emerging economies in Asia Pacific are home to around 60% of the global population, and governments are taking initiatives to provide affordable housing. For instance, the Government of India runs Pradhan Mantri Awas Yojana (Rural) and Pradhan Mantri Awas Yojana (Urban) to provide reasonably priced housing to people experiencing poverty in rural areas & urban areas, respectively.

Growing Requirement for Aesthetics in Buildings Presenting Significant Demand for Flooring

The global population is increasing rapidly, creating substantial demand for housing facilities. When constructing or purchasing a prebuilt home, the consumer focuses on the interior and aesthetic design. As a result, several manufacturers incorporate suitable aesthetic surface solutions and maintain the house's interior, following the specifications about impact resistance, durability, and strength. Moreover, several consumers prefer visual and touch aesthetics while purchasing their products. These factors are anticipated to increase consumer investment in aesthetically superior products and drive the market's growth.

RESTRAINING FACTORS

Volatility in Raw Material Prices and Concerns Associated with Waste Management of the Product to Limit Market Growth

Fluctuations in the raw material prices may restrict the market's growth by affecting the manufacturer's profitability. Raw materials, such as fibers, vinyl, resins, and fiber composites, are primarily utilized in surface-covering products. Thus, increasing raw material prices result in rising production costs and raise the price of the finished products. Hence, higher prices of the raw materials & finished products ultimately affect the demand for the floor covering. Moreover, the price volatility and declining availability of petroleum-based raw materials used in manufacturing certain products, such as vinyl surfaces for the floors, are anticipated to impact market growth. For instance, carpets and rugs are manufactured using crude oil-based raw materials, including nylon, polyester, latex, synthetic backing materials, various dyes, and chemicals. Hence, the volatility in crude oil prices is anticipated to limit market growth.

Flooring Market Segmentation Analysis

By Type Analysis

Non-Resilient Segment to Dominate Due to Surging Need for Easy-to-Install Floor Coverings

By type, the market is segregated into non-resilient, resilient, and carpets & rugs. The non-resilient segment is further segmented into ceramic, wood, laminate, and others. Similarly, the resilient flooring segment is sub-segmented into vinyl, rubber, linoleum, and cork. Also, the carpets & rugs segment is further classified into tufted, woven, and others.

The non-resilient segment accounted for the largest flooring market share of 55.46% in 2026, with the ceramic sub-segment being the most significant type. Ceramic tiles have a distant protecting layer on their surface, impervious to spreading pigment and water damage. They also provide a harder surface, no allergy concerns, easy maintenance, and durability. These properties surge their use mainly on residential floors. Laminate is a low-investment floor alternative, replicating wood and stone floors. The segment growth is attributed to the rising need for easy-to-install floor coverings.

In the resilient segment, vinyl is anticipated to drive the market owing to its moisture-resistant qualities and durability. Luxury vinyl tiles are ideal in residential and commercial buildings.

The tufted subsegment is the leading type in the carpets and rugs segment. Tufted carpets are widely used for wall-to-wall carpeting and are ideal for rooms with heavy furniture.

By End-Use Analysis

Residential Segment to Hold Dominant Share Owing to Rising Residential Expansion

By end-use, the market is segmented into residential, commercial, and industrial.

The residential segment led the global market contributing 60.32% globally in 2026. The segment’s expansion is driven by the increasing disposable income of consumers and the rising population. The surging preference for renovation solutions to enhance the overall building appearance is expected to boost floor product demand from the residential flooring industry. Hence, rising residential buildings will fuel the flooring market growth.

The commercial segment is expected to grow significantly, owing to the swiftly growing need for commercial buildings, including offices, hospitals, and institutes. Additionally, the increasing demand for seamless floorings, such as epoxy, polished concrete, and polyurethane from industrial and commercial workspaces will boost market growth.

The industrial segment is expected to grow considerably due to stringent safety regulations set by various government organizations. The industries are expected to follow guidelines to prevent accidents and mishaps on-site. For instance, the Occupational Safety and Health Administration (OSHA) has regulations for industrial floor safety to avoid hazards such as trips, falls, and slips. These regulations are outlined in standard 1910.22, which covers general requirements for walking and working surfaces at workplaces.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Based on geography, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific Flooring Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific recorded USD 85.12 billion in annual revenue during 2025 and will continue to be the largest and fastest-growing region in the market. The market’s growth in the region is driven by surging planned investments, rapid industrialization, and structured policies for construction activities in China, India, and Southeast Asia. China is the leading country in the market and is expected to record higher growth. The increasing population and need for infrastructure and new residential buildings are the key factors driving market growth in China. The Japan market data is not available for 2026. The China market is projected to reach USD 149.13 billion by 2026. The India market is expected to reach USD 24.15 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe will witness significant growth during the review period owing to the growing use of vinyl and ceramics in non-residential buildings. Additionally, rising consumer preference and expenditure toward luxurious living spaces would drive growth in this region. The UK market is expected to reach USD 7.98 billion by 2026. The Germany market is anticipated to reach USD 14.06 billion by 2026.

North America

The rising demand for healthcare facilities, luxurious houses, and commercial buildings drives north America’s market growth. Rising consumer expenditures on interior design to improve the aesthetics of residential spaces will also increase product demand in the region. Moreover, growing renovation and construction repair activities in the U.S. are anticipated to grow steadily, further driving the market during the forecast period. The U.S. market is projected to reach USD 30.79 billion by 2026.

South America

In South America, the market is expected to grow significantly due to increasing renovation and remodeling activities in private and multi-story houses to change the appearance and structure of buildings.

Middle East & Africa

The Middle East & Africa market is expected to rise considerably during the forecast period due to the increasing product demand from ongoing construction projects. The increasing government investments in building schools, institutes, public recreational spaces, and hospital facilities will drive product adoption in the region.

KEY INDUSTRY PLAYERS

Key Players Adopted Product Innovation Strategy to Maintain Their Market Position Drives Market Growth

The market is fragmented due to the presence of many players around the globe. Key companies operating in the market have invested their resources in novel product developments. Production competency, a wide range of product offerings, and safe and unique technology development for floor applications are enhancing the strengths of the key market players. Companies have adopted new product development strategies, acquisitions, expansion, and joint ventures to increase their regional presence and product portfolio.

List of Top Flooring Companies:

- Mohawk Industries, Inc. (U.S.)

- Shaw Industries Group, Inc. (U.S.)

- TARKETT S.A. (France)

- Armstrong Flooring, Inc. (U.S.)

- Forbo Flooring Systems (Netherlands)

- Gerflor (France)

- Interface, Inc. (U.S.)

- Beaulieu International Group (Belgium)

- Toli Corporation (Japan)

- Milliken & Company (U.S.)

- Congoleum (U.S.)

- Flowcrete (U.K.)

- James Halstead (U.K.)

- The Dixie Group (U.S.)

- Victoria PLC (U.K.)

- Mannington Mills, Inc. (U.S.)

- Swiss Krono (Switzerland)

- LX Hausys (South Korea)

- Parador GmBH (Germany)

- MBB - Ihr Bodenausstatter GmbH (Germany)

- Altro Limited (England)

- Welspun Group (India)

- Avant Holding (UAE)

- Twintec Group Limited (Germany)

- Mirage (Canada)

- Kajaria Ceramics (India)

- Engineered Floors (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2023 – Shaw Industries announced the installation of innovative solar technology at its carpet tile manufacturing facility. This move shows the company's commitment to sustainability and reducing its carbon footprint. By utilizing renewable energy sources, Shaw Industries is taking a proactive step toward protecting the environment and ensuring a cleaner future for future generations.

- November 2022 - Tarkett North America reintroduced its Johnsonite product line, which includes resilient flooring, stairwell management systems, wall base, and finishing accessories. These products have low VOC levels, supporting a healthier indoor environment and reducing the need for harsh chemical cleaners. Moreover, many Johnsonite product lines have received Cradle to Cradle certification, indicating their adherence to stringent material health, product circularity, renewable energy, climate requirements, social fairness criteria, and water stewardship. The company prioritizes the quality of its products while also considering their environmental and societal impact.

- November 2022 – Mohawk Industries acquired Brazilian-based company Elizabeth. This acquisition is expected to help Mohawk Industries increase its production capabilities in the South American market. Further, this acquisition will also offer Elizabeth access to Mohawk Industries' extensive distribution network and resources.

- July 2022 - Mohawk Industries announced that it will acquire Foss Floors, which sells primarily to national home centers and other manufacturers. It is a leading non-woven flooring specialty product using 100% recycled PET polyester manufactured from plastic drinking bottles. It is expected to bring the company new product categories and exciting opportunities. The acquisition is set to close in the third quarter of this year.

- July 2022 - AHF Products acquired certain assets from Armstrong Flooring, including the rights to the brand name. AHF has purchased three of Armstrong's U.S. manufacturing facilities in Lancaster, Beech Creek, PA, and Kankakee, IL. They're successful in various flooring categories and responsible for commercial brands, such as Bruce Contract and Parterre.

- June 2022 - Mohawk Industries acquired Vitromex, a leading tile manufacturer in Mexico, from the Group Industrial Saltillo with a deal value of USD 293 million. This acquisition includes four Vitromex manufacturing plants at strategic locations and a nationwide supply chain network in Mexico. This deal will provide a strategic advantage to Mohawk Industries in Mexico by widening the product offerings.

- November 2021 - Shaw Industries announced plans to expand its operations in Aiken County at a USD 400 million investment, bringing more job opportunities and economic growth to the area. The company will invest in the community and looks forward to working with local leaders to make this expansion successful. This move highlights Shaw Industries' commitment to providing quality products and services. The expansion is expected to be completed by the end of 2024.

REPORT COVERAGE

This report delivers a detailed analysis of the flooring market and emphases key aspects such as leading companies, product types, and end-uses of the product. In addition, the report provides insights into the market drivers and trends and highlights recent technological advancements and key industry developments. Furthermore, the report includes several factors that led to the market growth over recent years and will create opportunities for the market during the forecast period.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2026 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion), Volume (Million sq. m.) |

|

Segmentation |

By Type

|

|

By End-Use

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global flooring market size was valued at USD 439.27 billion in 2025 and is projected to grow from USD 463.13 billion in 2026 to USD 646.7 billion by 2034, exhibiting a CAGR of 5.70%.

Key drivers include rapid urbanization, rising demand for residential and commercial construction, and growing consumer preference for aesthetically appealing and durable flooring materials.

Registering a significant CAGR of 5.70%, the market will exhibit considerable growth over the forecast period (2026-2034).

Asia Pacific dominates the global flooring market, accounting for 53% of the market share in 2025, driven by rapid infrastructure development and strong demand in countries like China and India.

Major trends include the rise of sustainable flooring materials, increased demand for luxury vinyl tiles (LVT), waterproof flooring solutions, and the integration of smart flooring technologies.

Non-resilient flooring, particularly ceramic tiles, holds the largest market share due to its durability, water resistance, and easy maintenance—making it ideal for residential applications.

Leading companies include Mohawk Industries, Shaw Industries, Tarkett S.A., Armstrong Flooring, Forbo Flooring Systems, Gerflor, Interface Inc., and Beaulieu International Group, among others.

Key challenges include raw material price volatility, especially for petroleum-based inputs, and growing concerns around product waste management and environmental impact.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us