Forklift Trucks Market Size, Share & Industry Analysis, By Type (Class I, Class II, Class III, Class IV, and Class V), By End-User Industry (Mining, Manufacturing, E-commerce, Retail & Wholesale, Logistics (Excluding E-commerce), Construction, Automotive, Food & Beverages, Natural Resources, and Others (Chemicals)), and Regional Forecast, 2026 – 2034

Forklift Trucks Market Size

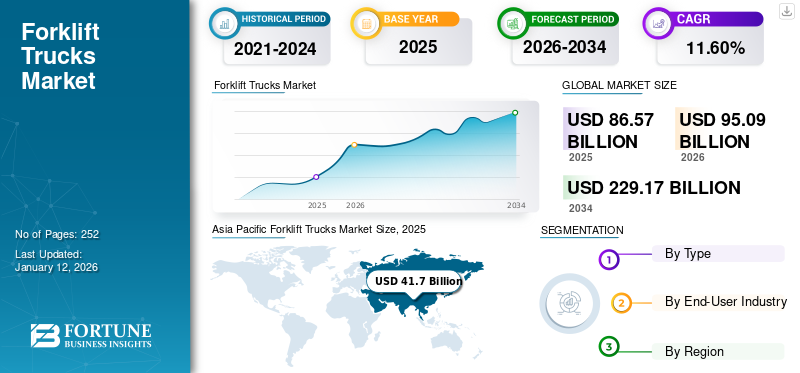

The global forklift trucks market size was valued at USD 86.57 billion in 2025 and is projected to grow from USD 95.09 billion in 2026 to USD 229.17 billion by 2034, exhibiting a CAGR of 11.60% during the forecast period. The Asia Pacific dominated global market with a share of 48.60% in 2025.

Forklift trucks, also known simply as lift trucks, are industrial vehicles specially designed for lifting and transporting heavy materials from one location to another place. They are essential equipment used across distribution centers, warehouses, construction sites, and manufacturing facilities. They are attached with a pair of fork-like blades at the front, which are used to lift and move loads. These machines are powered by internal combustion engines such as gasoline, diesel, and propane gas and are suitable for indoor use and outdoor use on industrial premises. Moreover, these trucks are equipped with hydraulic systems, which enable the lifting and lowering of movement loads. Forklift designs in various sizes with different load capacities range from small loads to medium loads to heavy-duty loads, which are capable of lifting several tons of goods at industrial premises. This scope includes net sales generated by Class I, Class II, Class III, Class IV, and Class V forklift trucks.

Download Free sample to learn more about this report.

The market is being driven by rising urbanization, industrialization, and infrastructure development in China, India, and Southeast Asian countries, all of which are increasing the demand for effective material handling solutions. Moreover, increasing disposable income, convenient delivery, impulsive shopping patterns, and reduced product cost are further boosting the demand for material handling solutions such as forklifts. Rising e-commerce, increased online shopping, sales, and deliveries are now handling a larger number of orders for individual items across warehouses. For instance, the Census Bureau of the Department of Commerce estimated total e-commerce sales of USD 1.12 trillion in the U.S. in 2023, showing about 7.6% year-on-year growth.

In addition, these trucks offer several benefits, including low noise pollution, reduced emissions, optimal running, and reduced maintenance costs. Manufacturers such as Jungheinrich AG, Doosan Corporation, and Crown Equipment Corporation are increasingly developing Lithium-ion battery-based electric forklifts, which offer significant advantages over lead-acid batteries, such as no maintenance, increased efficiency, and faster charging times.

- For instance, in March 2024, Jungheinrich AG introduced a new series of forklift trucks named EJC 1i, specifically designed for warehouse and distribution center operations. These forklifts are powered by lithium-ion batteries and are available in five different capacities: 50 Ah, 100 Ah, 105 Ah, 150 Ah, and 200 Ah. Key features include a compact size, enhanced performance, and enhanced residual capacity.

The COVID-19 pandemic had a significant impact on the global market owing to temporary shutdowns of manufacturing facilities, suspension of warehouse operations, and supply chain disruption, all of which restricted market growth. However, in the post-pandemic period, rising e-commerce growth across the globe and the increasing trend of online shopping experienced a surge in demand for logistic and warehouse services. This, in turn, boosted the forklift truck's need to handle heavy loads within these facilities efficiently.

IMPACT OF TECHNOLOGY

Adoption of Advanced Technologies to Drive market growth

A rising adoption of Industry 4.0 technologies, including Artificial Intelligence (AI), Machine Learning (ML), and robotics, is gaining traction in the market across various industry verticals. Moreover, an increasing shift from internal combustion engines to electric-powered products, particularly those using advanced lithium-ion battery-powered systems. These systems offer longer run times, faster charging capabilities, and less maintenance cost and operating costs. Additionally, it offers features such as eco-friendly and reduced carbon emissions generated during industrial operation. Technological advancements in forklift trucks enable real-time fleet monitoring, predictive maintenance, and collision avoidance systems and provide asset-tracking solutions across several industrial sectors. All these developments underscore the transformative impact of technology on the forklift trucks market share.

IMPACT OF U.S. TARIFFS

The global forklift trucks market experiences several challenges due to ongoing U.S. tariff policies, which have raised the cost of imported forklifts. These include a 25% tariff on imported vehicles, including forklifts, and an additional 10% tariff on all imported goods. These measures create cost pressures for market participants. Additionally, shifts in supply chain realignment across the globe and efforts to enhance the competitiveness of U.S.-made forklifts are reshaping market dynamics. In addition, accelerated adoption of advanced technologies has increased the cost of forklifts, further contributing to higher import and export expenses. Such a way leads to a rise in the cost of import and export of this equipment across the globe, which may be challenging for end users.

FORKLIFT TRUCKS MARKET TRENDS

Advancements in Lithium-Ion Technology to Fuel Industry Development

Lithium-ion battery-sourced electric lift trucks offer extended lifespan, longer runtime, consistent high performance, faster charging, and no battery changing. Several manufacturing companies provide batteries and chargers with varied capacities, helping end users reduce overall operating costs over time. Moreover, major players are engaged in producing lithium-ion battery-powered systems. For instance, in August 2024, Godrej & Boyce, a subsidiary of Godrej Enterprises Group, launched a new lithium-ion battery forklift for effective logistics and material handling applications. These lithium iron-based trucks offer more than 4 times longer battery life compared to other models. Forklift trucks also contribute to greater durability and lower operational costs, making them ideal for use in numerous industry verticals such as automotive, FMCG, consumer durables, e-commerce, and pharmaceutical sectors. These developments reflect the key trends shaping the global market.

MARKET DYNAMICS

Market Drivers

E-commerce Industry Growth and Warehouse Development Propel Market Growth

The growth of online shopping and the global expansion of the e-commerce sector has increased the need for more distribution centers and fulfillment facilities, surging demand for this equipment for effective material handling management. For instance, according to the source of SOAX, the global growth in the e-commerce sector is projected to grow by 27% from 2024 to 2027. Moreover, the growth in warehouse spaces and increasing need for logistics operations has boosted forklift truck demand. Traditional warehouses to improve efficiency and fasten the loading and unloading process are generating strong, sustainable, and efficient forklift truck demand. The demand for forklifts used in truck loading is growing across various geographies. Furthermore, increasing online spending and changing consumer perception in Tier II and Tier III cities of developing economies are further propelling the establishment of warehouses in regional areas, thereby supporting driving market growth.

Market Restraints

Stringent Regulatory Policies Hamper Market Expansion

The transport and logistics sectors are major contributors to carbon emissions, mainly due to the use of conventional engines in industrial trucks and construction equipment. In response, government authorities and local bodies worldwide have initiated regulatory action to reduce carbon emissions across geography.

Moreover, major players are also regulating their product offerings to comply with updated regulations in various markets. For instance, in March 2023, Toyota Corporation launched two models of forklifts with diesel engines and gasoline engines. The main aim of this announcement is to support air quality standards and remove emissions generated from forklift trucks. Rental agencies and buyers follow these regulatory measures. For example, in April 2023, the California Air Resources Board decided to decrease sales and purchases of spark-ignited forklifts to meet U.S. air quality regulations.

Market Opportunities

Expanding Third-Party Logistics across Developing Nations to Bring Market Opportunities

Growing disposable income, changing consumer lifestyles, and effective product pricing for price-sensitive markets have propelled an increase in orders across developing nations such as India.

Increasing industrial warehouses are primarily driven by third-party logistics service providers, who are transforming the logistics sector in these economies. Larger skilled workforce availability, emerging technological innovations, and adoption of green solutions across geographies are further anticipated to surge the growth of industrial warehouses, generating strong forklift truck demand.

Moreover, several manufacturing companies offer hybrid lift trucks that include both fuel cell systems and lithium-ion battery-based technology, which helps reduce environmental impact across geographies. Lithium-ion Lift Trucks are anticipated to cater to increasing demand across sectors as a result of their zero CO2 emissions, excellent environmental performance, and increased durability. For instance, Toyota Material Handling Japan launched its fuel cell lift Trucks in September 2022 with a significant reduction in cost by 30% and increased durability compared to current vehicles.

SEGMENTATION ANALYSIS

By Type

Class III to Lead the Market Due to its Ability to Operate in Confined Spaces

By type, the market is divided into Class I, Class II, Class III, Class IV, and Class V.

Class III (Electric Motor Hand Trucks or Hand/Rider Trucks) will dominate the market in terms of market share and is projected to grow at a significant CAGR. This growth is driven by factors such as maximum storage capacity and load capacity, ability to operate in limited space, eco-friendliness, and enhanced operational efficiency. The Class III segment accounted for 31.07% of the total market share in 2026.

Class V (International Combustion Engine) is anticipated to grow at steady growth during the forecast period, owing to factors such as strong demand from infrastructure, construction, and logistics operations. It offers features such as superior performance in outdoor and indoor industrial environments.

Moreover, Class I (Electric Motor Rider Trucks) is expected to grow at a moderate rate during the forecast period due to rising demand from warehouses and distribution centers where emissions control and low noise levels are essential.

Class II and Class IV are projected to grow decently during the forecast period due to the growing need for maximum warehouse space utilization and rising high-density storage systems across distribution centers and logistics sectors.

To know how our report can help streamline your business, Speak to Analyst

By End-User Industry

Food & Beverages Led Owing to Increased Product Demand from Food Processing Plants & Distribution Centers

Based on end-user, the market is fragmented into manufacturing, retail & wholesale, logistics, construction, automotive, food & beverages, e-commerce, natural resources, mining, and others.

The food and beverages segment dominated the market in 2026, accounting for 23.13% of the total market share, owing to a surge in the demand for such systems in food processing plants, distribution centers, and warehouses. Additionally, many food & beverage operations also require a cold storage freezer, which necessitates specialized forklift systems to move material or goods from one location to another, which fuels segment growth.

The e-commerce sector is anticipated to grow significantly during the forecast period, owing to factors such as the rising growth of online retail worldwide, which increases the demand for forklifts to handle packaged goods and accessories efficiently. Moreover, the rising demand for expanding warehouses and the increasing need for higher storage density through vertical racking systems will drive segment growth.

The retail and wholesale segment is projected to grow steadily, owing to rising demand for eco-friendly systems in the wholesale industry. Moreover, it offers features such as reduced downtime required for material handling operations, reduced manual handling injuries, and optimized small spaces in retail environments.

The automotive segment is expected to experience major growth during the forecast period due to the large demand for material handling solutions for handling components, finished vehicles, and sub-assemblies within manufacturing facilities, logistics facilities, and distribution centers. Several automotive key players have adopted forklifts with high precision, reliability, and safety features to optimize production efficiency.

The mining, manufacturing, and construction segment is anticipated to witness moderate growth during the forecast period. This growth is attributed to a rise in government investments in mining, manufacturing, and infrastructure development. This bolsters forklift truck demand for effective material handling. Moreover, the increasing adoption of Industry 4.0 technologies in forklift systems is enhancing operational efficiency and improving handling across these industries.

The natural resources segment is projected to grow moderately during the forecast period, owing to the rising use of such systems in applications such as timber lifting, lumber yard operation, paper mills, oil refineries, and wood processing. Moreover, there is rising adoption of these systems from forestry sites and oil refineries for efficient handling applications.

Others consist of chemicals and pharmaceuticals and are anticipated to grow at decent growth owing to the safe transportation of goods within warehouses and distribution centers. The product supports the handling of sensitive materials, inventory management, and compliance with regulatory standards, all of which drive the growth of the segment.

FORKLIFT TRUCKS MARKET REGIONAL OUTLOOK

Based on region, the market is studied across North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific

Asia Pacific Forklift Trucks Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market in terms of revenue, with the market size valued at USD 41.7 billion in 2025 and increasing to USD 46.42 billion in 2026. This growth is driven by rapid urbanization and industrialization in countries such as China, India, and Southeast Asia. The product is widely used in material handling operations across various sectors, such as manufacturing, logistics, retail, and construction sectors. Moreover, the growing trend of online shopping and e-commerce, in turn, creates the demand for these systems in warehouse and distribution centers. The Japan market is projected to reach USD 3.45 billion by 2026, the China market is projected to reach USD 32.11 billion by 2026, and the India market is projected to reach USD 3.75 billion by 2026.

A rising rate of urbanization and rapid industrialization across China are key market drivers. Growth in the e-commerce sector and retail activities across China, boost the demand for forklifts. For instance, according to the source of the International Trade Administration, e-commerce growth in China increased by 6.9% in 2024 compared to 2023.

To know how our report can help streamline your business, Speak to Analyst

North America

The market in North America is projected to witness significant growth during the forecast period, owing to strong economic growth, strong manufacturing infrastructure, large logistics networks, and modern warehousing facilities. In addition, rising industry expansion and the growing trend of online shopping, which creates the demand for this system for the shipment of goods for inventory management, fuels the forklift trucks market growth.

In addition, growth in the automotive, mining, and retail sectors across the U.S. fuels market growth. For instance, according to Automotive Logistics Source, light vehicle sales in the U.S. increased by 1.9% in 2024 compared to 2023. Such growth in the automotive sector has led to a rise in demand for forklifts, driving market growth. The US market is projected to reach USD 12.3 billion by 2026.

Europe

Europe is expected to witness steady growth during the forecast period, owing to the strong automotive sector, rising investment in manufacturing facilities, and enhanced logistics operations. Moreover, the region also benefits from the strong presence of key players such as Toyota Material Handling, Jungheinrich AG, KION Group AG, Hyster-Yale Materials Handling, Inc., and Crown Equipment Corporation in the European market. Key players engaged in adopting product launch and business expansion as key developmental moves to boost market growth. For instance, In January 2023, KION Group announced to develop and produce in-house fuel cell systems for industrial Trucks and invested about USD 11.9 million. The company is planning to launch a 24V fuel cell system by Spring 2023. The United Kingdom market is projected to reach USD 6.62 billion by 2026, while the Germany market is projected to reach USD 9.54 billion by 2026.

Middle East & Africa

The Middle East & Africa region is projected to experience moderate growth during the forecast period, owing to rising forklift truck demand from numerous industry verticals such as logistics, retail, mining, warehousing, and e-commerce sectors. A rise in the growth of the e-commerce and mining sector across Turkey, Israel, and South Africa is fueling the need for efficient material handling and logistics solutions, thereby driving the growth of the market.

South America

South America is projected to grow at a decent pace, owing to factors such as the growth of e-commerce activities and the expansion of logistics and warehousing sectors. Moreover, rising trade activities at seaports and increased adoption of loading, unloading, and packaging operations are further fueling product demand in the region.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Major Players Adopt Product Launches and Acquisition Strategies to Stay Competitive

Toyota Industries Corporation, Anhui Heli Co. Ltd, Crown Equipment Corporation, and Jungheinrich AG are among the key players in the global forklift trucks market. Market participants are actively pursuing strategies such as product launches, acquisitions, product development, and joint ventures to strengthen their competitive positioning. For instance, in November 2023, Toyota introduced an electric forklift truck designed for retail, wholesale, and logistics operations. This model features pneumatic control, making it suitable for outdoor operations and extreme weather conditions. It is available in 48V and 80V battery variants and is used in home centers, lumberyards, and landscaping operations.

Long List of Companies Studied (including but not limited to)

- Toyota Industries Corporation (Japan)

- Anhui Heli Co. Ltd (China)

- Cargotec Corporation (U.S.)

- Clark Material Handling Company Inc (U.S.)

- Crown Equipment Corporation (U.S.)

- Hangcha Group Co. (China)

- Hyster-Yale Materials Handling Inc (U.S.)

- Jungheinrich AG (Germany)

- KION Group (Germany)

- Mitsubishi Heavy Industries Ltd (Japan)

- Nissan Forklifts (U.S.)

- Linde (U.K.)

- Kalmar (Finland)

- Cesab (Italy)

- Cimbria (Denmark)

- Hyundai (South Korea)

- Doosan Corporation (South Korea)

- BYD (China)

- Sany Group (China)

- Hangcha Group Co. (China)

KEY INDUSTRY DEVELOPMENTS

- March 2024 – UniCarriers Forklift, a part of Mitsubishi Logisnext Americas, announced its partnership with C&C Lift Trucks Inc., a manufacturer and provider of lift Trucks based in North Jersey.

- February 2024 – KION North America, a subsidiary of KION Group, expanded its product portfolio by launching a new Linde Series 1293 of the new electric forklift. This offering offers a lifting capacity ranging from 4,000 – 5,000 lbs, powered by Lithium-ion batteries.

- September 2023 – Mitsubishi Logisnext Americas and Jungheinrich AG formed a new joint venture named Rocrich AGV Solutions to offer a comprehensive portfolio of mobile and robotics solutions for material handling.

- July 2023 – Jungheinrich AG opened a new manufacturing facility in the Czech Republic to meet the increasing demand for material handling equipment. The project budget for the 37,000 sq. meters facility is estimated to be around USD 63.5 million.

- January 2023 – Crown Equipment expanded its lift Trucks portfolio by adding IC and electric counterbalance forklifts with lifting capacities of up to 5.5 tons. The Crown SC and FC Series four-wheeled forklifts are designed for indoor and outdoor applications.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, type, end-user industry, and region. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Growth Rate |

CAGR of 11.60% from 2026 to 2034 |

|

|

Unit |

Value (USD Billion) and Volume (Thousand Units) |

|

|

Segmentation |

By Type

By End-User Industry

By Region

|

|

|

Key Market Players Profiles in the Report |

Toyota Industries Corporation (Japan), Anhui Heli Co. Ltd (China), Cargotec Corporation (U.S.), Clark Material Handling Company Inc (U.S.), Crown Equipment Corporation (U.S.), Hangcha Group Co. (China), Hyster-Yale Materials Handling Inc (U.S.), Jungheinrich AG (Germany), KION Group (Germany), and Mitsubishi Heavy Industries Ltd (Japan) |

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 229.17 billion by 2034.

In 2025, the market was valued at USD 86.57 billion.

The market is projected to grow at a CAGR of 11.60% during the forecast period.

By type, the class III segment is likely to lead the market.

The rising e-commerce industry and warehouse optimization propel market growth.

Top players in the market include Toyota Industries Corporation, Anhui Heli Co. Ltd, Cargotec Corporation, Clark Material Handling Company Inc., Crown Equipment Corporation, Hangcha Group Co., Hyster-Yale Materials Handling Inc, Jungheinrich AG, KION Group, and Mitsubishi Heavy Industries Ltd.

Asia Pacific generated maximum revenue in 2025.

The E-commerce industry is anticipated to grow at the highest CAGR due to efficient and hygienic maintenance.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us