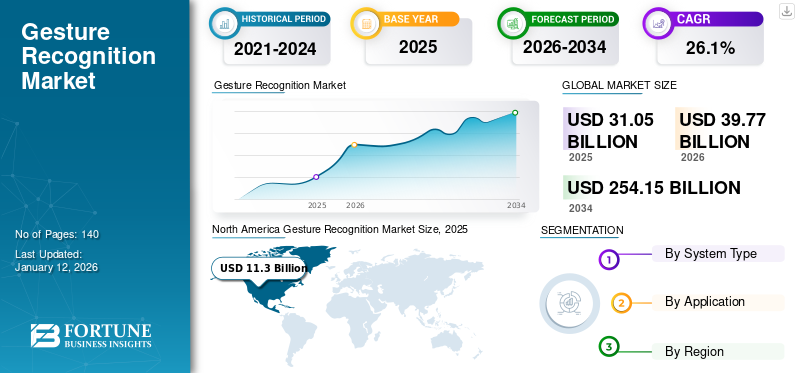

Gesture Recognition Market Size, Share & Industry Analysis, By System Type (Touchless and Touched), By Application (Human-computer Interaction, Gaming, Virtual Reality, Robotics, Healthcare, Automotive, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global gesture recognition market size was valued at USD 31.05 billion in 2025 and is projected to grow from USD 39.77 billion in 2026 to USD 254.15 billion by 2034, exhibiting a CAGR of 26.10% during the forecast period. North America dominated the gesture recognition market with a market share of 36.4% in 2025.

Gesture recognition refers to the technology and process of analyzing and interpreting human gestures and movements in real-time, captured by cameras or sensors. It enables natural and intuitive interaction between humans and machines, enabling users to control devices or gestures instead of traditional input methods. It has diverse applications in various industries, including human-computer interaction, virtual reality, robotics, and gaming. By implementing this technology, businesses can enhance the user experience, provide more immersive interactions, and enable intuitive control mechanisms.

The market has witnessed significant growth and is expected to continue expanding throughout the forecast period, owing to its growing prominence across various industries, including consumer electronics, gaming, healthcare, automotive, and retail. The market is driven by the increasing demand for intuitive and immersive human-machine interfaces, advancements in sensor technologies, and the rising adoption of this technology in smartphones and wearable devices. Furthermore, with ongoing research & development and continuous evolution of machine learning algorithms, the market is expected to witness substantial growth, offering new opportunities for businesses to innovate and cater to the growing demand for seamless and natural user interfaces. For instance,

- In November 2020, the National Institutes of Health (NIH) in the S. has allocated funds for research and development, exploring the application of gesture recognition technology to enhance the diagnosis and treatment of neurological disorders.

The market is dominated by established key players, such as Intel Corporation, Google LLC, Jabil Inc., Sony Corporation, and Apple Inc. These players are significantly investing in advanced sensing technologies such as LiDAR, radar-based sensing, ultrasonic sensors, AI-powered computer vision, and 3D depth cameras to enhance gesture responsiveness and accuracy. For instance, Sony Corporation integrates time-of-flight sensors in devices to capture accurate hand motion. These factors are anticipated to fuel market growth across the globe.

Impact of Generative AI

Generative AI-Simulated Gestures Under Diverse Conditions Enhance Real-World Model Performance

Generative AI technology creates large volumes of synthetic data, which is important for training gesture recognition systems. It can simulate various gestures under different backgrounds, angles, and lighting conditions. This leads to more accurate models that can perform well in real-world scenarios. For instance, AI can generate data when parts of the user’s body are hidden, such as when wearing gloves or using assistive devices. In such scenarios, the adoption of gen AI improves recognition accuracy.

Moreover, in AR and VR environments, generative AI improves gesture-based interactions by enabling the real-time creation of 3D models of gestures. This creates an immersive experience, essential for both gaming and training simulations. Thus, as AI technology continues to evolve, the future of gesture recognition will likely become even more dynamic and immersive, creating new opportunities for innovative applications.

Gesture Recognition Market Dynamics

Market Drivers

Surging IoT Implementation and Demand for Efficient Human-Machine Interface to Fuel Market Growth

IoT’s expansion fosters the integration of smart devices and sensors, necessitating intuitive and efficient HMIs. With its ability to enable natural and seamless interactions between machines and humans, gesture recognition is emerging as a critical component in this context. As IoT applications become more prevalent, the demand for advanced gesture recognition technologies is expected to soar, particularly in sectors such as automotive, healthcare, consumer electronics, and industrial automation.

As industries strive to enhance user experiences and streamline operations, there is a growing emphasis on intuitive interfaces that can accurately interpret and respond to human gestures. This demand is fueled by the need for more natural and convenient interactions with devices, especially in scenarios where traditional input methods such as keyboards and touchscreens are impractical. Furthermore, as AR and VR technologies become more advanced and widespread, seamless user interactions are becoming paramount, with gesture recognition playing a crucial role in enabling users to interact with virtual environments. For instance,

- In February 2024, Apple Inc. launched its Vision Pro VR headset in U.S. stores, featuring advanced gesture recognition features. Marking its first major release in nine years, the headset was priced at USD 3,500 and offered innovative virtual environments and interactions.

Market Restraints

High Installation Costs and Lack of Standardization to Impede Market Expansion

Gesture recognition systems often rely on predefined gesture sets, limiting the range of recognizable and utilized gestures. The lack of standardized gestures across different devices and platforms can lead to inconsistency and fragmentation, making it challenging for users to adapt to different systems. The development and implementation costs associated with the technology are high, including hardware components such as sensors and cameras. These costs can pose a barrier to entry, particularly for smaller businesses and organizations. Furthermore, the technology involves capturing and analyzing user movements and gestures, raising privacy and security concerns.

Market Opportunities

Rise in Adoption of Augmented Reality (AR) and Virtual Reality (VR) Technologies to Create a Major Opportunity for Market Growth

Gesture recognition technology enables devices to interpret hand, eye, and head movements of the human body without physical touch by using sensors, cameras, and AI algorithms. To identify accurate human body movements, augmented reality (AR) and virtual reality (VR) are increasingly integrated into gesture recognition systems. For example, in a VR game, users can perform various actions, such as throwing and grabbing, using gestures that enhance the gaming experience. Moreover, businesses are increasingly adopting VR/AR technology to make virtual meetings more productive. In virtual meeting rooms, participants can gesture to interact with objects, change presentations, or collaborate on 3D models, making meetings more interactive.

Furthermore, this technology is significantly used for training simulations in industries such as robotics, healthcare, and automotive. For example, in healthcare, surgeons use VR simulators to practice complex tasks in virtual environments. Thus, these factors are expected to fuel gesture recognition market growth during the forecast period.

Gesture Recognition Market Trends

Increasing Use of Smart Devices among Consumers to Boost Market Growth

The increasing use of smart devices, including smartphones, tablets, smart TVs, and wearables, is a significant driver for the growth of the market. These devices have become integral to consumers’ lives, presenting a significant market opportunity for intuitive and interactive device control and navigation methods. For instance,

- According to Think with Google, a marketing podcast by Google, 61% of individuals own a smart device.

- Moreover, according to EarthWeb, a U.S.-based consulting firm, approximately 57% of smart device users state that these devices contribute to time savings. Additionally, around 45% of users also believe that smart devices help them save money.

Gesture recognition technology offers a touchless and hands-free approach, enabling users to perform various actions through hand movements, gestures, and motion-based commands. This technology enhances the overall user experience and provides a competitive edge to device manufacturers by offering a more natural and seamless interaction paradigm. By replacing traditional input methods, such as physical buttons or touchscreens, the technology addresses the growing consumer demand for convenience, ease of use, and interactivity.

Download Free sample to learn more about this report.

Segmentation Analysis

By System Type

Touched Segment Dominated due to its Growing Adoption Across Various Fields

By system type, the market is bifurcated into touchless and touched.

The touched segment captured the largest share of the market In 2026, the segment is anticipated to dominate with a 60.75% share, owing to its early adoption across various fields, making it widely familiar to most users. Touch sensors are widely available and relatively inexpensive compared to cameras, LiDAR, or advanced motion-tracking hardware. Moreover, the user interface (UI) is interactive, as users are habituated to actions such as swiping, tapping, and pinching, especially on smartphones, tablets, and laptops.

The toucheless segment is expected to grow at a CAGR of 30.30% over the projected period.

By Application

To know how our report can help streamline your business, Speak to Analyst

Human-computer Interaction Segment to Lead due to Growing Need for Improved User Experience and Satisfaction

By application, the market is fragmented into human-computer interaction, gaming, virtual reality, robotics, healthcare, automotive, and others.

The human-computer interaction segment dominated the market in 2025. In 2026, the segment is anticipated to dominate with a 37.48% share, as it offers several advantages that enhance user experience and interaction with technology, improving the usability, accessibility, and overall satisfaction of computer systems and applications.

- For instance, a real-time HCI system achieved 75.37% recognition accuracy across twenty-four NATOPS hand gestures, indicating reliable performance in operational gesture interfaces.

The human-computer interaction segment is expected to grow at a CAGR of 31.30% over the forecast period.

GESTURE RECOGNITION MARKET REGIONAL OUTLOOK

By geography, the market is categorized into North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Gesture Recognition Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America held the dominant gesture recognition market share in 2025, valued at USD 11.3 billion, and continued to lead in 2026, with USD 14.28 billion. The factors fostering the dominance of the region include increasing demand for intuitive human-machine interfaces, advancements in sensor technology, and the growing adoption of smart devices. For instance,

- As per a report by MediaPort, smart devices are present in approximately 69% of households in the U.S. Among those households, approximately 12% (equivalent to around 22 million homes) possess multiple smart devices.

In 2026, the U.S. market is estimated to reach USD 8.61 billion. Furthermore, the country is home to many of the world’s largest technology companies, such as Apple, Microsoft, Google, Intel, and others. These companies are at the forefront of integrating gesture recognition technology into gaming consoles, smart devices, and automotive systems.

To know how our report can help streamline your business, Speak to Analyst

Europe

The European market is anticipated to witness a notable growth in the coming years. During the forecast period, the region is projected to record a growth rate of 27.57%, which is the fourth highest amongst all regions, and touch the valuation of USD 11.4 billion in 2026. This is primarily due to factors such as the proliferation of smart devices and technological advancements. Additionally, this region's automotive and healthcare industries are expected to experience increased adoption of the technology, boosting overall market growth. Backed by these factors, countries including the U.K. is anticipated to record the valuation of USD 2.34 billion, Germany USD 2.42 billion in 2026 and France USD 1.43 billion in 2025.

Asia Pacific

After Europe, the market in Asia Pacific is estimated to reach USD 10.19 billion in 2026 and secure the position of the third-largest regional market, and is expected to grow at the highest CAGR during the study period. Within the region, China and India both are estimated to reach USD 3.19 billion and USD 2.04 billion, respectively, in 2026. Factors such as rising demand for smart home devices, IoT technologies, and AI-powered consumer electronics, and advanced human-machine interface technologies will significantly contribute to market growth. The Japan market is projected to reach USD 2.19 billion by 2026.

South America and Middle East & Africa

Over the forecast period, South America and Middle East & Africa regions would witness a moderate growth. The South America market in 2025 is set to record USD 1.19 billion. In Middle East & Africa, the GCC region is set to attain the value of USD 0.65 billion in 2025. Owing to the increasing footprints of major companies, countries such as the UAE, Saudi Arabia, Brazil, and South Africa are leading the adoption of gesture systems in smart homes, public services, and automotive applications. Additionally, an increase in the acceptance of touchless systems in these regions is expected to boost market growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Wide Range of Product Offerings coupled with Strong Geographic Presence of Key Companies Supported their Leading Position

The global gesture recognition market shows a semi-concentrated structure with numerous small-to-mid-size companies actively operating across the globe. These players are actively involved in product innovation, strategic partnerships, and geographic expansion.

Intel Corporation, Google LLC, Jabil Inc., Sony Corporation, and Apple Inc. are some of the dominant market players actively creating advanced solutions to cater to customer demands. They also focus on collaboration, acquisitions, and partnerships with regional players to maintain their dominance across various regions.

Apart from this, other prominent players in the market include Promega Corporation, QIAGEN, KACTUS, Jena Bioscience GmbH, and others. These companies are undertaking various strategic initiatives, such as investments in R&D, geographic expansion, and product launches, to bolster their product offerings.

LIST OF KEY GESTURE RECOGNITION COMPANIES STUDIED

- Intel Corporation (U.S.)

- Jabil Inc. (U.S.)

- Microchip Technology Inc. (U.S.)

- Sony Corporation (Japan)

- Elliptic Laboratories ASA (Norway)

- GestureTek (U.S.)

- Microsoft Corporation (U.S.)

- Alphabet Inc. (Google LLC) (U.S.)

- Ultraleap (U.K.)

- Apple Inc. (U.S.)

- Cipia Vision Ltd. (India)

KEY INDUSTRY DEVELOPMENTS

- April 2024: Sony Corporation entered into a partnership with AMERIA AG, a provider of an integrated gesture based controls system. Through this collaboration, the company aims to design a touchless solution, that can be integrated with any Sony professional display model.

- February 2024: Apple Inc. launched its Vision Pro VR headset in U.S. stores, featuring advanced gesture recognition features, marking its first major release in nine years. The headset was priced at USD 3,500 and offered innovative virtual environments and interactions.

- December 2023: NXP Semiconductors expanded its ultra-wideband portfolio with the launch of Trimension NCJ29D6, a fully integrated automotive UWB family. The offering combined real-time localization with short-range radar for features, such as child presence detection, secure car access, gesture recognition, and intrusion alerts.

- September 2023: Meta and EssilorLuxottica launched the new Ray-Ban Meta smart glasses, featuring improved cameras and audio, over 150 custom lens and frame options, and a more comfortable design. The glasses enabled users to live stream on social media applications and interact with AI using voice commands and hand gestures.

- May 2023: SAP partnered with Accenture to leverage immersive technologies, including augmented reality and AI, for business transformation. These technologies, including gesture recognition, were part of a broader spectrum expected to create a USD 1 trillion revenue opportunity by 2025.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| ATTRIBUTE | DETAILS |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2021-2024 |

| Growth Rate | CAGR of 26.10% from 2026 to 2034 |

| Unit | Value (USD Billion) |

| Segmentation | By System Type

|

Frequently Asked Questions

The market is projected to reach USD 254.15 billion by 2034.

In 2025, the market was valued at USD 31.05 billion.

The market is projected to grow at a CAGR of 26.10% during the forecast period.

By system type, the touched segment led the market in 2025.

The surging IoT implementation and demand for efficient human-machine interfaces fuel are key factors driving market growth.

Intel Corporation, Jabil Inc., Microchip Technology Inc., Sony Corporation, Elliptic Laboratories ASA, GestureTek, Microsoft Corporation, Google LLC, Apple Inc., and Ultraleap are the top players.

North America held the highest market share.

By application, human-computer interaction is expected to grow with a highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us