India Wires and Cables Market Size, Share & Industry Analysis, By Voltage (Low Voltage, Medium Voltage, High Voltage, and Extra-High Voltage), and By End-User (Aerospace & Defense, Construction, IT & Telecommunication, Power Transmission & Distribution, Oil & Gas, Consumer Electronics, Manufacturing, Automotive, and Others), and Country Forecast, 2025-2032

India Wires and Cables Market Size

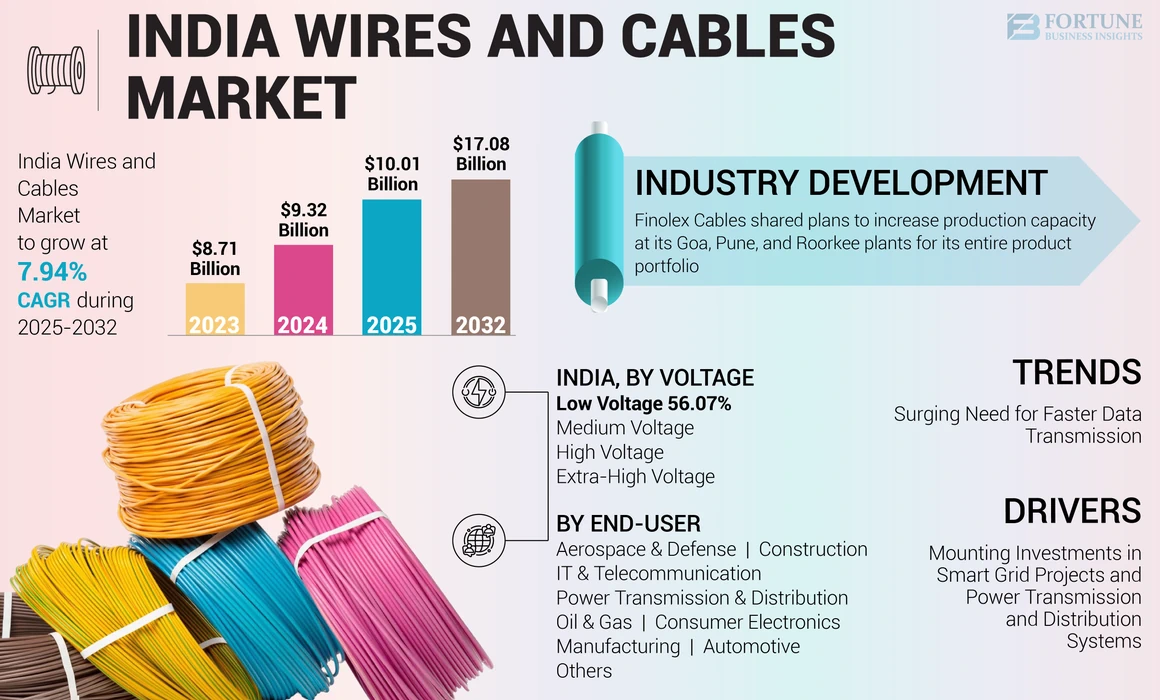

The India wires and cables market size was valued at USD 9.32 billion in 2024. The market is projected to grow from USD 10.01 billion in 2025 to USD 17.08 billion by 2032, exhibiting a CAGR of 7.94% during the forecast period.

India has observed a substantial rise in the demand for wires and cables due to the country's ambitious renewable energy goals and the growing awareness of the potential of renewable energy, such as solar and wind power. In solar power plants, photovoltaic (PV) projects require a high-quality cabling system that connects all electrical components with minimal energy loss. The significant growth of solar panels in India is creating a considerable demand for solar cables. According to industry standards, a 1 MW solar project will use about 50 km of solar cable. Considering the Indian government's target of 100 GW of installed solar capacity by 2022, India's solar cable requirement alone is more than 5 million kilometers.

The spread of the COVID-19 pandemic affected almost every country worldwide. Some countries were at the peak of infection and were urgently building surge capacity in their health systems. The impact of the COVID-19 pandemic on the wires and cables market growth was moderate, as it hampered consumption in many end-use industries. However, as countries emerge from the pandemic and industries recover, there are opportunities for the wire and cable market to rebound. Infrastructure development projects, investments in 5G networks, and the expansion of renewable energy sources could drive the demand for wires and cables in the coming years.

India Wires and Cables Market Trends

Growing Need for Transmission of Data at Increasingly Faster Speed

Rapid advancements in cable and connection technology are occurring alongside the shift toward digital technology. One of the key trends is that increasing volumes of data must be transmitted at increasingly faster speeds. Specialty cable designs with thermal insulation and space-saving engineering are being tested. Therefore, the trend is moving toward the frequent use of hybrid cables, which combine power cables, data cables, and even pneumatic and hydraulic hoses in a single sheath. When large volumes of data are transmitted, high-speed Cat.7 industrial Ethernet cables can replace some of the slower cables, and fiberglass cables can replace even more copper cables. Along with cables, connectors are also getting thinner. A modular connector system combines multiple contact points for different cable types in a single housing.

Download Free sample to learn more about this report.

India Wires and Cables Market Growth Factors

Increasing Investments in Smart Grid Projects and Upgradation of Power Transmission and Distribution Systems to Drive Market Growth

Energy storage is crucial to achieving the country's goal of integrating a large share of renewable energy into the electricity system. Clean, reliable, and sustainable power systems increasingly need smart grids. India views smart grid technology as a strategic infrastructure investment that will fund its long-term economic prosperity and help achieve its carbon reduction goals. In India, the main application areas of the smart grid system are energy arbitrage by storing excess renewable energy to reduce constraints, 24/7 and seasonal storage, smart metering, energy accounting, and renewable energy (RA) outage management.

The government launched Revamped Distribution Sector Scheme (RDSS) with an outlay of 3.03 trillion for the next five years from 2021-22 to 2025-26. This scheme aims to provide financial support to Power Distribution Companies (DISCOMs) for the modernization and strengthening of distribution infrastructure, aiming to improve the quality, reliability and affordability of power supply

RESTRAINING FACTORS

Fluctuation in the Raw Material Prices May Hinder the Wires and Cables Market Pace

The India wires and cables market highly depends on materials such as copper, aluminum, steel, and PVC for the efficient conduction of power. The conductive material, copper/aluminum, makes up about 40-60% of the cable's raw material. Polymers such as PVC, polyethylene, and other engineering plastics contribute significantly to the cost. Metal supplies from Indian copper/ aluminum producers are almost stagnant, which is mainly due to restrictions on mining bauxite used to produce aluminum. Furthermore, the pollution and environmental concerns arising at copper and aluminum refineries are negatively influencing the supply of these metals in India hindering the India wires and cables market growth.

India Wires and Cables Market Segmentation Analysis

By Voltage Analysis

Low Voltage Cable Segment Dominated the Indian Market Owing to Rapid Development in Infrastructure

Based on voltage, the market is segmented into low voltage, medium voltage, high voltage, and extra high voltage. The low voltage segment held the largest India wires and cables market share in 2023 owing to its wide application in multiple sectors.

- As India continues to urbanize and develop its infrastructure, there is a significant demand for low-voltage cables to support residential and commercial construction projects. These cables are used for electrical wiring in buildings and infrastructure. The construction of new homes, office buildings, and commercial spaces often requires extensive low-voltage wiring for lighting, power outlets, HVAC systems, and other electrical components.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Construction Emerged as a Dominant Consumer of Wires and Cables Owing to Rapid Urbanization in India

Based on end-user, the market is segmented into aerospace and defense, construction, IT & telecommunications, power transmission & distribution, oil & gas, consumer electronics, manufacturing, automotive, and others. The construction segment held the largest share in 2023 owing to the increasing installation of electrical appliances in the commercial and residential sectors.

- The construction industry in India has experienced substantial expansion in recent years, and it is likely to continue rising at double-digit rates in the foreseeable future. The construction of residential and commercial facilities requires a substantial amount of wiring and cabling for power distribution and control systems. Moreover, the expansion of renewable energy projects, such as wind and solar farms, often requires specialized cables for power transmission and connectivity.

KEY INDUSTRY PLAYERS

Major Players Are Focusing on Advancements in Wire Technology for Increasing Green Energy Solutions

Companies are currently pursuing the development of new wires and cables projects. This shift in focus is driven by the increasing demand for green energy solutions and advancements in wire technology. Ongoing infrastructure development, comprising the construction of residential and commercial buildings, transportation networks, and energy infrastructure, has stimulated the demand for various wires and cables for power transmission and distribution, communication, and construction. The focus on the greater adoption of advanced and green technologies has allowed the company to streamline wires and cables, considerably improving its sales and volume shipments.

LIST OF TOP INDIA WIRES AND CABLES COMPANIES:

- Polycab (India)

- RR Kabel Ltd. (India)

- Finolex Cables Inc (India)

- Havells India Ltd (India)

- KEI Industries Ltd (India)

- Tortek India Private Ltd (India)

- Plaza Cables Electric Private Limited (India)

- Universal Cables Ltd. (India)

- V-Guard Industries Ltd (India)

- Gupta Power Infrastructure Ltd (India)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: UKB Electronics, India’s primary electrical and electronics manufacturing company, took approval from the Directorate General of Quality Assurance, Electronics Division. This approval includes the supply of specialized wires and cables tailored for signal and transmission equipment, as well as wiring harnesses and cable assemblies for army tanks and armored vehicles.

- November 2023: Ultracab, a leading Indian manufacturer and exporter of electric wires and cables with over 23 years of experience in the industry possesses cutting-edge technology and advanced machinery to produce high-quality products and has secured an order of approximately USD 5.70 million from Sterling & Wilson.

- September 2023: Polycab India unveiled a new logo and a brand identity that reflects its future business roadmap. After the launch of the new logo, Polycab India Ltd. shares rose by 2.38%. The rebrand signifies a commitment to innovation, technology, safety, and sustainability, supporting the Polycab brand purpose of “Connecting all for a better future. A visual update by Interbrand, incorporating sunrise-inspired colors and an innovative visual logo featuring the letter "O," an essential sound in the Polycab name. The colors red, blue, and purple represent leadership in the wires and cable industry, connecting customers through FMEG and preparing for the future. Polycab is diversifying its products to provide more electrical solutions for modern life, focusing on safety and durability.

- September 2023: RR Kabel shared plans to raise USD 236 million through an IPO (Initial Public Offering). RR Kabel competes with Polycab India and Finolex Cables, whose shares rose more than 100% in 2023 on government infrastructure spending and a real estate boom.

- April 2023: Finolex Cables shared plans to expand production capacity at its Pune, Goa, and Roorkee plants for its entire product portfolio, including telecom cables, solar cables, and cables for the automotive and construction industries. The company also announced plans to expand its optical line. In the FMEG segment, the company is expanding its range and has entered the segment of small household appliances with steam and dry irons. Finolex also enters the category of smart switches and smart door locks.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as an overview of the technological advancements, the prevalence of new wire & cable technologies in India, and pricing analysis. Additionally, it includes an overview of the installation scenario for companies, the number of replacements and maintenance in India, new product introductions, key industry developments such as mergers, partnerships, and acquisitions. Besides this, the report also offers insights into the market trends and highlights key industry dynamics. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.94% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Voltage

|

|

By End-User

|

Frequently Asked Questions

Fortune Business Insights says that the market was worth USD 9.32 billion in 2024.

The market is expected to exhibit a CAGR of 7.94% during the forecast period (2025-2032).

By voltage, the low voltage segment is the leading segment and held a dominant market share in 2024.

Polycab, KEI Industries Ltd, and Havells India Ltd are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us