Industrial Dust Collector Market Size, Share & COVID-19 Impact Analysis, By Mechanism Type (Dry and Wet), By Product Type (Baghouse Dust Collectors, Cartridge Dust Collectors, Wet Scrubbers Dust Collectors, Inertial Separators, and Electrostatic Precipitators), By End-use Industry (Food & Beverage, Pharmaceutical, Energy & Power, Steel, Cement, Mining, and Others), and Regional Forecast, 2026– 2034

Industrial Dust Collector Market Size

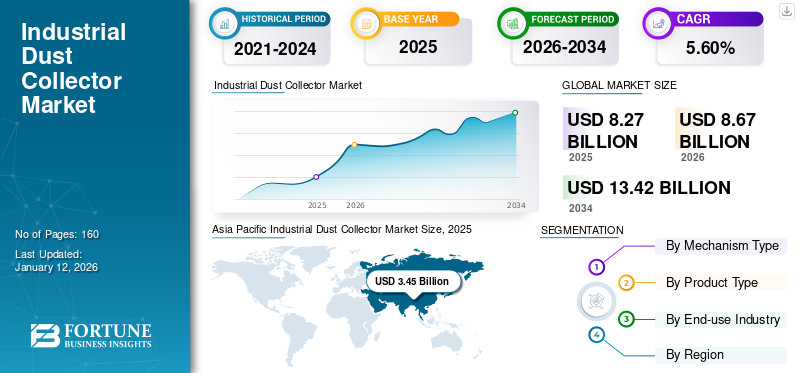

The global industrial dust collector market size was valued at USD 8.27 billion in 2025. The market is projected to grow from USD 8.67 billion in 2026 to USD 13.42 billion by 2034, exhibiting a CAGR of 5.60% during the forecast period. Asia Pacific dominated the global market with a share of 41.8% in 2025.

An industrial dust collector is a type of air pollution control equipment used in plants, factories, warehouses & other commercial or industrial settings to meet safety requirements for the environment and workplace. Efficient dust collection systems decrease, control & remove potentially hazardous gases & particulate matter from the air and the surrounding environment during production & manufacturing.

An industrial dust collector is designed to filter & purify dangerous fine and dust particulate contaminant matter from the atmosphere and control air quality. Rising infrastructural development and industrial manufacturing activities are responsible for the growth of the global market.

In the workplace, industrial dust collectors are useful tools for collecting fine and dispersed dust. These industrial dust extractors are built to meet the specific needs of customer's processing facility for maximum efficiency. The catch, transport, and collect principle governs dust collector systems, which are utilized to improve air quality in residential, commercial, and business settings.

COVID-19 IMPACT

Increasing Usage of Dust Collectors in Pharmaceuticals Industry Propelled Market Growth Amid the Pandemic

During the pandemic, the lockdowns enforced by governments of several economies across the world brought about a halfway or complete closure of organizations, which hampered market proliferation. However, the pharmaceuticals sector continued to grow during the COVID-19 pandemic. Dust collectors helped in destroying pollutants to maintain a sterile climate in pharmaceutical manufacturing units.

Pharmaceutical companies need a high degree of value control in the vicinity to ensure product quality and safety amid the pandemic. Clinics and wellbeing frameworks across the world were following strict cleanliness conventions to control the spread of infections and viruses. Increasing medicine demand during the pandemic boosted production activities thus generating the need for dust collectors and driving market augmentation.

Industrial Dust Collector Market Trends

Technological Advancements & Integration of Filter System to Propel Market Growth

Manufacturing facilities are positioning these dust collectors to decontaminate the air in and around machinery and where employees work. Dust collectors are present in several plants over the world, from woodworking shops to metal fabricators, to grain elevators & food processing plants. In most operations, they are considered ancillary equipment as they safeguard the core production assets, but do not play a role in manufacturing the product themselves.

As most of the operations have restricted staff who do not play a role in manufacturing, industrial dust collector maintenance and filter changes are falling behind. This generates a need for IoT connected equipment as it will run more cost-effectively, more self-sufficiently & perhaps, even remotely. Furthermore, leading organizations are launching products with abrasive recycling filter systems. Flexibility of systems plays an important role in the dust collector landscape as this aspect is benefiting stakeholders in the dust collectors industry. Newly-introduced systems in the market are standalone equipment that integrate into any side of a blast cabinet or blast room.

Download Free sample to learn more about this report.

Industrial Dust Collector Market Growth Factors

Increasing Awareness Regarding Environmental Regulations to Aid Market Augmentation

The market development is driven by stringent government regulations to achieve environmental compliance and increasing hygiene standards in the food industry. The increasing application of the product in the construction industry, rising industrial manufacturing & global economic activities, and increasing number of coal power plants along with rapid infrastructure development will drive market expansion.

In addition, there are some organizations, such as Occupational Safety and Health Administration (OSHA), that issue standards to regulate air quality in the industries. One of the main industries emitting hazardous gases is the energy and electrical industry. Flue gases from the energy and power plant industry must be cleaned before they are released into the environment. Dust collectors support the collection and removal of harmful particles from exhaust gases.

RESTRAINING FACTORS

High Maintenance Costs and Requirements to Hinder Market Augmentation

Factors such as high costs associated with maintenance and high priority over other air filtration technologies are expected to adversely affect market growth from 2021 to 2028. Additionally, certain dry dust collectors require compressed air and cannot be used with damp or wet contents. Some are energy and time sensitive and cannot handle extreme temperatures. These factors are expected to influence the industrial dust collector market growth to some extent.

Industrial Dust Collector Market Segmentation Analysis

By Mechanism Type Analysis

Dry Segment to Hold Larger Share Owing to Higher Removal Efficiency

According to mechanism type, the market is classified into dry and wet.

The dry segment is expected to hold a strong revenue share over the forecast period due to its higher particle removal efficiency compared to wet dust collectors. These dust collectors also use less energy to trap small, dangerous dust particles. The dry segment is projected to dominate the market with a share of 58.48% in 2026.

Meanwhile, the wet segment is likely to grow at a considerable rate due to its utilization in other fields such as pharmaceuticals, biomedical manufacturing, and food processing. These collectors trap dust and particles by passing the air stream through a body of water.

By Product Type Analysis

Baghouse Dust Collectors to Grow Significantly Fueled by their Cost-effectiveness & High Efficiency

Based on product type, this market is split into baghouse dust collectors, cartridge dust collectors, wet scrubbers dust collectors, inertial separators, and electrostatic precipitators.

The baghouse dust collectors segment is expected to dominate the market. All biological pollutants, smoke, dust, and other harmful particles are effectively collected by industrial baghouse dust collectors. Moreover, they are very cost-effective when compared to other categories of products. The baghouse dust collectors segment is expected to lead the market, contributing 32.87% globally in 2026.

There are three main types of inertial separators such as sedimentation chambers, impact chambers, and centrifuges. These devices use a combination of forces such as inertial force, centrifugal force, and gravity to remove or collect dust particles. These product types are ideal for industries with flue gas temperatures between 40°F and 200°F.

Electrostatic precipitators segment is anticipated to have major growth. It is attributed to its utilization to remove soot and ash from exhaust fumes from a variety of sectors looking to decrease particulate matter in the exhaust air. Therefore, this decreases the level of particulate matter within the environmental restrictions.

The cartridge dust collectors segment is expected to grow moderately during the forecast period. These products are highly efficient as they can capture dust particles & have a faster filtration rate than other types.

Wet scrubbers dust collectors can handle high temperature ranges, making them ideal for use in almost any industry. Wet scrubbers can also be used to filter humid gases. These devices can be used to remove various pollutants such as sulfur and other acid gases that cause acid rain.

To know how our report can help streamline your business, Speak to Analyst

By End-use Industry Analysis

Cement Industry Accounted for Major Growth Due to Rising Demand in Construction Sector

As per end-use industry, the market is divided into food & beverage, pharmaceutical, energy & power, steel, cement, mining, and others.

The cement segment will record significant growth as it produces a large amount of dust. Cement plants need different types of dust collectors to control air quality. Concrete batching involves various processes such as measurement, storage and transport, all of which require dust collectors. The cement segment will account for 28.37% market share in 2026.

Moreover, the energy & power sector is one of the largest producers of poisonous gases. Flue gases emitted by the energy and electricity industry contain harmful particles that must be removed before entering the environment. Thus, dust collectors help to collect and remove such contents of flue gases, which is propelling the need for dust collectors.

The steel segment is one of the main users of dust bag collectors due to the high moisture content and particulate emissions generated during the manufacturing process. Additionally, stringent emission level regulations of the government are expected to increase the demand for such products during the forecast period.

The pharmaceuticals segment is going to witness moderate growth. It is attributed to the production and manufacture of medicines, harmful particles and dust are generated, which can be toxic to workers and the environment. The key factors boosting the growth of the segment are rapid growth of the pharmaceutical industry, growing production in pharmaceutical companies, and spread of various industrial dust collection systems.

Rising hygiene standards in the food and beverage industry will boost market growth. The market is primarily driven by the widespread use of these devices in industries such as construction. The increase in industrial production activities integrated with infrastructure development will increase demand. Development of coal-fired power plants will contribute to market growth during the forecast period.

REGIONAL INSIGHTS

The market is analyzed across five main regions, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

Asia Pacific

Asia Pacific Industrial Dust Collector Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific industrial dust collector market share is the highest, owing to rapid industrialization and increasing economic activity in developing countries such as India and China. Additionally, the region's reduced dependence on coal due to the shift to sustainable practices is also fueling market growth. India's manufacturing industry is growing in demand with the acceleration of infrastructure projects. This will lead to growth in the transport and industrial fuels sector. The Japan market is forecast to reach USD 1.00 billion by 2026, the China market is set to reach USD 1.21 billion by 2026, and the India market is likely to reach USD 0.76 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

In Asia Pacific, the China market is expected to grow the fastest, mainly due to the support initiatives announced by the Chinese government. Fine particles continue to be a problem in Chinese cities, especially in the 75 cities that participated in air quality monitoring. The Ministry of Environmental Protection (MKM) has introduced effective environmental protection monitoring, which ensures the improvement of air quality. Such initiatives by the Chinese government will lead to the growth of the market.

North America

The North America market is expected to grow significantly due to stricter government regulations on emissions control. The EPA enacted the Clean Air Act, which regulates industrial emissions of hazardous air pollutants (HAPs). EPA has developed various technology-related standards to control industrial emissions. Maximum Achievable Control Technology (MACT) standards regulate emission levels by regulating and limiting the source of polluted air. These regulations increase the use of industrial dust collectors to limit emissions, and thus increase the demand for dust collectors. The U.S. market is estimated to reach USD 1.32 billion by 2026.

Europe

There are several organizations in Europe that are developing technologies to limit dust emissions. AECC is an international association of European companies developing filter-based technologies to reduce emissions. Filter-based technologies include various woven and non-woven filter materials, reducing emissions to the environment. These technologies are increasing the demand for industrial dust collectors and fueling the market growth in this region. The UK market is expected to reach USD 0.30 billion by 2026, while the Germany market is anticipated to reach USD 0.59 billion by 2026.

Rest of The World

The Middle East & Africa region is predicted to have steady growth during the forecast period. The contribution of the industrial sector to the economy is the greatest due to the presence of local and large centralized facilities for coal power plants and oil refineries. This will lead to increased demand for industrial dust collectors in the industry, which will increase market growth in this region.

South America is likely to grow at a moderate rate due to its niche in manufacturing industry development. However, limited presence of market players and the underdeveloped distribution channel of the market are the reasons for the slow growth of the industry in South America.

KEY INDUSTRY PLAYERS

Companies Emphasize on Advanced Technologies & Product Upgrades

The companies integrate proprietary filter technologies that ensure effective filtration of pollen and dust. Major manufacturers such as FLSmidth and Hamon experienced a huge drop in annual sales due to the COVID-19 pandemic. The market is expected to recover in the coming years. New product developments and technological advancements are expected to boost market growth.

LIST OF TOP INDUSTRIAL DUST COLLECTOR COMPANIES:

- FLSmidth (Denmark)

- 3M Company (U.S.)

- Kelin Environmental Protection Technology Co., Ltd. (China)

- Emerson Electric Co. (U.S.)

- KC Cottrell (South Korea)

- Nederman Holding AB (Sweden)

- Sumitomo Heavy Industries, Ltd (Japan)

- Donaldson Company, Inc. (U.S.)

- Babcock & Wilcox Enterprises, Inc. (U.S.)

- RoboVent (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Camfil Air Pollution Control launched the latest resource for battery manufacturers that reports the need for efficient dust collection, which is significant for both worker and environmental safety.

- October 2022: Emerson launched its new ASCOTM DPT control system. The solution optimizes the performance of filter and dust collection systems by providing accurate and reliable low-particle monitoring, enhanced cleaning control, early warning leak detection, and real-time diagnostics.

- April 2022: Donaldson Company, Inc. is a manufacturer of filtration products and solutions. The company has incorporated new features into the iCue Connected Filtration Service for performance monitoring and data collection.

- November 2022: Camfil Air Pollution Control, a global manufacturer of industrial dust and mist collection systems, announced plans to build a groundbreaking, innovative manufacturing and office building.

- June 2022: Donaldson Company, Inc. is expanding its operations in Pune, India. The factory's industrial dust, smoke and mist collectors and filters meet the needs of South Asian customers in particular. They allow the company to expand its activities in other areas as well.

REPORT COVERAGE

The global industrial dust collector market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Mechanism Type

|

|

By Product Type

|

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 8.27 billion in 2025.

The market is likely to grow at a CAGR of 5.60% over the forecast period (2026-2034).

The baghouse dust collectors segment is expected to lead the market due to its cost-effectiveness & high efficiency.

The Asia Pacific market size stood at USD 3.45 billion in 2025.

Increasing environmental regulations awareness to drive the market growth.

Some of the top players in the market are FLSmidth, Emerson Electric Co., Donaldson Company, Inc., and Nederman Holding AB.

China dominated the market due to rising government regulations in 2025.

High initial investment and daily maintenance of industrial dust collectors restrain the deployment of the product.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us