Industrial Gases Market Size, Share & Industry Analysis, By Gas Type (Oxygen, Nitrogen, Carbon Dioxide, Hydrogen, Argon, and Others), By Application (Packaging, Coolant, Carbonation, Cryogenic, Cutting & Welding, Laboratory, Air Separation, and Others), By End-User (Metallurgy, Healthcare, Chemical, Food and beverage, Oil & Gas, Power, Pulp and Paper, Electronics, Water Treatment, Mining, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

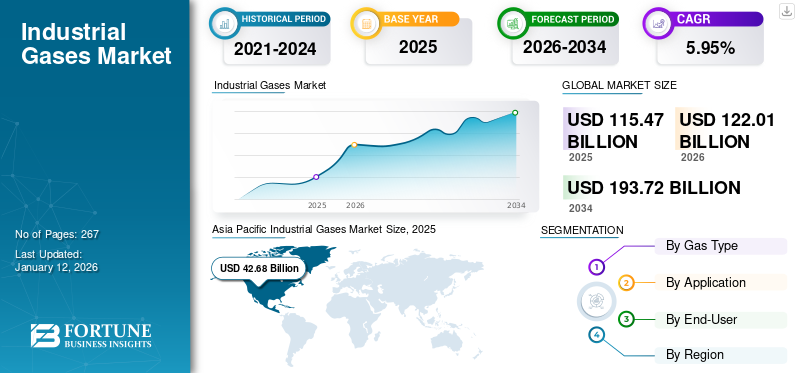

The global industrial gases market size was valued at USD 115.47 billion in 2025 and is projected to grow from USD 122.01 billion in 2026 to USD 193.72 billion by 2034, exhibiting a CAGR of 5.95% from 2026 to 2034. The market is driven by high demand in automotive, metallurgy, chemicals, and healthcare sectors, rising investments in hydrogen and green technologies, and rapid industrialization across Asia Pacific. Asia Pacific dominated the industrial gases market with a share of 36.97% in 2025.

Rising demand from sectors such as automotive, metallurgy, and chemicals is driving growth. Industrial gases are crucial in applications such as welding, metal cutting, and process optimization. Gases such as oxygen and nitrogen have high demand in the healthcare industry for respiratory support, medical imaging, and sterilization processes. The robust growth of electronics and semiconductor manufacturing has increased demand for high-purity gases such as nitrogen, hydrogen, and specialty gases for processes such as etching and circuit board production. Hydrogen gas, with its role in fuel cells and green energy applications, is receiving significant attention, further driving investments in hydrogen production.

The growing demand from major end-use industries, such as oil and gas, chemicals, petrochemicals, food and beverage, and power, has contributed to the growth of the market. The increasing production of low-sulfur, clean-burning fuels requires a massive amount of hydrogen for the hydrotreating of petroleum distillates, which is driving the demand for merchant supplies. The rising popularity of electronic devices throughout the world and the surging demand for renewables are projected to offer opportunities for market growth.

Air Liquide is a prominent and leading company in the global market, recognized for its extensive operations, innovative solutions, and strong customer base. It's one of the largest producers of industrial gases globally, competing alongside companies such as Linde. Air Liquide offers a wide range of gases and services, including those for industrial, medical, and healthcare sectors.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Hydrogen as a Fuel Drives Market Growth

Hydrogen is a versatile and clean energy carrier that produces no direct carbon emissions when used as fuel. As global commitments to reduce carbon footprints intensify, hydrogen offers a viable alternative to fossil fuels for sectors with high emissions, such as transportation, manufacturing, and energy production. The appeal of hydrogen lies in its potential to decarbonize these sectors without a complete overhaul of existing infrastructure, which makes it particularly attractive.

- In March 2025, the Government of India launched pilot projects for the adoption of hydrogen in commercial buses and trucks, aligning with the country's carbon emission reduction target. For instance, in transportation, hydrogen fuel cells are increasingly adopted in heavy-duty vehicles, buses, and even trains. These vehicles require energy-dense fuel sources, and hydrogen fits the bill by providing a high energy yield without the emissions associated with gasoline or diesel

While conventional hydrogen production methods (such as steam methane reforming) are carbon-intensive, the rise of “green hydrogen” is changing the landscape. Green hydrogen is produced through the electrolysis of water using renewable energy sources such as solar or wind, ensuring a zero-emission production process. Governments and companies alike are increasing investments in green hydrogen production, which is expected to be a game-changer for the industrial gases market growth.

Expanding Use of Industrial Gases in Healthcare Aids Market Growth

The healthcare sector's reliance on industrial gases is expanding, with oxygen, nitrogen, nitrous oxide, carbon dioxide, and other specialty gases playing critical roles in various medical applications. These gases are essential for patient care, pharmaceutical manufacturing, laboratory research, and diagnostics, supporting a range of treatments and procedures.

In January 2025, Air Liquide signed a contract with 20 hospitals in Europe to reduce its carbon footprint through the supply of low-carbon oxygen and nitrogen. Oxygen is a vital gas for respiratory therapy, especially with rising respiratory conditions. It is used in emergency care, operating rooms, and ICUs to treat hypoxia and ensure patient stability during and after surgeries.

Nitrogen is crucial in pharmaceutical manufacturing to maintain product stability by preventing oxidation and contamination, particularly in the production of vaccines and biologics. Additionally, liquid nitrogen is used in cryosurgery to remove abnormal tissues and preserve biological samples. Other significant gases include helium for cooling MRI machines, nitrous oxide for anesthesia and pain management, and carbon dioxide for laparoscopic surgeries. Specialty gases such as argon, nitrogen, and carbon dioxide are also essential in life sciences and biotechnology research. Factors such as an aging population and increased healthcare access initiatives are further driving the demand for these medical gases.

MARKET RESTRAINTS

Stringent Laws and Regulations for Manufacturing, Storage, and Distribution of Gases to Restrain Growth

Industrial gases must meet high purity standards, especially for applications in healthcare, food processing, and electronics manufacturing. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), enforce strict guidelines on gas purity and safety. Compliance with these standards requires specialized equipment and rigorous quality control processes, increasing manufacturing costs and making market entry challenging for new players.

MARKET OPPORTUNITIES

Sustainable and Green Technology Application to Fuel Market Growth

Carbon Capture and Storage (CCS) is a process aimed at reducing carbon dioxide (CO₂) emissions from industrial sources, such as power plants, cement manufacturing, and steel production. Industrial processes often emit large amounts of CO₂, a greenhouse gas contributing to global warming. To counteract this, CCS technology captures CO₂ at the emission source, preventing it from entering the atmosphere.

The process typically involves capturing CO₂ at its source, transporting it via pipelines, and storing it in underground geological formations, such as depleted oil and gas fields or deep saline aquifers. This helps reduce CO₂ emissions from large-scale industrial operations. Industrial gas companies are integral to the CCS process, as they supply high-purity CO₂ for capture and storage initiatives. These companies develop specialized technologies to facilitate CO₂ capture and purification, making it suitable for storage. Additionally, gases such as nitrogen and argon are used in supporting processes, helping ensure safety and efficiency in the capture and transport stages.

MARKET CHALLENGES

Regulatory Compliance and Environmental Concerns to Create Challenges for Market Players

The market faces challenges, including safety risks, environmental concerns, regulatory compliance, supply chain management, price volatility, and infrastructure constraints, which require companies to implement robust safety protocols, sustainable practices, and efficient logistics. The handling, production, and transportation of industrial gases involve inherent risks, including exposure to hazardous materials, high-pressure systems, and cryogenic temperatures. Moreover, compliance with safety, environmental, and quality standards for industrial gas production, handling, and storage involves regulatory oversight, certification requirements, and risk management practices.

INDUSTRIAL GASES MARKET TRENDS

Decarbonization And Green Ammonia Production Is Expected Support Market Growth

One of the most significant trends is the push toward decarbonization. Agriculture is a substantial contributor to greenhouse gas emissions, and fertilizer production, particularly ammonia synthesis from natural gas, is a major culprit. Consequently, there's increasing investment and focus on "green ammonia" production, utilizing renewable energy sources for electrolysis to produce hydrogen, a key ingredient in ammonia.

For instance, CF Industries, a leading nitrogen and hydrogen products manufacturer, is investing heavily in green ammonia production. In 2023, they announced a planned expansion of their Donaldsonville, Louisiana, facility to produce green ammonia using approximately 50,000 tons of green hydrogen annually. A grant from the U.S. Department of Energy partially funds this project.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic significantly impacted the global market, affecting supply chains, production, and demand across various sectors. The demand for industrial gases such as oxygen, nitrogen, and carbon dioxide varied by industry. Healthcare witnessed a surge in oxygen demand, especially for ventilators and respiratory care, due to the high number of COVID-19 patients, creating a short-term spike in demand. Conversely, demand dropped in sectors such as manufacturing and oil & gas as operations slowed down due to lockdowns and reduced workforce availability.

Many industrial gases rely on a global supply chain for raw materials, production, and distribution. Lockdowns, border restrictions, and transportation bottlenecks led to challenges in maintaining a steady supply. This was especially pronounced in the early phases of the pandemic, with localized shortages affecting gas supplies in some regions. Lockdowns and health protocols limited workforce availability in production facilities and distribution channels. Companies had to implement strict health and safety measures, which affected productivity and led to higher operating costs.

SEGMENTATION ANALYSIS

By Gas Type

Increasing Steel Production across the Globe to Propel Growth of Oxygen Segment

Based on gas type, the market is segmented into oxygen, nitrogen, carbon dioxide, hydrogen, argon, and others.

Oxygen accounted for the most significant portion of the industrial gas market, and the steel industry primarily drives its demand. Oxygen is crucial in the steelmaking process, enhancing efficiency and reducing impurities. The growth of the construction and automotive sectors, which rely heavily on steel, directly impacts the oxygen demand. The Oxygen segment dominates the market contributing 29.80% globally in 2026

Similarly, nitrogen's versatility makes it essential in the food and beverage industry for food preservation and cryogenic freezing, driven by the growing global demand for processed foods.

Carbon dioxide is crucial in the beverage industry for carbonation in soft drinks and beer, with increasing consumption in emerging markets fueling its demand.

Hydrogen is gaining traction as a clean energy carrier, driven by the growing emphasis on decarbonization and its potential as a low-emission fuel source.

To know how our report can help streamline your business, Speak to Analyst

By Application

Increasing Demand from Cryogenic Segment to Boost the Market Growth in Near Future

In terms of application, the market is segmented into packaging, coolant, carbonation, cryogenic, cutting & welding, laboratory, and air separation, and others.

The cryogenic segment is dominating the market owing to its wide applications with a share of 22.84% in 2026. It is mainly used to produce cryogenic fuels, such as liquid hydrogen and liquid oxygen, for rockets and spacecraft applications.

The packaging segment is also set to grow steadily, owing to changing lifestyles and the rising demand for packaged food products from the food and beverage industry.

The expanding process industry, which drives the need for coolant applications from the petrochemical, chemical, energy, food, and pharmaceutical industries, would propel the growth of the coolant segment in the upcoming years. Air separation application involves separating atmospheric air into its constituent gases such as nitrogen, oxygen, and argon. These gases are then used in various other applications. Driven by the growing demand for these core gases across industries, air separation remains a cornerstone of the industrial gas market.

By End-User

Increasing Demand from Metal Manufacturing to Aid Market Growth

In terms of end-users, the market is segmented into healthcare, food and beverage, oil & gas, chemical, power, metallurgy, electronics, mining, pulp and paper, water treatment, and others.

The metallurgy sector is a major consumer of industrial gases, particularly oxygen, nitrogen, and argon. These gases are essential for processes such as steelmaking (oxygen for combustion and refining), heat treating (nitrogen for inert atmospheres), and welding (argon for shielding).

The Healthcare segment is dominating the market with a share of 21.98% in 2026. Healthcare relies heavily on medical gases, especially oxygen for respiratory therapy, nitrogen for cryopreservation, and nitrous oxide for anesthesia. The growing aging population and increasing prevalence of respiratory diseases are driving segment’s market growth.

The chemical industry utilizes industrial gases as raw materials, process enablers, and for safety purposes. Industrial nitrogen is crucial for creating inert environments, while hydrogen is vital for ammonia production. Hence, the global industrial gases market continues to grow, propelled by technological advancements, expanding industrial activity, and the increasing recognition of the benefits that these versatile gases offer across diverse applications which is expected to fuel market growth in coming years.

INDUSTRIAL GASES MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Asia Pacific Industrial Gases Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

High Demand from the Manufacturing Industry Drives Market Growth in the Region

North America holds a significant share of the global market, driven by a robust industrial base and stringent environmental regulations. The region represents a mature market characterized by high demand for specialty gases used in electronics manufacturing, pharmaceuticals, and research. Innovation in gas production and application technologies is a key driver. Moreover, the aging population and increasing healthcare expenditure are fueling the demand for medical gases such as oxygen and nitrogen, further boosting market growth.

U.S.

Increasing Demand from Healthcare and Manufacturing Drives the Market in the Country

The U.S. industrial gases market is experiencing growth driven by increasing demand from various industries, especially healthcare and manufacturing, along with advancements in technology and environmental regulations. The U.S. market is projected to reach USD 28.4 billion by 2026. The rising need for industrial gases in medical treatments, surgical procedures, and respiratory applications is a major driver. The use of gases such as nitrogen and helium for cryopreservation and medical imaging is also driving market growth.

Europe

Government Inclination toward Hydrogen Adoption to Boost Market Growth in Europe

The European Hydrogen Strategy, coupled with national hydrogen strategies across member states, is fostering investments in hydrogen production, infrastructure, and applications. Companies such as Linde, Air Liquide, and Messer are heavily investing in green hydrogen projects across Europe, including electrolyzer development and hydrogen refueling stations. The UK market is projected to reach USD 4.59 billion by 2026, while the Germany market is projected to reach USD 5.64 billion by 2026.

- In October 2023, Air Liquide announced a partnership with Siemens Energy to build a 200 MW electrolyzer in Oberhausen, Germany, to produce green hydrogen for industrial applications. This signifies the growing scale of green hydrogen projects driven by European policy and demand. Another example is the H2Global initiative, a dual auction mechanism that aims to import green hydrogen and hydrogen derivatives from countries outside the EU to meet domestic needs. This reflects the acknowledgment that Europe's production capacity might not be sufficient in the short-to-medium term.

Asia Pacific

Rapid Industrialization in Key Countries to Boost Market Growth in the Region

The growth in the Asia Pacific region is heavily reliant on emerging economies such as China, India, and Southeast Asian nations. The region holds the leading industrial gases market share amongst the other regions studied. These countries are experiencing rapid industrialization, infrastructure development, and urbanization, leading to substantial demand for industrial gases across various sectors. A mix of global giants and numerous regional and domestic players characterizes the Asia Pacific market. This intense competition leads to price pressures and necessitates companies to differentiate themselves through innovation, customer-centric solutions, and strong regional partnerships. The Japan market is projected to reach USD 1.62 billion by 2026 and the India market is projected to reach USD 7.16 billion by 2026.

China

Expansion of the Healthcare Sector in the Country to Drive Market Growth

The industrial gas market in China is experiencing growth, driven by factors such as the expansion of the healthcare sector, increasing industrialization and urbanization, and the growing demand from manufacturing industries, especially in metallurgy, semiconductors, and healthcare. China market is projected to reach USD 19.74 billion by 2026

China's Manufacturing PMI Remains in Expansion Territory reports highlight the continued strength of the Chinese manufacturing sector, a significant consumer of industrial gases. In October 2024, Linde China announced a strategic partnership with a leading Chinese steel manufacturer to supply on-site oxygen and nitrogen generation plants, optimizing production efficiency and reducing carbon emissions. This partnership highlights the trend of integrated gas supply solutions tailored to specific industry needs.

Latin America

Increasing Demand for Processed and Packaged Food to Create Growth Opportunities for Industry Players

The Latin America market is influenced by factors such as economic conditions, industry concentrations, and regulations. Brazil and Mexico, in particular, are witnessing increased application of industrial gases for food preservation, packaging, and modified atmosphere applications. This is fueled by a growing middle class with rising disposable incomes and a demand for processed and packaged food products. News reports indicate significant investments in food processing facilities across the region, further bolstering the demand for gases such as nitrogen and carbon dioxide.

Middle East & Africa

Flourishing Oil & Gas Industry Drives Market Growth in the Region

The market in the Middle East & Africa (MEA) presents a unique set of opportunities and challenges distinct from other global regions. Fueled by rapid industrialization, infrastructure development, and the expanding petrochemical sector, the demand for industrial gases such as oxygen, nitrogen, argon, hydrogen, and carbon dioxide is experiencing significant growth.

Countries such as Saudi Arabia, the UAE, and Qatar are actively diversifying their economies away from crude oil dependence by expanding their petrochemical production capabilities. This expansion directly translates into increased demand for industrial gases used in various processes, including cracking, distillation, and the production of polymers and other specialty chemicals. For example, the recent expansion of SABIC's petrochemical facilities in Saudi Arabia has significantly boosted local demand for industrial gases.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Company’s Focus on Investment to Tackle Carbon Emissions to Gain a Competitive Edge

Different small and large players present across the competitive landscape have experienced substantial investment in the healthcare and pharmaceutical industries, driving the potential for industry expansion. However, numerous participants operating at the national and regional levels, such as Bombay Oxygen Corporation Limited, SICGIL India Limited, Yateem Oxygen, Goyal MG Gases Pvt. Ltd., and many others, are continuously striving to provide various gases to fortify their position across the regions.

For instance, in February 2025, Bristol joins the UK Push to boost greenhouse gas tracking. The capability of the U.K. to assess greenhouse gases has advanced due to a new atmospheric monitoring station. This station, operated by the University of Bristol and the University of Manchester, will supply data to enhance estimates of emissions, including atmospheric hydrogen produced by the country's growing hydrogen economy. New initiatives by many such organizations to deliver different gases in an optimized procedure are likely to favor the growth in their market shares and thereby propel the global industry size.

List of the Key Industrial Gases Companies Profiled

- Air Liquide (France)

- Air Products (U.S.)

- Linde (Ireland)

- Matheson Tri-Gas (U.S.)

- Messer Group (Germany)

- Gulf Cryo (Kuwait)

- BASF (U.S.)

- Southern Company Gas (U.S.)

- Universal Industrial Gases (U.S.)

- Ellenbarrie Industrial Gases Ltd (India)

- Bhuruka Gases Ltd (India)

- Concorde-Corodex Group (UAE)

- Dubai Industrial Gases (UAE)

- Bristol Gases (UAE)

KEY INDUSTRY DEVELOPMENTS

- October 2024: Air Liquide announced to supply oxygen to LG Chem for their electric vehicle battery plant in the U.S. Supplying oxygen to LG Chem’s future cathode active material plant, the Group will be supporting the growth of the battery ecosystem in the U.S. This investment will increase the Group’s footprint in a key region and support the development of its industrial merchant market.

- October 2024: Linde announced an agreement with Tata Steel to obtain and manage two additional Air Separation Units (ASUs) and enhance industrial gas supply to Tata Steel in Odisha, India. This arrangement will more than double Linde's on-site capacity at Tata Steel's Kalinganagar facility, where it presently runs two plants. The new ASUs, anticipated to be operational by 2025, will deliver oxygen, nitrogen, and argon to aid Tata Steel's expansion project and cater to the local merchant market. Linde has additionally acquired renewable energy agreements to lower its scope emissions, in line with its 2035 GHG reduction goals.

- July 2024: Air Liquide announced an investment of USD 104.914 million to support Aurubis AG, a major global provider of non-ferrous metals and one of the largest recyclers of copper worldwide, in Bulgaria and Germany. This investment will finance a new Air Separation Unit (ASU) in Bulgaria and the upgrading of four existing units in Germany. Besides supplying substantial amounts of oxygen and nitrogen for the rising copper and other metal production by Aurubis, these facilities will also assist in the growth of industrial merchant markets in both areas.

- January 2024: Air Products, a company in industrial gases and clean hydrogen projects, announced the opening of its expanded Project Delivery Centre in Vadodara, India.

- July 2023: Nippon Sanso Holdings Corporation announced that Matheson Tri-Gas, Inc, NSHD’s U. S. operating entity, has entered into a gas supply contract with PointFive to deliver oxygen for the carbon capture, utilization, and sequestration company’s inaugural Direct Air Capture (DAC*) facility in Texas. MATHESON will invest in and set up an Air Separation Unit to provide oxygen to “Stratos,” PointFive’s DAC facility currently under construction in Ector County, Texas. The oxygen is utilized in the DAC process to generate a pure stream of CO2, which is subsequently securely sequestered in geological reservoirs.

Investment Analysis and Opportunities

The market presents significant investment opportunities due to its steady growth across various sectors. Moreover, th focus on environmentally friendly practices and products aligns with global trends and regulations, attracting investment from various governments and market players.

- In February 2025, Braskem announced plans to increase its petrochemical plant to 220,000 metric tonnes (t)/yr, located in Rio de Janeiro, following the “switch to gas” efficiency initiative. Moreover, the company will also increase domestic ethane from state-controlled Petrobras to reduce the utilization of naphtha.

- In June 2024, Praxair announced an investment in advanced CO2 capture technology at one of its key US facilities. The project seeks to capture and purify CO2 emissions for use in various applications, including enhanced oil recovery and food and beverage industries.

REPORT COVERAGE

The global industrial gases market report delivers a detailed insight into the market. It focuses on key aspects such as leading companies in the market. Besides, it offers regional insights and global market trends & technology and highlights key industry developments. In addition to the factors above, it encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 5.95% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Gas Type

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 122.01 billion in 2026.

The market is likely to grow at a CAGR of 5.95% during the forecast period of 2026-2034.

The oxygen segment is expected to lead the market during the forecast period.

Asia Pacific dominated the industrial gases market with a share of 36.97% in 2025.

Rising demand for hydrogen and increasing use of industrial gases in healthcare are driving market growth.

Some of the top players in the market are Air Liquide, Air Products, Linde, Matheson Tri-Gas and others.

The global market size is expected to record a valuation of USD 193.72 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us