Joint Pain Injections Market Size, Share & Industry Analysis, By Product (Corticosteroid Injections, Hyaluronic Acid Injections, Platelet Rich Plasma Injections, and Others), By Joint Type (Knee, Hip, Hand & Wrist, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

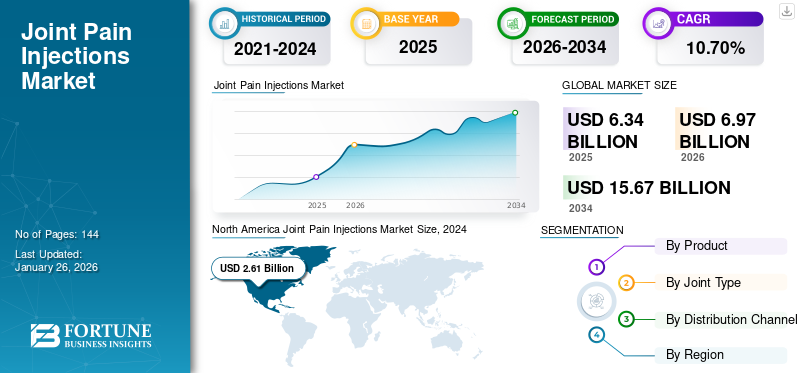

The global joint pain injections market size was valued at USD 6.34 billion in 2025. The market is projected to grow from USD 6.97 billion in 2026 to USD 15.67 billion by 2034, exhibiting a CAGR of 10.70% during the forecast period. North America dominated the joint pain injections market with a market share of 45.52% in 2025.

Moreover, the U.S. joint pain injection market is projected to grow significantly, reaching an estimated value of USD 5.49 billion by 2032, driven by the rising incidence of sports injuries and awareness regarding joint disorders.

Joint pain injections are an effective method for reducing inflammation and managing pain among patients who have various musculoskeletal disorders, including rheumatoid arthritis, psoriatic arthritis, and others. The corticosteroid injections are usually the first line of pain management. They are delivered directly to the painful area in the patients. The growing prevalence of several musculoskeletal disorders, such as osteoarthritis and rheumatoid arthritis, among others in the general population, is leading to a large patient pool requiring treatment. The increasing focus of the players operating in the market on developing and introducing novel therapies and products to cater to the rising demand is expected to augment market growth.

Moreover, the growing number of treatments is attributed to the favorable reimbursement policies in developed countries. In addition, the increasing awareness of the benefits of intra-articular injections in treating joint pain is responsible for the rising demand for joint pain injections.

- According to a 2021 report published by Versus Arthritis, approximately 20 million people in the U.K. suffer from musculoskeletal conditions (MSK), such as arthritis.

The market declined during the COVID-19 pandemic due to reduced patient visits for treatment, thereby decreasing the overall demand for joint pain injections. However, the rising prevalence of musculoskeletal conditions among the general population and the robust focus of the key market players on developing and introducing novel products are anticipated to fuel the market's growth during the forecast period.

Joint Pain Injections Market Overview & Key Metrics

Market Size & Forecast

- 2025 Market Size: USD 6.34 billion

- 2026 Market Size: USD 6.97 billion

- 2034 Forecast Market Size: USD 15.67 billion

- CAGR: 10.70% from 2026–2034

Market Share

- North America led the joint pain injections market with a 45.52% share in 2026, driven by high osteoarthritis prevalence, advanced healthcare infrastructure, and favorable reimbursement policies in the U.S. and Canada.

- By Product, Hyaluronic Acid (HA) Injections dominated in 2024 due to growing osteoarthritis incidence and strong awareness of HA's clinical efficacy in pain relief.

Key Country Highlights

- United States: Joint pain injections are projected to reach USD 5.49 billion by 2032, fueled by a rise in sports injuries and growing awareness of joint disorders. Government support and Medicare coverage (e.g., Aetna's DUROLANE access) are accelerating treatment adoption.

- Japan: Aged population (35.8% over 60) is driving demand for intra-articular injections, especially for knee osteoarthritis. Government-backed awareness and support for aging-related musculoskeletal conditions further bolster growth.

- China: Rapidly aging population and urbanization are contributing to increased musculoskeletal disorder prevalence, making China a major growth market for HA and PRP injections.

- Europe: Policies such as the European Alliance of Associations for Rheumatology (EULAR) support HA injections for osteoarthritis, promoting joint pain injection adoption, especially in Germany, France, and the U.K.

Joint Pain Injections Market Trends

Growing Preference for Minimally Invasive Procedures Among the Patient Population Globally

Recent advancements in the pharmaceutical industry are leading to the development of novel therapies and treatment options for the management of various musculoskeletal conditions, including osteoarthritis.

The increasing awareness about minimally invasive procedures for the treatment and management of these conditions and rising benefits of the procedures, such as rapid adsorption of the drug, more extended relief period for patients, less pain, and others, are resulting in a rising preference for such procedures among the patient population.

- For instance, in August 2021, Bioventus completed its investment in Trice Medical, Inc., one of the leading companies focused on developing and commercializing minimally invasive technologies for sports medicines and orthopedic surgical procedures.

Furthermore, the rising focus of the key players operating in the market on increasing their R&D activities to develop and introduce minimally invasive treatment options is a significant trend involved in the development of innovative treatment solutions such as platelet-rich plasma injections and plasma matrix therapy. In addition, ongoing research activities highlight benefits associated with novel treatments, which support the adoption of innovative products.

- According to an article published by the U.S. National Library of Medicine in July 2022, phase 3 clinical trials are carried out by Emory University on the effectiveness of injection with the composition constituting Mesenchymal Stem Cell (MSC) preparations from autologous Bone Marrow Concentrate (BMAC) and human mesenchymal stem cells manufactured from Umbilical Cord Tissue (UCT) for the treatment of knee osteoarthritis.

Therefore, the introduction of innovative products in the market is responsible for increasing the shift of preference toward joint pain injections.

Download Free sample to learn more about this report.

Joint Pain Injections Market Growth Factors

Rising Number of Sports Injuries and Growing Awareness of Musculoskeletal Disorders to Boost Market Growth

The increasing cases of sports injuries, such as ligament and muscle injuries globally, are resulting in a rising patient population suffering from chronic pain and other bone disorders. The increasing patient population is leading to a growing demand for pain management therapies such as joint pain injections, among others.

- According to 2022 data published by the National Safety Council (NSC), there were more than 445,000 injuries related to exercise equipment in the U.S.

The rising number of injuries, increasing initiatives by the government and other national organizations to increase awareness regarding musculoskeletal conditions, and the availability of various treatment options are expected to boost the demand for these products.

In addition, increasing per capita expenditure on healthcare in developed countries and new product launches by market players bolster the demand for intra-articular injections in the global market.

RESTRAINING FACTORS

High Cost Associated with the Products May Hamper their Adoption in Emerging Countries

The benefits of joint pain injections, including HA injections and PRP injections, among others, are a significant factor contributing to the rising penetration of these devices among the general population in the U.S., Germany, France, and others. However, the relatively high cost of these products as compared to other forms of medications is one of the major factors expected to limit the adoption of the devices.

- For instance, according to a 2021 article published by the Arizona Pain and Spine Institute, PRP injections cost around USD 500 – USD 2,000 per injection in the U.S. The patients are usually required to take two to three doses of the injections for better results.

Along with this, the availability of alternative treatment options for pain management, including oral drugs and sprays, among others, is expected to hinder the adoption of joint pain injections in emerging countries.

- According to a 2022 article published by the National Center of Biotechnology Information (NCBI), a course of physical therapy was more cost-effective than a course of glucocorticoid injections for patients with knee osteoarthritis.

Limited reimbursement policies for these products in developing countries are further anticipated to limit the adoption of these injections among the patient population, discouraging the joint pain injections market growth. Moreover, the lack of awareness about these products in developing countries is accountable for the lower adoption of intra-articular injections in the treatment of joint pain.

Joint Pain Injections Market Segmentation Analysis

By Product Analysis

Growing Patient Pool Suffering from Osteoarthritis to Propel the Hyaluronic Acid Injections Segment Expansion

Based on product, the market is segmented into corticosteroid injections, hyaluronic acid injections, platelet rich plasma injections, and others.

The hyaluronic acid injections segment led the market accounting for 66.38% market share in 2026. The dominance was due to the rising patient pool suffering from osteoarthritis and increasing awareness regarding the clinical efficiency of HA injections.

The rising support of government authorities to promote treatment options among patients in several countries is another major factor contributing to the growth of the segment. Along with this, the increasing regulatory and ethical approvals by regulatory bodies to continue clinical trials are another significant factor contributing to the growth of the segment.

- For instance, in April 2023, Synartro AB received the Swedish Medical Products Agency and the Swedish Ethical Review Authority to start phase 1/2a, the first-in-human clinical study of the investigational drug candidate SYN321 for the treatment of knee osteoarthritis.

The corticosteroid injections segment is expected to grow at a considerable CAGR during the forecast period. The growth of the segment is attributed to the rising use of these injections as the first line of treatment for osteoarthritis, among other joint pain disorders. The growing patient pool undergoing diagnosis and treatment is a significant factor supporting the segmental growth in the market.

The platelet-rich plasma injections segment is anticipated to grow at the highest CAGR during the forecast period, owing to the rising clinical studies demonstrating positive and efficient results of these injections in pain management in patients with osteoarthritis.

- According to a 2021 article published by Baylor College of Medicine, a single PRP injection in patients with knee osteoarthritis showed significant improvement in terms of mobility, pain, and quality of life within six weeks of the treatment.

To know how our report can help streamline your business, Speak to Analyst

By Joint Type Analysis

Growing Prevalence of Knee Osteoarthritis Among the Population to Impel Segment Growth

Based on joint type, the market is segmented into knee, hip, hand & wrist, and others.

The knee segment dominated the market accounting for 48.32% market share in 2026. The dominance is attributed to several factors, such as the rising prevalence of knee OA, the increasing diagnosis rate of the condition among the patient pool, and others.

- According to the 2023 study published in the Lancet, osteoarthritis is the most common form of arthritis, and around 15.0% of the population worldwide is affected by the condition.

The hand and wrist segment is expected to expand at a considerable growth rate during the forecast period. Growing awareness regarding the condition of patients suffering from osteoarthritis and increasing diagnoses among patients are some of the major factors expected to fuel the segment's growth.

The hip segment is projected to grow at a nominal CAGR during the forecast period. The rising prevalence of the condition among osteoarthritis patients is one of the major factors anticipated to fuel the growth of the segment.

- According to a 2023 article published by the University of Washington, the prevalence of hip osteoarthritis among patients suffering from osteoarthritis is projected to increase by around 78.6% by 2050.

The others segment is expected to grow owing to the rising prevalence of other joint conditions related to the spine, foot, and ankle, among others. The rising adoption of the treatment among the global population is another major factor driving the growth of the segment.

By Distribution Channel Analysis

Increasing Number of Retail Pharmacies with Pain Injections to Support Segment Growth

The market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies based on distribution channel.

The retail pharmacies segment will account for 85.31% market share in 2026. The dominance is owed to the increasing number of retail pharmacies supplying joint pain injections globally. The easy accessibility and procurement of injections from retail pharmacies and the availability of these drugs at a discounted rate are some of the major factors contributing to the growth of the segment.

On the other hand, the online pharmacies segment is anticipated to record a significant CAGR during the forecast period. The rising regulatory policies for online sales of prescription drugs in developed countries and the entry of leading e-pharmacy players in Germany, the U.K., and other countries are leading to a shift in patient preference toward online pharmacies.

In addition, the lower selling prices of injections by online pharmacies are another major factor responsible for the growth of the segment.

- For instance, Synvisc injection, used to treat joint pain in osteoarthritis patients, is sold on the Canada Pharmacy website for USD 100-150 per 2ml syringe, whereas the same product costs around USD 300-350 per 2ml syringe in offline stores.

The hospital pharmacies segment is anticipated to grow owing to factors such as the growing hospitalization rate of patients suffering from orthopedic conditions, rising patient visits to hospitals for the diagnosis of the condition, and others.

REGIONAL INSIGHTS

The market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America Joint Pain Injections Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2024, North America dominated the global joint pain injections market with a share of 45.52% in 2025 and market size of USD 3.19 billion in 2026.

The growing prevalence of osteoarthritis in the U.S. and Canada is one of the prominent factors leading to the increasing adoption of treatment options, including intra-articular injections among this patient population. The U.S. market is projected to reach USD 2.92 billion by 2026.

- For instance, according to a 2022 article published by the Radiological Society of North America (RSNA), there are around 32.5 million U.S. adults affected by osteoarthritis.

The rising focus of the government bodies in the region on the promotion of the adoption of joint pain injections among the patients by creating awareness and increasing the coverage policies of the products, among others, are some of the factors that are expected to augment the growth of the market in the region.

Asia Pacific market for joint pain injections is expected to grow at the highest CAGR during the forecast period owing to the increasing geriatric population in China, Japan, India, and others, leading to a higher risk of development of various musculoskeletal conditions. The Japan market is projected to reach USD 0.53 billion by 2026, the China market is projected to reach USD 0.4 billion by 2026, and the India market is projected to reach USD 0.1 billion by 2026.

- According to 2022 data published by Population Pyramid, the population aged 60 years and above in Japan was nearly 44.5 million and constituted around 35.8% of the total population.

Europe is projected to expand at a considerable growth rate during the forecast period. The increasing support of government bodies and other healthcare organizations to create awareness about musculoskeletal conditions, available treatment options, and others is expected to spur regional growth during the forecast period. The UK market is projected to reach USD 0.33 billion by 2026, while the Germany market is projected to reach USD 0.4 billion by 2026.

- For instance, the 2020 European Alliance of Associations for Rheumatology updated the recommendations for the management of knee osteoarthritis and supported the use of hyaluronic acid injections among patients.

Latin America and the Middle East & Africa are expected to expand at a nominal growth rate during the forecast period. The improving healthcare infrastructure, growing healthcare expenditure, and rising prevalence of musculoskeletal conditions in the countries are some of the major factors anticipated to augment the growth of the regions.

- According to a 2020 study published by the World Health Organization (WHO)/International League Associations for Rheumatology Community Oriented Program for the Control of Rheumatic Diseases (COPCORD), the prevalence of osteoarthritis is increasing in Latin American countries, with prevalence rates of 10.5% in Mexico, 4.1% in Brazil, 14.4% in Peru, and 20.4% in Cuba. In addition, knee osteoarthritis accounted for around 45.0% of the total osteoarthritis cases in Latin American countries.

- Similarly, according to a 2020 article published by the National Library of Medicine, the prevalence of knee osteoarthritis in Africa is 21.0% among the population.

The increasing focus of the key players on fueling the adoption of the products in Brazil, Mexico, and others are a few other factors contributing to the growth of the regions.

List of Key Companies in the Joint Pain Injections Market

Key Players Focus on R&D Activities to Enhance the Efficiency of Pain Management Products

The global market is fragmented and operated by several players with a broad product portfolio. Some of the prominent players operating in the market include Bioventus, SEIKAGAKU CORPORATION, and Zimmer Biomet, among others. These players increasingly focus on R&D activities to improve the efficiency of pain management products and create awareness regarding the products to cater to the rising demand among the patient population.

- For instance, in September 2021, Bioventus announced that the American Academy of Orthopaedic Surgeons (AAOS) updated the clinical practice guidelines (CPG) and indicated that DUROLANE showed statistically significant results in the management of knee osteoarthritis patients.

Few players, such as Ferring B.V., Dr. Reddy’s, Anika Therapeutics Inc., and Sanofi, among others, have a robust focus on developing and introducing novel products in global markets, which is expected to support their growing joint pain injections market shares.

- For instance, in April 2022, Dr. Reddy’s Laboratories Ltd. launched Methylprednisolone Sodium Succinate for Injection, USP, the generic equivalent of SOLU-MEDROL in the U.S. for the treatment of arthritis, blood disorders, and several allergic conditions.

Thus, the rising prevalence of various musculoskeletal conditions, including osteoarthritis, among the population, along with the growing treatment rate among patients, is expected to support the market players in developing and introducing novel therapies for the treatment and management of the conditions.

LIST OF KEY COMPANIES PROFILED:

- SEIKAGAKU CORPORATION (Japan)

- Bioventus (U.S.)

- Anika Therapeutics, Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Sanofi (France)

- Pacira BioSciences, Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Ferring B.V. (Switzerland)

- Dr. Reddy’s Laboratories Ltd. (India)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 – Bioventus agreed to a nationwide contract with Aetna Medicare Advantage plans, wherein over 3 million Aetna Medicare Advantage plan members will have access to DUROLANE, single-injection hyaluronic acid (HA)-based joint-fluid treatment, to treat knee osteoarthritis (OA).

- November 2022 – Anika Therapeutics, Inc. announced that its product Cingal demonstrated positive results in phase III clinical trials and is planning to proceed further for the U.S. FDA approval.

- March 2022 – Sanofi collaborated with IGM Biosciences Inc. to develop, manufacture, and introduce potential therapeutics in the fields of immunology and inflammation.

- January 2022 – SEIKAGAKU CORPORATION announced the establishment of a new company in Canada, SEIKAGAKU NORTH AMERICA CORPORATION, with an aim to expand its geographical presence.

- August 2021 – SEIKAGAKU CORPORATION launched Hylink, a viscosupplementation injection, in Taiwan through TCM Biotech International Corp. for the treatment of knee osteoarthritis.

REPORT COVERAGE

The research report provides an overall joint pain injections market scenario. It focuses on key aspects such as leading companies, product, joint type, and distribution channels. Besides this, it offers insights into the trends in the global market, highlights key industry developments, and COVID-19's impact on the market. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.70% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Joint Type

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 6.97 billion in 2026 to USD 15.67 billion by 2034.

In 2025, the market size of North America was at USD 2.89 billion.

The market is expected to grow at a CAGR of 10.70% during the forecast period (2026-2034).

By product, the hyaluronic acid injections segment led the market in 2025.

The rising prevalence of osteoarthritis and obesity, the presence of potential pipeline candidates for pain relief in osteoarthritis, and the rising adoption of injections among the population are anticipated to propel market growth.

Bioventus, SEIKAGAKU CORPORATION, and Zimmer Biomet are some of the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us