Leather Chemicals Market Size, Share & Industry Analysis, By Product Type (Beamhouse Chemicals, Tanning, Dyeing, and Finishing Chemicals), By End-use Industry (Foot Wear, Garment, Automobile, Furniture, Glove, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

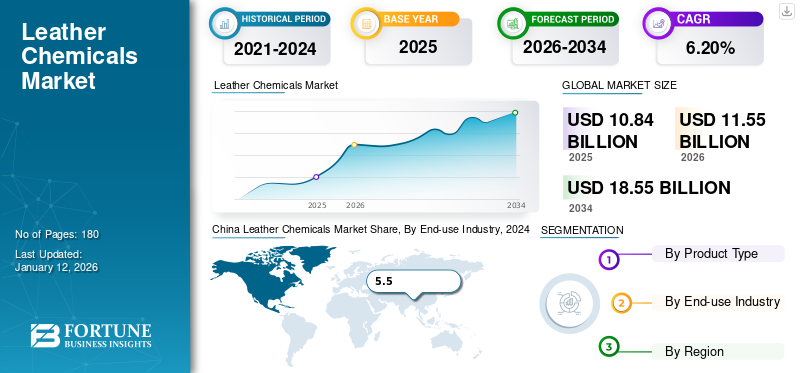

The global leather chemicals market size was valued at USD 10.84 billion in 2025 and is projected to grow from USD 11.55 billion in 2026 to USD 18.55 billion in 2034 at a CAGR of 6.20% during the 2026-2034 period. Asia Pacific dominated the leather chemicals market with a market share of 43% in 2025.

Chemicals used in the tanning, dyeing process, and finishing stages of the leather manufacturing process are referred to as leather chemicals. The tanning and dyeing chemicals used in leather processing are determined by the desired finished product's attributes, making the industry sensitive to changes in the fashion industry. The demand for leather chemicals is expected to rise significantly due to increasing demand from the footwear and automobile upholstery industries, especially in Asia Pacific's developing economies. In recent times, the types of chemicals used in leather processing have been governed by sustainability and health impacts, prompting the use of eco-friendly and sustainable chemicals.

The COVID-19 pandemic led to many challenges for industrial production globally. Restrictions enforced to prevent the virus from spreading significantly impacted the production facilities globally, resulting in reduced capacity or even total shutdown. The leather market and associated industries, including manufacturing, were among the most severely affected due to the disrupted supply chain.

Global Leather Chemicals Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 10.84 billion

- 2026 Market Size: USD 11.55 billion

- 2034 Forecast Market Size: USD 18.55 billion

- CAGR: 6.20% from 2026–2034

Market Share:

- Asia Pacific dominated the leather chemicals market with a 43% share in 2025, driven by high domestic consumption, strong export capabilities, and growing demand from footwear and automobile upholstery sectors in China, India, and ASEAN countries.

- By product type, tanning chemicals are expected to retain the largest market share in 2025, supported by advancements in technology, increasing demand for high-quality leather, and the dominant role of chemical manufacturers in the leather supply chain.

Key Country Highlights:

- United States: Demand is driven by premium automobile interiors and increased consumer preference for luxury upholstery, despite a growing shift towards synthetic alternatives.

- China: The country dominates the leather sector due to its integrated supply chain, rising disposable income, and leadership in footwear and leather goods manufacturing.

- India: Growth is fueled by a thriving footwear and tanning industry, supported by affordable labor, abundant raw materials, and export-oriented production.

- Germany: European expertise in high-quality leather, especially in fashion and automotive applications, continues to drive demand for specialized, sustainable chemicals.

- Brazil: With strong domestic production and exports of leather goods, Brazil remains a key market for leather chemicals, bolstered by investments in technology and skilled labor.

Leather Chemicals Market Trends

Rising Demand for Eco-friendly Leather Processing to Prompt Development of New Technologies

Chemicals with lower exposure toxicity, greater biodegradability, organic solvent-free finish formulations, and sustainability in both application and production are examples of green solutions in leather chemicals. Amid rising environmental concerns, manufacturers are adopting and developing new products and technologies that are cleaner and less damaging to the environment. For example, in January 2022, Stahl, a leather chemical manufacturer, and the Dutch NGOs Solidaridad and MVO Nederland, these three project partner tanneries in Ethiopia, performed successful trials that resulted in a much lower environmental impact in overall leather processing. As part of these trials, Stahl’s chemical techniques and systems were employed by the Green Tanning Initiative in Ethiopia. A few of the green technologies employed during trials include probiotics in the beam house, a pickle-free tanning process, and ZDHC-compliant chemicals for the retanning and finishing steps. With governments increasingly emphasizing sustainable green technologies and enacting stricter regulations, more leather chemical makers are expected to develop sustainable and ecologically friendly chemicals.

Download Free sample to learn more about this report.

Leather Chemicals Market Growth Factors

Rising Demand for Upholstery Leather for Automobiles to Drive Market Growth

Rising consumer preference for attractive vehicle interiors has prompted automakers to adopt high-quality leather upholstery in vehicle interior manufacturing. The majority of vehicle owners are concerned about the aesthetics of their vehicle's interior, preferring upholstery leather for car interior. The interior of an automobile is an essential aspect that appeals to the customer. Automotive leather upholstery is used to improve the feel and appearance of the interior, which may be a persuasive factor for a consumer making a vehicle purchase decision. Growing prosperity in most of Asia, along with the typical Asian preference for premium products, is expected to result in the purchase of high-quality leather upholstery and other goods. Premium grade leather demand is expected to rise faster in Asia in comparison to other regions globally during the forecast period. For example, in the high-value segments, the percentage of leather-upholstered vehicles sold in China is close to 100. The rise in consumer preference for premium and high-end automobile interiors, owing to an increase in buyers' purchasing power globally, is expected to grow the automotive leather upholstery sector, which in turn will drive the leather chemicals market growth.

RESTRAINING FACTORS

Implementation of Stricter Environmental Regulations to Hinder Market Growth

The leather processing industry poses detrimental environmental challenges, leading governments worldwide to adopt stricter environmental regulations to protect the environment. Disposing of tannery waste is expensive, making environmental issues a top priority for tanners. Tannery effluent has a high concentration of dissolved and suspended organic and inorganic matter, resulting in a high oxygen demand. Leather manufacturing operations are linked to an unpleasant odor produced by waste material and the presence of sulphide, ammonia, and other volatile chemicals. Due to increased consumer awareness, the demand for eco-friendly alternatives to leather chemicals has been rising steadily. Leather manufacturers aim to manufacture sustainable leather that has a low environmental impact. For example, they are developing expertise in wet-end processing chemicals that meet the highest environmental and quality standards. Adherence to initiatives such as Zero Discharge of Hazardous Chemicals (ZDHC) and Manufacturing Restricted Substances List (MRSL) standards reflects their commitment to environmental responsibility. However, strict compliance with health and environmental laws is estimated to reduce the use of environmentally damaging chemicals, hindering market growth.

Leather Chemicals Market Segmentation Analysis

By Product Type Analysis

Tanning Segment Holds a Major Market Share due to Technological Advancements

Based on product type, the market is segmented into beam house chemicals, tanning, dyeing, and finishing chemicals. The tanning segment is projected to dominate the market with a share of 41.13% in 2026. Over the last few decades, chemical companies have conducted extensive research and development, both long-term and seasonal, leading to a shift in technology ownership from tanneries, research institutes, and educational institutions to these corporations. As a result, tanning chemical producers have become a dominant force in the leather supply chain, with higher profit margins than those obtained in the tanning sector itself.

The beamhouse chemicals typically involve substances used in the process of beaming, where hides are treated with beamhouse chemical solutions to remove hair and flesh and prepare the leather for subsequent processing.

To know how our report can help streamline your business, Speak to Analyst

By End-use Industry Analysis

Foot Wear End-use Industry Accounted for the Dominant Market Share owing to Rising Demand for Leather

In terms of end-use industry, the market is segmented into foot wear, garment, automobile, furniture, glove, and others. In terms of value, the footwear end-use industry segment is expected to account for 48.57% of the market share in 2026. Over the last few decades, developing economies in Asia Pacific, particularly China, have progressed from a poorly structured industry catering primarily to its domestic market to becoming the world's most dominating player in footwear. Due to increased demand from domestic and international markets, Asian footwear manufacturing is likely to rise further during the forecast period. The growth of the footwear sector, particularly in Asia Pacific, is predicted to convert these regions into global footwear centers, benefiting and driving market expansion.

Another significant segment in terms of value is the automotive segment, where leather enhances the interior design of the automobile, contributing to higher levels of comfort, luxury, and aesthetic appeal. Rising demand from the expanding automotive industry, particularly the premium vehicle segment, is expected to fuel demand for leather, driving market growth in tandem.

REGIONAL INSIGHTS

Based on geography, the market is studied across Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Leather Chemicals Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

The market size of Asia Pacific stood at USD 4.63 billion in 2025 Asia Pacific accounts for the highest market share in terms of domestic consumption and export of leather chemicals. China is the region's major consumer of leather chemicals, followed by India, Japan, South Korea, and a few other ASEAN countries. Due to the fact that the Chinese industry is highly integrated, tanneries often work closely with shoe or garment factories, resulting in its dominance in leather footwear, garments, upholstery, and other leather products. China's size and population, together with rising disposable income per capita, indicate that it is likely to maintain its leading position in most leather manufacturing sectors. The leather processing industry is anticipated to prosper during the forecast period owing to the region's locally available raw materials and cheap labor costs. Since people's purchasing power is rising in the region, demand for leather products will increase substantially. Rising consumer demand and the region's robust leather manufacturing capability are expected to fuel leather chemicals market growth. The Japan market is projected to reach USD 0.86 billion by 2026, the China market is projected to reach USD 2.92 billion by 2026, and the India market is projected to reach USD 0.27 billion by 2026.

China Leather Chemicals Market Share, By End-use Industry, 2024

To get more information on the regional analysis of this market, Download Free sample

Europe

Europe is a significant player in the international leather trade. European leather products are well-known and valued by manufacturers worldwide for their high quality and fashionable designs. In the European Union, tanneries are mainly family-owned, small and medium-sized enterprises. Tanners in Italy and France have a long history of creating a wide range of leathers, from bovine and calf leather to sheep and goat leather, sole and exotic specialties to double-face garment leather. Their expertise contributes significantly to the growth of leading footwear, clothing, furniture, and leather product manufacturers. This solid experience and superior know-how of European tanners are expected to continue to generate significant demand for their leather products in domestic and international markets. This, in turn, is anticipated to benefit and drive demand for leather chemicals. The Germany market is projected to reach USD 0.07 billion by 2026.

Latin America is a major consumer of leather chemicals owing to the region's thriving leather processing industry. The region has a substantial domestic supply of raw materials and a massive pool of skilled labor, implying that the regional leather processing industry's future is solid. Brazil is a major regional consumer of leather processing chemicals and a major player in the global leather export business. The country produces high-quality footwear and leather goods domestically and has a logistical advantage as an exporter to the U.S. and Canada. Italy and China are two other major importers of Brazilian leather. Over the last few years, the regional leather sector has become more entrepreneurial, investing in new technology and improving the quality of its products. During the forecast period, the regional leather processing and end-use industries are anticipated to expand, which will benefit and drive market growth.

North America

The market in North America is expected to witness sluggish growth. The leather industry in the U.S. has been experiencing a challenging situation for some years, which is likely to continue during the forecast period. Customers are increasingly opting for plastic synthetic substitutes that resemble leather. In consumer goods segments such as footwear and automotive upholstery, synthetic alternatives have taken a major market share away from leather. The trade war between the U.S. and China has worsened the situation, causing significant damage to the leather industry. The U.S. market is projected to reach USD 0.27 billion by 2026.

List of Key Companies in Leather Chemicals Market

Strategic Collaborations Pursued by Companies to Strengthen Their Market Share

Global chemical manufacturers, historically engaged in chemical production, supply leather chemicals to various end-use industries. The major key market players operating include Chemtan Company, Inc., Eastman Chemical Company, Stahl Holdings B.V., Pidilite Industries Limited, and TFL Ledertechnik GmbH. Large firms compete with independent, small- and medium-sized specialty companies in the market, which are highly competitive. A few of the strategic initiatives adopted by these companies to safeguard their market position is to develop collaborations with other players to increase their regional presence in unexplored markets.

LIST OF KEY COMPANIES PROFILED:

- Chemtan Company, Inc. (U.S.)

- DyStar Singapore Pte Ltd (Singapore)

- SCHILL+SEILACHER GMBH (Germany)

- Stahl Holdings B.V. (Netherlands)

- Pidilite Industries Limited (India)

- TFL Ledertechnik GmbH (Germany)

- Eastman Chemical Company (U.S.)

- TEXAPEL (Spain)

- Indofil Industries Limited (India)

- TANNINGOIL (Spain)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 – Pidilite Industries Limited collaborated with Syn-Bios, an Italy-based company involved in R&D, manufacturing, and marketing of chemicals primarily for the leather tanning industry. As per the collaboration, Pidilite would be responsible for the sales and distribution of Syn-Bios products in India, Bangladesh, Nepal, Sri Lanka, and Vietnam. Both companies also aim to collaborate on developing technical solutions for the leather industry.

- March 2021 – Stahl introduced the Stahlite product line for use in the retanning and fat liquoring stages of wet-end leather production process. Specialty polymers are used in place of traditional retanning and softening chemicals in the new product. These polymers penetrate deeper into the leather fiber structure, forming a smooth coat over the fiber bundles and fibrils. This results in a lightweight automotive leather that, when compared to conventional leather, saves up to 30% of its weight - in a luxury automobile with a complete leather interior. This eliminates the weight excess associated with a typical leather interior, leading to lower fuel consumption in conventional vehicles and increased range in electric vehicles.

- January 2020 – LANXESS AG completed the sale of its chrome chemicals business to Brother Enterprises, a Chinese manufacturer of leather chemicals. LANXESS received approximately USD 87 million upon the closure of the deal. Brother Enterprises also acquired the Newcastle plant in South Africa from LANXESS. Sodium dichromate is produced at the plant and part is converted into chromic acid. LANXESS would continue to produce chrome tanning salts from sodium dichromate exclusively for Brother Enterprises on a contract basis at Merebank, South Africa, likely until 2024.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, products, and products. Additionally, it offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses various factors contributing to the market's growth in recent years. It further includes historical data and forecasts revenue growth at global, regional, and country levels and analyzes the industry's latest market dynamics and opportunities.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.20% during 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 10.84 billion in 2025 and is projected to reach USD 18.55 billion by 2034.

In 2025, the Asia Pacific market size stood at USD 4.63 billion.

Registering a CAGR of 6.20%, the market will exhibit steady growth during the forecast period (2026-2034).

The foot wear segment is the leading end-use industry in the market.

Rising demand for upholstery leather for automobiles is a key factor driving the market growth.

Chemtan Company, Inc., Eastman Chemical Company, Stahl Holdings B.V., Pidilite Industries Limited, and TFL Ledertechnik GmbH, are the major players in the market.

Asia Pacific dominates the market in terms of share.

Growing foot wear sector in developing countries is likely to drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us