Lithium-ion Battery Recycling Market Size, Share & Industry Analysis, By Chemistry (Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Manganese Oxide, Lithium Nickel Cobalt Aluminum Oxide, and Lithium Nickel Manganese Cobalt Oxide), By Source (Electronics, Electric Vehicles, Power Tools, and Others), By Process (Physical/Mechanical, Hydrometallurgical, and Pyrometallurgical), and Regional Forecast, 2026-2034

Lithium-ion Battery Recycling Industry Overview (2026-2034)

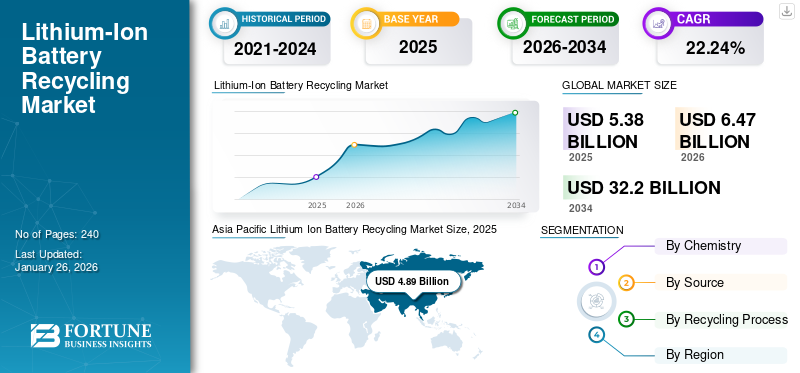

The global lithium-ion battery recycling market was valued at USD 5.38 billion in 2025 and is expected to grow from USD 6.47 billion in 2026 to USD 32.20 billion by 2034, with a CAGR of 22.24% during the forecast period. Asia Pacific dominated the global lithium-ion battery recycling market in 2025, accounting for 90.83% market share. The market is driven by rising demand for electric vehicles and extended producer responsibility (EPR) programs, which require manufacturers to manage waste batteries at the end of their life.

A Lithium-Ion Battery (LIB) is a type of electrochemical cell made up of components, such as electrodes and catalysts to support power generation for various applications. Materials present in the cathode and anode tubes consist of various precious metals with limited reserves and high resale values. Consequently, the recycling process of li-ion batteries is utilized to extract and sell the raw materials accumulated in the electrode composition to lower the overall project cost and reduce the environmental impact. These factors will help the lithium-ion battery recycling market grow.

The novel coronavirus or COVID-19 infection caused a significant delay in operations across different industries. The pandemic plummeted numerous verticals into the girth of declining revenue and demand, affecting the financial health of organizations. Additionally, different administrations rolled out policies, such as national lockdowns and social distancing rules to counter the spread of the viral disease, thereby harming industrial procedures.

However, post-pandemic recovery has boosted investment in recycling facilities, notably in the lithium-ion battery recycling solution industry. Strategic public-private partnerships are focusing on regional resilience, circular resource models, and sustainable waste management, which are expected to speed up market recovery. The increase in gigafactory building in North America and Europe is prompting parallel investments in recycling ecosystems to better manage battery end-of-life.

Lithium Ion Battery Recycling Market Trends

Growing Consumer Awareness of Sustainability to Drive Lithium Ion Battery Recycling Market Growth

Consumers are increasingly making purchasing decisions based on the environmental and social impacts their purchases will have. They are choosing products made with recycled materials, thereby minimizing waste and supporting companies with sustainable practices. This trend directly translates to the lithium-ion battery recycling market, where consumers are demanding Electric Vehicles (EVs) and electronic devices with recycled battery components. This creates pressure on manufacturers and brands to invest in and promote responsible battery recycling practices.

Consumers are more informed and critical than ever, seeking information about the lifecycle of products and the ethical sourcing of materials. This includes transparency about battery sourcing, production, and responsible disposal. Battery recycling addresses these concerns by demonstrating a commitment to circularity and resource conservation. Companies that prioritize and communicate their recycling efforts gain a competitive advantage in attracting environmentally conscious consumers. Growing consumer awareness of sustainability is not just a trend; it's a fundamental shift in values and expectations. This awareness is a powerful driver for the lithium-ion battery recycling market, pushing companies and governments toward a more circular and responsible future.

The emergence of global ESG investment is forcing firms to reveal recycling rates and circular material sourcing information, notably in the lithium-ion battery recycling solution sector. This convergence of consumer values and business environmental goals is driving innovation in second-life battery applications and reverse logistics frameworks, particularly in the lithium-ion battery recycling market in the United States and Europe.

Growing Efforts to Propel Commercialization of Battery Recycling Technology to Shape Industry Prospects

The market has observed the implementation of significant expansion strategies by various public and private players to enhance their recycling capacities to expand the lithium ion battery recycling industry landscape. The setup of new recycling infrastructures is expected to greatly augment the rate of commercialization of various lithium ion battery recycling processes. It is also anticipated to generate high technology demand over the upcoming decades for lithium ion battery recycling. For example, in December 2020, a Canadian li-ion battery recycling company called Li-Cycle announced the inauguration of its new recycling plant in Rochester, New York. The new facility was designed to process 10,000 tons of battery waste a year through a two-step procedure of hydrometallurgy and wet chemistry method to retrieve about 95% of materials.

Automation, AI-driven process optimization, and robotics-based sorting technologies are also being implemented in recycling operations to improve material recovery rates and operational safety. The advent of "urban mining" operations in the United States, China, and South Korea indicates the industry's commitment to localizing raw material recovery and lowering reliance on global supply chains. This modernization wave puts the lithium-ion battery recycling industry on track for exponential development, with sophisticated solutions expected to dominate industrial use by 2030.

Download Free sample to learn more about this report.

Lithium Ion Battery Recycling Market Growth Factors

Increasing Demand For Electric Vehicles To Unlock New Potential For The Lithium Ion Battery Recycling Industry

The rise in popularity of electric vehicles is one of the main driving factors for lithium ion battery recycling industry. As more electric cars were being produced and sold the need to recycle their batteries at the end of their life cycle became more apparent. As awareness of environmental issues and the impact of greenhouse gas emissions grew, there was a global push toward adopting cleaner and more sustainable transportation options. Electric vehicles emerged as a viable alternative to traditional internal combustion engines due to their zero tailpipe emission. Continuous improvements in battery technology and electric vehicle design led to longer driving ranges, faster charging time and overall better performance of EVs. This made electric cars more practical and attractive to a wider audience, driving up the demand.

According to the administration of BILITI Electric estimates, there are about 3 million electric cars in the U.S., representing approximately 1% of the total number of cars on the road. In 2022 alone, companies manufactured around 442,000 electric vehicles, indicating a significant increase in automakers' production of electric cars.

Tesla, Ford, and General Motors are forming strategic partnerships with recycling companies to ensure stable supply chains for critical materials such as nickel, cobalt, and lithium. The lithium-ion battery recycling market in the United States is particularly benefiting from the Biden administration's clean energy policies, which emphasize domestic sourcing and recycling in order to reduce foreign mineral dependence. This alignment of industrial growth and regulatory frameworks will ensure a strong circular battery economy in the coming years.

New Government Rules And Incentives Has Enhanced The Production In The Lithium-Ion Battery Recycling Industry

Many government around the world are implementing regulations to promote responsible battery recycling and waste management. Incentives and policies supporting the recycling of lithium ion batteries encourage businesses and consumers to participate in recycling programs. Some countries and regions set specific recycling targets for lithium ion batteries. Manufacturers and recyclers are required to achieve certain recycling rates to meet these targets. Failure to do so can result in penalties or fines. Such recycling targets drive the industry to develop efficient recycling processes and encourage greater participation in recycling initiatives. Government may offer financial incentives or subsidies to support the establishment and operation of battery recycling facilities. These incentives can take the form of grants, tax benefits or low interest loans. Financial support lowers the barriers for businesses to invest in recycling technologies and facilities making lithium ion battery recycling more economical.

Extended producer responsibility (EPR) laws, as well as the European Union's Battery Regulation 2023, require full traceability of critical minerals recovered through recycling. These initiatives are influencing major OEMs and recycling companies to implement closed-loop supply chain systems. Similar regulatory momentum in the United States is expected to significantly expand the lithium-ion battery recycling market over the next decade, thanks to funding from the Department of Energy's Battery Recycling Initiative and the Infrastructure Investment Act.

Furthermore, the emergence of cross-border recycling alliances, such as those between Japan and South Korea, demonstrates the increasing international collaboration in the lithium-ion battery recycling solution market. These collaborations aim to increase technology transfer, standardize recycling protocols, and promote high-efficiency material recovery in Asia-Pacific and Europe.

RESTRAINING FACTORS

High Initial Investment and Lack of Stern Policies in Some Nations May Hinder Market Growth

The construction of new recycling facilities requires high capital expenditure and dedicated collection & supply chains, the lack of which can limit the growth of this market. Additionally, the absence of a proper regulatory framework in various developing nations to extract battery materials, coupled with the increasing recycling of other batteries, such as lead-acid batteries may pose a problem for the market growth.

Furthermore, inadequate waste collection infrastructure, a lack of awareness of circular economy models, and insufficient collaboration between policymakers and private recyclers continue to limit the lithium-ion battery recycling market. Emerging economies require stronger policy enforcement and technology transfer to improve operational scalability, particularly in the lithium-ion battery recycling solution market and the lithium-ion battery recycling market in the United States.

Lithium Ion Battery Recycling Market Segmentation Analysis

By Chemistry Analysis

Lithium Cobalt Oxide (LCO) Segment Projected To Account For The Major Share Due To Higher Installation Of Battery Bases

Based on chemistry, the industry is segmented into Lithium Cobalt Oxide (LCO), Lithium Iron Phosphate (LFP), Lithium Manganese Oxide (LMO), Lithium Nickel Cobalt Aluminum Oxide (NCA), and Lithium Nickel Manganese Cobalt Oxide (NMC). The Lithium Cobalt Oxide (LCO) segment is projected to lead the industry in terms of volume as well as revenue owing to the large installed base of these batteries. The Lithium Cobalt Oxide segment is expected to lead the market, contributing 49.91% globally in 2026. Besides, the significant presence of recoverable and expensive cobalt material will propel the industry growth.

The transition to LFP batteries, driven by cost savings and safety benefits, is gradually reshaping the lithium-ion battery recycling market landscape. However, the lower metal value of LFP cells presents challenges for recyclers, emphasizing the need for innovation in lithium recovery techniques in the global lithium-ion battery recycling solution industry.

By Source Analysis

Electric Vehicles to Dominate Market Owing to Shift Toward Green Economy

Based on source, this market is divided into electronics, electric vehicles, power tools, and others. The electric vehicle segment is set to hold a dominant part in the lithium-ion battery recycling market share. The recovery of batteries from electric vehicles is projected to observe a significant rise due to the abundant availability of different automobiles, such as cars, buses, bikes, and many more. Besides, the electronics segment is also expected to hold a considerable share of 64.95% in 2026 owing to various factors, such as improved profitability in recycling, disassembling of large devices, and long-standing battery installation in products among others.

The lithium ion battery recycling market in the United States is expected to grow significantly as EV penetration increases and federal incentives encourage closed-loop battery ecosystems. Automakers and recyclers are increasingly collaborating to accelerate domestic material recovery, establishing the United States as a strategic hub for sustainable battery waste management.

By Recycling Process Analysis

Improved Operational Efficiency and Better Metal Recoverability to Propel Adoption of Hydrometallurgical Process

Based on recycling process, the industry is divided into physical/mechanical, hydrometallurgical, and pyrometallurgical. The hydrometallurgical segment is set to hold a significant position in the global market owing to its environment-friendly operations, less complex procedure, and negligible water and gas emissions. Additionally, the pyrometallurgical segment is anticipated to observe considerable growth due to its economical extraction processes and ability to treat a wide range of battery chemistries.

Hydrometallurgical methods are gaining traction in the lithium-ion battery recycling market because they offer higher recovery rates and lower carbon footprints than traditional pyrometallurgy. Innovations in solvent extraction and closed-loop leaching are expected to improve metal yield and process sustainability, boosting the lithium-ion battery recycling solution market's global competitiveness.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Asia Pacific Lithium Ion Battery Recycling Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The regional analysis of the market primarily includes three major regions - North America, Asia Pacific, and Europe. The presence of a large number of recycling companies, availability of different battery manufacturers, large battery installed base, and favorable battery energy storage policies are some of the key factors propelling.

The Asia Pacific dominated the global market in 2025, with a market size of USD 4.89 billion. For instance, in January 2020, GS Engineering & Construction Corp., a South Korean civil engineering company, announced the construction of a new facility for the recycling of lithium-ion batteries at an investment of around KRW 100 billion or USD 86 million by 2022. The company declared that the new unit with a projected capacity of 4.5 kilotons was awarded by Pohang City and North Gyeongsang Province administrations to propel the industry outlook. The lithium-ion battery recycling market in the U.S. is projected to grow significantly, reaching an estimated value of USD 282.03 million by 2032. The Japan market is projected to reach USD 0.29 billion by 2026, and the China market is projected to reach USD 4.47 billion by 2026.

Additionally, North America's industry size is predicted to grow considerably as different market players are formulating significant plans with respect to the treatment of battery systems established over the years. The regional market growth is also backed by the encouraging investments and regulatory frameworks by various administrations and organizations. For example, in February 2021, the Office of Energy Efficiency and Renewable Energy, the U.S. Department of Energy (DoE), and the National Renewable Energy Laboratory (NREL) presented the third and final phase of the Lithium-Ion Battery Recycling Prize. NREL was expected to be the administrator of the competition prize worth USD 5.5 million which aims to work in line with the DoE’s objective to obtain 90% of all consumed LIBs to recover crucial materials and return the new product to the supply chain.The U.S. market is projected to reach USD 0.14 billion by 2026.

Europe's market size is also projected to grow significantly over the forecast timeline. Various companies in the region are actively participating in the industry as they are equipped with a combination of treatment technologies to treat different battery chemistries. Furthermore, European countries are supported by the large clean energy generation targets introduced by the European Union to curb the overall carbon footprint from various industry verticals. For instance, in December 2020, the European Commission unveiled its plans to increase the battery recycling and collection targets for industry players. Apex Organization is likely to increase its portable battery collection and recycling objective from 45% to 65% by 2025 to ensure high rates of recovery across the member states. The UK market is projected to reach USD 0.02 billion by 2026, while the Germany market is projected to reach USD 0.1 billion by 2026.

Furthermore, the lithium-ion battery recycling solution market is experiencing strong cross-regional collaborations to create efficient recycling infrastructure and shared technology frameworks. In Asia Pacific, Japan and China are heavily investing in closed-loop recycling systems to meet rising EV battery waste, whereas the US lithium ion battery recycling market is focusing on localized processing hubs to reduce raw material imports and strengthen supply chain resilience.

Key Industry Players

Umicore to Focus on Fortifying Its Presence Through Organic & Inorganic Expansion Strategies

The global market has observed various small and big players participating at various stages of the li-ion battery value chain. These companies are focusing on enhancing their recycling capacities and deploying environmentally friendly processes to improve their market positions. Umicore is a Belgium-based energy company offering a wide range of products & services catering to battery & catalysts production, chemical treatments, battery recycling, and many more industry verticals.

Additionally, emerging players such as Li-Cycle (U.S.), Redwood Materials (U.S.), and Accurec Recycling GmbH (Germany) are reshaping the competitive landscape of the lithium-ion battery recycling market. These firms are leveraging proprietary hydrometallurgical technologies and closed-loop recovery systems to improve metal yield efficiency and sustainability standards, positioning themselves as frontrunners in the rapidly expanding global lithium-ion battery recycling solution market.

In June 2021, Umicore announced that it would provide equity investment to a U.S.-based battery manufacturer called Solid Power to strengthen its product portfolio for passenger electric vehicles integrated with lithium-ion batteries. The company is focused on increasing its stronghold in battery recycling by integrating the supply chain synergies to expand its usage potential for recycled materials.

LIST OF TOP LITHIUM ION BATTERY RECYCLING COMPANIES:

- SNAM (France)

- Umicore (Belgium)

- Sumitomo Metal Mining Co., Ltd. (Japan)

- Lithion Recycling Inc. (Canada)

- BATREC INDUSTRIE AG (Switzerland)

- American Zinc Recycling Corp (U.S.)

- Fortum (Finland)

- DOWA ECO-SYSTEM Co., Ltd. (Japan)

- Li-Cycle Corp. (Canada)

- Neometals Ltd (Australia)

- ACCUREC Recycling GmbH (Germany)

- AkkuSer (Finland)

- San Lan Technologies Co., Ltd (China)

- Duesenfeld (Germany)

- Glencore (Switzerland)

- Redux GmbH (Germany)

- uRecycle Group (Finland)

- Retriev Technologies Inc. (Canada)

KEY INDUSTRY DEVELOPMENTS:

- April 2023 - Glencore, FCC Ámbito, and Iberdrola collectively announced that they had partnered to provide lithium-ion battery recycling solutions on a large scale for Spain and Portugal. The aim is to tackle one of the biggest medium to long-term challenges in the sector, recycling of lithium-ion batteries through the establishment of a purpose-built facility.

- March 2023 - Fortum Battery Recycling started its EV battery recycling operations in Kirchardt, Germany to offer its services for the collection and processing of end-of-life batteries and production scrap close to central European customers. The hub in Germany can pre-treat over 3,000 tons of batteries per year and is connected to the Harjavalta site where the hydrometallurgical process takes place.

- February 2023 - Li-Cycle announced that it was awarded USD 375 million loan by the U.S. Department of Energy to develop a recycling facility for key battery materials near Rochester, New York for lithium-ion batteries. Much of the focus has been on mining as while the U.S. has an abundance of lithium, getting it out of the ground is expensive, and such projects frequently face local opposition.

- August 2022 - Mercedes-Benz Group AG announced that it had partnered with Contemporary Amperex Technology Co. Ltd. to build a battery factory in Hungary with an investment of USD 7.6 billion. The factory will have a capacity of 100 gigawatt hours, enough to power more than 1 million cars, and will run on renewable energy.

- May 2022 - Glencore announced that it had established a strategic partnership with Li-Cycle Holdings Corp., a leading lithium-ion battery recycler in North America. Both the companies announced that battery recycling would form a key part of energy transition. The company’s aim was to support the creation of a genuinely circular economy that supplies recycled materials and minerals back into the battery supply chain.

REPORT COVERAGE

The research report offers an in-depth analysis of the market. It further provides details on the adoption of li-ion battery recycling technologies across several regions. Information on trends, drivers, opportunities, threats, and restraints of the market can further help stakeholders gain valuable insights into the market. The report also offers a detailed competitive landscape by presenting information on key players along with their strategies in the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 22.24% from 2026 to 2034 |

|

Unit |

Value (USD Billion), Volume (Tonnes) |

|

Segmentation |

By Chemistry

|

|

By Source

|

|

|

By Process

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was valued at USD 5.38 billion in 2025.

The global market is projected to record a CAGR of 22.24% during the forecast period.

The market size of Asia Pacific was valued at USD 4.89 billion in 2025.

Based on process, the hydrometallurgical segment holds the dominating share in the global market.

The global market value is expected to reach USD 32.20 billion by 2034.

Rising adoption of battery-powered electric vehicles is expected to unlock new growth avenues for the industry.

Umicore and Glencore are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us