Loyalty Management Market Size, Share and Industry Impact Analysis, By Offering (Solution {Channel Loyalty, Customer Loyalty, and Customer Retention} and Services {Professional and Managed}), By Operator (B2B and B2C), By Deployment (On-Premise and Cloud), By Enterprise Type (Large Enterprises and Small & Medium Enterprises), By End-Use (BFSI, IT and Telecommunications, Transportation, Retail, Hospitality, Manufacturing, Media & Entertainment, and Others), and Regional Forecast, 2026-2034

Loyalty Management Market Size

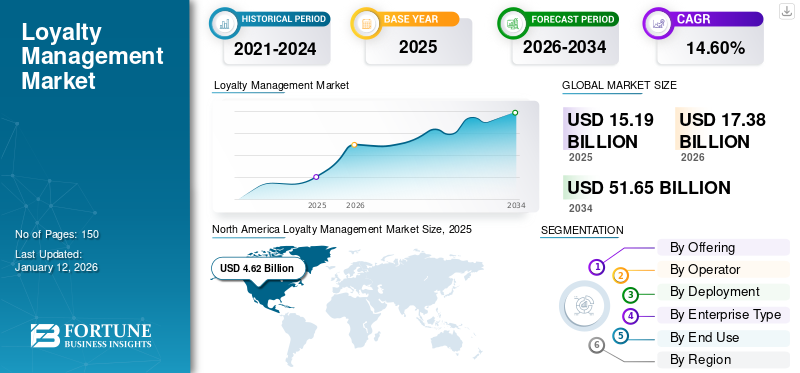

The global loyalty management market size was valued at USD 15.19 billion in 2025 and is projected to grow from USD 17.38 billion in 2026 to USD 51.65 billion by 2034, exhibiting a CAGR of 14.60% during the forecast period. North America dominated the global loyalty management market, holding a dominant market share of 30.40% in 2025.

The scope includes solutions and services offered by companies, such as Comarch SA, Loyalty Management Solutions Pty Limited, and IGT Solutions Pvt. Ltd. As the landscape of customer loyalty is evolving rapidly, coming years is set to witness some momentous trends driven by changing consumer behaviors and advancements in Artificial Intelligence (AI). While AI is changing the narrative of loyalty management, the Metaverse is predicted to play a crucial role in expanding the loyalty experience by offering interactive and immersive platforms for customer engagement. Taking into consideration an era of instant customer gratification, companies are more focused on strategically managing customer loyalty to achieve customer delight and higher revenue.

During the COVID-19 pandemic, end-user purchasing patterns changed drastically. According to a survey conducted by Ketchum, 45% of American shoppers changed their brand choices during the crisis. The survey highlighted that shoppers switched toward larger e-commerce competitors, such as Amazon, Aldi, Walmart, Target, and others, for basic merchandise. This resulted in merchants adopting loyalty management solutions.

IMPACT OF GENERATIVE AI

Growing Integration of Generative AI to Shape Loyalty Management Programs Propel Market Growth

Generative AI is shaping the loyalty management programs in several ways, mainly by enhancing customer experiences. AI helps in automating tasks, such as updating customer profiles and processing rewards, which frees up staff to emphasize other aspects of the business and also leads to major cost savings. Besides, the technology can be used to target high-value customers with personalized offers, which can aid in increasing brand advocacy and sales. By leveraging AI in businesses, companies can create more engaging, relevant, and rewarding loyalty programs for customers.

Furthermore, the implementation of AI in loyalty programs helps in personalized recommendations, customer support & engagement, predictive analytics, fraud detection & prevention, and efficient data analysis. For instance,

- American Express (AMEX) uses AI to prevent and detect deceitful activities in its loyalty program. AI helps AMEX to identify transactions that are likely to be fraudulent or false, such as any transactions carried out from a different location than the user’s usual location.

In the near future, AI will be known to create even more sophisticated and personalized loyalty programs, as it is assumed that it will keep getting refined over the years, thereby improving its performance levels.

Loyalty Management Market Trends

Growing Application of Artificial Intelligence for Innovative Solutions to Drive Market Growth

Providing best-in-class customer experience is vital for the success of any business. However, building customer loyalty is a challenge. The adoption of emerging technologies, such as Machine Learning (ML) and Artificial Intelligence (AI), enables revolutionizing loyalty management systems and enhancing customer engagement. AI-powered loyalty solutions analyze customer data to create personalized offers using their purchase history. For instance, Starbucks uses AI to offer customized offers to each individual based on their purchasing behavior.

Moreover, AI-powered chatbots use Natural Language Processing (NLP) to provide faster and more efficient responses. Through predictive analytics, companies tailor their loyalty programs to meet specific customer preferences. AI is capable of detecting fraud by monitoring various transactions that target loyalty point accounts. For instance, Amazon uses AI to detect and prevent fraudulent activity in the AWS marketplace.

These tools’ advantageous features are expected to boost the loyalty management market growth even further.

Download Free sample to learn more about this report.

Loyalty Management Market Growth Factors

Growing Customer Preference for Personalized Solutions to Push Market Growth

Key players have implemented personalization capabilities into their reward programs to draw significant growth from them. This feature aids in attracting customer attention and improving their overall experience. Customers want individualized advice, discounts, and promotions from companies to profit from them. Such initiatives increase client happiness, which drives their adoption across sectors. Brands may acquire customer attention and trust by making individualized suggestions and offers based on data gathered via multichannel solutions. Many shops are implementing individualized incentive programs due to their numerous benefits. For instance,

- In April 2022, Universal Drugstore partnered with Comarch to launch the Wellness Rewards loyalty program. The program uses Comarch's Loyalty Marketing Cloud to aid enterprises in connecting and engaging with their customers.

- In April 2021, Schuh, a U.K.-based trendy footwear store, partnered with Salesforce.com to develop its reward program. To attract consumers, the program based on the Salesforce Customer 360 Platform creates customer-centric and customized initiatives.

Retailers consider personalized reward programs as they improve sales, consumer loyalty, web traffic, and profit. These aspects are anticipated to boost the loyalty management market growth over the forecast period.

RESTRAINING FACTORS

Stringent Government Regulations May Affect the Adoption of Loyalty Programs

Strict government regulations may hamper the loyalty management market expansion. Concerns regarding various federal and state regulations, such as gift certificate laws, trade stamp laws, data security laws, and privacy laws, may limit the implementation of loyalty programs. Many privacy and security standards and regulations limit merchant access to client information. As a result, businesses are failing to match realistic customer-centric expectations, impacting platform adoption. Various credit card-related rules and laws prevent the banking industry from reorganizing its incentive system, which influences the overall market growth.

Loyalty Management Market Segmentation Analysis

By Offering Analysis

Solutions to Captivate Highest Market Share Owing to Its Enhanced Functionalities

On the basis of offering, the loyalty management market is classified into solution and services. Solution has been further categorized into channel loyalty, customer loyalty, and customer retention. Similarly, services have been further studied for professional and managed services.

Solution captures the largest loyalty management market share owing to its demand from various industries to manage their loyalty programs. Besides, features such as easy implementation within the current framework, efficient testing & management, quick integration with other systems and third-party apps, and scalable & secure infrastructure are attracting end users to deploy loyalty management solutions in their businesses. The solution segment is projected to dominate the market with a share of 59.76% in 2026.

The services segment is predicted to showcase the highest CAGR during the forecast period as it assists end-users in performing extensive data analysis to make data-driven decisions and gain valuable insights. Moreover, loyalty management service providers ensure that they provide 24/7 support to their clients to increase their customer retention rate and enhance their relations with customers.

By Operator Analysis

Growing Urge of B2C Operators to Build Strong Relationships with Customers Drive B2C Segment Growth

Based on operator, the loyalty management market has been classified into B2B and B2C.

B2C operator is expected to grow at the highest CAGR during the forecast period as the demand for loyalty management solutions has been increasing for maintaining and building strong and long term relationships with individual consumers.

Fostering customer loyalty is crucial for B2B companies/operators as it allows them to build long-lasting relationships and, ultimately, gain access to more opportunities with their clients. Thus, B2B operators represent a much greater potential for business engagements, thereby capturing the largest loyalty management market share. The B2B segment is projected to dominate the market with a share of 57.38% in 2026.

By Deployment Analysis

Affordable Program Designing Solutions to Boost Cloud Demand

Based on deployment, the loyalty management market is bifurcated into on-premise and cloud.

The cloud deployment segment is anticipated to hold the dominant market share and witness significant growth throughout the forecast period. The cloud deployment strategy offers an array of devices that are simple to use, such as social media, mobile phones, tablets, and others. The cloud-based software also keeps track of real-time updates on client inquiries and response rates at reasonable pricing. For instance, in March 2021, Comarch SA announced its Loyalty Cloud 1.2 to make management, operations, and building immersive programs more affordable for users. Attributed to the robust security framework, on-premises will demonstrate consistent development. The cloud segment is expected to account for 52.6% of the market in 2026.

By Enterprise Type Analysis

Growing Focus on Customer Retention to Drive Large Enterprises Investments in Loyalty Program

Based on enterprise type, the loyalty management market is bifurcated into small & medium enterprises and large enterprises.

Large enterprises segment will dominate the market share owing to the investments made in loyalty solutions as a result of their large client base and increasing purchase frequency. It increases prospective brand exposure and boosts their market position.

Small & medium enterprises would witness the highest growth rate throughout the projected period, owing to the rising affordability of cloud-based solutions. For instance, to improve consumer engagement and relationships, in May 2022, Zithara, the UPI rewards app, launched the Bharat Loyalty program for small & medium-sized businesses.

By End-Use Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Competition to Drive Reward Program Adoption in the Retail Industry

By end-use, the market is categorized into BFSI, manufacturing, retail, IT & telecommunication, transportation, hospitality, media & entertainment, and others.

The retail segment will attain a largest market share as the industry's strong rivalry is encouraging the development of customer-rewarding solutions. Furthermore, due to increased purchase frequency and as retail business is more transactional, the loyalty program aids in increasing sales and revenue growth.

The BFSI segment will expand rapidly throughout the forecast period. JustBilling, Punchcard, EchoApp, SailPlay, and others are BFSI's rewarding software. Growing competition in the banking industry drives banks to use these solutions to expand and retain their client base. Furthermore, online banking and mobile banking platforms are opening up new possibilities for capturing clientele interests and dedication.

The hospitality sector is also heavily utilizing the rewarding solution to increase client retention by delivering prizes based on their preferences, interests, and spending habits, among other things.

Similarly, the transportation, media, and entertainment industries are transitioning toward rewarding software to increase client trust in their businesses.

REGIONAL INSIGHTS

By geography, the loyalty management market is studied across North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa. They are further classified into countries.

North America

North America Loyalty Management Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America holds the largest loyalty management loyalty management market share due to the rapid adoption of loyalty management software across the regional retail sector. This is due to the preference of North American customers for monetary incentives, such as payback or rebates, free shipping, free items, and product discounts. The U.S. market is estimated to reach USD 3.62 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe will have the second-largest loyalty management market share over the projection period. Loyalty programs are well-established in several European nations. The area is more inclined toward tailored loyalty schemes. For instance, in June 2022, METRO and Capillary Technologies partnered to develop a multi-country B2B loyalty program. This partnership with METRO aids Capillary in its debut in the European market. The UK market is expected to reach USD 1.12 billion by 2026, while the Germany market is anticipated to reach USD 1.17 billion by 2026.

Asia Pacific

Asia Pacific is anticipated to grow at a rapid pace in the market during the forecast period, owing to the growing adoption of digital channels and increasing focus on customer experiences. Key players in the region are providing tailored loyalty programs at reasonable prices to meet the current needs of customers. WeChat, Alipay, WhatsApp, Paytm, and others are some platforms that companies use to deliver their loyalty programs. The Japan market is forecast to reach USD 0.73 billion by 2026, the China market is set to reach USD 1.50 billion by 2026, and the India market is likely to reach USD 1.10 billion by 2026.

Middle East & Africa

The Middle East & Africa will witness a considerable rise in the implementation of loyalty programs. Given the increased usage, in February 2021, Salesforce announced a new loyalty management solution for end users, such as manufacturing, consumer goods, retail, and travel & hospitality, to enhance customer engagement and trust.

Similarly, service firms in Latin America are implementing loyalty programs to enhance consumer engagement and revenue.

List of Key Companies in Loyalty Management Market

New Product Development to Boost Market Position of Key Players

Key market players are focusing on continual product design and portfolio growth with the use of modern technologies, such as AI, machine learning, blockchain, cloud computing, and others. As smartphone penetration grows, several industry participants have begun to provide mobile loyalty management solutions. Real-time, cloud-based analytical management models dramatically improve customer experience. Similarly, the creation of a tailored and personalized loyalty program is projected to boost the key players’ market position. Collaborations, acquisitions, and strategic alliances help market participants improve their financial performance.

- April 2023 – Capillary Technologies acquired Brierley to expand its footprint in the North American market. This acquisition leverages Brierley’s Emotional Loyalty Quotient with Capillary’s enterprise-ready AI-powered Software as a Service (SaaS) platform.

- March 2021 – Comarch SA developed a new webpage for its loyalty and marketing solutions, including its Loyalty Marketing Cloud to improve functionality and navigation. This makes it possible for any industry or small firm to start its own loyalty program.

List of Top Loyalty Management Companies:

- Antavo Limited (U.K.)

- Capillary Technologies (India)

- Bond Brand Loyalty (Canada)

- Comarch SA (Poland)

- IGT Solutions Pvt. Ltd (India)

- Oracle Corporation (U.S.)

- Salesforce.com, Inc. (U.S.)

- Target Brands, Inc. (U.S.)

- TIBCO Software, Inc. (U.S.)

- OSF Digital (Canada)

KEY INDUSTRY DEVELOPMENTS:

- April 2024 – Visa, a digital payment company, launched the Visa Web3 Loyalty Engagement Solution to enable brands to bring immersive, digital experiences, and gamify rewards to consumers.

- April 2023 – Cerillion, a BSS/OSS-as-a-Service solutions provider launched Cerillion 23.1 to transform customer engagement by assimilating loyalty management within the core BSS/OSS.

- March 2023 – Salesforce joined Polygon Labs to create a proprietary NFT-based loyalty program. The NFT management platform brought NFT capabilities to all of Salesforce’s clients while expanding Polygon’s market in the enterprise industry. Companies are delivering blockchain rewards to customers with the support of Salesforce’s loyalty program.

- March 2023 – Sabre Corporation collaborated with Capillary Technologies to help airlines and hoteliers with Capillary's loyalty management features. This agreement enabled the companies to gain valuable insights through real-time analytics.

- March 2022 – Antavo partnered with BMW (U.K.) Ltd on Inside Edge, a B2B loyalty program. The collaboration facilitated company drivers with rewards to benefit them, save money and time, and enjoy the ride.

REPORT COVERAGE

The research report highlights leading regions across the world to offer a better understanding to the user. Furthermore, the report provides insights into the latest industry and market trends and analyzes technologies deployed at a rapid pace at the global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Offering

By Operator

By Deployment

By Enterprise Type

By End Use

By Region

|

Frequently Asked Questions

The market is projected to reach USD 51.65 billion by 2034.

In 2025, the market size stood at USD 15.19 billion.

The market is projected to grow at a CAGR of 14.60% over the estimated period.

The cloud deployment segment led the market in 2025.

A growing focus on customer experience and retention is estimated to drive market growth.

Antavo Limited, Capillary Technologies, Bond Brand Loyalty, Comarch SA, IGT Solutions Pvt. Ltd, Oracle Corporation, and Salesforce.com, Inc. are the top players in the market.

North America held the highest market with a share of 30.40% in 2025.

Asia Pacific is expected to grow with the highest CAGR over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us