Home / Chemicals & Materials / Bulk Chemicals / Marine Lubricants Market

Marine Lubricants Market Size, Share & Industry Analysis, By Product (Marine Cylinder Oil, Piston Engine Oil, System Oil and Others; By Ship Type (Bulk Carrier, Oil Tankers, General Cargo, Container Ships, Others), and Regional Forecast, 2024-2032

Report Format: PDF | Latest Update: Feb, 2025 | Published Date: Mar, 2020 | Report ID: FBI100423 | Status : PublishedThe global marine lubricants market size was valued at USD 8.01 billion in 2018, and it is estimated to reach USD 9.47 billion by 2026, with a CAGR of 2.13% over the forecast period. Asia Pacific dominated the marine lubricants market with a market share of 2.75% in 2018. The marine lubricants market in the U.S. is projected to grow significantly, reaching an estimated value of USD 253.65 million by 2032, driven by the increasing demand for marine lubricants due to hightened coastal tourism and recreation activities.

MARINE LUBRICANTS MARKET TRENDS

North America dominated the marine lubricants market with a market share of 2.75% in 2018. Marine lubricants are a special class of lubricants that are manufactured to meet the rugged performance required in marine vessels for optimized operations. Various machinery component in marine systems require lubricants for better functioning, protection, and prolong life cycles. Considering this, the adoption of marine lubricants plays a significant role in the shipping industry. As per the International Maritime Organization (IMO) stats, around 90% of the world’s trade is carried through maritime transport. Thus, it is important to optimize the performance and prolong the life of machinery components and systems of the marine vessels to ensure uninterrupted and cost-effective propagation of trade throughout the world.

Marine lube market is classified based on product such as marine cylinder oil, piston engine oil, system oil, and others. Based on ship type, the global marine lubricant market is segmented into bulk carrier, oil tankers, general cargo, container ships, and others. These lubricants are majorly used in marine engines, bearings & circulation systems, gas compressors, gear systems, hydraulic systems, transmission system, turbines, and others. In 2018, the marine cylinder oil segment accounted for 50.31% share in the global marine lubricants market.

MARINE LUBRICANTS MARKET GROWTH FACTORS

“Low-cost Operations and Enhanced Fuel Efficiency of Lubricants to Promote Adoption of Marine Lubricants.”

Marine lubricants are an essential part of the maritime supply chain. The increasing cost of fuel and the implementation of stringent regulations by IMO is likely to increase the consumption of global marine lubricants. Moreover, with the increase in fuel prices, shippers are expected to operate the engines at slow steaming level which in turn, will save the fuel. The marine engines are not capable of operating continuously at reduced rates and this could raise the corrosion concerns in the engine and strained components & system associated with it. To ensure safety and proper functioning of the engine, the dependence on these lubricants is expected to increase and this is anticipated to drive the marine lube market over the forecast period.

MARINE LUBRICANTS MARKET SEGMENTATION ANALYSIS

By Product Analysis

“High-performance Requirements by the Marine Engine to Increase the Consumption of Marine Cylinder Oil.”

Marine engines are continuously exposed to the risk of corrosion due to the rugged operation in the marine environment. Marine cylinder oil plays a crucial role in protecting the engine components and enhances the performance of the engine. With the implementation of new norms on marine fuel oils by IMO of Sulphur content, not more than 0.5% is expected to cause disruption in the supply chain during the short-term forecast. Reformulation of marine fuels to reduce the sulphur content is likely to increase the percentage of catalyst fine-containing cutter stocks, which will further improve the wear process of marine fuel injection systems. This has encouraged marine fuel and lubricants manufacturers to reformulate their products. The dependence on lubricants is most likely to increase due to these regulations. Marine cylinder oil failure can cause significant damage to the engine and accounts for 28% of all machinery claims. As per The Swedish Club, an average claim cost is around USD 0.65 Mn. This signifies the importance of marine cylinder oil and cost-saving aspects for uninterrupted operations of the vessel.

By Ship Type Analysis

“Bulk Carrier Segment is poised to Generate the Highest Revenue During the Forecast Period.”

Bulk carrier vessels account for the largest fleet (on the basis of dead-weight tonnage) in the global maritime transport industry. These bulkers are responsible for the transportation of bulk unpackaged cargo such as steel, grains, cement, coal, etc. These vessels account for a significant share in the consumption of marine lubricants owing to high usage in systems and components like lifeboat launch system, engine and davit, shaft bearing, mooring winch, low-speed main engine, and others. The increase in global trade is expected to increase the use of bulk carriers and also boost the consumption.

Oil tankers account for the second-largest share in the global market. The disruption in the production of crude oil and changes in the trade of crude oil supply affects the marine lubricants market growth. Container ships and general cargo carriers are expected to create lucrative growth opportunities with the expansion of e-commerce business in the developing regions across the world.

REGIONAL MARINE LUBRICANTS MARKET ANALYSIS

Asia Pacific is anticipated to remain a major consumer during the forecast period on the back of large ownership of ship fleet companies such China Ocean Shipping Company, China Shipping Container Lines, Mitsui O.S.K. Lines and others in the region. As per the United Nations Conference on Trade and Development (UNCTAD) , around 50% of the ships are owned by companies in Asia-Pacific accounting for the major share in the consumption of marine lubricants. Also, the number of dry docks is high in the region which supports the growth of the market in the region. Emerging economies such as India, China, Taiwan are increasing their trade activities which is expected to boost the market growth over the forthcoming years. Moreover, the increasing number of naval vessels in the region is expected to provide impetus to the marine lubricants market in the forecast period.

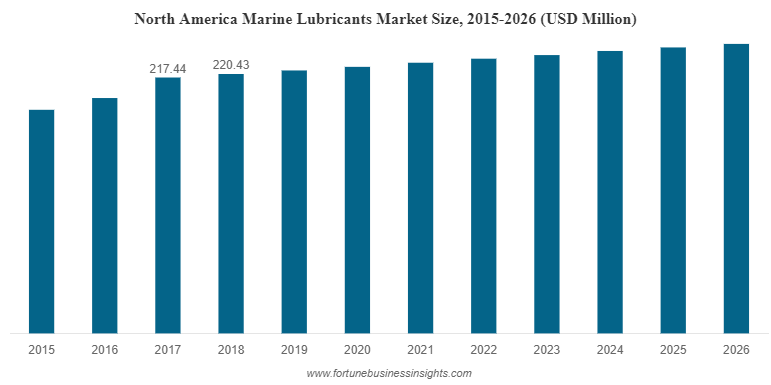

North America accounts for a single-digit market share due to the low number of ship ownership in the region. However, the marine lubricants market is expected to grow moderately during the foreseeable period with a steady increase in trade.

Europe accounts for the second-largest share in the global marine lubricants market after Asia-Pacific. Europe accounts for a significant share in the global trade and has a number of ports and dry docks to support the healthy consumption of marine lubricants in the region. Netherlands, Germany and the UK are amongst the prominent consumers.

The market in the Middle East & Africa is driven by the lubricants consumption in oil tankers. However, the turbulence in the political conditions such as sanctions on Iran may hamper the marine lubricants market growth over the forecast period. On the other side, GCC countries and Turkey account for more than half of the regional marine lubricant demand.

Latin America is one of the fastest-growing market on the back of increased trade activities and expansion of e-commerce business in the region. Brazil, Mexico, Panama, Chile, and Argentina will greatly drive the marine lube market in the region.

INDUSTRY KEY PLAYERS

“Key Players to Sign Long-Term Supply Contracts with the Shipping Companies”

More than 85% of these lubricants worldwide are reported to be sold through contracts and supply agreements instead of selling at stock price rates. Thus, the manufacturers focus on signing long-term supply agreements with the shipping companies and strengthen their network across various ports of supply across the globe. For instance, in November 2019, Shell signed a framework agreement with CCCC Dredging (Group) Co. Ltd, China, for the supply of shell marine lubricants along with technical services. Shell has a strong sales & distribution network which includes services through more than 700 ports in 61 countries around the world.

LIST OF KEY COMPANIES PROFILED IN MARINE LUBRICANTS MARKET:

- Exxon Mobil Corporation

- BP p.l.c.

- Royal Dutch Shell Plc

- Total SA

- Chevron Corporation

- The PJSC Lukoil Oil Company

- Croda International Plc

- Eni oil Products

- Repsol S.A.

- Gazprom Neft PJSC

- AvinOil S.A.

- SINOPEC

- CEPSA

- Other

Key Industry Developments

- November 2019, Royal Dutch Shell Plc, manufacturer of wide range of specialty chemicals & materials, headquartered in Netherlands signed an agreement with China COSCO Shipping Company Limited (COSCO SHIPPING), for supply of marine lubricants for five multi-purpose pulp carriers till the end of 2020. Shell will supply various types of cylinder oil lubricants under this agreement.

- June 2019, Lukoil Marine Lubricants, a manufacturer of marine lubricants and a Dubai-based subsidiary of The PJSC Lukoil Company, renewed its contract for the supply of marine lubricants to 24 ships of Kuwait Oil Tanker Company (KOTC).

- July 2018, CEPSA, a manufacturer of oil and gas related products, headquartered in Spain; announced its partnership with GP Global, headquartered in UAE, to manufacture and market CESPA brand marine and power generation lubricants in India.

REPORT COVERAGE

A growing trend is observed in the penetration of these lubricants market and a detailed analysis of the marine lubricants market growth rate & size for all possible segments that exist in the market. The Marine Lubricants market is segmented by product, ship type and geography. Based on product, the market is segmented into marine cylinder oil, piston engine oil, system oil, and others.

Based on ship type, the market is classified into bulk carrier, oil tankers, general cargo, container ships, and others. Geographically, the marine lubricants market has been analysed across five major regions, which are North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. These regions are further categorised into countries.

Along with this, the report provides an elaborative analysis of the marine lubricants market dynamics and competitive landscape. Various key insights presented in the report are the price trend analysis, recent industry developments in this market, the regulatory scenario in crucial countries, macro, and microeconomic factors, SWOT analysis, and key industry trends, competitive landscape, and company profiles.

Report Scope & Segmentation

ATTRIBUTE |

DETAILS |

Study Period |

2015-2026 |

Base Year |

2018 |

Forecast Period |

2019-2026 |

Historical Period |

2015-2017 |

Unit |

Value (USD Million) and Volume (Kilo Tons) |

Segmentation |

By Product

|

By Ship Type

|

|

By Geography

|

Frequently Asked Questions

How much is the marine lubricants market worth?

Fortune Business Insights says that the Market size was valued USD 8.01 Billion in 2018 and is projected to reach USD 9.47 Billion by 2026.

At what CAGR is the Marine Lubricants Market projected to grow in the forecast period (2019-2026)?

The Marine Market will exhibit steady growth at a CAGR of 2.13% over the forecast period (2019-2026).

Which is the leading Marine Lubricants Market segment in the market?

Market is the leading segment in the market due to large consumption in marine Engines.

Which is the key factor driving the market growth?

The necessity of lubricants to optimize various marine operations will drive the global market.

Which region is expected to hold the highest market share in the marine lubricants?

The Asia Pacific is expected to hold the highest market share in marine lubricants

Which ship type is expected to drive the adoption of Marine Lubricants?

Bulk carriers are expected to lead the consumption of over the forecast period.

What are the market trends of marine lubricants?

Bio-based Marine Lubricants is the current trend in the global market.

- Global

- 2018

- 2015-2017

- 135