Mass Notification System Market Size, Share & Industry Analysis, By Deployment (On-premises and Cloud-based), By Application (Public Alerts & Warnings, Emergency Response Management, Disaster Recovery & Business Continuity, Reporting & Analytics, and Others), By End-user (Government, Energy & Utility, Education, Healthcare, Manufacturing, Military & Defense, IT & Telecom, and Others), and Regional Forecast, 2026- 2034

KEY MARKET INSIGHTS

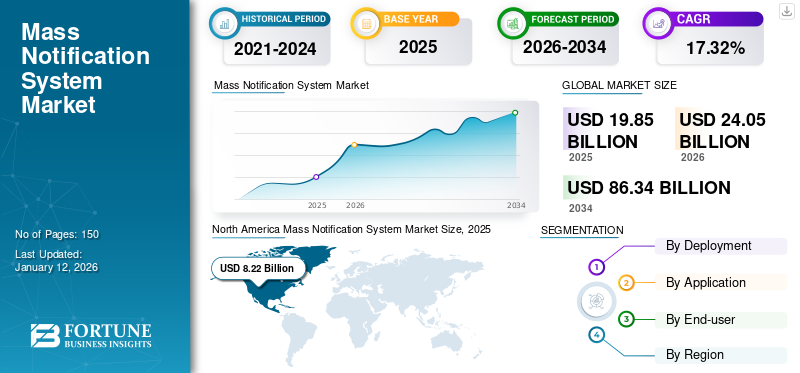

The global mass notification system market was valued at USD 19.85 billion in 2025 and is projected to be worth USD 24.05 billion in 2026 and reach USD 86.34 billion by 2034, exhibiting a CAGR of 17.32% during the forecast period. North America dominated the global market with a share of 41.42% in 2025.

A mass notification system is a single access point to deliver alerts to various contacts across multiple distributed data stores. This system sends alerts in the form of text, images, and colour codes to a group of people in emergency situations. A surge in the use of Internet Protocol (IP)-based notification devices by various users present in different industry verticals and an increase in the number of BYOD devices is anticipated to drive market growth. The rise in crime and accident rates over the past decade has increased attention on life safety, which has increased the demand for mass notification systems among different industry verticals.

Global Mass Notification System Market Overview

Market Size:

- 2025 Value: USD 19.85 billion

- 2026 Value: USD 24.05 billion

- 2034 Forecast Value: USD 86.34 billion

- CAGR (2026–2034): 17.32%

Market Share:

- Regional Leader: North America accounted for 41.42% of the market in 2026 due to high adoption in government, defense, and enterprise sectors.

- Fastest‑Growing Region: Asia Pacific is projected to grow at the highest CAGR, driven by smart city initiatives, urbanization, and increasing use of emergency communication systems.

Industry Trends:

- Public alerts and warnings remain the dominant application for emergency response and disaster recovery.

- Cloud-based deployment is growing rapidly due to scalability and cost-efficiency, while on-premises solutions continue in legacy systems.

- Adoption is strong across government, education, healthcare, energy & utilities, transportation, manufacturing, and defense sectors.

Driving Factors:

- Rising demand for real-time incident alerts and critical communication during emergencies.

- Increasing use of IP-enabled and BYOD devices for mass communication.

- Integration of AI, IoT, and multi-channel platforms to enhance crisis management and situational awareness.

The adoption of mass notification systems is growing significantly as there is a rising demand for systems to communicate more securely and effectively with employees in a short period across all industries. The increasing use of technology by educational institutions is contributing to the market growth. As increasing urbanization increases the need for alarm and notification systems to alert employees in the event of an emergency, MNS developers can focus on developing more accurate and reliable systems. This enhancement of MNS is expected to have benefits such as improved public safety and the ability to widely disseminate disaster management events during the forecast period. Companies are actively working on introducing new products to gain a competitive advantage over other market participants.

The increased use of mass notification solutions by companies helped disseminate important information regarding safety procedures at the workplace. Similarly, sending alerts to people regarding the availability of COVID-19 vaccination centers and information regarding the number of infected patients enhanced the product demand. Thus, increasing usage of mass communication systems in the healthcare industry boosted market growth during COVID-19.

Mass Notification System Market Trends

Integration of AI with Mass Notification Platform to Fulfill ENS Needs to Enhance Market Growth

The penetration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is projected to deliver high security and value to the company operations to fulfil the corporate Emergency Notification System (ENS) requirements. AI and ML techniques offer a variety of inputs for predictions and recommendations to boost organizational development and provide deep insights to users. Thus, integrating AI with Mass Notification Systems (MNS) can significantly improve existing emergency notification systems by reducing operational downtime and helping businesses respond quickly to various technological crises. These factors are expected to drive the mass notification system market growth.

Download Free sample to learn more about this report.

Mass Notification System Market Growth Factors

Rise in Usage of Mass Communication Platforms to Extend Real-Time Incident Visibility to Drive Market Growth

The usage of mass notification solutions for incident management by combining software, hardware, and other networking components delivers accurate data about natural and other threat incidents with real-time response.

- For instance, in June 2023, China built the largest earthquake early warning system to inform people about upcoming earthquakes by offering a countdown in seconds.

The mass notification system broadcasts information across various channels, including mobile phones, TVs, and other communication terminals, to spread awareness. This factor will lead to increased usage of mass communication platforms to provide real-time incident visibility to people.

RESTRAINING FACTORS

Promotion of Fake News and Disinformation through MNS May Restrict Market Growth

The spread of unreliable news and misinformation through media and different communication channels creates an unconducive environment for the market’s growth. According to the survey, fake news spread by communication channels across countries such as Brazil, the U.K., Spain, the U.S., France, and Turkey is 80%, 70%, 68%, 64%, 60%, and 59%, respectively. These aspects can hinder market development.

Mass Notification System Market Segmentation Analysis

By Deployment Analysis

Provision of Quick Emergency Alerts to Propel Adoption of Cloud-based Mass Notification Platform

On the basis of deployment, the market is segmented into on-premises and cloud-based systems with a share of 56.54% in 2026. The cloud-based systems are likely to exhibit the highest growth rate. The usage of cloud-based mass notification systems will increase among public and private enterprises due to their low cost and highly secured alert capabilities.

Furthermore, the on-premises MNS systems help to deliver live or pre-recorded messages to multiple endpoints throughout the organization. Thus, there has been a huge adoption of on-premise-based MNS systems in different industrial sectors.

By Application Analysis

Increase in Natural Disasters to Bolster Product Use for Delivering Public Alerts & Warnings

Based on application, the market is divided into public alerts & warnings, emergency response management, disaster recovery & business continuity, reporting & analytics, and others contributing 35.57% globally in 2026. The public alerts & warnings segment captures the will likely to grow with the highest CAGR over the forecast period. This is due to the rising number of Wireless Emergency Alerts (WEAs) being delivered by authorized local, federal, state, tribal, and territorial authorities to specific areas.

Similarly, emergency response management is the second leading segment of the market. It helps to reduce the number of fatalities by prompting people to seek safety. Furthermore, companies are adopting emergency response management systems to protect sensitive data along with the prevention of system damage from cyberattacks.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Government Segment Leads as Occurrence of National Emergencies Boost Product Use among End-Users

Based on end-users, the market has been segmented into government, energy & utility, education, healthcare, manufacturing, military & defence, IT & telecom, and others. The government segment holds the largest market with a share of 28.62% in 2026 of this market during the forecast period.

The government sector is expected to grow with highest CAGR during the forecast period. As the government delivers quick notifications about national emergencies and natural calamities via government-funded institutions, state & local agencies, and other organizations. It will boost the adoption of MNS across the government sector to deliver real-time emergency alerts for public safety.

The government segment is followed by energy & utility, which is the second leading segment. This is due to rise in the number of oil leaks, gas explosions, and electrical outage cases in the last few years. Thus, the energy & utility sector propels the demand for the adoption of MNS to spread information in a fast and reliable way.

REGIONAL INSIGHTS

The global market scope is classified across five regions, North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Mass Notification System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is projected to hold the largest mass notification system market dominated the market with a valuation of USD 8.22 billion in 2025 and USD 10.14 billion in 2026. due to the presence of many mass notification system providers across the region. For instance, in April 2022, Everbridge, Inc., a prominent player in the market, partnered with Atalait to deliver Critical Event Management (CEM) enterprise solutions to organizations across Mexico and Latin America to protect employees. According to a research survey of 2,000 U.S. adults by OnePoll in August 2023, 54% of people use a medical alert system with emergency assistance.The U.S. market is projected to reach USD 5.91 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Usage of smartphones and other communication devices helps customers send SMS notifications, emails, and web emergency alerts to reach all users and convey information quickly and effectively. The SMS alert system helps users reach out to many people to ensure their safety as early as possible. Hence, the growing popularity of mobile phones across India, China, and Japan will enhance the Asia Pacific market growth with the highest CAGR. Furthermore, rising awareness about climate disasters and health-related emergency and non-emergency notifications in the region will exhibit market growth. Similarly, the surge in Internet Protocol (IP)-based notification devices across different industry verticals in Asia is projected to enhance the market growth during the forecast period.The Japan market is projected to reach USD 0.81 billion by 2026, the China market is projected to reach USD 1.8 billion by 2026, and the India market is projected to reach USD 1.16 billion by 2026.

Europe is projected to record a remarkable CAGR during the forecast period due to the growing integration of public warning systems with cell phones to provide text or voice messages to people. On April 23, 2023, according to UK5G.org, the U.K. government launched a mobile phone emergency alert initiative to conduct a nationwide test of a public warning system for life-threatening events, such as floods and wildfires. Similarly, Article 110 of the EECC (European Electronic Communications Code) states that public warnings should be issued via mobile-based communication services and be capable of sending geo-located mass alerts for people's safety and security.The UK market is projected to reach USD 0.78 billion by 2026, while the Germany market is projected to reach USD 0.86 billion by 2026.

South America and the Middle East & Africa are still in their development phase due to the growing usage of advanced communication channels and rising penetration of internet-based communication channels. This factor will help increase awareness about the incidents taking place across these regions, further enhancing market growth.

Key Industry Players

Key Players Invest in Partnerships to Develop Advanced Mass Notification Systems

The key market players are increasing their efforts in the development of mass notification systems to deliver emergency alerts to the public and maintain their security. Product advancements are helping key players maintain their competitive edge. These companies are also engaging in strategic partnerships, acquisitions, and collaborations to expand their business & distribution networks to maintain their market growth.

List of Top Mass Notification System Companies:

- Everbridge, Inc. (U.S.)

- Alertus Technologies LLC. (U.S.)

- Eaton Corporation (U.S.)

- Blackboard Inc. (France)

- Johnson Controls (U.S.)

- Honeywell International Inc. (U.S.)

- OnSolve, LLC (U.S.)

- Evolv Technologies Holdings, Inc. (U.S.)

- ATI Systems (U.S.)

- BlackBerry Limited. (Canada)

KEY INDUSTRY DEVELOPMENTS:

- February 2023 – Everbridge, Inc., a Critical Event Management (CEM) software and public warning software provider, developed a new AI-powered situational awareness software, “DigitalOps Insights”. The software provides real-time incident commanders and other information alerts to enterprise IT service providers.

- February 2023 – F24 completed the acquisition of Norway-based FramWeb AS, a mass alert system provider, to expand its market presence in Scandinavia to deliver emergency notification and crisis management alerts to Scandinavians.

- September 2022 – AlertMedia, a threat intelligence and emergency communication system provider expanded its global reach by unveiling its new headquarters in RiverSouth, Austin, Texas. The new office is equipped with innovative user functionality and a technological foundation to help businesses during emergencies.

- August 2022 - Acoustic Technology, Inc. (ATI Systems), a Mass Notification System (MNS) and Emergency Communication System (ECS) provider, revealed a next-generation mass notification outdoor solution HPSS to provide physical security alerts to enterprises.

- August 2022 – Alertus Technologies LLC. Partnered with Raptor Technologies, a school safety software developer, to deliver integrated safety and security solutions to K-12 schools and districts to provide emergency response and critical communication during emergencies.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product types, and leading applications of the product. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 17.32% from 2025 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Application

By End-user

By Region

|

Frequently Asked Questions

The market is projected to reach USD 86.34 billion by 2034.

In 2025, the market size was valued at USD 19.85 billion.

The market is projected to record a CAGR of 17.32% during the forecast period.

The public alerts & warnings segment leads market growth in terms of application.

Rise in the usage of mass communication platforms to extend the real-time incident visibility is estimated to drive market growth.

Everbridge, Inc., Eaton Corporation, Alertus Technologies LLC., Blackboard Inc., Johnson Controls, Honeywell International Inc., and Blackberry Limited are the top players in the market.

North America is expected to hold the largest market share.

Asia Pacific is expected to record a highest CAGR over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us