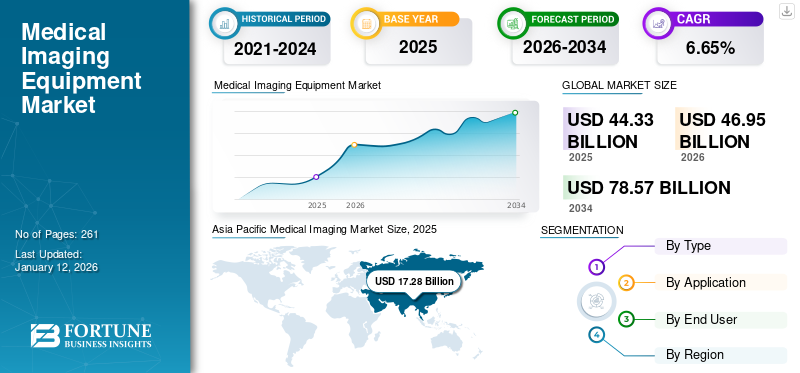

Medical Imaging Market Size, Share & Industry Analysis, By Type (Magnetic Resonance Imaging, Computed Tomography, X-ray, Ultrasound, and Molecular Imaging), By Application (Cardiology, Neurology, Orthopedics, Gynecology, Oncology, and Others), By End User (Hospitals, Specialty Clinics, Diagnostic Imaging Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global medical imaging market size was valued at USD 44.33 billion in 2025 and is projected to grow from USD 46.9 billion in 2026 to USD 78.57 billion by 2034, exhibiting a CAGR of 6.65% during the forecast period. Asia Pacific dominated the medical imaging market with a market share of 38.98% in 2025.

Medical imaging is a non-invasive technology that refers to the application of image analysis methods including X-rays, computed tomography, ultrasound, and others. It helps in the diagnosis and treatment of various disorders including cancer, neurological disorders, and gynecological disorders, among others. The rising incidence of chronic diseases such as cardiovascular, neurology disorders, and other disorders, combined with the realigning healthcare system, have led to an increase in emphasis on early diagnosis. According to the Centers for Disease Control and Prevention (CDC), in 2021, Coronary Artery Disease (CAD) affected an estimated of 18.2 million adults annually in the U.S. alone.

Diagnostic imaging refers to the use of different imaging modalities to get visual representations of the interior of a body for diagnostic and therapeutic purposes. This includes various types of modalities that are used to capture images of the human body for diagnosis and treatment of diseases which plays a vital role in improving overall health.

The rising prevalence of chronic diseases such as cardiovascular, cancer, orthopedics, and diabetes is responsible for a growing number of diagnostic imaging procedures across the globe. As per a report published by the World Health Organization (WHO), approximately 3.6 billion diagnostic procedures are performed globally every year. Of these, around 350 million examinations are carried out on pediatric patients. This, along with the growing focus of government organizations on early diagnosis of diseases to control healthcare costs, also influences the number of patients undergoing X-ray, magnetic resonance, and computed tomography scans globally.

Furthermore, the outbreak of COVID-19 has had a negative impact on the global market, owing to a significant decline in patient visits to hospitals. Key players, such as GENERAL ELECTRIC COMPANY, Koninklijke Philips N.V., and Siemens Healthineers AG, reported a significant decline in revenues during 2020. For instance, the diagnostic imaging segment of Koninklijke Philips N.V. recorded a 3.7% decline in revenues in 2020 compared to the revenue generated in 2019.

Global Medical Imaging Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 44.33 billion

- 2026 Market Size: USD 46.95 billion

- 2034 Forecast Market Size: USD 78.57 billion

- CAGR: 6.65% from 2026–2034

Market Share:

- Asia Pacific dominated the medical imaging market with a 38.98% share in 2025, driven by the rising prevalence of chronic diseases, rapidly developing healthcare infrastructure, and increasing demand for advanced diagnostic equipment across China, India, and Southeast Asia.

- By type, X-ray systems held the largest market share in 2026, fueled by technological advances in mobile and interventional X-ray equipment, including the development of digital radiography-based mini C-arms and flat-panel detectors for image-guided surgeries.

Key Country Highlights:

- United States: Market growth is driven by a large installed base of imaging centers, continuous product innovations, and a growing demand for AI-enabled imaging systems to support early disease diagnosis.

- Europe: Rising collaborations between academic institutions and key players for developing novel imaging technologies, alongside increasing regulatory approvals for advanced imaging devices, are propelling market adoption.

- China: Growth is supported by expanding hospital infrastructure, rising healthcare expenditure, and a growing patient pool requiring diagnostic imaging procedures for chronic disease management.

- Japan: Increasing focus on portable and AI-powered imaging systems, supported by a well-established healthcare ecosystem, is enhancing diagnostic capabilities and driving market penetration.

MEDICAL IMAGING MARKET TRENDS

AI-enabled Imaging Equipment to Fuel Product Demand

The introduction of technologically advanced medical imaging equipment is one of the major elements stimulating market growth. Increasing use of advanced AI-enabled diagnostic equipment for rapid diagnosis and predictive analysis in developed countries is one of the major factors anticipated to contribute to the rising product demand during the forecast period.

In addition, constant government support to launch new products is further contributing to the market growth. The U.S. FDA ensures that all the AI tools marketed have a positive benefit: risk ratio for patients.

- In January 2024, according to the FDA publication, as of July 2023, overall 692 AI-enabled medical devices received market authorization, out of which more than 75% accounted for radiology applications.

The increasing benefits of integration of artificial intelligence in imaging equipment are resulting in the rising focus of key players toward developing and introducing novel products in the market.

- For instance, in October 2024, FUJIFILM Corporation launched ECHELON Synergy 1.5T MRI system software with AI-powered workflow enhancements with the aim of strengthening its product portfolio.

- In November 2023, GE HealthCare announced the launch of MyBreastAI suite – a platform of AI apps, which assists in breast cancer detection and imaging workflows.

Other Prominent Trends:

- Development of portable and point-of-care imaging devices – There is an increasing innovation in medical imaging technologies as they have become much faster owing to the use of advanced technology with the development of portable and point-of-care imaging systems. Point-of-care Ultrasound Systems (POCUS) enable more accurate and faster assessments by enabling quick detection and diagnosis among patients. POCUS has also moved into its subspecialties, most notably in critical care, internal medicine, emergency medicine, and anesthesia.

- The emergence of 3D and 4D imaging technologies – Increasing advancements such as accelerating processing speed, visualization software, expansion of the parameters to 3D and 4D, superconducting magnets, and automating workflow are further enabling an upsurge in the demand for these systems globally.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Introduction of Technologically Advanced Systems to Propel Market Growth

The rising R&D focus of key players operating in the market to develop and introduce products with novel technology to cater to the growing number of population undergoing different imaging procedures is a crucial factor contributing to the rising adoption of these devices in the market. Along with this, the rising number of product approvals and launches that are integrated with artificial intelligence, machine learning, and other advanced features is another significant factor supporting the global medical imaging market growth.

- For instance, in June 2024, the company launched its Biograph Trinion, an energy-efficient Positron Emission Tomography/Computed Tomography (PET/CT) scanner, with the aim of strengthening its product portfolio.

- In January 2024, Hyperfine, Inc., launched AI-powered brain imaging software, the Swoop system. The introduction of latest software enhances the image quality and introduces ease-of-use features, such as real-time aid for precise patient loading and positioning.

This, along with the rising R&D funding by academic and research institutes to promote the production of imaging equipment within the countries, is expected to boost the penetration of these devices globally. The rising R&D activities among these academic and research institutes is further likely to introduce new advancements for these devices in the market.

Thus, the launch of several new products is expected to spur product demand, propelling the growth of the market.

Other Prominent Drivers:

- Increasing prevalence of chronic diseases is expected to drive the market growth. The soaring prevalence of chronic conditions such as cancer, Alzheimer’s disease, dementia, and others is expected to present a large patient pool requiring proper diagnosis and treatment globally. The rising geriatric population globally is another major factor contributing to the growing patient population suffering from these conditions. Thus, the rising geriatric population coupled with a growing inclination toward a sedentary lifestyle are prominently expected to spike the prevalence of chronic ailments. Thus, the growing prevalence of chronic disorders is likely to support the rising demand for these systems globally.

- Growing demand for early and accurate diagnosis is likely to boost the market growth. Companies, healthcare providers, and others are expected to support the growing demand for imaging systems and increase their focus on raising awareness regarding early diagnosis of diseases among the general population.

- Rising healthcare expenditure is expected to support market growth. The increasing healthcare expenditure, especially in emerging countries including China, India, and others, along with growing healthcare infrastructure in these countries, is one of the major factors contributing to the increasing diagnosis of various neurological and musculoskeletal conditions among the general population, thereby supporting the growing demand for imaging equipment globally.

- Government initiatives and funding are expected to support the market growth. Increasing initiatives among governmental organizations to raise awareness about the benefits of these imaging procedures is expected to contribute to the growing demand for these procedures in the market.

RESTRAINING FACTORS

Frequent Product Recalls to Hinder Market Growth

Frequent product recalls in imaging equipment are one of the major elements slated to restrain the global market growth over the projection period. For instance, in February 2021, Koninklijke Philips N.V. recalled 109 Incisive CT scanner systems for urgent medical device corrections.

Such instances, combined with the increased adoption rate of refurbished equipment market, especially in lucrative and emerging markets such as India and China, have further limited the adoption of innovative and new equipment in these countries. Several domestic and established players have entered this segment, offering refurbished and low-cost equipment to healthcare facilities across the globe. The overall cost-benefit ratio of these refurbished devices for small and medium-sized healthcare units is higher, which has led to the lower adoption of new equipment/systems.

Other Prominent Restraints:

- High cost of imaging equipment - The direct cost involved in the purchase and implementation of imaging equipment is very high due to the inclusion of manufacturing costs, distributors’ margins, and service costs, which are expected to hinder the adoption of these devices in the market.

- Regulatory and reimbursement issues – Stringent rules and regulations regarding the approvals of imaging equipment such as CT scanners, ultrasound, and others are expected to hamper the demand for these products in the market.

- Shortage of skilled radiologists - A limited number of skilled radiologists, especially in emerging countries such as Poland, China, Brazil, and others, is resulting in a reduced number of imaging procedures, thereby hampering the demand for imaging equipment in the market.

- Data privacy and security concerns – Increasing risks regarding loss of patient’s vital data, unauthorized exposure, and other factors are limiting the number of imaging procedures among the patient population.

- Economic disparities affecting access to imaging services – Limited healthcare expenditure, less-developed healthcare infrastructure, and others, especially in emerging countries such as Brazil and Mexico, further hamper the access of individuals to imaging services, hindering the market growth.

SEGMENTATION ANALYSIS

By Type

Technological Advances in X-ray Systems to Augment Product Demand

Based on type, the market is segmented into magnetic resonance imaging, computed tomography, X-ray, ultrasound, and molecular imaging.

The X-ray segment held a dominant medical imaging market share by 35.55% in 2026. The segment growth is primarily driven by the increasing use of interventional X-ray systems, including C-arms, and others, for image-guided surgeries. The advances in C-arms, including mini C-arms based on digital radiography and flat panel detectors, have been instrumental in augmenting the demand for X-ray equipment globally.

- In July 2022, Siemens Healthineers AG launched a mobile X-ray system, Mobilett Impact. The device offers all the advantages of mobile X-ray system for imaging patients at bedside at an economical price and with full digital integration.

- In July 2022, Koninklijke Philips N.V. announced plans to integrate cloud-based artificial intelligence (AI) and 3-D mapping into its mobile C-arm System Series Zenition to improve endovascular treatment outcomes and enhance workflow efficiency.

The ultrasound segment is anticipated to grow at a considerable CAGR during the forecast period. The rising prevalence of chronic conditions related to heart, breast, among others, growing number of ultrasound scans among the patient population along with rising technological advancements in the equipment by market players are some of the prominent factors driving segment growth.

- In December 2022, Koninklijke Philips N.V. launched a new compact 5000 Series ultrasound system at RSNA 2022. The new system delivers the premium image quality needed to provide a reliable diagnosis in a portable unit.

To know how our report can help streamline your business, Speak to Analyst

By Application

Prevalence of Orthopedic Disorders is Boosting the Growth of Segment

On the basis of application, the market is subdivided into oncology, cardiology, orthopedics, gynecology, neurology, and others.

The orthopedics segment dominated the market share of 26.79% in 2026. The dominant share can be attributed to the rising incidence rate of trauma and sports injuries among the population, further boosting the use of these systems across healthcare settings. Moreover, rising technological advancements for effective and rapid medical intervention of orthopedic injuries also augmented segmental growth.

- According to an article published by Radiology Associates of Ocala (RAO) in December 2022, more than 7.0 million sports and recreation-related injuries are reported in the U.S. each year, ranging from sprains to bone fractures to concussions.

The oncology segment is expected to grow at a highest CAGR of 6.9% during the forecast period. The increasing incidence of cancer across the globe, along with the rising emphasis on early detection and diagnosis of cancer, is driving the demand for oncology imaging. This, along with improving access to healthcare facilities and diagnostic imaging centers in emerging countries, is projected to drive the oncology application segment.

By End-user

Increasing Patient Visits to Diagnostic Imaging Centers Segment led to the Segment’s Dominance

Based on end-user, the market is segmented into hospitals, specialty clinics, diagnostic imaging centers, and others.

The diagnostic imaging centers segment dominates the market owing to the increasing number of these centers in developed and emerging countries. The segment is expected to dominate the market share of 47.08% in 2026.

- According to an article published by HealthCare Appraisers, Inc., in July 2020, within the outpatient segment, there are more than 6,000 independent diagnostic testing facilities (IDTFs) in the U.S.

The hospital segment is anticipated to grow at a significant CAGR of 6.4% over the forecast period of 2025-2032. The segmental growth can be attributed to an increase in hospital surgical centers across developed and developing countries, which is anticipated to increase the demand and utilization of these systems among patients. Furthermore, the growing number of surgeries among patients owing to the rising prevalence of cancer, and heart diseases, among others, is driving the demand for imaging systems in hospitals, further contributing to the segment growth.

MEDICAL IMAGING MARKET REGIONAL OUTLOOK

Based on region, the market has been studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Medical Imaging Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market and generated a revenue of USD 18.47 billion in 2026. Asia Pacific is expected to register the highest growth rate during the forecast period (2026-2034) owing to the rising prevalence of chronic diseases and the demand for advanced diagnostic devices. In 2025, the market size stood at USD 17.28 billion in the Asia Pacific region. Additionally, a large and aging installed base of imaging equipment in the region is presenting a lucrative opportunity for market players. This, along with a rapidly developing healthcare and hospital infrastructure in the region, especially in countries such as China and India, is anticipated to drive the demand for new imaging equipment during the forecast period. The market in China is estimated to be USD 6.16 billion in 2026.

The Japan’s market size is estimated to be valued at USD 6.20 billion and India is likely to stand at USD 1.60 billion in 2026.

- According to an article published by the Australian Institute of Health and Welfare (AIHW) in July 2022, around 27.7 million people in Australia underwent diagnostic imaging services across non-hospital settings.

North America is anticipated to account for the second-highest market size of USD 12.97 billion in 2026, exhibiting the second-fastest growing CAGR of 5.6% during the forecast period. The region held the second-highest share of the global market in 2024. The increasing number of patients undergoing diagnostic imaging procedures in the country is propelling the growth of the diagnostic imaging market in this region. Moreover, the rising number of imaging centers across the region, owing to high demand across the region, further boosted the market growth. However, limited medical tourism in North American countries is likely to limit the number of imaging procedures in the region.

The U.S. market is expected to stand at USD 12.19 billion in 2026, owing to developed healthcare infrastructure, growing awareness and accessibility of medical imaging among the general population, and technological innovations among the players in the products.

- According to the 2023 statistics published by Definitive Healthcare, there are about 19,000 imaging centers in the U.S. Amongst all the regions, the Southeast region has the most imaging centers, with 4,975.

European region is to be anticipated the third-largest market with USD 11.05 billion in 2026. The region is anticipated to grow at a significant CAGR over the forecast period owing to the presence of well-established healthcare facilities. The rising collaborations among academic and research institutes with key players operating in the market to develop and introduce novel products to expand their application is another major factor contributing to the introduction of technological advancements devices and is expected further to boost the adoption of these devices in the region. This, along with the rising focus of key players on receiving approval for their imaging devices, is likely to support the regional market growth. However, limited awareness of the benefits of these imaging technologies in emerging European countries such as Poland and others is likely to limit the growth of the market. The market in U.K. is estimated to be USD 1.38 billion in 2026.

The Germany’s market size is estimated to be valued at USD 2.99 billion in 2026. France is likely to stand at USD 1.73 billion in 2025.

- For instance, in May 2023, the University of Sheffield, in collaboration with GE Healthcare, developed a new MRI scanning technology to improve the diagnosis of multiple lung diseases, including cystic fibrosis, COPD, interstitial lung disease, and others. The entire project is funded by the Engineering and Physical Sciences Research Council (EPSRC), UKRI’s Biotechnology and Biological Sciences Research Council (BBSRC) and Medical Research Council (MRC).

Latin America region is to be anticipated the fourth-largest market with USD 2.68 billion in 2026. It is anticipated to grow at a comparatively lower share of the market owing to the presence of a huge underpenetrated market. Rapidly developing hospital networks in the Middle East & Africa are poised to drive the market in the regions at a moderate CAGR during the forecast period. The GCC countries market size is estimated to be USD 1.09 billion in 2025. For instance, Mayo Clinic, a U.S.-based network, invested around USD 50.0 million in 2021 in an ongoing 741 bed hospital project in the UAE. Furthermore, the public-private partnerships in Latin American countries are leading to the rapid development of hospitals, owing to increasing investments by the private sector. This is projected to drive the increasing demand for new imaging equipment in these countries.

However, the limited availability of skilled radiologists, less-developed healthcare infrastructure, and others are some of the factors limiting the growth of the market in these regions.

According to data published by Pharma Boardroom Limited in April 2023, under Saudi Arabia’s Vision 2030 plan, the country has been activating the private sector’s participation in advancing the Public-Private Partnership (PPP) model to step up the rollout of new and more efficient healthcare infrastructures.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Extensive Distribution Network, Strong Portfolio, and Stout Brand Presence to Consolidate Market

A diverse portfolio of imaging equipment, combined with a strong and widespread distribution network globally, are some of the major factors driving the dominance of the players in the market. GE Healthcare, Philips, and Siemens Healthineers AG are among the leading players in the medical imaging industry in 2024. Moreover, there is a high emphasis of industry players on the introduction of technologically advanced and portable imaging equipment against traditional systems to aid in diagnostic imaging.

- In November 2024, GE Healthcare received the U.S. FDA approval for the Head-Only SIGNA MAGNUS 3.0T MRI System. This helped the company to strengthen its product portfolio.

- In May 2023, GE HealthCare received U.S. FDA authorization for its Precision DL – a deep learning-based image processing software. The software advances imaging capabilities by offering more accurate, robust, and data-driven information as well as support proper workflows and exams.

Other key players, such as Hitachi, Ltd., and Hologic Inc., Butterfly Inc., Analogic, and others, have also entered the market competition by introducing novel and technologically advanced devices. Moreover, rising initiatives of collaborations among key players to expand their existing product portfolio further drives their company growth.

- In February 2024, Hologic, Inc., launched its FDA authorized digital cytology system, genius digital diagnostics system. The device combines deep-learning-based Artificial Intelligence (AI) with volumetric imaging technology to help identify cervical cancer cells and pre-cancerous lesions.

- In April 2021, Hitachi, Ltd., launched its new Genius Digital Diagnostics System in collaboration with ZotzKlimas Diagnostics Laboratories in Germany. The system is a new technology of cervical cancer screening that combines advanced volumetric imaging technology with deep learning-based Artificial Intelligence (AI) to help identify cervical cancer cells and pre-cancerous lesions in women.

LIST OF KEY COMPANIES PROFILED:

- General Electric (U.S.)

- Hitachi, Ltd. (Japan)

- Shimadzu Corporation (Japan)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Hologic, Inc. (U.S.)

- Samsung (South Korea)

- Fujifilm Holdings Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- September 2023 - GE Healthcare entered a collaboration agreement with Mayo Clinic to advance innovation in medical imaging and theranostics. The collaboration aims to provide advanced technologies to healthcare providers and clinicians which can help them to precisely treat and diagnose medical conditions and provide personalized treatment to patients.

- December 2022 - Koninklijke Philips N.V. launched a new Ultrasound Compact System 5000 Series that delivers premium image quality needed to aid in a confident diagnosis in a portable unit.

- June 2022 - The newly-launched Symbia Pro.specta system by Siemens Healthineers AG, a Single Photon Emission Computed Tomography/Computed Tomography (SPECT/CT) received the Food and Drug Administration (FDA) clearance that has advanced SPECT and CT imaging technologies.

- May 2021 – Siemens Healthineers AG launched Somatom X.ceed, a new and efficient version of the Somatom X.cite system that the company launched in 2019.

- May 2021 – Koninklijke Philips N.V. launched Spectral CT 7500, a new flagship CT scanner intended to perform spectral imaging for routine daily use.

Future Outlook

- Predicted market trends and growth areas – There is an increasing focus on the implementation of artificial intelligence with imaging technologies, adoption of portable and mobile scanners, and others, further driving the R&D activities among the key players to develop and introduce these devices in the market.

- Potential technological breakthroughs – The adoption of smart technology to create multi-purpose imaging scanners is augmenting the focus of key players to collaborate among the major players to research and develop innovative solutions in the market.

- Evolving regulatory landscape - There is an increasing focus on improving the regulatory landscape among regulatory bodies with an aim to provide flexible approval for imaging systems, further enabling the key players to launch their products in the market.

- Strategic recommendations for stakeholders - Increasing product launches among the major players is expected to increase the adoption rate for these products globally. Significant focus on strategic initiatives such as the expansion of their R&D facilities, among others, is expected to fuel the adoption rate for these devices globally.

- Summary of key insights - The report provides the prevalence of key disorders and technological advancements in imaging devices such as CT, MRI, and others. Along with this, the report also provides installed bases for imaging modalities and key industry developments among the prominent players. The key insights section also includes the impact of COVID-19 on the market.

- Final thoughts on the future of the medical imaging industry – Rising technological advancements, growing utilization of these imaging modalities, and rising demand, among others, are some of the factors creating a lucrative opportunity for the key players in the market globally.

REPORT COVERAGE

The global medical imaging market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides this, the global report offers insights into the market growth trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth and advancement of the market over the recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 6.65% from 2026-2034 |

|

Unit |

Value (USD Billion), ASP (USD), and Volume (Units) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 46.95 billion in 2026 and is projected to reach USD 78.57 billion by 2034.

In 2026, the Asia Pacific regional market value stood at USD 18.47 billion.

Growing at a CAGR of 6.65%, the market will exhibit steady growth over the forecast period (2026-2034).

The X-ray equipment segment is expected to be the leading segment in this market during the forecast period.

The introduction of technologically advanced products is one of the major factors driving the growth of the market.

GE Healthcare, Koninklijke Philips N.V., Siemens Healthcare GmbH are the major players in the global market.

Asia Pacific dominated the medical imaging market with a market share of 38.98% in 2025.

The launch of AI-enabled products by market players is expected to drive the adoption of these devices globally.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us