Medical Transcription Software Market Size, Share & Industry Analysis, By Deployment (Cloud /Web Based and On Premises/Installed), By Type (Voice Capture and Voice Recognition), By End-user (Radiologists, Clinicians, Surgeons, and Others), By End-user Facility (Hospitals, Diagnostic Centers, Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

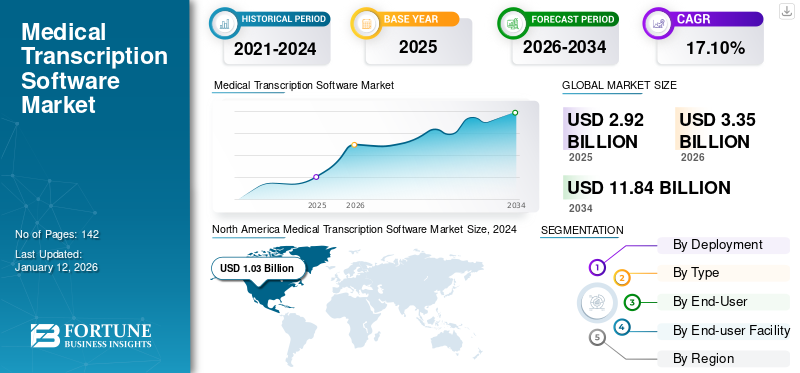

The global medical transcription software market size was valued at USD 2.92 billion in 2025. The market is projected to grow from USD 3.35 billion in 2026 to USD 11.84 billion by 2034, exhibiting a CAGR of 17.10% during the forecast period. North america dominated the medical transcription software market with a market share of 44.84% in 2025.

Medical transcription software is a unique program created to transform audio-recorded medical reports into detailed and organized written documents, making it easier to keep track of patient details. The software offers several advantages, including increased efficiency, reduced errors from manual work, and guarantee of prompt and accurate record-keeping. These benefits are anticipated to play a significant role in the expansion of the industry over the forecast timeframe.

Moreover, the growing number of initiatives and research activities by market players to create new software that is integrated with cutting-edge technologies for medical record-keeping is anticipated to accelerate the expansion of the market over the forecast period. Moreover, the growing partnerships among industry participants and research organizations to broaden the software's reach and enhance its customer base are expected to contribute to the market's growth.

- In August 2021, Nuance Communications, Inc. collaborated with Cooper University Health Care to expand the deployment of the Nuance Dragon Ambient eXperience to around 90 locations in more than 20 specialties. Ambient eXperience is a clinical intelligence solution that documents patient encounters with efficiency and accuracy.

Moreover, the COVID-19 pandemic had a positive impact on the global medical transcription software market growth. Abrupt increase in the demand for telemedicine services boosted the adoption of transcription software in healthcare facilities during the COVID-19 pandemic. This scenario led to a rise in the adoption of Electronic Health Records (EHR) and telemedicine. The major benefit of these products was timely and precise diagnosis of the disease. Such factors contributed to the growth of the market during the pandemic. In 2021 and 2022, the market witnessed a recovery. Then, in 2023, the market bounced back to pre-pandemic years and is expected to grow at a moderate rate during 2025-2032.

Medical Transcription Software Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.92 billion

- 2026 Market Size: USD 3.35 billion

- 2034 Forecast Market Size: USD 11.84 billion

- CAGR: 17.10% from 20265–2034

Market Share:

- North America dominated the medical transcription software market with a 44.84% share in 2025, driven by the high adoption of Electronic Health Records (EHRs) and Electronic Medical Records (EMRs), along with a robust digital infrastructure in the U.S. and Canada.

- By deployment, the cloud/web-based segment held the largest share in 2024 due to enhanced scalability, ease of installation, and rising digitalization investments across healthcare systems.

- By type, voice recognition led the market in 2024, fueled by the integration of advanced Natural Language Processing (NLP) algorithms and real-time speech-to-text features that boost clinical efficiency and reduce administrative burden on healthcare providers.

Key Country Highlights:

- Japan: Rising adoption of AI-driven transcription tools, particularly in radiology and oncology, is enhancing documentation accuracy and reducing physician burnout. Government initiatives to digitize healthcare records further boost the market.

- United States: Federal initiatives, including the HITECH Act and the ongoing implementation of AI tools like Nuance’s Dragon Ambient eXperience (DAX), are driving adoption across hospitals, clinics, and ambulatory centers.

- China: Rapid growth in the number of hospitals and increased government funding for healthcare IT infrastructure have supported the adoption of cloud-based medical transcription software.

- Europe: Adoption is supported by the European Union’s focus on digitization, regulatory mandates for health data documentation, and strategic partnerships such as Voicepoint AG and Dragon Medical One delivering speech recognition solutions across the region.

Medical Transcription Software Market Trends

Shift from Traditional Medical Transcription Services to AI-Powered Speech Recognition Solutions

The healthcare industry has embraced transcription software due to notable progress in technology. There is a significant change happening in the market due to a major shift from conventional medical transcription services to solutions powered by Artificial Intelligence (AI) for speech recognition. These AI-based solutions, such as speech recognition technology, provide quicker and more accurate written records, thereby minimizing mistakes and making the whole transcription process more efficient. Such medical transcription software market trends will propel the market growth during the forecast period.

In today’s era, medical services and tools are moving away from old-fashioned systems and toward technologies driven by data, capable of forecasting outcomes using the current health data. This shift has resulted in more affordable care and also greatly enhanced patient results as medical choices are made on reliable information.

Furthermore, the implementation of AI-driven voice recognition tools has helped healthcare workers concentrate more on patient care instead of clinical documentation. Moreover, the creation of these innovations has shortened the time it takes to complete tasks and provided superior technical features compared to conventional services in radiology report writing.

Additionally, increasing strategic initiatives by the key players to develop AI-based advanced audio transcription solutions are expected to boost the product’s adoption during the forecast period.

- For instance, in August 2023, Oracle developed NVIDIA Riva. This AI-powered medical transcription software delivers superior performance in both real-time and batch job throughput processing modes. It uses fine-tuning techniques, such as keyword boosting, speech hints, and domain-specific vocabulary enhancement.

Download Free sample to learn more about this report.

Medical Transcription Software Market Growth Factors

Rising Importance of Clinical Documentation in Healthcare to Propel Market Expansion

A key factor contributing to the expansion of the market is the rising recognition of the importance of clinical documentation in delivering high-quality care to patients. Medical facilities are turning to this technology more frequently due to its effectiveness in keeping detailed records of patient interactions and treatment strategies. The increasing significance of clinical documentation, motivated by legal mandates and aimed at improving patient care and results, is expected to accelerate the growth of this market.

- For example, in May 2021, new rules were implemented in Europe, encompassing detailed guidelines for EHR producers. These guidelines are advantageous for EHR producers as they can help them meet the standards set by regulatory authorities. Additionally, these guidelines assist producers in securing a CE mark for their innovative products.

Moreover, heightened significance of medical records in developing countries are also anticipated to increase the adoption of Electronic Health Records (EHRs) and Electronic Medical Records (EMRs). This factor is projected to drive the expansion of the global market. The growing emphasis by market players on the creation and launch of new and sophisticated products is also expected to increase the demand for and adoption of this software throughout the forecast period.

Technological Advancements in Software to Expand Market Growth

The market has experienced several significant developments in technology, including voice recognition, artificial intelligence, and machine learning. These innovations are increasingly being applied in healthcare technologies to enhance treatment results and improve the accuracy of medical records, resulting in a rise in market expansion in the coming years.

Moreover, transcription tools enhance precision by incorporating sophisticated capabilities, such as voice recognition and Natural Language Processing (NLP). These NLP algorithms within transcription tools actively convert the content into significant terms, thereby increasing the effectiveness and quality of the process.

- According to an article published in Towards Data Science in March 2022, Artificial Neural Networks (ANN) act as building blocks of AI tools for virtual physicians and medical transcription. ANN is implemented through the use of automatic speech recognition for medical transcription in the international field.

The vital benefits associated with this software, such as reduction of the time required during patient encounters and improvement of patient satisfaction, have contributed to the market expansion.

RESTRAINING FACTORS

Issues Associated With Software Adoption and Risk of Cyberattacks May Restrict Market Expansion

Medical transcription software handles a lot of sensitive data, making it vulnerable to security breaches if not adequately protected. The danger of data breaches, unauthorized entry, or ransomware attacks presents a major obstacle to the widespread use of healthcare transcription software in both developed and developing nations.

Hacks into healthcare sites via transcription tools can damage the reputation of the brand and lead to legal issues for the software maker, thus obstructing the company's ability to make money.

- For instance, in November 2023, TechTarget, Inc. published a news article stating that Perry Johnson & Associates (PJ&A), which provides transcription services to healthcare organizations, reported a data breach that occurred in May 2023. Cook County Health (CCH) and Northwell Health were reported to be impacted by the incident.

Moreover, certain factors, such as the high cost of this software and lack of adoption in emerging nations are anticipated to hamper the medical transcription software market growth during the forecast period.

Medical Transcription Software Market Segmentation Analysis

By Deployment Analysis

Enhanced Agility Enabled Cloud/Web-based Segment Dominated Market in 2024

In terms of deployment, the market is segmented into on premises/installed and cloud/web-based.

The cloud/web-based segment led the market accounting for 77.86% market share in 2026. The dominant share of the segment is attributed to factors, such as improved agility, scalability, and one-click installation. Furthermore, the growing adoption of digitalization in the healthcare sector is also contributing to the segment’s expansion.

- In March 2023, the Brazil–Country Commercial Guide reported that from 2020 to 2028, the Ministry of Health announced investments of USD 83 million to digitalize the basic public healthcare system. Rising investments in the digitalization of the healthcare sector are supporting the growing penetration and adoption of this software in the market.

The premises/installed segment is expected to experience substantial growth over the forecast period due to advantages, such as enhanced data protection, reduced time usage, and full ownership of the software. Moreover, software installed on-site allows customers to customize the software to meet their specific needs, contributing to the expansion of this segment.

To know how our report can help streamline your business, Speak to Analyst

By Type Analysis

Technological Advancements Spurred Voice Recognition Segment Expansion

On the basis of type, the market is segmented into voice recognition and voice capture.

The voice recognition segment dominated the market accounting for 63.54% market share in 2026. Voice recognition technology uses Natural Language Processing (NLP) algorithms that can transform real-time speech-to-text. This sophisticated feature is enabling doctors to reduce the time spent on paperwork. Moreover, continuous improvements in the software are leading to more hospitals, clinics, and other medical facilities adopting voice recognition AI solutions.

- In October 2022, Augnito's voice recognition AI solutions were adopted by PhysicianOne Urgent Care across 20+ locations in the U.S. to transform its clinical workflows. This transformation will help reduce the administrative burden on providers and improve the quality of clinical documentation.

The voice capture segment is anticipated to grow during the forecast period. The engagement of key players with active marketing strategies and providing various types of voice capture technologies are anticipated to propel the segment’s expansion.

By End-user Analysis

Introduction of Advanced Software Contributed to Clinicians' Segment Expansion in 2024

Based on end-user, the market is segmented into clinicians, surgeons, radiologists, and others.

The clinicians segment will account for 43.26% market share in 2026. It also held a major medical transcription software market share in 2024. The segment’s expansion is linked to an increased number of patient interactions. Moreover, the adoption of government rules for the merging of medical records and launch of sophisticated software for medical staff are anticipated to propel the growth of the medical professionals segment over the forecast period.

- For instance, in July 2023, Amazon launched a generative AI-based clinical documentation software called HealthScribe to provide physicians with advanced software to create transcripts of patient visits.

The radiologists segment has recorded a considerable CAGR in the global market. This is attributed to the increasing number of medical imaging procedures across the globe.

Moreover, the ability of the software to provide solutions for intricate diagnostic imaging problems, along with its simplicity and compatibility, is anticipated to bolster the growth of the segment over the forecast period.

The others segment includes allied health professionals and others. The growth of this segment is attributed to the rising utilization of the software among these users to accelerate the clinical flow among healthcare professionals.

By End-user Facility Analysis

Increased Focus of Hospitals On Better Management of Patient Information Propelled Product’s Adoption

Based on end-user facility, the market is segmented into hospitals, diagnostic centers, clinics, and others.

In 2026, the hospitals segment is projected to lead the market with a 48.03% share. The rising number of private medical facilities, along with their ongoing emphasis on enhancing hospital infrastructure, is significantly driving the growth of this segment. Moreover, rising investments in the digitalization of the healthcare industry in developed nations are anticipated to increase the adoption of this transcription software among healthcare workers, further supporting the growth of this segment.

- For instance, according to the data published by Discovery Therapy in October 2023, there are approximately 165,000 hospitals in the world. Such a significant number of hospitals are supporting the growing demand for medical transcription software, thus propelling the segment’s growth.

The clinics segment is expected to record a moderate CAGR during the forecast period. An increasing number of diagnostic procedures is enhancing the adoption of this software. The software improves the clinical workflow of data among healthcare professionals, thereby supporting the growth of the segment in the market.

REGIONAL INSIGHTS

Based on region, this market is divided into Europe, North America, Asia Pacific, and the rest of the world.

North America Medical Transcription Software Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market for medical transcription software with a revenue of USD 1.49 billion in 2026. The rapid adoption of Electronic Health Records (EHRs) and Electronic Medical Records (EMRs) is enabling prominent players to launch the software. Moreover, the increasing number of clinics and hospitals in the U.S. and Canada is majorly responsible for the growth of the market in this region. The U.S. market is projected to reach USD 1.4 billion by 2026.

The market in Europe held a sizeable share in 2024. The expansion is linked to the availability of skilled medical experts and increasing implementation of policies by governments to encourage the adoption of this technology among the medical staff. Moreover, increased focus on the application of sophisticated technologies to improve the efficiency of medical processes and record-keeping in leading nations, such as the U.K., Germany, and France is expected to enhance the development of the European market. The UK market is projected to reach USD 0.21 billion by 2026, while the Germany market is projected to reach USD 0.25 billion by 2026.

- For example, in March 2022, Voicepoint AG, a Swiss company specializing in cloud-based solutions for medical speech recognition technology, teamed up with Dragon Medical One to provide its offerings across different European nations. Therefore, the rising number of new voice recognition applications is expected to aid the expansion of the market in the region.

The market in Asia Pacific is expected to expand at the highest CAGR during the forecast period. The expansion of the market is linked to the rising incidence of long-term illnesses and accidents, leading to more diagnostic tests being conducted. This, in turn, is driving the use of this software in the regional market. The Japan market is projected to reach USD 0.19 billion by 2026, the China market is projected to reach USD 0.13 billion by 2026, and the India market is projected to reach USD 0.09 billion by 2026.

The market in the rest of the world is expected to expand at a comparatively lower CAGR during the forecast period. This is due to the increasing utilization of medical transcription software among healthcare facilities to cope with the clinical workflow.

KEY INDUSTRY PLAYERS

Diversified Cloud Based/Web Based Software Portfolio by the Companies Dominated Market in 2024

The market depicts a consolidated nature. This is attributed to the presence of key players with significant market shares. Some of the major players holding the maximum share of the market include Nuance Communications, Inc. (Microsoft), Speech Processing Solutions GmbH (Philips Dictation), and 3M. The dominance of Nuance Communications, Inc. (Microsoft) in the market is due to its strong hold on exceptional technology, extensive range of product offerings, strong distribution network, superior quality & post-sale support, and robust brand presence.

- In May 2024, Nuance Communications Inc., a company owned by Microsoft, revealed that Intermountain Health in Utah implemented the Dragon Ambient eXperience (DAX) Copilot AI technology. This technology will enhance efficiency in clinical and operational processes by automating tasks related to clinical documentation and administration.

Other players, such as Dolbey, Scribe Technology Solutions, ZyDoc Medical Transcription, LLC, DeepScribe Inc., Xelex Digital, LLC (WebChartMD), and others held substantial market shares. This is due to increasing research and development initiatives, along with frequent product launches by market players.

LIST OF TOP MEDICAL TRANSCRIPTION SOFTWARE COMPANIES:

- Nuance Communications, Inc. (Microsoft) (U.S.)

- 3M (U.S.)

- Dolbey (U.S.)

- Voicebrook, Inc. (U.S.)

- Speech Processing Solutions GmbH (Philips Dictation) (Austria)

- Xelex Digital LLC (WebChartMD) (U.S.)

- Scribe Technology Solutions (U.S.)

- ZyDoc Medical Transcription (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: DeepScribe Inc. announced the introduction of its Customization Studio for its fully automated AI Scribe. This launch further empowered the healthcare systems to support specialized workflows, enhancing the company's growth in the medical transcription market.

- August 2023: Dolbey partnered with SOAP Health to bring together Dolbey's advanced speech recognition technology, Fusion Narrate powered by nVoq, with SOAP Health's expertise in leveraging AI for medical encounters. This move will revolutionize physician-patient interactions, improving productivity, revenue, and patient outcomes.

- March 2023 - Nuance Communication, Inc. (Microsoft) introduced the Dragon Ambient eXperience (DAX) Express, a workflow-integrated and fully automated clinical documentation application. It combines conversational and ambient AI with OpenAI's newest and most capable model, GPT-4.

- February 2021 – Carrus partnered with 3M to leverage its award-winning and industry-standard transcription tool with its medical transcriptionist courses.

- December 2019 – Amazon Web Services (AWS), part of Amazon Transcribe Medical, launched a HIPAA-eligible, machine learning-powered medical transcription service. It uses automatic speech recognition applications designed to convert clinician and patient speech to text.

REPORT COVERAGE

The report offers industry overviews and dynamics that include drivers, restraints, opportunities, and trends. Furthermore, it provides information related to technological advancements and key developments in the market. Additionally, the impact of COVID-19 and the industry overview during the pandemic are covered in the report. Moreover, it higlights the revenue models and key features of solutions for selective players and analysis of the pros and cons of transcription software in the healthcare industry.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Growth Rate |

CAGR of 17.10% from 2026-2034 |

|

Segmentation

|

By Deployment

|

|

By Type

|

|

|

By End-user

|

|

|

By End-user Facility

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD USD 3.35 billion in 2026 and is projected to reach USD 11.84 billion by 2034.

In 2025, the North America market value stood at USD USD 1.31 billion.

The market is expected to exhibit a CAGR of 17.10% during the forecast period.

By deployment, the cloud/web-based segment led the market in 2025.

North America dominated the market in 2025.

The growing importance of clinical documentation in healthcare facilities, operational benefits, enhanced flexibility of transcription software and technological advancements are expected to drive the market growth.

Nuance Communications, Inc., 3M, and Speech Processing Solutions GmbH (Philips Dictation) are the prominent players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us