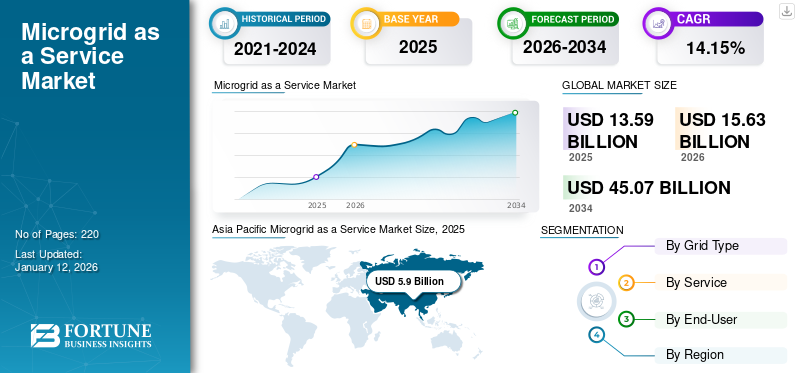

Microgrid as a Service Market Size, Share & Industry Analysis, By Grid Type (Grid Connected and Islanded), By Service (Engineering and Design Service, Software Service, Monitoring Services, Operation and Maintenance Services), and By End-User (Remote, Utility Distribution, Commercial and Industrial, Community, Military, and Others), and Regional Forecast, 2026-2034

Microgrid as a Service Market Size

The global microgrid as a service market size was valued at USD 13.59 billion in 2025 and increased to USD 15.63 billion in 2026, with the market projected to reach USD 45.07 billion by 2034, registering a CAGR of 14.15% during the forecast period. Asia Pacific dominated the global market with a share of 43.41% in 2025. The Microgrid as a service market in the U.S. is projected to grow significantly, reaching an estimated value of USD 2.58 billion by 2032.

A microgrid is an electric network that encompasses loads and at least two sources of generation, where sources are mostly renewable or non-renewable. The microgrid system is interconnected with the utility and can function in parallel or isolation from the superior power grid. This is an operative way to mitigate outages' operational, economic, and financial impact. As a part of the innovative electricity system, this is being delivered as a service to global applications and end users. The rising requirements of energy distribution in several areas are driving the microgrid as a service demand. To achieve sustainable goals toward a better future, many brands are coming up with the microgrid as a service (MaaS). The service covers operations, such as engineering and design services, software services, monitoring services, and maintenance services, among others. This is also driven by the adoption of microgrid as a service across industrial, commercial, military, institutional, and remote applications.

The COVID-19 pandemic impacted the market, which also includes microgrid services delivered to several applications. Despite the lockdowns, in many areas, microgrid services benefited due to the demand for energy applications. As per the market insights, microgrid segments may gain an advantage from COVID-19 for vendors, utilities, and other end-users.

Microgrid as a Service Market Trends

Implementation of New Regulations & Policy Incentives by Government Bodies are Influencing the Market

Policymakers play a significant role in forming programs and events that incentivize and facilitate the development of microgrids. Recent regulation is the most promising of the utility and other application models. However, the key to microgrid legality lies in attaining a Qualifying Facility (QF) cataloging under the Public Utilities Regulatory Policy Act (PURPA). For instance, the maximum number of clients a microgrid can supply varies significantly by state, with Iowa at the lower bound of 5 and Minnesota at the upper bound of 25. In addition, the relative size of generation within a microgrid is currently limited to 1 mile (1.6 KM) for QF.

Download Free sample to learn more about this report.

Microgrid as a Service Market Growth Factors

Economic Incentives & New Business Models to Boost Market Growth

Rising fuel costs and falling renewable energy costs are met to boost microgrid adoption. In the interim, technological progress is enabling innovative sellers and large utilities to connect digitization and distributed energy to solve new ways of monetizing energy infrastructure and services. Microgrid as a service is the new model trending nowadays and will create significant demand in the energy sector. This is owing to the rising optimal design of microgrid systems from a financial cost minimization outlook, which delivers both an overview of the current state-of-the-art of the field and highlights likely avenues of future research. Such factors will boost the microgrid as a service market growth in the forecast years.

Adoption of Microgrids to Improve Energy Reliability to Fuel Market Expansion

Extreme weather conditions, aging grid structure, and risks of energy outages are driving attention and adoption of microgrids to improve energy reliability. Current market development is compounded by extensive climate mitigation, which is one of the factors driving the market growth. Moreover, rising investments toward a sustainable future and “net zero” strategies across private and public sectors are also boosting the demand for microgrid services. For instance, in 2020, The Department of Energy started the development of the DOE Microgrid Program Strategy (Strategy) to define strategic research and development areas for Microgrids R&D (MGRD), DOE Office of Electricity (OE).

RESTRAINING FACTORS

Emissions of Toxic Components to Hinder Microgrid as a Service Demand

The grid power source in many emerging countries is deficient and irregular, resulting in many commercial applications relying on incompetent and air pollution-concentrated off-grid captive diesel generators as a backup power source. Most microgrid services are powered by diesel generators, which emit massive amounts of carbon dioxide and more than 30 toxic air contaminants, counting known carcinogens. That’s not the fittest solution for several industries. Healthcare providers and manufacturers of consumer goods products are the sites that may consider this factor.

Microgrid as a Service Market Segmentation Analysis

By Grid Type Analysis

Grid Connected is the Dominating Segment Driven by its Improved Reliability

Based on the grid type, the market is segmented into grid connected and islanded.

Grid connected is the dominating segment owing to its advantages, such as improved reliability, enhanced energy efficiency, increased resilience, incorporation of renewable energy sources, and the ability to operate separately. These are the primary reasons it will grow in the coming years.

Moreover, islanded is the fastest growing segment globally. They are frequently intended to improve, increase flexibility, and reduce carbon emissions at the same time.

By Service Analysis

Monitoring Services Segment is Dominating the Global Market Due to Requirement of Tracking Solutions

Based on the service, the market is segmented into engineering and design services, software services, monitoring services, and operation & maintenance services.

The monitoring services segment is dominating the global market, driven by the requirement of tracking solutions for overall operation during several applications. This service are growing in numbers during recent years backed by the rising demand in power sector. It is expected to drive the market in forecast years.

Rising technological advancements in the industry are backing software services. It is expected to dominate the market in the forecast years.

The engineering segment plays a crucial role in the deployment of the microgrid structure, which is totally dependent on the site and other factors that can be beneficial to the microgrid applications.

The maintenance segment also contributes majorly to microgrid services, which are driven by the continuous flow of electricity that cannot be compromised during the practice. Microgrid as a service market is expected to grow with full demand owing to its advantages in real-time.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Need for Clean Energy in Remote Areas Boosts Segment Expansion

Based on end-user, the market is segmented into remote, utility distribution, commercial and industrial, community, military, and others.

Remote is the dominating segment in the end-user segment. This is owing to the rising deployment of the microgrid in remote areas where power management solution is needed. In March 2024, The U.S. Department of Energy (DOE) proclaimed a plan to assign over USD 366 million for 17 projects focused on clean energy in rural and remote areas in the U.S. Moreover, the projects cover diverse types of clean energy, including Battery Energy Storage Systems (BESS), solar, microgrids, and electric vehicle charging infrastructure.

The rising growth of the commercial sectors is also contributing to the microgrid as a service market, as these sectors require a continuous supply of energy. Commercial and industriai is the leading sub-segment with a market size of USD 4.37 billion in 2026, representing 27.96% of the market.

Utility is also one of the fastest growing segments in the global market, owing to the rise in the transmission line to several rural areas requiring microgrid services.

Military segment is also one of the fastest growing segments backed by energy requirements to the army in different sites.

REGIONAL INSIGHTS

Geographically, the market for microgrid as a service is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Microgrid as a Service Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific held the largest regional share in 2025, with a market size of USD 5.9 billion accounting for 43.41% of the global market share in 2025. The rising deployment of microgrid projects in the emerging areas of China, India, and Australia drives the microgrid services owing to the energy necessity. In addition, the rising requirement for systematic power distribution systems is driving market growth in the region. The China market is valued at USD 4.01 billion by 2026, the India market is valued at USD 0.99 billion by 2026, and the Japan market is valued at USD 0.12 billion by 2026.

North America

The North American microgrid as a service (MaaS) market is expected to be the fastest growing in the coming years owing to the rising application of microgrid services in the U.S. Moreover, as per the data of the Center for the Climate and Energy Solution, microgrids provide less than 0.3% energy solution to the U.S., but energy use has grown by over 11% in the past five years. This means the necessity of energy is rising every year in the state. This factor is backing the market in North America.

Europe

European countries are focusing on the deployment of microgrid projects to remote areas owing to the energy requirements. In addition, it plays in the energy transition, supporting the integration of an increasing share of renewable energies. For Instance, in 2023, The Islandable Rural Network launched a microgrid project in the Hauts-de-France region of France focused on demonstrating how to increase resilience at the local level. The United Kingdom market is valued at USD 0.25 billion by 2026, and the Germany market is valued at USD 0.35 billion by 2026.

Latin America

Latin America and the Middle East & Africa regions also contribute to a significant share in the global market. Brazil significantly contributes more than other countries in Latin America driven by the rising industrial practices that require the energy transition. Latin America is expected to grow in the coming years, driven by a focus on a sustainable future.

Middle East & Africa

Middle East & Africa is also a growing region driven by the focus on renewable energy. This is anticipated for the microgrid services, which manage the energy requirements of several industrial, utility, and remote applications.

KEY INDUSTRY PLAYERS

Growing Focus on Strong Product Portfolio by Key Players to Boost Market Expansion

The microgrid as a service market is focused on investments and a strong product portfolio by leading market players, which are Eaton, ABB, GE, and others. Eaton is one of the leading global players in the market for microgrid as a service. Eaton has been an offering energy products for more than an era and delivers quality services to multiple sectors.

LIST OF TOP MICROGRID AS A SERVICE COMPANIES:

- Eaton (Ireland)

- ABB (Switzerland)

- GE (U.S.)

- Younicos (U.S.)

- Green Energy Corp (India)

- NRG Energy (U.S.)

- EnSync Energy (U.S.)

- Spirae (Colorado)

- PowerSecure (U.S.)

- Ameresco (U.S.)

- Schneider Electric (France)

- ENGIE (France)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: Duke Energy, an American electric power and natural gas holding company, was placed into service for one of the nation’s most progressive green microgrids in the Madison County town of Hot Springs. This project consists of a 2-megawatt (AC) solar facility and a 4.4-megawatt lithium-based battery storage capacity.

- March 2024: The U.S. Department of Energy (DOE) proclaimed a plan to assign over USD 366 million for 17 projects focused on clean energy in rural and remote areas in the U.S. Moreover, the projects cover diverse types of clean energy, including Battery Energy Storage Systems (BESS), solar, microgrids, and electric vehicle charging infrastructure.

- January 2024: The Agartala government endorsed approx. USD 6,688 million to Tripura, India, for planning up to 274 solar microgrids in remote areas of the northeastern state to deliver lights to over 9,000 houses.

- September 2023 The U.S. Department of Energy is delivering grants to deploy solar microgrids across the Southeast. Rural health centers throughout Tennessee, the state in the U.S. will be getting solar microgrids in the coming years.

- February 2021: BoxPower, a solar microgrid solution provider announced it was given close to USD 3 million in grant funds from the California Energy Commission (CEC) through the Electric Program Investment Charge (EPIC) program’s realizing quicker manufacturing and production for clean energy technologies (ramp).

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.15% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Grid Type

|

|

By Service

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights states that the global market was USD 15.63 billion in 2026.

The global market is projected to grow at a CAGR of 14.15% over the forecast period.

The Asia Pacific microgrid as a service market size stood at USD 5.9 billion in 2025.

Based on the end-user, the remote segment accounts for a dominating share.

The global market size is expected to reach USD 45.07 billion by 2034.

Economic incentives & new business models will boost the Market Growth.

ABB, Eaton, and GE are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us