Mobile ECG Devices Market Size, Share & Industry Analysis, By Device Type (Patch, Wearable, and Handheld), By Type (Continuous Monitoring and Intermittent Monitoring), By End User (Hospital & Clinics, Home Healthcare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

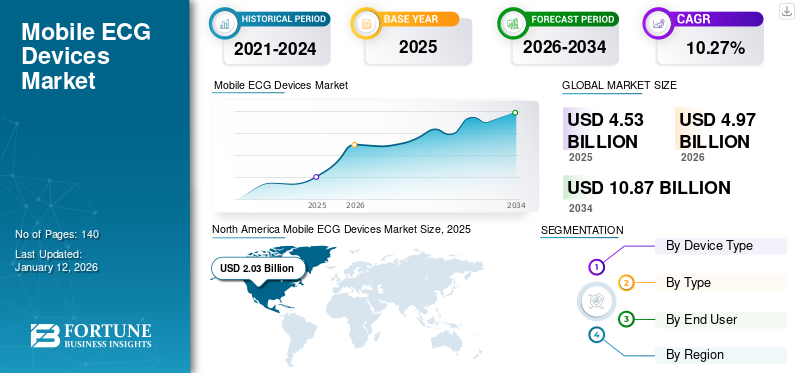

The global mobile ECG devices market size was valued at USD 4.53 billion in 2025 and is projected to grow from USD 4.97 billion in 2026 to USD 10.87 billion by 2034, exhibiting a CAGR of 10.27% during the forecast period. North America dominated the mobile ecg devices market with a market share of 44.78% in 2025.

Mobile ECG devices are used to monitor cardiac activity and detect cardiac arrhythmia. The rising prevalence of cardiac disorders among the population and increasing awareness regarding early diagnosis of the disorder and possible treatment options are some of the factors anticipated to support the growing demand in the market.

- According to a 2023 article published by the Heart Rhythm Society, atrial fibrillation is one of the most common types of cardiac arrhythmia and affects around 40 million people globally. In addition, the condition affects approximately 6 million people in the U.S.

- According to 2019 statistics published by the Centers for Disease Control and Prevention (CDC), there will be an estimated 12.1 million people in the U.S. with atrial fibrillation by 2030.

The rising focus of the companies operating in the market on the development and introduction of portable devices with novel technologies and increasing penetration of cardiac monitoring devices, including mobile ECG devices, are other factors expected to contribute to the global market growth during the forecast period.

The market was positively impacted during the COVID-19 pandemic due to the increased demand for devices, including remote monitoring devices. Several market players reported the growth in their ECG monitoring system segment owing to increased sales of the products.

Global Mobile ECG Devices Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 4.53 billion

- 2026 Market Size: USD 4.97 billion

- 2034 Forecast Market Size: USD 10.87 billion

- CAGR: 10.27% from 2026–2034

Market Share:

- North America dominated the mobile ECG devices market with a 44.78% share in 2025, driven by the rising prevalence of cardiac arrhythmia, growing awareness regarding early diagnosis, and robust product launches by key players.

- By device type, the patch segment is expected to retain the largest market share due to increasing product introductions catering to patient needs and the rising preference for convenient, wearable cardiac monitoring solutions.

Key Country Highlights:

- United States: Increasing demand for ambulatory cardiac monitoring driven by a high prevalence of arrhythmia and robust initiatives by companies to expand product availability through collaborations and regulatory approvals.

- Europe: The growing presence of med-tech startups and collaborations with healthcare organizations are enhancing awareness and adoption of mobile ECG devices for early cardiac disorder detection.

- China: The rising geriatric population and growing prevalence of cardiac conditions are propelling the demand for mobile ECG monitoring solutions aimed at remote patient care and early diagnosis.

- Japan: Increasing focus on integrating advanced technologies into wearable cardiac monitoring devices is supporting market growth, along with initiatives to promote at-home health management solutions.

Mobile ECG Devices Market Trends

Rising Technological Advancements in Remote Patient Monitoring Devices

The rising demand for remote monitoring devices is increasing the companies' focus on research and development activities to develop and introduce products with novel technologies in the market.

The development of various novel technologies, miniaturization of the devices, and increasing the devices' capabilities to detect more than one type of cardiac arrhythmia are some of the latest trends followed in the market. The shifting preference toward wearable cardiac monitoring devices among the patient population is owing to these benefits along with other advantages offered by these devices, such as easy monitoring of heart health from the comfort of one’s home, convenience to carry the device, reduced need for frequent hospital visits, and others.

Furthermore, the integration of artificial intelligence in monitoring devices is another major upcoming trend witnessed in the market. Several players are constantly focusing on innovations with the aim of catering to the rising demand for devices in the market.

- For instance, according to a 2023 article published by NCBI, the ZioPatch device by iRhythm Technologies, Inc., uses an AI-powered algorithm to analyze continuous ECG recordings for up to 14 days and has been shown to improve the detection of arrhythmias and other cardiac events.

Download Free sample to learn more about this report.

Mobile ECG Devices Market Growth Factors

Growing Prevalence of Cardiac Disorders Among the Population to Boost the Demand in the Market

The growing prevalence of various cardiac disorders, including cardiac arrhythmia, among the population is a primary factor contributing to the growing patient population requiring diagnosis and treatment in the market.

- According to a 2024 article published by the Lancet Journal, atrial fibrillation affects approximately 1.5-2% of adults in Europe. The prevalence is projected to grow to 9.5% in people aged 65 years and above by 2060.

The rising patient population is leading to a growing demand for the devices among these patients owing to growing initiatives by the market players to increase awareness regarding these devices and their benefits for early diagnosis of life-threatening conditions. The rising focus of the companies on collaborating with various healthcare facilities to expand the adoption of these devices among the population is another significant factor contributing to the growing global mobile ECG devices market size.

- In September 2023, AliveCor, Inc. partnered with Thomas Jefferson University Hospital in the U.S. to evaluate the benefits of QTc monitoring with KardiaMobile 6L for patients receiving methadone maintenance therapy for opioid use disorder. The development aims to improve the product's efficiency and increase the customer base in the market.

Therefore, the rising patient pool and the players' robust efforts to increase the adoption of the devices in the market are expected to fuel the market growth during the forecast period.

RESTRAINING FACTORS

Certain Limitations of the Devices Affecting the Results May Hamper the Market Growth

The rising technological advancements in portable ECG devices are leading to the growing adoption of these devices in the market. However, certain limitations associated with the devices pose a risk, hampering market growth. One of the major limitations is the tendency to give false-negative results that are anticipated to slow the adoption of these devices among the patient population.

The limited availability of data on the clinical efficiency of mobile ECG devices, concerns regarding data safety and privacy in wearable devices connected to smartphones, and fewer FDA approvals of such devices are some of the other factors expected to result in slowing the mobile ECG devices market growth during the forecast period.

Mobile ECG Devices Market Segmentation Analysis

By Device Type Analysis

Patch Segment Dominated Owing Rising Adoption of the Devices among the Patient Population

Based on device type, the market for mobile ECG devices is segmented into patch, wearable, and handheld.

The patch segment dominated the market with a share of 59.76% in 2026. The dominance of the segment is attributable to the growing focus of the companies on development and introduction of patch ECG devices to cater to the rising demand among patients. The rising number of product launches in the market is another crucial factor supporting the growth of the segment.

- In January 2024, Wellysis, a leading digital healthcare innovator, launched its ECG monitoring solution, S-Patch, in the U.S. and Indian markets with strategic collaborations and distribution agreements.

The wearable segment is expected to grow at the fastest CAGR during the forecast period. The segment's growth is due to the rising innovations in wearable products by market players to increase efficiency and specificity and fuel the adoption of these devices among the patients in the market. In addition, the growing collaborations among market players to introduce novel products in various markets are another factor contributing to the growth of the segment.

- In September 2023, OMRON Healthcare Co., Ltd. launched the AliveCor KardiaMobile portable ECG device in France and Italy based on its distribution agreement with AliveCor, Inc.

Similarly, the handheld segment is also projected to grow during the forecast period owing to the growing R&D focus among the players in developing and introducing products with novel technology.

To know how our report can help streamline your business, Speak to Analyst

By Type Analysis

Continuous Monitoring Segment Led the Market Due to Increased Proven Clinical Benefits of the Devices

Based on type, the market is bifurcated into continuous monitoring and intermittent monitoring.

The continuous monitoring segment accounted for the largest share of the global mobile ECG devices market, capturing 60.16% in 2026. Continuous monitoring is more likely to detect infrequent cardiac events than short-term heart activity recordings. In addition, the rising focus of the market players is on developing and introducing products with advanced technology and new features in the devices to surge the demand and adoption of these devices.

- In February 2024, UltraLinQ launched its new Holter program with the UbiqVue Holter and ECG Interpretation Software, capable of up to 5 days of continuous monitoring activity.

On the other hand, the intermittent monitoring segment is also projected to grow during the study period. The segment's growth is majorly due to the rising focus of the market players on developing handheld devices that enable intermittent cardiac monitoring among patients.

By End User Analysis

Home Healthcare Segment Dominated the Market Owing to the Rising Adoption of Remote Patient Monitoring Devices

On the basis of end user, the market for mobile ECG devices is segmented into hospitals & clinics, home healthcare, and others.

The home healthcare segment dominated the market with a share of 60.97% in 2026 and is expected to grow at the highest CAGR during the forecast period. The increasing adoption of devices for remote monitoring among patients is one of the significant factors contributing to the segment's dominance. The rising healthcare expenditure in emerging countries is increasing the adoption of remote monitoring devices, including ECG devices.

The hospitals & clinics segment is projected to grow considerably during the forecast period. The segment's growth can be attributed to the rising number of hospital visits to diagnose and treat various cardiac disorders, including cardiac arrhythmia and other heart diseases. The increasing number of hospitals in emerging countries owing to improving healthcare expenditure and infrastructure is another major factor contributing to the segment growth. In addition, the rising efforts of the market players to collaborate with hospitals & clinics are supporting the segment growth.

- In October 2023, Infobionic, a digital health company providing AI-powered diagnostic remote patient monitoring solutions, entered an agreement with Mayo Clinic. The development is aimed at the enhancement of remote cardiac patient monitoring.

The others segment is projected to grow at the highest CAGR during the forecast period. The rising efforts of the market players to increase the access and penetration of cardiac monitoring devices are leading to growing R&D activities among research institutes and others.

REGIONAL INSIGHTS

Based on geography, the market for mobile ECG devices is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Mobile ECG Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market in 2025 and was valued at USD 2.03 billion. The rising prevalence of cardiac arrhythmia and awareness regarding the diagnosis of the condition among the population in countries such as the U.S. and Canada are leading to increasing demand for cardiac monitoring devices. The U.S. market is projected to reach USD 2.11 billion by 2026.

In addition, the increasing focus of companies on introducing products in the region is another major factor expected to fuel market growth.

- In April 2023, Icentia Inc. received the U.S. FDA approval for its CardioSTAT, an ambulatory ECG monitoring solution. The approval is aimed at catering to the rising patient population and demand for diagnosis of cardiac disorders in the U.S.

Europe

Europe market for mobile ECG devices is expected to expand at a considerable growth rate during the forecast period. The growing number of medical technology startups and the robust focus of these companies on strengthening their brands and footprint are expected to support the market growth in the region during the study period. The growing initiatives and partnerships among the market players, healthcare organizations, and others are expected to drive the demand for these devices in the region. The UK market is projected to reach USD 0.29 billion by 2026, while the Germany market is projected to reach USD 0.33 billion by 2026.

- In January 2023, Implicity, a leading player in remote patient monitoring (RPM) and cardiac data management solutions, partnered with the German Society of Cardiologists in Private Practice to increase awareness regarding cardiac disorders among patients.

Asia Pacific

The Asia Pacific market for mobile ECG devices is expected to grow during the forecast period owing to the increasing geriatric population in countries such as China and India, among others, which is leading to an increasing number of people suffering from various cardiac disorders. The growing awareness regarding the condition and available monitoring solutions in the region is another crucial factor expected to boost the demand for devices in the region. The Japan market is projected to reach USD 0.25 billion by 2026, the China market is projected to reach USD 0.17 billion by 2026, and the India market is projected to reach USD 0.14 billion by 2026.

- According to 2023 data published by the Population Pyramid, the population aged 60 years and above in China was approximately 278.1 million in 2023, which accounted for around 19.5% of the country's total population.

Latin America and the Middle East & Africa are projected to register a steady CAGR and grow during the forecast period. The increasing healthcare expenditure among countries such as Brazil and Mexico, among others, is resulting in the rising diagnosis of cardiac disorders and the adoption of ambulatory monitoring devices among the population. The growing efforts of the market players and national healthcare organizations, among others, to create awareness regarding various cardiac disorders and available products to diagnose and manage these conditions are further expected to fuel the adoption of the devices.

- In January 2022, UPOlife launched an UPOlife Wearable Biosensor Patch, enabling users to monitor vital signs and assess their heart health and wellness state remotely.

Key Industry Players

Rising Focus of Key Companies on Mergers & Acquisitions is Leading to Their Growing Shares

The global market for mobile ECG devices is a semi-consolidated market with few prominent players operating with innovative product portfolios.

iRhythm Technologies Inc., Koninklijke Philips N.V., GE Healthcare Inc., and Baxter International Inc. are some of the major companies holding a large proportion of the total market share. The rising focus of these companies on mergers & acquisitions to combine advanced technology and develop products with novel features to penetrate the expanding market is a major factor responsible for the growing market shares of these companies.

- In September 2023, iRhythm Technologies, Inc. launched its next-generation Zio monitor and enhanced Zio long-term continuous monitoring (LTCM) service in the U.S.

A few other prominent players operating in the market include AliveCor, Inc. and Boston Scientific Corporation. The growing efforts of these players to introduce their products in various countries through strategic collaborations is one of the main reasons for their growing market share in the global market.

LIST OF TOP MOBILE ECG DEVICES COMPANIES:

- iRhythm Technologis Inc. (U.S.)

- AliveCor, Inc. (U.S.)

- Qardio, Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- GE Healthcare Inc. (U.S.)

- Baxter International Inc. (U.S.)

- VivaLNK, Inc. (U.S.)

- SmartCardia Inc. (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- March 2024 – Wellysis, a digital healthcare company spun off from Samsung, launched a remote cardiac monitoring system in the U.S. in partnership with Artella Solutions.

- November 2023 – HeartBeam, Inc., a cardiac technology company, received the patent grant from the U.S. Patent and Trademark Office for its novel 3D-vector electrocardiogram (VECG) platform for the detection of heart attacks and complex cardiac arrhythmia.

- October 2023 – Infobionic received the U.S. FDA clearance for its next-generation MoMe ARC Solution, a remote ECG monitoring device, intending to enable enhanced monitoring solutions for arrhythmia detection and virtual care and chronic disease management.

- September 2023 – SmartCardia received the U.S. FDA clearance for its 7-lead real-time ECG monitoring patch and cloud platform, which can be used for continuous monitoring for up to 14 days.

- April 2023 – Movesense Ltd. received the Europe MDR certification for its Movesense Medical wearable ECG. The launch is aimed at increasing the company's penetration in the region.

REPORT COVERAGE

The market research report provides a detailed analysis of the industry and focuses on key aspects such as leading companies, device type, type, and end user. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors focusing on the market forecast that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.27% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Device Type

|

|

By Type

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market was worth USD 4.53 billion in 2025.

In 2026, North America led the global market.

In 2025, North America market for mobile ECG devices was valued at USD 2.03 billion.

The market is slated to exhibit steady growth at a CAGR of 10.27% during the forecast period.

Based on device type, the patch segment led the market in 2026.

The rising prevalence of cardiac arrhythmia and other cardiac disorders and the introduction of advanced products for cardiac activity monitoring are some of the key factors driving the market growth.

iRhythm Technologis Inc., AliveCor, Inc., Koninklijke Philips N.V., and Baxter International Inc. are some of the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us