Modular Construction Market Size, Share & Industry Analysis, By Type (Permanent Modular Construction and Relocatable Modular Construction), By Material (Wood, Steel and Concrete) By Application (Commercial, Healthcare, Education & Institutional, Hospitality, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

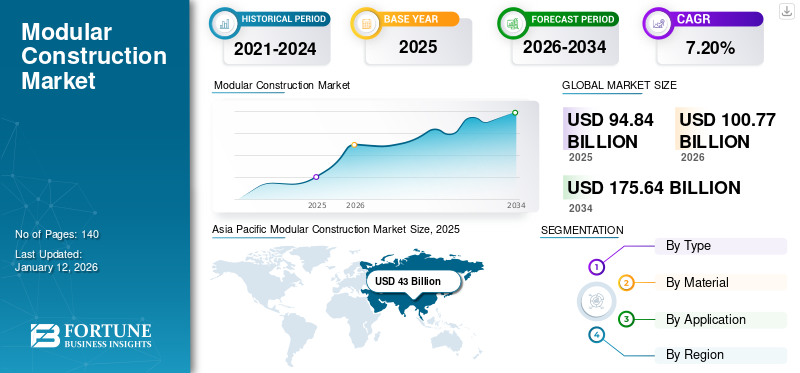

The global modular construction market size was USD 94.84 billion in 2025 and is projected to grow from USD 100.77 billion in 2026 to USD 175.64 billion by 2034, exhibiting a CAGR of 7.20% during the forecast period. The Asia Pacific dominated the modular construction market with a share of 45.40% in 2025.

The delivery and installation of prefabricated, engineered building units at the construction site are modular. The volumetric building modules are often heavily serviced units like kitchens, bathrooms, whole rooms, or room portions. Modular building construction is faster than traditional construction because it takes less time to complete. Other advantages of modular buildings include greater flexibility, higher air quality, and a shorter construction timeline.

Modular building solutions are picking up steam among housing giants owing to their major benefits, including less waste, better durability, lower costs, environmental friendliness, and flexibility. Industry experts say such projects can take 30%-50% less time than traditional construction. Due to the custom-made fittings that are developed according to the client's requirements, modular structures are exceptionally versatile. Infrastructure activities have sprung up in response to the growing demand and supply mismatch caused by rapid urbanization. AMANA Investments, located in the Gulf Cooperation Council (GCC), plans to establish a platform for seamless offsite building under the DuPod and DuBox brands, culminating in the adoption of innovative manufacturing processes.

However, due to COVID-19, the volatility in the stock market around the world has had an adverse impact on stock prices and trading volumes for manufacturers. This has resulted in a significant decline in new residential and non-residential constructions that has shrunk the demand for modular construction. Also, commercial and residential construction projects are usually backed by financial institutions and investors. According to the European Investment Bank, approximately USD 13.30 Billion was invested in Europe for infrastructure development, environmental projects, SMEs, and midcap financing. Owing to the sudden pandemic outbreak, the cash inflow-outflow ecosystem has been majorly hampered, resulting in low returns on investments.

Modular Construction Market Trends

Smart Manufacturing Technology Deployment to Enhance Product Demand

Modular building is one of the most well-known businesses today pursuing agile approaches to optimize overall operational operations. Permanent modular construction (PMC) is a construction method that uses off-site manufacturing processes to prefabricate single and multi-story structures. This enhances overall construction workflow by improving operational performance, identifying and evaluating process improvement measures, and identifying and evaluating process improvement measures. For instance, Skender opened a modular production building at its advanced manufacturing site in Chicago in May 2022. Furthermore, major companies worldwide use novel ways to modernize their businesses, including lean manufacturing and management, standardized project management (SPM), and building information modeling (BIM), further contributing to market growth.

Download Free sample to learn more about this report.

Modular Construction Market Growth Factors

Increasing Infrastructure Investments in Fast-Growing Economies to Propel the Market Development

Increasing infrastructure investments owing to the rise in industrialization and urbanization in developing economies such as India, Vietnam, and China are expected to drive the market growth. Besides, rising commercial space investments are expected to contribute positively to the prefabricated construction market’s revenue. For instance, in India, commercial property leasing has witnessed a growth of 30% in the first quarter of 2022, and the leased area is estimated to be around 60 million sq. ft., according to secondary sources.

Favorable Policies Drafted by the Government is Driving Positive Market Growth

To promote sustainable construction activities and to create green infrastructure as part of their ecofriendly initiatives, most of the government authorities across the globe are keen toward formulating policies which would reduce construction and demolition waste. For instance, the Government of Singapore has implemented a policy which mandates the application of PPVC products (pre-finished, prefabricated, and volumetric construction) in projects developed on government owned lands. Moreover, to increase the adoption of modular construction, governments across the globe are offering subsidiaries to construction companies.

Evolving government initiatives to reduce construction waste and promote green buildings drive the market. For instance, the Government of Singapore has mandated using PPVC (prefabricated, pre-finished, volumetric construction) elements in numerous projects on government lands. In addition, the government provides companies with subsidies that standardize modern construction methods. In 2016, the State Council of China released a circular stating that 30% of the new buildings would utilize prefabricated construction materials. In addition, increasing government spending on R&D for novel construction solutions is expected to drive the prefabricated construction market shortly.

RESTRAINING FACTORS

Rising Offsite Manufacturing Investments & Financial Crisis Hinders the Market Growth

Modular construction is strongly associated with offsite manufacturing that requires huge investments and long-term returns and needs stable market growth. Project pre-planning is one of the key restraints in the modularization process, as it may lead to extensive planning of critical components such as design coordination, onsite installation, and transportation. Hence, strategic project pre-planning increases manufacturing investments, which creates pressure on the investment rate for further stage planning, hindering the overall market growth.

Modular Construction Market Segmentation Analysis

By Type Analysis

PMC Holds a Major Market Share Owing to Its Cost Effectiveness

By type the market is divided into permanent modular construction (PMC) and relocatable modular construction.

The Permanent (PMC) segment is expected to lead the market, contributing 57.08% globally in 2026. PMC holds the largest market share and is the fastest-growing market segment. The PMC module can be retrofitted to the existing building or delivered as a turn-key solution with time and cost-efficiency. Relocatable modular construction is expected to grow progressively as temporary housing for emergency and relief operations has gained importance over the past few years. These buildings are specially designed to be reused, repurposed, and transported to various project sites.

By Material Analysis

Concrete Segment Dominated Global Market in 2022, due to the Increasing Need for Road Infrastructure

By material type, the market is divided into concrete, steel, and wood.

In 2026, the Concrete segment is projected to lead the market with a 61.70% share. Concrete segment generated prominent revenue in 2022. It is due to the increasing demand for concrete materials from the road and highway infrastructure industry. Furthermore, the wood segment shows the highest CAGR during the forecast period due to the rising demand for antique multi-storey wooden and bamboo houses. However, the steel segment is growing moderately due to the industrial sector's growing demand for steel infrastructure.

By Application Analysis

Commercial Application To Be The Fastest Growing Segment Due To Rising Number Of Start-Ups

On the basis of application, the market is divided into commercial, healthcare, educational & institutional, hospitality, and others (residential, etc.).

In 2026, the Commercial segment is projected to lead the market with a 43.08% share. The rising number of start-ups in developing economies is resulting in the growth of the commercial sector. In December 2022, As per the research published in Financial Express, start-up unicorn companies in India will be contributing nearly 4% to 5% of the country’s total GDP. Healthcare providers are seeking prefab as a viable option due to its cost efficiency, high quality, and time efficiency. They are using prefab for bathrooms, headwalls, and entire hospitals.

The cost and time efficiency of easy installation are expected to increase demand for modular units in the hospitality and education sectors. The others segment is anticipated to exhibit stable growth with moderate demand for modular structures worldwide.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Asia Pacific Modular Construction Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 43 billion in 2025 and USD 45.72 billion in 2026. Substantial rise in the infrastructure development and fast paced urbanization lead to growth of commercial and residential sector. Moreover, a steep rise has been recorded in government efforts toward the development of modular activities, especially in developing economies. The Japan market is valued at USD 5.89 billion by 2026, the China market is valued at USD 19.12 billion by 2026, and the India market is valued at USD 8.29 billion by 2026.

Rising demand for modular engineering for construction in several sectors, such as healthcare, education, and multi-family homes, is expected to result in the growth of prefab construction in the U.S. Moreover, general contractors in the U.S. use modular structures to build superstructures and fulfill electrical, plumbing, and mechanical requirements. The U.S. market is valued at USD 19.92 billion by 2026.

According to sources, more than 69% of general contractors in the northeastern USA use modular components. The modular construction market in the U.S. is projected to grow significantly, reaching an estimated value of USD 31.32 billion by 2032, driven by the increasing use of prefabricated construction in hospitality industry.

In Europe, government initiatives in the U.K. are further expected to result in market growth. For instance, the U.K. government implemented policies to accelerate construction programs and home-building funds to support innovators in developing land for housing, including modular projects. Also, the government has planned to achieve a 50% reduction in greenhouse gas emissions. It will thus result in the growth of the prefab construction market. The UK market is valued at USD 3.62 billion by 2026, while the Germany market is valued at USD 7.4 billion by 2026.

The Middle East & Africa is expected to exhibit significant growth over the forecast period owing to the increasing adoption of advanced technologies in the modular construction industry. Latin America is expected to observe sluggish growth due to resistance to the adoption of modular housing.

KEY INDUSTRY PLAYERS

KEF Partners with Katerra to Bolster Market Position and Growth

The key manufacturers in this market are focusing on mergers and acquisitions. For instance, KEF Katerra is a joint venture of Katerra and KEF Infra to enhance their capabilities and offerings and expand their geographic reach. Furthermore, they are trying to find solutions to provide affordable and eco-friendly products. In addition, companies are increasingly focusing on energy efficiency and customization to fulfill specific customer requirements. For instance, Blu Homes provides customized home styles, finishes, and layouts. According to sources, they provide 40% more energy-efficient homes with advanced features, including thermal insulation and eco-friendly water fixtures.

LIST OF TOP MODULAR CONSTRUCTION COMPANIES:

- Guerdon Modular Buildings (U.S.)

- Laing O'Rourke (U.K.)

- ATCO (Canada)

- Red Sea International Company (Saudi Arabia)

- Bouygues Construction (France)

- VINCI Construction Grands Projets (U.K.)

- Skanska AB (Sweden)

- Algeco (U.K.)

- KLEUSBERG GmbH & Co. KG (Germany)

- Katerra (U.S.)

- Lendlease Corporation (Australia)

KEY INDUSTRY DEVELOPMENTS:

- September 2024: Atco Structures announced its acquisition of NRB Limited (NRB), a leading Canadian manufacturer of modular educational, industrial, and residential buildings.

- November 2023: Module-AR Ltd, which operates as a firm engaged in modern construction, was acquired by Vanguard to significantly increase its capacity for both temporary and permanent modular construction space production.

- November 2023: Private Equity firm based in Mutares finalized the acquisition of Byldis UK which operates as a modular construction specialist.

- December 2022: Modulex Modular Buildings Plc and PHP Ventures Acquisition Corp. ventured into a collaboration. The decision was made eyeing more structured business and increased sales footprints in the market.

- August 2021: SG Blocks Inc., a designer and fabricator of modern modular blocks, partnered with ATCO Structures. Through this partnership, both companies contribute to the national modular fleet rollout in the U.S.

REPORT COVERAGE

The modular construction market report provides an in-depth analysis of the market dynamics and competitive landscape. It provides key insights, including recent industry developments in the market, such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.20% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By Material

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to grow from USD 94.84 billion in 2025 to USD 175.64 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 43 billion.

Growing at a CAGR of 7.20%, the market will exhibit steady growth in the forecast period (2026-2034).

The permanent modular construction segment is expected to be the leading segment in this market during the forecast period.

Increasing infrastructure investments in developing economies and evolving government initiatives drive the markets growth.

Skanska, Algeco, Katerra, and Bouygues Construction are the major players in the global market.

Asia Pacific dominated the market in 2025.

Rising offsite manufacturing investments and financial crises are expected to hinder the adoption of modular buildings.

Commercial application is expected to drive the adoption.

The adoption of lean manufacturing techniques is the current leading market trend.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us