Oil Country Tubular Goods (OCTG) Market Size, Share & Industry Analysis, By Process (Seamless and Welded), By Product (Well Casing, Production Tubing, Drill Pipe, and Others), By Application (Onshore and Offshore), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

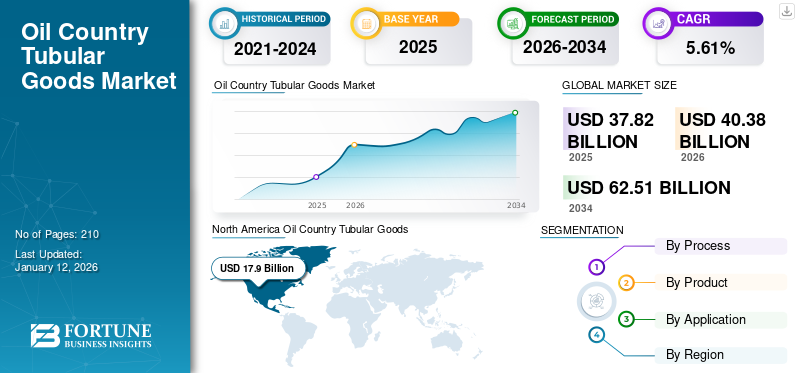

The global oil country tubular goods (OCTG) market size was valued at USD 37.82 billion in 2025. The market is projected to grow from USD 40.38 billion in 2026 and is expected to reach USD 62.51 billion by 2034, exhibiting a CAGR of 5.61% during the forecast period. The North America dominated the oil country tubular goods market with a share of 47.43% in 2025. Additionally, the U.S. Oil Country Tubular Goods Market is predicted to grow significantly, reaching an estimated value of USD 22.94 billion by 2032.

Oil Country Tubular Goods (OCTG) encompasses drilling, casing, and tubing utilized in the drilling, equipment, and operation of oil and gas wells. OCTG products are produced under strict standards to guarantee safety and reliability. The American Petroleum Institute (API) offers standards such as API 5CT for tubing and casing and API 5DP for drill pipes. These specifications define the physical and chemical characteristics, testing methods, and quality control requirements.

Tenaris is a prominent global producer and provider of steel pipe products and associated services for the energy sector and various industries globally. The company has a business presence in the Americas, Europe, the Middle East, Asia, and Africa. Tenaris offers seamless and welded steel casing and tubing, line pipe, and various other mechanical and structural steel pipes primarily serving the oil and gas industry, particularly oil country tubular goods used in drilling operations and other industrial applications.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Energy Demand to Propel Oil Country Tubular Goods (OCTG) Market Growth

The rising demand for energy, driven by swift industrial growth and urban expansion in developing nations, is a key factor propelling the market. Exploration and production of underground oil and gas reserves continue to expand to fulfill the requirements of expanding populations and economies. While the global shift toward sustainable energy is progressing, fossil fuel will remain a crucial part of the energy mix in the short to medium term, increasing demand for oil and gas.

Furthermore, governmental initiatives aimed at boosting domestic oil production also contribute to the growth of the oil country tubular goods market. While oil and gas maintain a dominant role in global energy supply and ongoing efforts to develop new oil fields, the need for oil country tubular goods will remain strong.

Rising Investments in Oil and Gas Projects to Drive Market Growth

Governments and private organizations are concentrating on creating new drilling sites, optimizing current operations, and upgrading production capabilities. Such efforts are driving the demand for vital tubular products, ensuring strong growth in the industry. Government and private entities are expressing a keen interest in discovering new oil well reserves to meet future energy systems. Significant investment by prominent companies in unlocking major oil and gas reserves is set to drive market expansion.

MARKET RESTRAINTS

Fluctuating Crude Oil Prices and Raw Material Prices to Hinder Market Growth

The Oil Country Tubular Goods (OCTG) market growth is greatly sensitive to crude oil prices. When oil prices decrease, exploration and drilling efforts slow down, reducing the need for OCTG. On the other hand, elevated prices increase drilling activity, stimulating demand. This volatility raises worries for producers and vendors. Businesses can be hesitant to pursue new operations when prices are low, leading to a decline in orders for OCTG products. This recurring trend affects long-term strategies and investments in new products and services within the sector.

The OCTG market encounters substantial difficulties due to variable costs of raw materials, particularly steel. Steel is an essential material in the production of OCTG products, and its price fluctuations directly affect production expenses and profit margins. Global steel prices have experienced significant variations due to factors such as trade regulations, geopolitical conflicts, and supply and demand imbalances.

MARKET OPPORTUNITIES

Improvements In Material Science To Offer Market Development Opportunities

Improvements in material science have led to the development of more robust, corrosion-resistant tubular products. Innovative materials and manufacturing techniques improve the performance and durability of OCTG products, particularly in extreme environments such as deepwater drilling and shale formations. These advancements allow oil companies to operate more effectively and securely, boosting the need for premium OCTG products. As the industry encounters increasingly challenging drilling situations, firms utilizing cutting-edge OCTG technologies gain a competitive edge, further boosting market demand for these high-performance materials.

MARKET CHALLENGES

Stringent Regulations Could Pose Challenge to Market Growth

Stringent environmental regulations on curbing carbon emissions and waste disposal pose difficulties for the oil country tubular goods industry. Governments globally are implementing stricter regulations to lessen the environmental effects of oil extraction and drilling. Compliance with these requirements often requires additional investment in environmentally friendly technologies, increased operational expenses.

OIL COUNTRY TUBULAR GOODS (OCTG) MARKET TRENDS

Growing Offshore Exploration to Encourage Market Expansion

The growth of offshore drilling activities is a key driver of the oil country tubular goods market. As production rates decrease in established onshore fields, the industry is redirecting its attention to offshore reserves, including deepwater and ultra-deepwater areas, to satisfy energy needs. Businesses are actively investing in offshore initiatives and exploration projects. As offshore drilling expands, the need for high-quality tubular products increases, enhancing market growth.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic had a significant impact on the global oil country tubular goods market. Disruptions in the supply of raw materials, such as steel, along with transportation challenges, have driven up production expenses and shipment delays. Producers struggled to meet deadlines, restricting their ability to supply OCTG products to the oil and gas sector. These interruptions put a strain on profit margins for both providers and end-users.

SEGMENTATION ANALYSIS

By Process

Seamless Segment Anticipated to Dominate Market as They Can Withstand High Pressures & Offers Superior Strength

Based on type, the market is classified into seamless and welded.

The seamless segment is dominated the market with a 84.13% share in 2026 to hold the dominant oil country tubular goods market share. Traditional energy sources, such as hydrocarbons, are crucial and are frequently utilized for numerous functions across various sectors. Seamless pipes can withstand extremely high pressures without failure, making them preferable to welded alternatives. Their uniform shape reduces the risk of a weak seam, making them suitable for high-pressure hydrocarbon production and exploration applications.

By Product

Well Casing Segment to Dominate Market as They Offer Wellbore Stabilization and Protection from Corrosive Fluids

Based on product, the market is divided into well casing, production tubing, drill pipe, and others.

The well casing segment is emerged as the largest sub-segment with a market size of USD 20.46 billion in 2026, accounting for 50.67% of the market. It is anticipated to dominate the market owing to heightened drilling and exploration in both traditional and non-traditional oil and gas regions. Well casing is utilized to line boreholes and offer structural reinforcement, preventing collapses and contamination of the wellbore.

Drill pipe, essential for drilling activities and fluid circulation, is experiencing rapid growth as drilling methods advance and exploration and production efforts extend into deeper and more challenging areas.

To know how our report can help streamline your business, Speak to Analyst

By Application

Onshore Segment to Dominate Market Owing to Increasing Demand for Oil and Gas Resources

Based on application, the global oil country tubular goods market is segmented into onshore & offshore.

The onshore segment held a major market share owing to the growing exploration efforts for oil and gas reserves, driven by heightened demand for these resources. Onshore drilling provides multiple benefits, such as better infrastructure access, fewer logistical difficulties, and decreased operational expenses relative to offshore drilling.

The offshore segment is led the market with a market size of USD 32.6 billion in 2026, representing 80.74% market share. It is anticipated to grow exponentially during the forecast period. It is gaining prominence with the discovery of deepwater and ultra-deepwater areas. Technological advancements and heightened investment in offshore exploration are fueling segment growth.

OIL COUNTRY TUBULAR GOODS (OCTG) MARKET REGIONAL OUTLOOK

Geographically, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Oil Country Tubular Goods (OCTG) Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Increase in Exploration Activities to Propel Market Growth

North America rising to USD 19.15 billion in 2026 dominant oil country tubular goods (OCTG) market share due to the rise in exploration activities at offshore and onshore sites. Technological advancements, along with significant reserves of unconventional oil and gas, have increased the need for premium OCTG products. The substantial demand from the U.S. is a major contributor to the market growth in the region.

U.S.

Rising Shale Oil & Gas Production to Support Market Growth

The boom in the U.S. shale oil and gas extraction is a key driver of the oil country tubular goods market. Innovations in hydraulic fracturing and horizontal drilling have opened up extensive reserves of shale gas and tight oil, greatly boosting the demand for OCTG. Moreover, government initiatives promoting energy self-sufficiency and advancements in drilling technology further drive market growth in the U.S. The U.S. accounting for USD 15.66 billion market size in 2026.

Europe

Growing Efforts for Energy Security in the Region to Support Market Growth

The oil country tubular goods market in Europe is valued at USD 3.94 billion by 2026 as the region seeks to reduce its energy dependency on other regions and establish a secure and reliable energy supply. While other energy sources contribute to the region’s needs, oil and gas remain essential. According to the EU Agency for The Cooperation of Energy Regulators (ACER), Gas represents 21.5% of the EU’s primary energy consumption. Countries in the region, such as Norway and the U.K., increased their gas supply to meet regional need, alongside other key suppliers, such as the U.S. and North African nations. Thus, gas-supplying countries in the region are anticipated to boost the demand for oil country tubular goods. The United Kingdom market is valued at USD 0.43 billion by 2026, and the Germany market is valued at USD 0.22 billion by 2026.

Asia Pacific

Growing Energy Demand in the Region to Support Market Growth

The growing energy demand in the region is anticipated to support the expansion of the oil country tubular goods market. The energy demand in countries such as China, India, and Southeast Asian nations owing to rapid urbanization and industrialization. This increasing demand has led to growth in exploration and production activities, thereby boosting demand for oil country tubular goods in the region. Government efforts in the region to develop domestic production are also anticipated to support market expansion. For instance, the Government of India implemented the Hydrocarbon Exploration and Licensing Policy (HELP) with the aim of enhancing domestic oil and gas production by intensifying exploration activity and investment. The Asia Pacific Oil Country Tubular Goods market is valued at USD 1.85 billion by 2026.

Latin America

The demand for oil country tubular goods in Latin America is anticipated to be driven by key oil-producing countries such as Brazil, Mexico, and others in the region. Brazil is the leading oil producer in Latin America, holds the largest recoverable ultra-deep oil reserves. Major energy reforms, regular oil field discoveries, and increasing investments from International Oil Companies (IOCs) globally are boosting oil & gas production in the region. These factors are expected to fuel demand for oil country tubular goods in the region. The Latin America Oil Country Tubular Goods market is valued at USD 7.83 billion by 2026.

Middle East & Africa

The Middle East & Africa Oil Country Tubular Goods market is valued at USD 7.61 billion by 2026. The Middle East’s prominence in global oil and gas production plays a crucial role in sustaining demand for oil country tubular goods. The region significantly impacts global energy output, propelled by continuous investments in oil and gas exploration and production. Furthermore, the strategic emphasis of Middle Eastern nations on diversifying energy sources and adopting advanced drilling technologies is further increasing the demand for oil country tubular goods.

Saudi Arabia

Saudi Arabia is one of the largest oil producers globally, with its oil and gas industry highly boosting demand for OCTG to assist drilling and production operations. Saudi Aramco, the government-owned oil corporation, has been investing significantly in boosting its production capabilities, which encompasses the development of conventional and unconventional resources. The country is focusing on enhancing oil production capacity and implementing strategic initiatives to uphold its dominance in the oil and gas industry. These advancements are expected to drive strong demand for oil country tubular goods.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Extensive Product Offering and Business Expansion Strategies Adopted by Key Players Anticipated to Benefit End-Use Industry

Globally, Vallourec, US Steel, and ArcelorMittal, are some of the key market players. United States Steel Corporation, under its Tubular business segment, manufactures and distributes round seamless and electric resistance welded (ERW) steel casing and tubing, and standard and line pipe and mechanical tubing, which primarily serves customer in the oil, gas, and petrochemical markets. For instance, in April 2025, Vallourec, the French tubular solutions provider has been awarded a contract to supply oil country tubular goods to Sonatrach, Algeria’s national oil and gas company. Vallourec will manufacture carbon steel OCTG with its VAM connections in various plants located in Brazil, China, France, and Indonesia. The expected delivery dates are in 2025 and 2026, and this operation is projected to generate more than USD 250 million in revenue for Vallourec overall. Also, in March 2025, Tenaris has planned to enhance its Midland center with a USD 16 million investment aimed at increasing storage capacity by 25,000 tons by year's end, by developing an additional 45 acres. According to Willy Moreno, Tenaris’ chief commercial officer in the U.S., this project will enhance the logistics and flow of the site’s layout.

List of Key Oil Country Tubular Goods (OCTG) Companies Profiled

- Tenaris (U.S.)

- Vallourec (France)

- US Steel (U.S.)

- Hunting PLC (UK)

- ArcelorMittal (Luxembourg)

- Voestalpine AG (Austria)

- Nippon Steel Corporation (Japan)

- Tubos Reunidos S.A. (Spain)

- Benteler (Austria)

- JFE Steel Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS

- November 2024 - Mubadala Investment Company acquired a 49% stake in Tubacex’s Oil Country Tubular Goods (OCTG) business. This investment aimed to strengthen Tubacex’s market position and capabilities in the CRA OCTG sector within the Middle East.

- July 2024 – Ramco Norway, provider of care and maintenance for OCTG and drilling tubulars, secured a long-term contract with Equinor. Under the contract, Ramco would provide services for 80% of the oil and gas pipe volume transported from Equinor at Fjord Base in Florø to the Norwegian Continental Shelf (NCS).

- January 2024 – Tenaris and Petrobras finalized a long-term contract for a three-year supply of tubing made from corrosion-resistant alloys (CRA) for offshore operations in Brazil. The contract involves pipes made from CRA materials and equipped with TenarisHydril Blue® premium connections and Dopeless® technology.

- May 2023 – Tenaris received a multi-year contract from Neptune Energy for the supply of OCTG and services for its drilling projects on the Norwegian Continental Shelf. Under the five-year agreement, Tenaris would produce, deliver, and offer pipe management services for a wide variety of casing, including high-performance conductor casing.

- January 2022 – Jindal SAW formed a joint venture with Hunting Energy Services to set up a premium OCTG threading plant in Nashik, India, under a 51%:49% partnership. This joint venture involves an initial investment of around USD 20-USD 25 million.

Investment Analysis and Opportunities

The oil country tubular goods (OCTG) industry present significant investment opportunities for the industry players owing to sustained global energy demand, rapid investments in upstream oil & gas activities that has led to increase in demand for durable and high performance tubular products across different countries.

- Indonesia’s Ministry of Industry initiated Southeast Asia’s largest seamless pipe factory in November 2024. It is a joint operation between PT Artas Energi Petrogas and Inerco Global International. According to the CEO of Indonesia Seamless Tube, the factory represents a significant domestic investment estimated at $148.2 million (Rp2.5 trillion).

- Saudi Arabia's King Salman Energy Park (SPARK) obtained investment agreements worth over 3 billion Saudi riyals (approximately USD 800 million) at ADIPEC 2024 to set up manufacturing plants in the Country. Among the key developments, Dalipal Holdings, a manufacturer of oil country tubular goods, signed a letter of intent to produce seamless steel pipes at its SPARK facility.

REPORT COVERAGE

The report delivers a detailed insight into the market. It focuses on key aspects such as leading companies in the oil country tubular goods market. Besides, the report analyzes market trends, technological advancements, and key industry developments. In addition to the factors above, the report examines several factors and challenges that have contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.61% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Process

|

|

By Product

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market was valued at USD 40.38 billion in 2026.

The market is likely to grow at a CAGR of 5.61% over the forecast period (2026-2034).

The Onshore segment dominate the market.

The market size of North America stood at USD 17.9 billion in 2025.

Rising investments in oil and gas projects is a key factor driving market growth.

Some of the top players in the market include Tenaris, Vallourec, US Steel Corporation, and others.

The global market size is projected to reach USD 62.51 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us