Oil-Free Screw Compressor Market Size, Share & COVID-19 Impact Analysis, By Stage Type (Single Stage and Multi Stage), By Industry (Food & Beverage, Automotive, Semiconductor, Pharmaceutical & Chemical, Metal & Mining, Oil & Gas, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

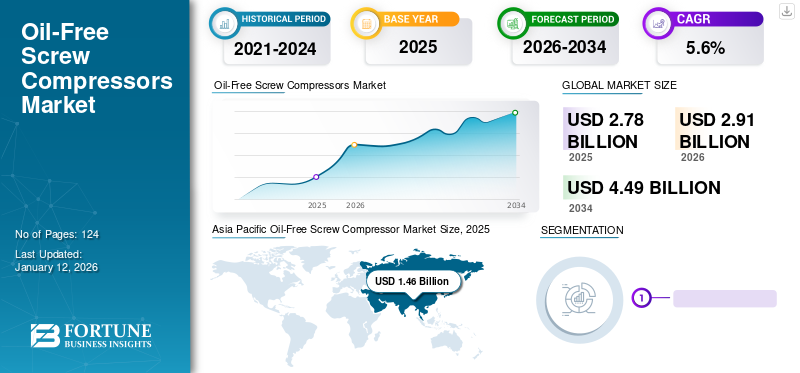

The global oil-free screw compressor market size was valued at USD 2.78 billion in 2025 and is projected to grow from USD 2.91 billion in 2026 to USD 4.49 billion by 2034, exhibiting a CAGR of 5.60% during the forecast period. Asia Pacific dominated the global market with a share of 52.40% in 2025. The oil-free screw compressor market in the U.S. is projected to grow significantly, reaching an estimated value of USD 713 Mn by 2032, driven by the technological upgrades for air control system and management.

An oil-free screw compressor refers to air compression by the action of the screw without the assistance of the oil seal. Screw compressors are manufactured by utilizing raw materials such as aluminum & steel and components such as bearings, crankshafts, switches, gauges, rotors, and housings. These are positive displacement compressors as the intermeshing rotors do not touch. The relative position is kept maintained through lubricated timing gears outside the compression chamber. Moreover, these compressors have low maximal discharge pressure. The application of compressors is in medical, semiconductor, and industrial manufacturing.

Factors such as the development of small & medium enterprises, rise in energy consumption, and ample opportunities for construction are stimulating the growth of these compressors globally. Companies are strengthening their market position by collaborating with local players. For instance, in April 2019, Gardner Denver, Inc., merged with the division of Ingersoll-Rand plc that produces the compressors. The merged market capitalization would be nearly USD 11.6 billion. Moreover, Comairco acquired D.R. Guilbeault, a Sullair distributor, to expand its product reach in the Northeast region of the U.S. that offers solutions to rebuild air compressors.

COVID-19 IMPACT

Growing Demand for Contamination Free Air Accelerated the Market Growth

The global market experienced a slight decline during the pandemic. These compressors are one of the key components of heavy assembly lines in numerous industrial verticals. Industrial oil-free screw compressors are utilized in the petrochemical as well as oil & gas sectors. However, the market ultimately restored after the pandemic due to the rising mandate for contamination-free air for critical environments and to lessen the total cost of ownership.

Moreover, during that time, oil-free screw compressors had a significant role to play as the breathing air provided to patients through the ventilation machine had to be totally free and clean from oil, humidity, pathogens, and dust. Emergency rooms, hospitals, and intensive care units remained deeply trusted on medical compressed air daily. Therefore, they witnessed the increased need for it as they treated COVID-19 patients, which further contributed to the oil-free screw compressor market growth.

LATEST TRENDS

Growing Capital Expenditure and Hybrid Fuel Infrastructure to Escalate the Market Growth

In the past few years, the automobile industry has witnessed major developments due to the rise in fuel technology that has helped in the growth of modern infrastructure for hybrid fuels such as hydrogen. In addition, the hydrogen market is progressing very rapidly, and establishing a regulatory framework is now a priority. Hydrogen is a possible solution to enable a quicker and more robust energy transition in Europe and all over the globe. Also, compressors are the primary elements that fulfill all the criteria, such as high production ratio, product purity, reliability, low energy costs, and sustainability, for hydrogen production.

Additionally, supportive government policies to uplift the condition of hydrogen infrastructure are a booster for adopting compressors in the market. For example, in September 2022, the European Commission approved USD 5.52 billion in the EU public to raise funding for hydrogen projects under the IPCEI Hy2Use initiative. Another prominent trend is the shift in the business and procurement process in the compressor industry.

Download Free sample to learn more about this report.

DRIVING FACTORS

Technological Upgrades for Air System Control and Management to Drive Market Growth

In the growing compressor industry, it is essential to manage the airflow throughout the industry. Many players in the sector provide solutions to the end users to solve complex industrial problems and enhance their operations. In addition, the energy-efficient oil-free screw compressors are designed with advanced technologies that minimize energy consumption and reduce operational costs. These compressors are equipped with features such as Variable Speed Drives (VSD), which allow the compressor to adjust its speed based on demand, resulting in optimized energy as well as eco-friendly usage. Additionally, advanced control systems and monitoring tools enable operators to monitor and optimize compressor performance, further improving and increasing demand for energy efficiency.

In addition, energy in the oil-free screw compressor industry is utilized for its generation. However, piping is a crucial part that transports from one point to another, but maximum losses are noted in this section. Hence, players are developing and providing centrally located system solutions that can easily control the whole airflow and monitor almost every aspect or point in the compressor systems, which is further contributing toward the market growth.

RESTRAINING FACTORS

Degrading Compressor Efficiency & Maintenance is Hindering Market Growth

Compressors are units that consume nearly 40-50% of the facility’s energy, only 10% is converted to use for energy, and the rest, 90%, is a loss in the form of heat. End users in the industry need equipment that can efficiently use energy and minimize the loss of energy and heat. Significantly, it should raise the output and reduce its operation costs.

- For example, in May 2022, ElGi launched two new oil-free screw compressors in the India market, diesel-powered PG575 - 225 and electric-equipped PG110E equipped with highly efficient IE3 motors.

Another big issue in the compressor industry is maintenance, where the high cost of parts replacement, filters, and lubricants, especially in the oil-filled compressor, is dominating the adoption. However, oil-free screw compressor technology is helping end users to minimize maintenance costs with filter replacements and preventive maintenance.

- For example, in July 2022, Atlas Copco launched ZR/ZT series compressors that deliver 100% oil-free certified air through its rotary screw compressor technology.

It comes with Z seal technology that provides additional cooling and efficiency. Thus, compressor manufacturers have to focus more on developing efficient equipment that offers more extensive operation time with low maintenance to avoid their shrinking shares in the market.

SEGMENTATION

By Stage Type Analysis

Single Stage Segment to Witness Highest CAGR due to Cost Effectiveness

By stage type, the market is classified into single stage and multi stage.

Based on stage type, the single stage segment is growing at the highest CAGR, i.e. 6.3% over the forecast period. These compressors comprise a single set of rotors in a single stator housing and are driven via a set of gears or by a belt and pulley arrangement & directly by the motor shaft. As single stage rotary screw air compressors are less expensive initially than two-stage air compressors, there are many trustworthy and cost-effective options readily available from a wide range of manufacturers.

Moreover, the multi stage segment will account for 58.08% market share in 2026. The multi stage segment is going to be the major trend as dual-stage rotary screw compressor is a kind of air compressor that compresses air using two rotating helical screw elements. Two electric motors, one for each stage, are typically used to drive the screws. Most pneumatic applications require compressed air at various pressures, which the two-stage air compressor can deliver.

By Industry Analysis

Food & Beverages Industry to Dominate Market Share due to Hygienic Standards

By industry, the market is categorized into food & beverage, automotive, semiconductor, pharmaceutical & chemical, metal & mining, oil & gas, and others (agriculture).

The food & beverages segment is dominating the market share due to the adoption of oil-free screw compressors. During the pandemic, the use of packaged foods increased significantly, changing consumer behavior. According to research, for March 2020, there was an 87.6% year-over-year increase in the week before lockdown announcements. Moreover, providing clean air through these compressors in food places is also aiding the market growth.

The automotive segment has experienced significant change on a global scale & expected to witness the highest CAGR during the forecast period. It is attributed to the technology t-transforming drive techniques and taking care of cars, from the electrification of cars and two-wheelers to self-driving and connected vehicles.

Moreover, the semiconductor segment is growing at a moderate rate as oil free air is required for most of the manufacturing process in semiconductors as any oil can possibly decay valuable products such as wafers. Therefore, compressed air is then applied to compress solder into tiny holes in the circuit board. This process is used to infuse the holes, which then attach the prime components to start the operation of making a circuit.

The pharmaceutical & chemical segment is expected to lead the market, contributing 21.65% globally in 2026.

The oil & gas segment is likely to have moderate market growth in the coming years as the mechanical device increases the pressure of gas by reducing its volume. They are widely used throughout the oil & gas industry.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The report comprises five major regions, North America, Asia Pacific, the Middle East & Africa, Europe, and South America.

Asia Pacific

Asia Pacific Oil-Free Screw Compressor Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the oil-free screw compressor market share in 2025 for a valuation of USD 1.46 billion. This is mainly due to the presence of numerous prominent players in China and India and a strong industrial base of the semiconductor industry in Taiwan and China. In addition, increasing adoption of atomization and automation in manufacturing, semiconductors & electronics, food & beverages, healthcare, appliances, energy, oil & gas industries are other significant factors driving the growth of the regional market. Additionally, the power & energy sector is experiencing a major rise in the region due to high investment in power plants from developing nations such as India and China. It is set to drive industrial growth, which is expected to surge the demand for oil-free screw compressors. The Japan market is projected to reach USD 0.3 billion by 2026, the China market is projected to reach USD 0.65 billion by 2026, and the India market is projected to reach USD 0.21 billion by 2026.

North America

Moreover, in North America, oil-free compressors are experiencing huge growth prospects owing to increasing consumer awareness of product quality, favorable government policies, and high demand for better air quality. These compressors are required in the workplace to comply with Occupational Health and Safety (OHS) standards, which are likely to have a positive impact on market growth during the forecast period, along with increasing demand for these compressors. Also, the strong presence of prominent companies and prominent global manufacturers in the market of North America are also aiding the growth of the market. The U.S. market is projected to reach USD 0.56 billion by 2026.

Europe

Europe accounted for the second largest revenue share in 2022 due to stringent government policies on developing compressors that are energy-efficient and meeting compliance standards. In addition, owing to significant investments in renewable energy production and manufacturing hubs in Germany and the U.K., it also accounts for a major share in revenue generation. Compressors are becoming more popular due to their cost-effective technology and decreased need for supplementary equipment in various applications, which is further contributing to the oil-free screw compressor market share. The UK market is projected to reach USD 0.09 billion by 2026, while the Germany market is projected to reach USD 0.13 billion by 2026.

Middle East & Africa

The Middle East & Africa is likely to have considerable growth owing to the hastily rising refining capacity and extensive deployment of compressors in plants. The oil & gas industry is anticipated to be the largest segment in the region during the forecast period.

South America

The South America market is expected to have a sizable growth during the forecast period. This is mainly due to the significant industrial developments across various sectors in South America, including manufacturing, food and beverage, and metal & mining. As industries expand, there is a growing need for compressed air systems, including oil-free screw compressors that provide clean and high-pressure air.

KEY INDUSTRY PLAYERS

Major Companies Accessing the Untapped Customer Base Using Cost-Effective Strategies

This market is identified as highly competitive, with the presence of multiple players operating at a global level as well as certain regions where the domestic players have a substantial market share. Key players in the market are Atlas Copco AB, Aerzen, Ingersoll Rand, ELGi, Hitachi, Ltd, and others are covering a decent market share. Companies are focusing on new product launches, partnerships, mergers, and acquisitions of businesses that offer similar technologies and services as part of their growth plan to extend their business and geographical footprint.

List of Key Companies Profiled:

- Elgi Equipments Limited (India)

- Atlas Copco AB (Sweden)

- Sullair, LLC (Hitachi, Ltd.) (Japan)

- Ingersoll Rand (U.S.)

- Kobe Steel Ltd (Japan)

- Howden Group (Chart Industries) (U.K.)

- Aerzen (Germany)

- Kaeser Kompressoren SE (Germany)

- FS-Curtis (U.S.)

- Airpack (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- April 2023: Aerzen unveiled its double-stage screw compressors 2C series at the HANOVER FAIR 2023. The compressors are available in air-cooled and water-cooled series and are specially made for volume flows ranging from 166 m³/h to 9,300 m3/h.

- February 2023: CompAir launched the DX series of screw compressors, with up to 7% energy reduction and up to 8% higher flow rates. The compressors are available at fixed and variable speeds, offering both water and air-cooled variants. Also, the models range from 200 kW up to 355 kW, aiding customers in selecting the correct configuration for their specific application.

- August 2022: Sullair and Hitachi together presented the oil-free air compressors at the Tairos/Automation Taipei Trade Show. The visitors were allowed to explore the range of highly efficient oil-free air compressors. The exhibition aided Sullair in actively investing in the Southeast Asian market.

- January 2022: Ingersoll Rand launched CompAir's D-Series oil-free rotary screw compressors to deliver dynamic efficiency with lower operating costs and high-quality oil-free compressed air. The compressors are available in air and water-cooled models ranging from 37 to 75 kW with both fixed and regulated speeds. It applies to use cases within the pharmaceutical, food and beverage, textile, and electronics industries.

- February 2020: Atlas Copco acquired Gustav Gail Drucklufttechnik GmbH, a Germany-based distributing company of industrial compressors and services to build a market presence in the Southern part of Cologne to increase its customer base.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.6% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Stage Type

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 4.49 billion by 2034.

In 2025, the market was valued at USD 2.78 billion.

The market is projected to grow at a CAGR of 5.6% during the forecast period.

The single stage segment is expected to lead the market.

Technological upgrades for air system control and management to drive the market growth.

Elgi Equipments Limited, Atlas Copco AB, Sullair, LLC (Hitachi, Ltd.), Ingersoll Rand, Kobe Steel Ltd, Howden Group (Chart Industries), Aerzen, Kaeser Kompressoren SE, FS-Curtis, and Airpack are the top players in the market.

Asia Pacific is expected to hold the highest market share.

By application, automotive is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us