Optical Wavelength Services Market Size, Share & Industry Analysis, By Transmission Rates (Less than 100 G, 100 G - 200 G, 201 G - 400 G, and 401 G - 800 G), By Configuration Type (Ethernet, Transparent Synch Frame, and Optical Transport Network), By Attributes (Metro, Long-haul, and Short-haul), By Industry (BFSI, Healthcare & Life Sciences, IT & Telecom, Manufacturing, Retail & E-commerce, Government, and Others), and Regional Forecast, 2026 – 2034

Optical Wavelength Services Market Size

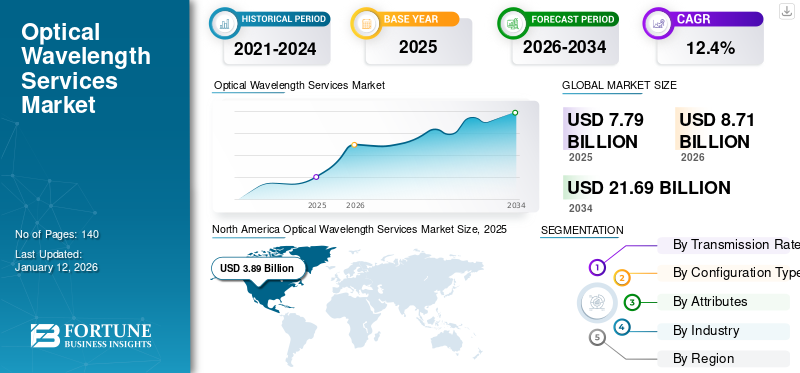

The global optical wavelength services market size was valued at USD 7.79 billion in 2025. The market is projected to be worth USD 8.71 billion in 2026 and reach USD 21.69 billion by 2034, exhibiting a CAGR of 12.01% during the forecast period. North America dominated the optical wavelength services market with a market share of 45.44% in 2025.

An optical wavelength service is a fully managed private delivery service offering high bandwidth network connections of up to 400 Gbps. Wavelength service uses a fiber optic multiplexing technology such as Dense Wavelength-Division Multiplexing (DWDM) to support the secure transmission of large amounts of time-sensitive data with ultra-low latency. In the last few years, considerable progress has been made in optical transmission technology which has resulted in the development of ultra-high-speed broadband networks. However, even with the availability of ultra-high-speed network, there is a growing demand for high-bandwidth. To meet the high-speed and high-bandwidth demand at an affordable cost, optical wavelength service providers are increasingly focusing on developing new technology that can increase network capacity.

The market growth is primarily attributed to the data center expansion, increased adoption of cloud computing, the rollout of 5G technology, and the increasing focus of organizations on digital transformation. As per the “Google Cloud Brand Pulse Survey”, 41.4% of global tech and business leaders are focusing on increasing their spending on cloud-based services. The adoption of cloud-based services by businesses requires secure and high-speed connectivity. Hence, to meet high-speed data center connectivity demand enterprises are increasingly turning to optical wavelength services as an ideal solution.

The COVID-19 pandemic significantly accelerated the internet traffic globally owing to increased remote work and online education trends. Due to this, there was an increase in the demand for remote work applications, voice, streaming, video-on-demand, and educational resources. In addition, many remote working application providers partnered with optical wavelength service providers to secure high-quality network availability.

Key optical wavelength service providers are increasingly launching high-bandwidth services to support enterprises’ increasing bandwidth demand. For instance,

- In March 2023, Lumen Technologies, a multinational technology and communications company, announced the launch of a 400 Gbps wavelength network across Europe for government agencies and enterprises requiring a high-bandwidth connection between data centers and the public cloud.

Optical Wavelength Services Market Trends

Advancement in Dense Wavelength-division Multiplexing (DWDM) System Aids the Market Growth

The rapid advancement in DWDM technology expanding market growth. DWDM technique is increasingly transforming the way data is efficiently transmitted over long distances. Presently, the DWDM system can support up to 96 channels on a single strand of optical fiber cable with each channel carrying 100 Gbps per wavelength. Ongoing advancements enable even faster speeds such as 400 Gbps per wavelength. DWDM can transmit various types of data such as voice, text, and video in long-haul transmission with minimal distortion. Coherent detection in DWDM technology increases the data rate and efficiency of the network.

DWDM uses optical amplifiers that amplify the entire DWDM spectrum and overcome long periods of tempering and fibre loss, thereby enabling transmission over long-distancess. For instance,

- In December 2023, Fujitsu Limited collaborated with KDDI Research to develop a large-capacity multiband wavelength multiplexing transmission technology using optical fibres. The technology enables the transmission of wavelength bands to other bands using multiband amplification and batch wavelength conversion technology.

In addition, advancements in technologies, such as Machine Learning (ML) and AI algorithms are expected to improve network reliability by calculating network congestion, optimizing routing, and detecting potential faults in real-time. The adoption of AI increases network availability through failure detection and optimization of increasingly complicated systems. It can also assist new service definitions for the organization with just-in-time restoration and deliver maximum availability for critical wavelengths.

Download Free sample to learn more about this report.

Optical Wavelength Services Market Growth Factors

Expansion of Data Centers to Fuel the Market Growth

As sectors such as BFSI, healthcare, government, and education become more and more data and cloud-centric, the rapid expansion of data center industry is expected. This, in turn, is anticipated to propel the demand of optical wavelength services during the forecast period. According to the Cloudscene, in the U.S. alone, there are more than 5,300 data centers. Optical wavelength services are ideal for the backup and recovery of data centers. It also enables efficient data center interconnection for real-time data processing and cloud connectivity. In the upcoming future, the rapid technological advancements in the Internet of Things (IoT), Artificial Intelligence (AI), and Autonomous Vehicles (AV) are expected to further augment the demand for these services.

RESTRAINING FACTORS

Data Security Concerns And Limited Geographic Coverage to Hinder the Market Growth

Data transmitted over wavelength services involves the sensitive information. Hence, data privacy and security become one of the primary challenges that are anticipated to limit market growth. Moreover, the limited geographic coverage also poses a significant challenge for widespread adoption. Optical wavelength services are typically available in metro and high-demand areas.

Optical Wavelength Services Market Segmentation Analysis

By Transmission Rates Analysis

Increased Media Consumption Is Set to Boost the market growth for Less than 10 Gbps

Based on the transmission rates, the market is divided into less than 100 G, 100 G-200 G, 201 G- 400 G, and 401 G- 800 G .

100 G -200 G holds a majority in 2026- 35.00%

401 G – 800 G Highest CAGR in 2025- 16.90%

Less than 10 Gbps is expected to hold the largest optical wavelength services market share during the forecast period. Less than 10 Gbps bandwidth is typically used in home networks for various applications including web browsing, remote work, and virtual meetings. Smartphone users increasingly rely on less than 10 Gbps bandwidth for social media use, video streaming, and online gaming.

In addition, more than 100 Gbps is expected to show the highest CAGR during the forecast period owing to ongoing advancements in DWDM technology that support higher data rates such as 100 Gbps, 400 Gbps, and 800 Gbps.

By Configuration Type Analysis

Increasing Demand for High-speed Data Transmission to Propel the Market Growth for Ethernet

Based on configuration type, the market is divided into Ethernet, transparent synch frame, and optical transport network.

Ethernet to hold the largest market share worth 57.37% in 2026. Ethernet wavelength services are commonly used in data center interconnect (DCI), enterprise connectivity as well as in the telecom sector to cater to increasing demand for high-speed data transmission. Ethernet supports broad rate of transmission rates including 1 Gbps, 10 Gbps, 100 Gbps, and more than 100 Gbps, making it suitable for various applications.

Moreover, optical transport network is anticipated to hold the largest market share and is expected to grow at the highest CAGR of 14.00% during the forecast period (2025-2032). An Optical Transport Network (OTN) is a technique of transporting, multiplexing, switching, supervising, and managing optical channels that maintain client signals. OTN technology is increasingly being deployed worldwide owing to its range of benefits including enhanced service-level agreements (SLA) and extended reach with forward error correction (FEC).

By Attributes Analysis

Increasing Need for High-capacity and Low-latency Network in Urban Areas to Increase the Adoption of Metro Wavelength Services

Based on attributes, the market is divided into metro, long-haul, and short-haul.

Metro wavelength services to hold the largest market share, which is valued at 57.37% in 2026. Metro wavelength services are used within a metropolitan area or city for data center connection as well as business connectivity. Metro wavelength services offer high-bandwidth connections, enabling businesses to meet their increasing bandwidth requirements for various data-intensive applications. In addition, metro wavelength offers low latency connectivity, making it suitable for high-performance computing (HPC) as well as financial trading.

In addition, the long-haul wavelength services to grow with a highest CAGR of 13.90% during the forecast period (2025-2032), owing to increasing importance of developing high-capacity networks that connects cities, countries, or regions for low-latency data exchange.

By Industry Analysis

Growing Cloud Adoption in BFSI Sector to Propel The Market Growth

Based on industry, the market is segmented into BFSI, healthcare & life sciences, IT & telecom, manufacturing, retail and e-commerce, government, and others.

The BFSI segment is expected to show the highest CAGR of 14.20% during the forecast period (2025-2032). The BFSI industry is expanding at a rapid pace due to the increased digitization. The BFSI sector is increasingly embracing cloud connectivity to process huge volumes of data in real time and improve decision-making, disaster recovery, and customer experience. Moreover, low-latency connectivity is pivotal for financial trading to avoid data transmission delays. Hence, more and more financial institutions are adopting wavelength services for fast and reliable data transmission.

To know how our report can help streamline your business, Speak to Analyst

In addition, IT & telecom to hold the highest market share with a valuation of 44.75% in 2026, owing to the growing importance of connecting data centers and enterprises with high-bandwidth and low-latency networks. Moreover, the rapid migration of public, private, and hybrid multi-cloud environments is driving companies to adopt wavelengths as part of their network infrastructures to enable cloud connectivity between IT infrastructures. The emergence of advanced technologies such as the Internet of Things (IoT) and 5G augment the demand for wavelength services further.

REGIONAL INSIGHTS

Geographically, the market share is fragmented into five major regions, including North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further categorized into countries.

North America Optical Wavelength Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America is expected to account for the largest market share with a valuation of USD 3.54 billion in 2025 and USD 3.89 billion in 2026, owing to the presence of major players, increased cloud computing adoption, rapid developments in digitization, and technological developments. The U.S. has maintained its leadership in the North America region with the presence of large number of data centers. Acquisitions, collaborations, and partnerships by key players in the region, contributes to the region’s market growth. For instance,

- In April 2021, Bell Canada, a telecommunication company, unveiled commercial 400G wavelength services to offer high-speed connectivity for cloud and data center providers.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Furthermore, the Asia Pacific market is expected to show the highest growth rate and gain the market value of USD 1.80 billion in 2026, due to the presence of the world’s fastest-growing economies such as India, South Korea, China, and Singapore. China is estimated to reach a market value of USD 0.62 billion in 2026.The region’s growth is also characterized by data center expansion, increasing smartphone users and data consumption, growing cloud adoption, and increasing investment in 5G infrastructure. India is projected to be valued at USD 0.46 billion in 2026, while Japan is poised to be worth USD 0.18 billion in the same year.

Europe

The market in Europe is set to gain the CAGR of 13.70% during the forecast period (2025-2032) and the market value worth USD 2.06 billion in 2026. The U.K. market is growing and is anticipated to be valued at USD 0.46 biliion in 2026. This growth is driven by the availability of high-quality digital infrastructure and the growing need for high-capacity and low-latency connectivity in this region. In addition, growing digital transformation is also anticipated to propel the market growth during the forecast timeframe. Germany is set to be worth USD 0.42 billion in 2026 and France is expected to be valued at USD 0.24 billion in the same year.

South America

South America is the fourth largest market with a valuation of USD 0.47 billion in 2025.In this region, the growing small and medium sized enterprises and cloud computing expansion are driving the market growth. Brazil is anticipated to dominate the regional market on account of increased high-speed bandwidth demand.

Middle East & Africa

The Middle East and Africa (MEA) region shows significant growth as many key players enter the regional market. GCC market is anticipated to gain a market share valued at USD 0.16 billion in 2025.

Key Industry Players

Key Players are Focused On Strengthening their Market Position with Continuous Developments

The global market is consolidated by leading players such as Lumen Technologies, Zayo Group LLC., Nokia Corporation, Verizon, AT&T, Colt Technology Services Group Limited, Crown Castle, Comcast Corporation, Telstra, TDS Telecommunications LLC, and others. These key players are expanding their operations by adopting strategies such as mergers, acquisitions, product launches, collaborations, and partnerships. For instance,

- In May 2023, Telstra, an Australian telecommunications and technology company unveiled wholesale 400 Gbps wavelength services to meet growing bandwidth demands by enterprises. These services are available on routes between Sydney, Melbourne, Adelaide, Canberra, and Brisbane.

List of Top Optical Wavelength Services Companies:

- Lumen Technologies (U.S.)

- Zayo Group LLC. (U.S.)

- Nokia Corporation (Finland)

- Verizon (U.S.)

- Colt Technology Services Group Limited (U.K.)

- Crown Castle (U.S.)

- Comcast Corporation (U.S.)

- AT&T (U.S.)

- Telstra (Australia)

- TDS Telecommunications LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Zayo completed a field trial of demonstrating a North American transmission of 800 Gbps over a single wavelength using Nokia Photonic Service Engine optics. The company will continue to make investments in its optical network to support new 400 and 800GE services.

- June 2023: Lumen collaborated with Microsoft and Google by launching ExaSwitch, a platform service that connects their data centers, sites, and central offices to the platform. The ExaSwitch can be set up in 400G transmission, which can be consumed on demand in 100G transmission, and traffic between networks without interference.

- January 2023: Lumen Technologies, a multinational technology and communications company launched 400 Gbps wavelength services in the U.S. to meet the growing demand for high-bandwidth interconnections between data centers and public cloud.

- March 2022: Zayo Group LLC, a bandwidth infrastructure solutions provider and Infinera Corporation, an optical networking system manufacturer completed 800G optical wavelength in the commercial network.

- October 2021: Peraton, an American national security and technology company, deployed 800G wavelength services using waveserver 5 platform of Ciena. This deployment enables Peraton to transmit data at 400 Gbps.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The market research report offers qualitative and quantitative insights into the market and a detailed analysis of the size & growth rate for all possible segments in the market. It also provides an elaborative analysis of market dynamics, emerging trends, and the competitive landscape. The report also offers key insights, such as the implementation of automation in specific market segments, recent industry developments such as partnerships, mergers, funding, acquisitions, and major industry trends. This detailed analysis provides a comprehensive view of the market and its potential for growth and development.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.01% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Transmission Rates

By Configuration Type

By Attributes

By Industry

By Region

|

|

Companies Profiled in the Report |

Crown Castle (U.S.) Verizon Communications Inc. (U.S.) Lumen Technologies (U.S.) Colt Technology Services Group Limited (U.K.) Charter Communications (U.S.) AT&T Intellectual Property (U.S.) Telephone and Data Systems, Inc. (U.S.) Zayo Group, LLC (U.S.) Comcast Corporation (U.S.) Telstra Group Limited (Australia) Ciena Corporation (U.S.) |

Frequently Asked Questions

The market is projected to reach a valuation of USD21.69 billion by 2034.

In 2025, the market was valued at USD 7.79 billion.

The market is projected to record a CAGR of 12.01% during the forecast period.

By transmission rates, the 100 G - 200 G segment led the market in 2025.

The growing adoption of 5G and emerging technologies to aid market growth

Crown Castle, Verizon Communications Inc., Lumen Technologies, Colt Technology Services Group Limited, Charter Communications, AT&T Intellectual Property, Telephone and Data Systems, Inc., Zayo Group, LLC, Comcast Corporation, Telstra Group Limited, Ciena Corporation are the top players in the market.

North America held the largest market share in 2025.

By industry, the BFSI segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us