Orthopedic Power Tools Market Size, Share & Industry Analysis, By Product Type (Instruments (Surgical Drills, Saws, and Others), and Accessories), By Technology (Electric Powered Device, Pneumatic Powered Device, and Battery Powered Device), By Usage (Reusable and Disposable), By End-user (Hospitals & ASCs and Specialty Clinics), and Regional Forecast, 2025-2034

KEY MARKET INSIGHTS

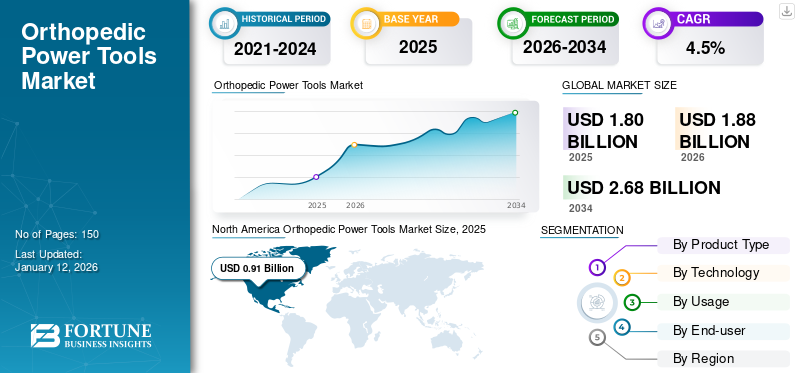

The global orthopedic power tools market size was USD 1.8 billion in 2025. The market is projected to grow from USD 1.88 billion in 2026 to USD 2.68 billion by 2034 at a CAGR of 4.5% over the forecast period. North America dominated the orthopedic power tools market with a market share of 50.50% in 2025.

The increasing incidence of road accidents, trauma, and rising prevalence of degenerative joint diseases among the geriatric population is presenting a large patient pool requiring treatment. According to the Centers for Disease Control and Prevention (CDC), an estimated 24.5 million emergency department visits were recorded in the U.S. for unintentional injuries in 2019. Falls and motor vehicle traffic-related injuries accounted for the majority share of these admissions in the country. This is leading to an increasing number of patients undergoing surgical procedures, leading to rising demand for surgical tools and devices, including orthopedic surgical power tools.

Currently, major market players, such as Zimmer Biomet, Stryker, and emerging players, such as Joimax GmbH, De Soutter Medical, are constantly focusing on introducing innovative power tools in the market to cater to the growing demand. Constant focus on R&D to innovate product portfolio and bridge the gap between unmet needs of healthcare providers and patients are leading to the introduction of new devices in the market.

- For example, in June 2021, Joimax GmbH introduced the Shrill Shaver system with the aim to remove soft tissue and bone on the spine during surgery. This new system is equipped with a handle and blade detection system to adjust them with the predetermined parameter and is intended to be used in the treatment of stenosis.

This, along with other macro and micro-economic factors, including improving healthcare and hospital infrastructure, and realigning reimbursement policies by healthcare agencies, is leading to the growing demand for new devices.

During the COVID-19, the global market was negatively impacted. The market's decline was augmented by a drop in patient visits to hospitals and other healthcare settings and a decrease in elective surgical procedures. However, with the ease of COVID-19 guidelines, in 2021, the market witnessed a slight growth with increasing patient visits and the resumption of elective surgical procedures. In 2022, the market saw substantial growth with the increasing sales of power tools. With the increasing prevalence of orthopedic disease and surgeries related to it, the market is expected to grow during the forecast period.

Global Orthopedic Power Tools Market Snapshot & Highlights

Market Size & Forecast:

- 2024 Market Size: USD 1.8 billion

- 2025 Market Size: USD 1.88 billion

- 2034 Forecast Market Size: USD 2.68 billion

- CAGR: 4.5% from 2025–2034

Market Share:

- Region: North America dominated the market with a 50.5% share in 2025. The region's growth is driven by a high number of orthopedic surgeries, the presence of adequate reimbursement policies, and an advanced healthcare infrastructure that supports the adoption of these devices.

- By Product Type: The accessories segment held the largest market share in 2023. This is due to the high replacement rate of items such as drill bits and saw blades, which are used frequently in the increasing number of orthopedic surgical procedures.

Key Country Highlights:

- Japan: The market is driven by the constant introduction of advanced surgical devices from key players to cater to the increasing demand from a growing number of patients with orthopedic disorders.

- United States: Growth is fueled by a very high volume of orthopedic surgeries, with approximately 1 million knee and hip replacements performed annually. The market is also supported by the introduction of new technologies, such as the SteriTrak surgical drill, designed for trauma centers.

- China: The market is expanding rapidly due to a significant increase in healthcare infrastructure, with the number of hospitals growing substantially. This has been accompanied by a sharp rise in surgical volumes, such as the number of total hip arthroplasty procedures, which increased from 168,040 to 577,153 between 2011 and 2019.

- Europe: The market is propelled by adequate reimbursement policies for major surgeries in countries like Germany, the U.K., and France. This, combined with an increasing number of surgical procedures, supports the consistent demand for orthopedic power tools.

Orthopedic Power Tools Market Trends

Increasing Demand for Disposable Devices to Stimulate Growth

Currently, a shift from reusable to disposable devices is being observed among surgeons in developed and emerging countries. Reusable devices are often associated with comparatively higher costs of maintenance of the devices, including routine inspections and sterilization. This leads to overall higher costs of ownership for reusable devices. However, these costs are eliminated in case of disposable devices

Disposable devices have gained popularity recently especially from small and mid-sized healthcare settings, owing to overall lower costs of ownership. This is further complemented by the reduction in cross-contamination and hospital acquired infections by the use of disposable devices, which leads to further cost reduction to these healthcare facilities. These kinds of tools can enhance infection control, provide cost-effectiveness, and offer convenience to the hospital staff as it eliminates the need for sterilization and maintenance. Overall distinct benefits offered by disposable devices and introduction of innovative devices by market players including drills, among others are driving the adoption of these devices in the global market.

Download Free sample to learn more about this report.

Orthopedic Power Tools Market Growth Factors

Increasing Prevalence of Various Orthopedic Diseases to Propel Market Growth

There is a gradual increase in the prevalence of disorders including osteoarthritis, osteoporosis, and among others.

- For example, in July 2023, according to data published by the World Health Organization in 2019, around 528.0 million people worldwide were suffering from osteoarthritis, and an increase of 113.0% in the cases of osteoarthritis from 1990. The rising prevalence of orthopedic diseases, coupled with rising knee replacement surgeries, escalates the growth of the orthopedic power tools market.

Also, there has been a marked increase in the number of trauma cases including road accidents, especially in emerging countries. According to a report published by National Centre for Biotechnology Information there were around 1.3 million road traffic injuries globally in 2020. Around 90.0% of these injuries occurred in the low and middle income countries.

These factors together are presenting a large patient pool requiring treatment and undergoing surgeries. This increase in the number of surgical procedures performed globally is driving the demand for various power tools including drills, saws, and others.

Technological Advancement in Powered Instruments to Fuel Adoption Rate

Majority of the manufacturers are currently focusing on the increasing investment in R&D for introducing innovative devices in the market.

- For instance, in May 2021, Arbutus Medical introduced SteriTrak surgical drill in the U.S. and Canada markets with an aim to perform an effective skeletal traction process especially in trauma centers.

- In addition, in November 2021, Medical Device Business Services, Inc. (Johnson & Johnson Services, Inc.) launched the UNIUM System to strengthen its power tools portfolio and it is a reliable and efficient system with ergonomic design used in trauma settings for small bones, spine, and thorax procedures.

Thus, introduction of disposable and battery operated devices has been instrumental in eliminating the ergonomic and clinical limitations that were presented by the other power tools. Battery operated devices have eliminated the difficulties faced by surgeons due to the power cables and other cords that were associated with electrical devices. Disposables have eliminated the need for sterilization of these devices, resulting in overall cost reduction for healthcare facilities. These distinct benefits offered by innovative devices are fueling the demand in the global market.

RESTRAINING FACTORS

High Procurement Cost of Devices to Limit Market Growth

The increasing number of surgeries is the one of major factors to propel the demand for these instruments. However, high acquisition and maintenance costs of these devices, especially reusable devices, are limiting the adoption of these instruments among surgeons.

- For example, according to an article by the National Center for Biotechnological Information, it was reported that the procurement cost of a single reusable battery drill is in the range of USD 6,000 to USD 6,700.

According to various research publication and articles, considerable number of incidents of breakage of drill bits and saw blades during surgical procedures in healthcare settings. For instance, according to a report by the National Center for Biotechnological Information, drill bits are the most common types of accessories reporting breakage during surgical procedures. In the U.S. approximately 1,000 incidents of retained pieces of drill bits and other accessories were reported during a surgery.

Hence, the majority of surgeons are shifting their preference toward hardware powered instruments. These instruments are cost effective and more durable as compared to drills and saws during surgeries.

Orthopedic Power Tools Market Segmentation Analysis

By Product Type Analysis

Accessories Dominated Market in Terms of Share in 2023

Among product type, the accessories segment accounted for the highest market share of 62.23% in 2026 as compared to instruments. The accessories include batteries, attachments, drill bits, and other specialized tools that provide versatility and compatibility with various surgical devices.

According to published articles and interviews with key opinion leaders, it was estimated that a reusable drill bit or saw blade can be used for approximately 8-10 surgeries. Also, according to a report by Proliance Orthopedic, an estimated 602,582 hip replacements procedures were performed from 2012 to 2018 in North America. Thus, the high replacement rate coupled with increasing number of surgeries is attributed to this segment's dominance. Additionally, the advancements in accessory technology, such as improved battery life and enhanced ergonomics, further drive their adoption and solidify their position as the leading segment of the market.

On the other hand, the instruments segment is expected to register a moderate CAGR during the forecast period owing to high cost and lower replacement rate.

By Technology Analysis

Battery Powered Device to Capture Highest Market Share during Forecast Period

Based on technology, the battery powered devices segment held a dominant share of 45.74% the market in 2025. Battery powered devices are offered in cordless design which led to elimination of power cables as in case of electrically powered tools. This has led to the increasing preference of healthcare providers and surgeons toward these devices.

Also, according to reports and research articles, battery powered devices are associated with less bacterial contamination as opposed to pneumatic powered devices during a surgery. Since pneumatic powered devices use a compressed air source for the power supply during a surgery, the chances for recurrence of bacterial contamination are more for this device.

The electric powered device segment is expected to grow with a significant CAGR during the forecast period due to presence of certain features including light weight, low maintenance cost and continuous power supply.

To know how our report can help streamline your business, Speak to Analyst

By Usage Analysis

Disposable Segment to Grow at a Highest CAGR during Forecast Periods

Based on usage, the disposable segment is expected to grow at a highest CAGR during the forecast period. The reusable segment is associated with recurring maintenance costs, which are not applicable for disposable instruments. Thus, the lower cost of ownership coupled with reduced risk of cross-contamination as compared to reusable devices are some of the key factors attributed for the increasing adoption of these devices.

On the other hand, the reusable segment dominated the global market with a share of 95.74% in 2026. The dominance is attributed to precise outcomes during a surgery, availability of a number of accessories such as drill bits, saw blades, batteries, for these devices and high preference among surgeons.

By End-user Analysis

Hospitals & ASCs Segment to Dominate over Other Segment in 2023

Based on the end-user, the hospitals & ASCs segment accounted for the highest market share of 95.74% in 2026. The increasing number of hospitals and ambulatory surgery centers, especially in the emerging countries, including India, China, Japan, and others, along with a higher number of surgical procedures performed in these settings is contributing to the growth of this segment.

- For instance, according to Statista, the number of hospitals in China increased from 20,000 to around 34,000 during the 2009-2019 period. Also, according to The Chinese Medical Association, the number of total hip arthroplasty in China increased from 168,040 to 577,153 in the 2011-2019 period.

The specialty clinics segment is expected to witness a higher CAGR during the forecast period due to the presence of trained healthcare professionals and emergence of private clinics and group practices especially in emerging countries including India and Brazil among others.

REGIONAL INSIGHTS

North America Orthopedic Power Tools Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The North America market size stood at USD 0.91 billion in 2025. The increasing number of surgeries performed in the U.S. and Canada is leading to the higher demand for power tools among surgeons. This coupled with the presence of adequate reimbursement policies and advanced healthcare infrastructure is further propelling the adoption of power tools in the region. The U.S. market is projected to reach USD 0.88 billion by 2026.

- For instance, according to Orthopedic & Neurosurgical Care & Research, approximately 1 million knee and hip replacement surgeries were performed in 2020 in the U.S., and it is projected to reach 3.5 million by 2030.

Europe

Europe accounted for the second largest proportion in the market. This is primarily attributed to the presence of adequate reimbursement policies for major surgeries and increasing number of surgical procedures in countries such as Germany, the U.K., and France, among others. According to OASES Health Horizons Ltd., the average cost of a hip replacement surgery is ranged in between USD 10,000-USD 14,000 and the cost covered by HSE is approximately up to 11,000 per hip replacement surgery. The UK market is projected to reach USD 0.07 billion by 2026, while the Germany market is projected to reach USD 0.11 billion by 2026.

Asia Pacific

Asia Pacific is expected to grow at a higher CAGR during the forecast period owing to upsurge in medical tourism and increasing number of patients with orthopedic disorders. This is leading to the increased demand for treatment options. Also, the key market players operating in this region are constantly introducing advanced surgical devices to cater the increasing demand. This is fueling the demand and adoption of powered devices for surgeries, further propelling the market growth of this region. The Japan market is projected to reach USD 0.05 billion by 2026, the China market is projected to reach USD 0.09 billion by 2026, and the India market is projected to reach USD 0.07 billion by 2026.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa held for a comparatively lower share in the global market. However, increasing investment by the government for development of healthcare infrastructure and introduction of cost-effective devices are expected to drive the growth of the market in these regions during the forecast period.

List of Key Companies in Orthopedic Power Tools Market

Strong Product Portfolio by Key Players Led to Market Dominance

The market is dominated by a few established players such as Stryker, Conmed Corporation, Zimmer Biomet, Johnson & Johnson Services Inc. (depuy synthes), and B. Braun Melsungen AG. Emphasis on introducing advanced instruments, along with a focus on inorganic growth strategies, are some of the key reasons responsible for the dominance of these companies. For instance, in March 2018, Stryker introduced the F1 Small Bone Power System for the surgical procedures of the extremities.

On the other hand, emerging players, including NSK/NAKANISHI INC., Kaiser Medical Technology, and others, are constantly focusing on the expansion of their production capacity and widening the product portfolio with an aim to cater the rising demand for power tools in developed and emerging countries. For instance, in March 2018, NSK introduced a new factory, “A1” with an aim to cater to the growing demand for various medical products, including drills, by increasing the production capacity. The other key players operating in the market are De Soutter Medical, AlloTech Co. LTD, Medtronic, and others.

LIST OF KEY COMPANIES PROFILED:

- Stryker (Kalamazoo, U.S.)

- Conmed Corporation (Largo, U.S.)

- Zimmer Biomet (Warsaw, U.S.)

- Johnson & Johnson Services, Inc. (New Brunswick, U.S.)

- B. Braun Melsungen AG (Melsungen, Germany)

- De Soutter Medical (Buckinghamshire, U.K.)

- AlloTech Co. LTD (Namyangju-si, South Korea)

- Kaiser Medical Technology (Chippenham, England)

- Medtronic (Dublin, Ireland)

- NSK/NAKANISHI (Kanuma, Japan)

KEY INDUSTRY DEVELOPMENTS:

- January 2024- Paragon 28, Inc. launched FJ2000 Power Console and Burr System. The system is designed for minimally invasive foot and ankle surgical procedures.

- January 2024- Arthrex launched a new online platform, NanoExperience.com, to educate people about Nano arthroscopy, a minimally invasive orthopaedic procedure.

- October 2023- Johnson & Johnson Services, Inc. launched VELYS, a Robotic-Assisted Solution for total knee surgery in the European market.

- November 2020 – Stryker announced the acquisition of Wright Medical Group N.V., intending to widen its product portfolio in its trauma and extremity business.

- May 2021 –Arbutus Medical introduced SteriTrak surgical drill in the U.S. and Canada markets with an aim to perform an effective skeletal traction process, especially in the trauma centers.

REPORT COVERAGE

The orthopedic power tools market report provides a detailed analysis of the industry and focuses on key aspects such as leading companies, products, and end-user. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the market report encompasses several factors that have contributed to the growth of the advanced market over recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation:

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.5% over 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type

|

|

By Technology

|

|

|

By Usage

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size stood at USD 1.8 billion in 2025 and is projected to reach USD 2.68 billion by 2034.

In 2025, the North America market value stood at USD 0.91 billion.

In 2023, the global market share of the electric powered device segment was 32.2%.

The market will exhibit steady growth at a CAGR of 4.5% during the forecast period (2026-2034).

By technology, the battery powered device segment is leading the market.

The rising prevalence of diseases and the introduction of technologically advanced power tools are the key drivers of the market.

Stryker, Conmed Corporation, Zimmer Biomet, Johnson& Johnson Services Inc., and B. Braun Melsungen AG are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us