Patent Analytics Market Size, Share & Industry Analysis, By Component (Solutions and Services (Patent Landscapes/White Space Analysis, Patent Strategy and Management, Patent Valuation, Patent Support, Patent Analysis, and Others)), By Enterprise Size (Small and Mid-sized Enterprises (SMEs) and Large Enterprises), By End-user (IT and Telecommunications, Healthcare & Pharma, Banking, Financial Services and Insurance (BFSI), Automotive, Media and Entertainment, Food and Beverages, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

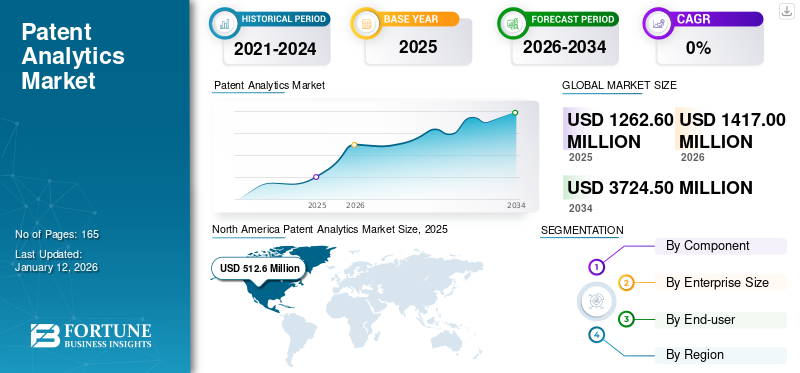

The global patent analytics market size was valued at USD 1,262.60 million in 2025. The market is projected to grow from USD 1,417.00 million in 2026 to USD 3,724.50 million by 2034, exhibiting a CAGR of 12.80% during the forecast period. North America dominated the global market with a share of 40.60% in 2025.

Patent analytics solutions are deployed across organizations to correlate and gain insights among designers, developers, industries, key technologies, geographical distributions, and others to establish and track emerging trends and identify breaches. Patent analytics solutions assist organizations in illustrating a representation of the technological landscape of a particular region or country based on its adoption rate, growth capacity, and the significance of R&D initiatives. Patent analytics solutions help government, public, and private enterprises to provide a robust source for making business decisions and evaluating factors such as market drivers, opportunities, trends, and challenges.

- In September 2023, Clarivate Plc, a trusted information and insights provider, showcased their next-generation intellectual property (IP) management software IPfolio at the Patent Information Fair & Conference (PIFC), 2023, in Japan. IPfolio is an end-to-end IP management software solution for corporations that require significant control of their IP assets portfolios, which consist of patents, trademarks, and designs.

- In January 2023, IBM Corporation lost the top spot for U.S. patents in 2022 for the first time in decades. IBM’s patent count declined by 44% to 4,743 in 2022, behind Samsung’s 8,513. This decline reflects the company's strategy shift in its portfolio.

The COVID-19 pandemic has led to a slight decline in the demand for patent analytics solutions worldwide. The decline in demand was owing to the temporary or permanent shutdown of small and medium enterprises, product development activities, production facilities, research institutes, innovation centers, and others. However, patents related to the healthcare industry were least impacted, owing to the surge in demand for advanced technology-based medical devices and pharmaceutical drugs to treat COVID-19-infected patients.

Patent Analytics Market Trends

Rising Adoption of Cloud Computing to Empower the Intellectual Property (IP) Management Platforms

A key trend in the patent analytics market share is the increasing adoption of cloud computing to empower intellectual property (IP) rights management. Key market players invest considerably in the deployment of cloud computing technology and developing cloud-based analytics platforms. For instance,

- In July 2021, Amazon.com, Inc. launched India's Intellectual Property (IP) Accelerator program to help sellers, brand owners, and small and medium-sized business owners. It helped secure trademarks, protect brands, and tackle infringement on Amazon websites globally. The program has offered sellers easy access to secure intellectual property rights and trademarks.

According to a January 2021 IBM research report, in 2020, IBM Corporation filed more than 9,130 patent applications in the U.S. Of these, an estimated 3,000 and 2,300 patents filed related to advanced technologies such as cloud computing and artificial intelligence, respectively.

Download Free sample to learn more about this report.

Patent Analytics Market Growth Factors

Increasing Number of Patent Filings Per Year Across the Globe to Aid Market Growth

Organizations focus on patent filings to create unique brands and develop innovative products. The increasing number of patent filings per year in various sectors has fueled the growth of the market. For instance, according to the International WIPO’s Patent Cooperation Treaty (PCT) Organizations Report 2023, an estimated 278,100 patent applications were filed under WIPO’s Patent Cooperation Treaty (PCT) in 2022, representing an increase in filing by 0.3% compared to previous year.

Furthermore, according to the U.S. Patent and Trademark Office (USPTO) Organization, an estimated 515,000 new patent applications were received, and 340,000 patents were granted by the office in the U.S. in FY 2023. This increase in international patent filings and surge in global research and development spending has created a massive demand for adopting advanced platforms and solutions to manage such substantial patent filings.

The increasing number of patent filings in the pharmaceutical and healthcare sectors has created a massive demand for the patent analytics solutions. The increase in patent filings can be credited to the rising global healthcare expenditure and growing government funding. For instance, according to the World Health Organizations Report in 2020, global healthcare expenditure was valued at around USD 8.3 trillion 2020 and is expected to reach USD 8.8 trillion by 2021. The increase in healthcare expenditure has created a massive demand for pharmaceutical drugs. Several leading pharmaceutical companies are investing in patent filings, which is expected to drive the patent analytics market growth. For instance, in October 2021, Medtronic medical device company has received a grant of more than 49,000 patents. In FY 2021, the company was recorded to invest USD 2.5 million in R&D initiatives.

RESTRAINING FACTORS

High Transactional Costs Associated with Software and Services Impede Market Growth

Patent analytics software is used to identify existing patent information and provide services such as task identifications, searching, segmentation, abstracting, clustering, visualization, and interpretations. Leading companies in the market, including Ocean Tomo, LLC., PatSnap Pte. Ltd., and others provide advanced software and tools to meet the demand for intellectual property rights. The companies invest in various stages of the invention process, patent applications, and filing procedures.

Patent analytics software is used for commercial patent searches and negotiating services. This software entails a high deployment and transaction cost, impeding patent application demand in developing nations. For example, the price of solutions and services offered by players such as Gridlogics, Harrity & Harrity, LLP and others ranges from USD 1,000 to USD 5,000 per year, depending on the type of patent searching and filing applications.

Furthermore, according to PatentSight GmbH, businesses would spend USD 5.1 million on annuity fees to preserve their patent portfolios at the world's top ten patent offices in 2020. The 166 firms with the most expensive portfolios would receive a portion of all annuity fee payments. Of these, 50 businesses alone spend USD 1.3 million.

The prominent companies in the market provide patent information extraction services monthly, with annual fees ranging from USD 12,000 to USD 35,000. Small and medium-sized organizations cannot afford advanced technology due to budget constraints, which may hinder market growth. In addition, leading companies provide customized patent searching solutions with expert guidance regarding intellectual property rights. The cost of solutions offered by these companies differ as per the client’s requirements.

Patent Analytics Market Segmentation Analysis

By Component Analysis

Strategic Importance of Patents in Technology Businesses Increases Demand for Patent Strategy and Management

Based on the component, the market is bifurcated into solutions and services. The services segment is further subdivided into patent landscapes/white space analysis, patent strategy and management, patent valuation, patent support, patent analysis, and others. The solution segment dominated the market with a share of 52.57% in 2026.

Due to the growing need for customized services by SMEs and large-scale enterprises, patent strategy and management holds the largest market share, and are expected to sustain its leading share during the forecast period. Patent strategies and management services are becoming increasingly crucial to the success of information-age enterprises, influencing valuations, reaping tax advantages, and raising the starting price per share. In addition, it highlights the impact patents can have on the strategic and tactical activities of technology-driven businesses.

PatentSight by LexisNexis will likely gain a significant proportion of the market. The increase is mainly attributable to the rising demand for intellectual property professional solutions and the number of patent applications in various industries, including healthcare, information technology, and telecommunications. For instance, according to the annual United Nations World Intellectual Property Organization overview, 277,500 worldwide patents were filed in 2021, rising 0.9% from 2020.

By Enterprise Size Analysis

Patent Analytics Tools Adopted by SMEs to Boost the Overall Sales of the Market

Based on enterprise size, the market is segmented into small and mid-sized enterprises (SMEs) and large enterprises.

The use of patent analytics tools among SMEs is predicted to grow with the highest CAGR during the study period. The availability and easy accessibility of various open-source analytics tools for SMEs would contribute toward the segment growth.

According to July 2021 statistics by EPO (European Patent Office), small and medium-sized firms (SMEs) and individual inventors account for approximately 21% of patent applications filed at the EPO by European applicants, with 5% coming from universities and government research organizations.

The large enterprises segment accounted for the highest market share of 53.02% in 2026 and is expected to continue its dominance during the forecast period. This is due to increased patent filings by leading international companies such as Microsoft Corporation, IBM Corporation, LG Electronics, and Sony Group Corporation.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

IT and Telecommunication Industry to Witness a Remarkable Market Growth Owing to Rising Patent Filing Activities by Tech Giants

By end-user, the market is divided into IT and telecommunications, healthcare, banking, financial services and insurance (BFSI), automotive, media and entertainment, food and beverages, and others (government, education).

The IT and telecommunications segment is expected to hold the highest CAGR during the forecast period. This is due to the rising number of patent filing activities by tech giants in the North American region. For instance,

In addition, other tech giants such as LG, Intel Corporation, Huawei Technologies Co., ltd., and Amazon.com, Inc. filed around 5,112, 3,284, 3,178 and 2,373 patent applications, respectively, in the U.S. Patent and Trademark Office.

An increasing number of patent filings in the pharmaceutical & healthcare sectors, rising healthcare expenditure, and growing government funding have created a massive demand for the market. Further, the pandemic has boosted innovations in the healthcare industry.

Therefore, the major players in the market are focused on developing advanced respective market solutions to cater to the demand across healthcare sectors, which is also boosting the sector's market growth. For instance,

- In April 2021, Harrity Analytics developed a patent analytics platform for medical diagnostics for IAM Medical to understand the impact of applications and grants.

REGIONAL INSIGHTS

Based on geography, the global market has been studied across five regions, namely North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Patent Analytics Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 512.6 million in 2025 and USD 568.6 million in 2026.

According to the WIPO statistics database, in 2022, there were 594,340 patent filings in the U.S. compared to 38,052 patent filings in Canada. The U.S. market is projected to reach USD 312.2 million by 2026.

Canada is expected to show the highest growth rate during the projection period owing to the rising PCT utilization rate and increasing R&D investments to escalate domestic innovation and production. For instance,

According to the IP Canada Report 2020, the rate of PCT utilization over the last decade in the country was between 76% and 80%, indicating that Canadian Intellectual Property Office (CIPO) applicants are making extensive use of the system.

To know how our report can help streamline your business, Speak to Analyst

The Europe is expected to hold a significant market share. The regional growth is driven by the increasing adoption of cloud services, a surge in data generation in the manufacturing and healthcare sectors, and growing government and public spending on simplifying business processes. For instance,

According to European organizations, around 70% of them are migrating their workloads to the cloud. This is primarily attributed to optimizing cost due to cloud usage and approximately 50% of organizations have deployed a cloud-first strategy to increase business efficiency. The UK market is projected to reach USD 45 million by 2026, while the Germany market is projected to reach USD 132.2 million by 2026.

During the COVID-19 pandemic, European players have been recorded to invest in many digitalizing industries, such as healthcare, manufacturing, and retail, to provide seamless consumer experience services. For instance,

- In September 2020, Minesoft Ltd and RWS, an intellectual property translation filing company, launched an updated version for enhanced patent search and analysis, PatBase 2.0. The new system leverages cutting-edge indexing technology and improves performance. PatBase 2.0 enable publication-level searching, indexing and traditional patent retrieval.

Asia Pacific is among the fastest-growing regions in the market. The region's innovation performance has been the most aggressive in the last decade, reducing the gap between North America and Europe. For instance, in the Global Innovation Index 2021 by WIPO, 5 Asian countries, including the Republic of Korea, Singapore, China, Japan, and Hong Kong, featured among the top 15 innovative economies. The Japan market is projected to reach USD 72.1 million by 2026, the China market is projected to reach USD 98.4 million by 2026, and the India market is projected to reach USD 49.8 million by 2026.

The Asia Pacific market is highly fragmented, owing to many end-use enterprises, technology developers, and service providers. The region's players focus on expanding their geographical presence by offering technologically advanced solutions and services to clients across developing nations.

Enterprises in countries such as China, Japan, India, Oceania, South Korea, Southeast Asia, and others are expected to increase their investment in adopting patent analytics in their businesses owing to the rising number of patent filings in the regions. For instance,

- According to the June 2020 report by Clarivate, Mainland China has witnessed a continued strong increase in patent filings throughout the previous decade, accounting for a large share of global totals and driving an overall rising trend. It was estimated that Mainland China's patent activity volume increased by 440% from 2010 to 2018.

The Middle East & Africa market is emerging, owing to the increasing number of startups and domestic players. Governments in the region are heavily investing in smart city projects to establish their position as a global center of sustainable infrastructure. An increase in the number of government projects is anticipated to create opportunities for key players in the market across the Middle East and African countries.

KEY INDUSTRY PLAYERS

Major Players Enter Strategic Collaborations and Bring Product Enhancements to Gain a Competitive Edge

Leading market players such as Clarivate Analytics Plc, IBM Corporation, LexisNexis, and others are implementing various business plans and strategies. They are expanding the range of services use to enhance their tools and technologies used to develop innovative solutions, and improve their capabilities in technology and analytics solutions with the help of Artificial Intelligence (AI), Machine Learning (ML), Natural Language Processing (NLP), and other technologies.

List of Top Patent Analytics Companies:

- Clarivate Analytics Plc (U.K.)

- IBM Corporation (U.S.)

- LexisNexis (U.S.)

- Anaqua, Inc. (U.S.)

- Harrity & Harrity, LLP (U.S.)

- Ocean Tomo, LLC (U.S.)

- Wynne-Jones IP Ltd. (U.K.)

- Gridlogics (India)

- Minesoft Ltd. (U.K.)

- PatSnap Limited (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 - PatSnap Limited, an AI-powered innovation intelligence platform provider, launched ‘Family Search Mode’ into Patsnap’s Analytics tool. The mode would provide instant access to family-level analysis.

- October 2023 - PatSnap Limited, an AI-powered innovation intelligence platform provider, attended the annual meeting of the American Intellectual Property Law Association (AIPLA) in 2023, where they showcased their industry-leading IP analysis and review tools.

- October 2023 – Wynne-Jones IP, a leading intellectual property company, announced a strategic partnership with CyNam, a cyber technology provider in the U.K. The partnership would sponsor and support the nurturing of cyber technology innovation in the U.K.

- June 2023 – Anaqua, Inc., an innovation and intellectual property management technology provider, announced the hosting of the Anaqua Experience Conference (AEC), the 2023 Annual User Experience Conference, with Keynotes from BASF, Copyright Clearance Center, and IBM.

- January 2023 - IBM Corporation lost the top spot for U.S. patents in 2022 for the first time in decades. IBM’s patent count declined by 44% to 4,743 in 2022, which is behind Samsung’s 8,513. This decline reflects the company's strategy shift in its portfolio.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.80% from 2026 to 2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Component

By Enterprise Size

By End-user

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 3,724.50 million by 2034.

In 2025, the market was valued at USD 1,262.60 million.

The market is projected to grow at a CAGR of 12.80% during the forecast period.

The patent strategy and management sub-segment is expected to lead the market.

Increasing number of patent filings per year across the globe to aid to the market growth is the key factor driving market growth.

Clarivate Analytics Plc, IBM Corporation, LexisNexis, Anaqua, Inc., and Harrity & Harrity, LLP are the top players in the market.

North America is expected to hold the highest market share.

By end-user, IT and telecommunication are expected to grow with the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us