Quantum Computing Market Size, Share & Trends Analysis, By Component (Hardware and Software), By Deployment (On-Premise and Cloud), By Application (Machine Learning, Optimization, Biomedical Simulations, Financial Services, Electronic Material Discovery, and Others), By End-user (Healthcare, Banking, Financial Services and Insurance (BFSI), Automotive, Energy and Utilities, Chemical, Manufacturing, and Others), and Regional Forecast, 2025-2032

Quantum Computing Market Size

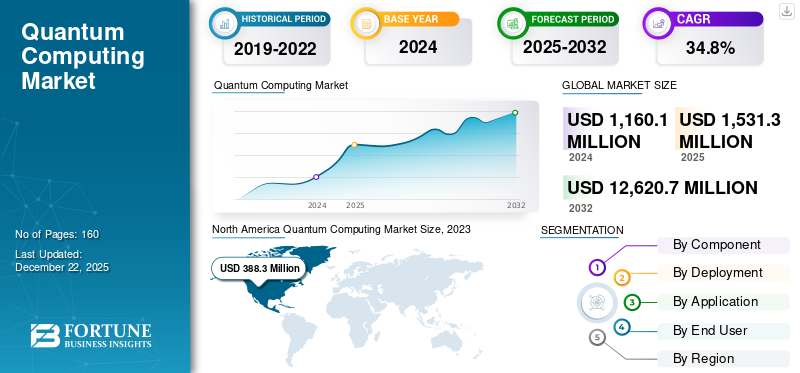

The global quantum computing market size was valued at USD 1,160.1 million in 2024. The market is projected to grow from USD 1,531.3 million in 2025 to USD 12,620.7 million by 2032, exhibiting a CAGR of 34.8% during the forecast period.

Quantum computing is a subfield of computer science based on quantum theory. It is a cutting-edge technology that uses quantum mechanics to solve more difficult problems for classical computers and is rapidly developing. Quantum computers have made it possible to use concepts from quantum physics in computing. It differs from standard computing in terms of speed, data, and bits. Most of the time, the system is used to compare and select the best answer to a complex problem. Quantum computers can be utilized to create more exact and productive machine learning calculations utilized in applications such as picture and discourse acknowledgment.

The companies are focusing on expanding their business units across developing nations. For instance, in June 2022, Xanadu launched Borealis, which outperforms the most promising classical supercomputers at distinct tasks and is available to users everywhere through Amazon Braket and Xanadu Cloud. It is a programmable photonic quantum computer with a quantum computational edge of 216 squeezed-state qubits.

The global expansion of computing services was significantly impacted by the COVID-19 outbreak. The proportion of private and venture capital-backed investments in quantum computing increased significantly in the second half of 2021. This rise accounted for over 70% of investments, indicating a growing belief among businesses in the technology's potential benefits. Hence, considering the above factors, Artificial Intelligence (AI), cloud computing, and other technologies are expected to be the disruptive technologies to enable future platforms.

Impact of Generative AI

Integration of Generative AI with Quantum Computing aids to Process Large Datasets with Accurate Calculations

The integration of quantum computing with generative AI has the potential to revolutionize business strategies and economic models. This fusion enables businesses to analyze market trends and consumer behavior with unprecedented accuracy and speed. The increased data processing power of quantum computers has an impressive ability to solve complex problems and enable the processing of large sets of data with machine learning.

Integrated quantum computers with generative AI help to perform accurate calculations much faster than classical computers. Furthermore, they help handle large datasets and improve optimization algorithms to uncover new insights. Similarly, growing investments in implementing generative AI among quantum computers bring development to accelerate the performance of enterprise applications. For instance,

Ø In April 2023, IBM Corporation in collaboration with Moderna, Inc., a biotechnology company developing messenger RNA (mRNA) vaccines under which Moderna invests in developing quantum computing skills and artificial intelligence technology to bring advancement in mRNA research and science.

Quantum Computing Market Trends

Rise in Number of Patent Filings by Key Players in Quantum Technologies to Boost Market Expansion

Quantum computing is an evolving high-tech technology. Patent filings for quantum technologies have been increasing rapidly in recent years. The increasing expansion of patenting activities along with computing technology across various technical and non-technical areas such as IT architectures, material engineering and drug development boosts the performance of the quantum ecosystem with a rising number of patent applications. For instance,

Ø In October 2023, Amazon filed a patent for quantum computing across multiple quantum technologies through edge computing devices to utilize computing services without the need for direct access to quantum hardware.

Patents and investments are shaping the future by developing enhanced technologies. For instance, AMD submitted a patent for teleportation in September 2021, to power quantum computing. By reducing the number of qubits needed for precise calculations, the patent's model aims to address the issues of stability and scalability.

Download Free sample to learn more about this report.

Quantum Computing Market Growth Factors

Growing Government Investments in the Technology to Boost Market Demand

Government organizations across the globe are majorly investing in quantum technologies to encourage companies and end-users for harnessing the power of these technologies. The investments reflect the importance of the technology in industry competitiveness, scientific research, and the security sector. These funds help to boost the penetration of advanced quantum technologies domestically.

Ø For instance, in February 2024, the U.K. government disclosed a speculation of GBP 45 million (USD 48.4 million) for quantum computers and GBP 27 million (USD 29.0 million) for novel semiconductors. This investment helps the U.K. government to build the U.K. into a science and innovation superpower and to construct a quantum-enabled economy by 2033.

Companies help investors to stay ahead of the tech curve in defense and computer improvements. China has been making heavy investments in the research and development of numerous computing technologies. The country’s public spending on quantum is four times higher than the U.S. Similarly, computing ventures are being pursued by the governments of Australia, the U.S., and developed nations in the European Union.

RESTRAINING FACTORS

Lack of Skilled Labor across the Globe to Hinder Market Proliferation

Quantum computing is still an emerging concept and there is an increasing talent shortage among regions worldwide. According to an analyst survey, there could be a demand for around 10,000 quantum skilled workers and a supply of under 5,000 by 2025. This factor is expected to restrict the quantum computing market growth in the coming years.

As quantum computers are fundamentally different from classical devices, they leverage the complex laws of quantum physics to create quantum bits, or 'qubits' to carry out calculations faster, which needs proper training and knowledge of the computing technology. Thus, the insufficient knowledge of managing quantum computers is expected to restrain market expansion.

Quantum Computing Market Segmentation Analysis

By Component Analysis

Software Segment to Dominate Owing to Rising Usage across Research Industries

By component, the market is divided into software and hardware.

The hardware segment held the highest market share of 50% in 2024 as it is a major ecosystem bottleneck. The quantum computing hardware platforms such as neutral atoms, spin qubits, and photonic networks can interact with software to bring advancements in this field. However, the commercially available quantum computers are based on trapped ions and superconducting circuits, which are the most advanced hardware platforms.

Furthermore, we have considered multiple quantum computing services in our scope including managed and professional services. These services can be delivered by large number of key players including Amazon, Accenture, and Microsoft.

The software segment is anticipated to grow at the highest CAGR during the forecast period. This is due to an increase in the number of startups across the globe and heavy investments in R&D activities related to computing technology. This information technology is used in deep learning, optimization, and simulation applications, resulting in more efficient operations and lower operating costs in various sectors.

By Deployment Analysis

Cloud Segment to Lead due to Surge in the Adoption of Cloud-based Solutions

By deployment type, the market is divided into cloud and on-premise.

During the forecast period, it is anticipated that the cloud segment will lead the market with high CAGR of 38.1% during the forecast period and likely to hold the largest market share of 53% in 2025. As more robust systems are developed, the demand for cloud-based computing services and solutions is likely to rise.

Ø For instance, in August 2023, China Electronics Technology Group Corp (CETGC) and China Mobile unveiled an advanced quantum computing cloud platform to help companies and researchers carry out quantum algorithm experiments to a practical stage.

Cloud technology provides a number of alternative methods for putting quantum computers in use with availability of more comprehensive solutions from major market players. The freedom of access offered to users is another factor driving the popularity of cloud-based services and systems.

The on-premise based quantum computers come with all essential hardware components which takes time to develop automated calibration and testing algorithms of large sets of data. This factor has reduced the usage of on-premise based quantum computers in near future.

By Application Analysis

Machine Learning Segment to Gain Traction Due to Rising Innovations in Market

Based on application, the market is divided into biomedical simulations, optimization, machine learning, electronic material discovery, financial services, and others (traffic optimization, weather forecasting, and others).

The machine learning segment will hold the majority of the market share by 24% in 2025, and expected to exhibit a CAGR of 36.7% during the forecast period. The technology helps enable quantum error-correcting codes, the creation of novel quantum algorithms, and the estimation of quantum system features. Quantum computers with machine learning technology (ML) can compress large datasets to a small number of qubits and enable them to solve problems with complex data with greater efficiency. Thus, the integration of machine learning with quantum computing technology raises the demand for efficient computing resources to bring innovations in the market.

The financial services segment is anticipated to exhibit a significant growth rate during the projection period. With rising competition to gain more consumers, startups across the healthcare and BFSI sectors are focused on adopting these services to enhance their offerings over cloud-based channels.

By End-user Analysis

Healthcare Industry Players Focusing on Streamlining their Business Processes to Propel Market Growth

Based on end-user, the market is subdivided into healthcare, automotive, BFSI, chemical, manufacturing, energy and utilities, and others (transportation, logistics, and others).

During the forecast period, the healthcare industry is anticipated to grow with the largest CAGR during the forecast period. This is due to the medical futurist claims that quantum computing can aid the formation of virtual environments in which specialists can examine variables, such as skin temperature, electrolytes, circulation, body fluids, and metabolism, on digital human replicas. This is one reason why the market is gaining traction in the healthcare industry. The healthcare sector is particularly interested in quantum-enhanced machine learning methods.

The BFSI industry is likely to hold the highest quantum computing market share of 26% in 2025. This is due to the increasing usage of computing services deployed in BFSI industry to resolve complex financial calculations with faster speed and to address the security challenges posed by super-powerful quantum computers.

The retail segment is projected to exhibit a CAGR of 36.5% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Based on region, the global market has been studied across five regions, North America, Asia Pacific, Europe, the Middle East & Africa, and South America.

North America Quantum Computing Market Size, 2023 (USD Million) To get more information on the regional analysis of this market, Download Free sample

Due to the early adoption of advanced technologies and a highly competitive market, the North America market held the largest market share of 507.5 million in 2024 and has experienced high expansion during the forecast period from 2024 to 2032. The North American market's expansion has been positively impacted by end-users' readiness to develop advanced services and the countries' readiness to adopt cloud computing. The U.S. market size is estimated to be USD 386.1 million in 2025. The region is likely to be the second-largest CAGR of 35.2% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

Europe is estimated to grow with the third highest CAGR as the region has an increasing number of startups operating in the field of quantum technology. The region is also expected to be the second-largest market with a value of USD 500.9 million in 2025. For instance, in January 2023, Paris–based quantum computer startup, PASQAL raised EUR 100 million (USD 109 million) to deliver commercial advantages over classical computers in Europe. Further, a growing number of digital government regulatory environments and initiatives to bring development across European industries using cloud and quantum technology are anticipated to drive market growth and technological advancements in the region during the forecast period. Owing to these reasons, the regional market is projected to exhibit healthy growth in the next few years. The market size in U.K. is expected to hit USD 93.1 million in 2025 while Germany’s market is likely to reach USD 75.2 million and France is poised to hit USD 72.4 million in 2025.

Asia Pacific is expected to be the third-largest market with a size of USD 290.9 million in 2025. Healthcare, chemicals, and banking and finance are major industries in Asia Pacific. South Korea, China, and Japan are the regions' producers of electronic goods such as gaming consoles, mobile phones, and laptops. Simulation, machine learning, and optimization applications must be addressed across these industries. The rapid expansion of Asia Pacific's expanding economies and the increased use of new technologies in the industrial sector are providing opportunities for the region's medium-sized and large businesses. The market in China is likely to hit USD 82.9 million in 2025. The market in Japan is expected to reach USD 54.8 million and India is poised for a growth of USD 55.8 billion in 2025.

Quantum services and systems are in high demand in Asia Pacific, which has a positive impact on the market's expansion. Hence, it is anticipated to grow with the highest CAGR during the forecast period i.e. from 2024 to 2032.

Growing investments in quantum computing technology to bring development across different sectors such as energy, life sciences, and finance across the Middle East & Africa and South America regions helps to drive the product demand during the forecast period. For instance, In February 2022, Saudi Arabia committed USD 6.4 billion investment in advanced technology to boost the demand of quantum computing to emphasize the R&D and technological advancements. The Middle East & Africa is likely to hold USD 51.9 million in 2025. The GCC market size is estimated to hit 21.2 million in 2025.

List of Key Companies in Quantum Computing Market

Market Value to Rise Due to Growing Emphasis on Partnerships and Acquisitions by Key Players

The leading players in the market are focusing on collaborations, partnerships, product innovation, and expansion of the market presence globally. The key players in the market include IBM Corporation, Microsoft Corporation, Intel Corporation, D-Wave Systems, QC Ware, Google LLC, and others developing innovative quantum solutions.

LIST OF KEY COMPANIES PROFILED:

· IBM Corporation (U.S.)

· D-Wave Systems Inc. (Canada)

· Microsoft Corporation (U.S.)

· Intel Corporation (U.S.)

· Rigetti & Co, Inc. (U.S.)

· Google LLC (U.S.)

· QC Ware (U.S.)

· Quantinuum Ltd. (U.S.)

· Riverlane (U.K.)

· IonQ (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2023: Terra Quantum, a quantum service provider, collaborated with NVIDIA to develop quantum-accelerated applications. The deal would help bridge the gap between classical and quantum computing, leveraging hybrid algorithms.

- October 2023: Fujitsu partnered with RIKEN and developed AI drug discovery technology. This launch of AI drug discovery technology combines the computing power of the newly developed 64 qubit superconducting quantum computer to deliver a new platform to businesses and research institutions.

- September 2023: Xanadu, partnered with Electronics and Telecommunications Research Institute (ETRI) to bring advancement in computing technologies using machine learning and artificial intelligence (AI) technologies.

- November 2022: IBM entered a collaboration with Vodafone on quantum-safe cybersecurity by joining the IBM Quantum Network. This collaboration would help validate and progress potential quantum use cases in telecommunications.

- March 2022: Quix Quantum unveiled new quantum photonic processor. It was developed at QuiX’ facility, in the Netherlands. It performs nearly two times better than current processors. This processor has a record number of qumodes (20) and the highest operating specifications.

REPORT COVERAGE

The research report provides a comprehensive analysis of the market. It focuses on key aspects such as prominent companies and leading applications of the product. Besides this, the report highlights key industry developments and offers insights into the market trends. In addition to the above-mentioned factors, the report includes several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019–2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2032 |

|

Historical Period |

2019–2022 |

|

Growth Rate |

CAGR of 34.8% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Component

By Deployment

By Application

By End-user

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 885.4 million in 2023.

Fortune Business Insights says that the market is expected to reach USD 12,620.7 million by 2032.

The market is anticipated to exhibit a CAGR of 34.8% during the forecast period (2024-2032).

By component, the software segment is expected to grow at the highest CAGR during the forecast period.

Growing investments in quantum computing technology by government bodies is a key driver of the market.

IBM Corporation, Google LLC, Intel Corporation, D-Wave Systems Inc., Rigetti & Co, Inc., IonQ, XANADU, Microsoft Corporation, and Pasqal are the top companies in the global market.

By end-user, the Healthcare sector is expected to grow with highest CAGR during the forecast period.

North America market size stood at USD 388.3 million in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us