Ready-Mix Concrete Market Size, Share & Industry Analysis, By Type (Transit Mix, Central Mix, and Shrink Mix), By Application (Residential, Commercial, and Infrastructure), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

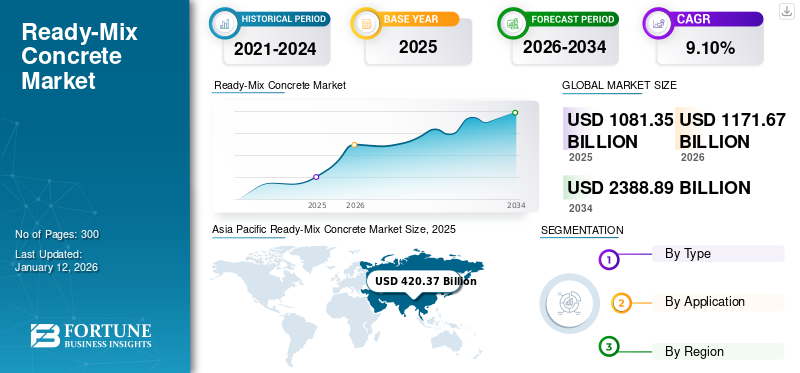

The global ready-mix concrete market size was USD 1,081.35 billion in 2025. The market is projected to grow from USD 1171.67 billion in 2026 to USD 2388.89 billion by 2034 at a CAGR of 9.10% during the forecast period. Asia Pacific dominated the ready-mix concrete market with a market share of 36% in 2025. Moreover, the ready-mix concrete market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 475.30 billion by 2032.

Ready-mix concrete (RMC) is a material deployed in construction. It is composed of cement (cement paste) and fine aggregates such as sand and coarse aggregates mixed along with water that cures with time. Aggregate consists of big chunks of material in a concrete mix that includes coarse gravel or crushed rocks, such as limestone or granite, with finer material, such as sand. Various types of cement are used in making concrete including hydraulic cement or Portland cement. The rising consumption of products for faster and easier construction processes is supporting market growth.

Moreover, additives such as superplasticizers or pozzolans are included in the mixture to improve the properties of the wet mix or the finished material. Most concrete is usually poured along with reinforcing materials such as rebar rooted to provide tensile strength and yield strengthened concrete. Concrete is frequently used in building materials, and its usage worldwide is greater than that of wood, steel, plastics, and aluminum altogether, thus improving the market size for RMC.

Admixtures are also added to enhance the properties of the concrete material. Mineral-based admixtures are used as a concrete ingredient for recycled products. Conspicuous materials include fly ash, a by-product generated from coal-fired power plants, and silica fume, a by-product of industrial electric arc furnaces. The growing construction industry is expected to support the market growth.

However, the outbreak of the COVID-19 pandemic caused a temporary stoppage in activities across various industries, including construction. Implementation of global lockdown and social distancing led to travel restrictions for laborers and workers, and hence, companies had to postpone their project plans. This factor negatively affected the market. However, the market recovered after the normalization of construction activities. The increase in construction projects is poised to boost the consumption of ready-mix concrete.

GLOBAL READY-MIX CONCRETE MARKET OVERVIEW

Market Size & Forecast:

- 2025 Market Size: USD 1,081.35 billion

- 2026 Market Size: USD 1171.67billion

- 2034 Forecast Market Size: USD 2388.89 billion

- CAGR: 9.10% from 2026–2034

Market Share:

- Asia Pacific led the market in 2025 with a 36% share, growing from USD 385.02 billion in 2025 to USD 420.37 billion in 2026.

- By type, transit mix dominated due to flexibility, reduced segregation risk, and suitability for urban infrastructure.

- By application, the commercial segment held the largest share, driven by rapid urbanization and prefabricated construction demand.

- The infrastructure segment is projected to hold 26.5% of the market in 2024.

- In China, infrastructure applications alone are expected to account for 27.3% of the market in 2024.

Key Country Highlights:

- China: Leading global producer, driven by large-scale construction demand and infrastructure projects.

- United States: Expected to reach USD 475.30 billion by 2032, fueled by housing demand and favorable construction policies.

- India: Strong growth due to rapid urbanization, population rise, and government-backed housing initiatives.

- Japan & South Korea: Increasing use in infrastructure and commercial buildings due to limited land and high efficiency needs.

- Middle East & Africa: Growth led by urban infrastructure programs and raw material availability, especially in the UAE and Saudi Arabia.

Ready-Mix Concrete Market Trends

Product Adoption in Green Constructions for Sustainable Development to Propel Market Growth

Ready-mix concrete (RMC) is a major product used in the construction industry. RMC manufacturers are making significant efforts to reduce greenhouse gas (GHG) emissions by increasing the percentage of additives such as fly ash/slag. This initiative is undertaken to reduce ordinary Portland cement consumption and improve the energy efficiency of the process. The adoption of the concept of green construction to help with the aforementioned effects has led to increased demand for eco-friendly products.

- Asia Pacific witnessed a ready mix concrete market growth from USD 324.82 billion in 2023 to USD 353.64 billion in 2024.

Green construction uses the resources of water and energy efficiently, reduces negative impacts, and creates positive impacts on the climate and the natural environment. This has caused producers to develop and invest in green ready-mix concrete. The construction activities of green buildings involve planning and design with the foremost considerations such as energy and water use, environmental quality, and material selection, among many others. The slow depletion of non-renewable resources and growing expensiveness have caused green construction to become a highly adaptable concept for the construction industry.

Download Free sample to learn more about this report.

Ready-Mix Concrete Market Growth Factors

Increasing Demand for Residential Structures from the Construction Industry to Drive Growth

The expanding construction industry is supporting market growth. Income growth in developed and developing countries has accelerated the construction of buildings and housing structures that would lead to the high consumption of concrete. The construction industry is observing tremendous and unparalleled changes due to economic growth and is gradually shifting toward ready-mix concrete for easy and quick use. India, Japan, China, and other Asian countries are the major drivers for market growth. The rising population in these regions is mainly affecting the concrete market positively, owing to the high demand for residential structures.

Moreover, an increasing shift of industrialization from the western regions to the Asia Pacific is directly supporting the growth of the construction industry, which, in turn, is set to result in the growth of the RMC market. Urbanization has also led to the development of infrastructure facilities which is a major factor behind the ready-mix concrete market growth.

Labor Benefits and High Private Investments is Driving Market Growth

The growing investments from the private sector and help from governmental organizations have led to a rise in construction opportunities. These include the construction of bridges, railroads, highways, urban infrastructure, power generation sector, real estate, commercial buildings, and others. The speedy development of all the above-mentioned structures is leading to a high demand for ready-mix concrete. This is also supported by the high-end investments in urbanization from developing countries such as China, India, Mexico, and South Korea from both the government and private sectors.

This further causes exponential growth in the market. Coupled with these, high labor benefits such as reduced labor costs, the provision of proper equipment, and health benefits are impacting the construction industry positively, thereby leading to high growth. This growth in the construction industry supports market growth.

RESTRAINING FACTORS

High Product Cost due to Large Initial Investments May Hinder the Market Growth

Ready-mix concrete has a high cost owing to the large initial investment made to set up a plant. Companies have to meet the regulatory mandates for emission control, which results in added costs. This causes hindrance to the new entrants in the market. Furthermore, this product requires space or area to mix the material on-site as it takes only 90 minutes to settle or gain shape. The limited space available near the construction site can increase the company’s cost for transportation of the mixture from the nearby location. All these factors will add to the product cost. Therefore, the high product cost is expected to hinder the market growth.

Ready-Mix Concrete Market Segmentation Analysis

By Type Analysis

Transit Mix Segment Dominated Owing to Its Flexibility

Based on type, the ready-mix concrete market is segmented into transit mix, central mix, and shrink mix.

In the overall market, the transit mix segment accounted for the largest ready-mix concrete market share 45.40% in 2026 and is anticipated to hold the dominating position throughout the forecast period. Transit-mix concrete is also called dry-batched is distinguished by the mixing of concrete in transit to construction sites. This method offers convenience, flexibility, and heightened control over concrete quality. The reduced risk of segregation, along with time-saving efficiency, led transit-mixed concrete to experience substantial demand, fueled by the expansion of the construction industry and infrastructure development. This demand is particularly pronounced in urban areas, where extensive projects necessitate a consistent flow of concrete for swift and dependable delivery.

On the other hand, shrink-mixed concrete is expected to grow significantly during the forecast timeframe. It is utilized to retain the advantages of transit-mixed concrete and surge the truck's load capacity.

Furthermore, the growing construction of residential and commercial buildings along with rapid infrastructure development, are expected to increase the demand for central mixed concrete. The segment holds the significant market share in the global market. This concrete is also called central batching plant concrete and is mixed carefully before being loaded into a truck mixer. Throughout transit, the truck’s mixing drum works as an agitator.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Commercial Segment Led Backed by Surging Urbanization

Based on application, the market is classified into residential, commercial, and infrastructure.

The commercial segment is the largest application with share of 40.67 % in 2026 . The growth is primarily driven by several factors. The increasing urbanization and rapid industrialization have led to a surge in construction activities, particularly in commercial buildings, shopping malls, and office spaces. Further, RMC offers several advantages over traditional on-site concrete mixing, including improved quality control, consistency, and efficiency. Moreover, the growing preference for prefabricated construction methods, which often rely heavily on RMC, has further boosted its demand. Additionally, the increasing focus on sustainable construction practices has led to the development of environmentally friendly RMC products, such as those incorporating recycled materials or using energy-efficient production processes. As a result, such factors have contributed to a significant rise in the consumption of RMC in the commercial sector, and is expected to making it a vital component of modern construction projects.

The residential segment is set to grow steadily during the forecast period due to the increased demand for the housing sector in the Asia Pacific owing to the growing population. This demand is also supported by the increasing disposable income levels of people in countries such as China and India.

The infrastructure segment is also expected to show the fastest growth in the RMC market during the forecast period due to rapid urbanization, which has led to the development of roads and highways, power construction, water systems, and others. Government schemes and investments in the construction of the above-mentioned structures are positively affecting segment growth. An increase in the construction of attractive manufacturing plants within developing economies such as India is also expected to lead to substantial segment growth. The infrastructure segment is expected to hold a 26.5% share in 2024.

REGIONAL INSIGHTS

The market is divided by region into Europe, the Asia Pacific, North America, the Middle East and Africa, and Latin America.

Asia Pacific

Asia Pacific Ready-Mix Concrete Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific market accounted for a value of USD 420.37 billion in 2026. The region is the largest and is expected to show substantial growth during the forecast period owing to the large-scale demand from developing economies such as China, India, and South Korea. Moreover, China is the major producer of concrete owing to the availability of raw materials and high demand for the product from the growing population. High infrastructural development and the construction of new manufacturing plants in developing nations are expected to drive the growth of the market further. The Japan market is projected to reach USD 52.21 billion by 2026, the China market is projected to reach USD 150.15 billion by 2026, and the India market is projected to reach USD 108.58 billion by 2026.

- In China, the infrastructure segment is estimated to hold a 27.3% market share in 2024.

North America

To know how our report can help streamline your business, Speak to Analyst

The market in North America is expected to grow during the forecast period with USD 345.56 Billion In 2026 . This growth can be attributed to the rising demand for residential and commercial sectors in the region. The demand for single housing units, along with the strong and sustainable economy, is propelling the market growth. Furthermore, favorable governmental regulations over construction policies and schemes are boosting the market's growth considerably in this region.

Europe

Europe's market is anticipated to show moderately high with USD 216.12 billion in 2026 during the forecast period. This growth can be associated with the high demand for residential structures along with the growing industrialization in the region. Government projects on infrastructure development are also significantly supporting the market growth in this region. The UK market is projected to reach USD 41.62 billion by 2026, while the Germany market is projected to reach USD 53.83 billion by 2026.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are expected to be the key markets as the product is in its key stage. Growing infrastructure in countries such as the U.A.E. and Saudi Arabia is supporting the market growth in the Middle East. Favorable governmental regulations in Saudi Arabia have included a program for infrastructure development, which, in turn, supports market growth in this region. Moreover, the easy availability of raw materials is expected to further show more attractive growth during the forecast period in the region. The U.S. market is projected to reach USD 277.97 billion by 2026.

Key Industry Players

Key Players are Forming Growth Strategies to Maintain Their Dominance in Market

The global market is competitive with key players operating, such as CEMEX S.A.B. de C.V., M. I. Cement Factory Limited, ACC Ltd., and UltraTech Cement Ltd. The key market players have used numerous strategies such as mergers, acquisitions, investment & divestment, partnership, and hiring suppliers and distributors for the growth of the market.

Furthermore, large, medium, and small-scale companies are offering highly enhanced product portfolios which include the addition of additives and admixtures for fast curing time. This trend is expected to have a positive impact on the global market over the forecast period.

List of Top Ready-Mix Concrete Companies:

- CEMEX S.A.B. de C.V.(Mexico)

- M. I. Cement Factory Limited. (Bangladesh)

- ACC Ltd.(India)

- UltraTech Cement Ltd. (India)

- LafargeHolcim (Switzerland)

- Buzzi Unicem SpA (Italy)

- R. W. Sidley, Inc. (U.S.)

- HEIDELBERGCEMENT AG (Germany)

- Italcementi Group (Italy)

- Hanson Cement Ltd. (U.K.)

- U.S. Concrete (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- March 2024– Shree Cement introduced Bangur Concrete and in Hyderabad commissioning its first Greenfield Ready Mix Concrete (RMC) plant. The plant has a production capacity of 90 cubic meters per hour. This initiative will help the company to expand its cement business.

- May 2023– Nuvoco Vistas Corp. Ltd. introduced its new Ready-Mix Concrete (RMX) plant in Vizag, Andhra Pradesh with a production capacity of 60 cubic meters per hour. With this launch, the company will provide a reliable source of highquality concrete while also reducing costs, improving efficiency, and promoting sustainability.

- May 2023– UltraTech announced the development of its in-house technology that collects all the remaining concrete from the construction sites and makes them into slurry for recycling in ready-mix concrete. The plant technology is automated and does not dispose of any solid or water waste, thus it is fully environmentally friendly.

- April 2023– Hanson Group supplied ready-mix concrete to meet the challenges of the COVID-19 pandemic in Swansea. The factory is temporarily being formed as an NHS field hospital for the treatment and care of the patients affected by the novel coronavirus.

- April 2023–Ambuja Cement and ACC limited, the leaders in cement manufacturing, collaborated to collectively support those who are impacted by the Covid-19. The companies together will be contributing the amount of Rs. 3.30 crore to three different NGOs that are providing support to the migrant workers and daily wagers.

REPORT COVERAGE

The research report provides a detailed analysis of the global market and focuses on key aspects such as prominent companies, products, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (Million Ton) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market worth was USD 1171.67 billion in 2026 and is projected to reach USD 2388.89 billion by 2034.

In 2025, the Asia Pacific market size stood at USD 1081.35 billion.

Growing at a CAGR of 9.10%, the market is expected to exhibit steady growth during the forecast period.

The commercial segment is expected to be the leading material.

The rising construction industry in developing countries is expected to drive market growth.

CEMEX S.A.B. de C.V., M. I. Cement Factory Limited., ACC Ltd., and UltraTech Cement Ltd. are the top players in the market.

The Asia Pacific dominated the global market in 2025.

Growing demand for residential structures is the key factor driving the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us