RF Front End Integrated Circuits Market Size, Share & Industry Analysis, By Type (Power Amplifier, RF Filter, RF Switch, Low Noise Amplifier, and Others), By Application (Consumer Electronics, Automotive Systems, Wireless Networks, Military, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

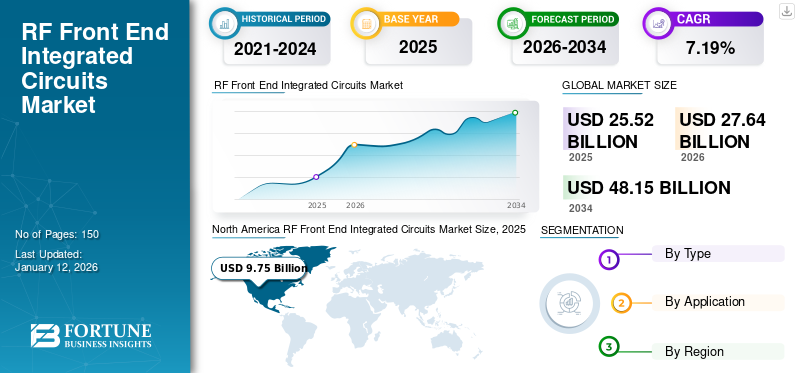

The global RF front end integrated circuits market size was valued at USD 25.52 billion in 2025. The market is projected to grow from USD 27.64 billion in 2026 to USD 48.15 billion by 2034, exhibiting a CAGR of 7.19% during the forecast period. North America dominated the global market with a share of 38.22% in 2025.

RF front end integrated circuits are electronic components specially designed to process Radio Frequency (RF) signals in wireless communication systems' input and output stages. An RF integrated circuit typically consists of basic functional circuits, such as filters, mixers, low-noise amplifiers, frequency synthesizers, switches, power amplifiers, oscillators, and others.

In addition, RFICs combine many functions, such as amplification, filtering, mixing, and modulation/demodulation, into a single chip. This integration enables compact, efficient, and robust wireless communication. They form the fundamentals of wireless technologies, including bluetooth, Wi-Fi, cellular networks, and satellite communications, and support the functionality of smartphones, laptops, and tablets. For instance,

- May 2024: Murata Manufacturing Co., Ltd. announced that it has been licensed by Michelin to integrate state-of-the-art Radio Frequency Identification (RFID) tires into automotive tires, helping to advance tire management, durability, safety, and ultimate traceability during transport and beyond the automotive industry.

The COVID-19 pandemic significantly affected the market. Many manufacturing facilities, especially in regions are heavily affected by the pandemic, faced temporary closures or operated at reduced capacity. This led to delays in production and shipment of RFFE ICs. However, global lockdowns and restrictions on movement disrupted the logistics and transportation networks, causing delays in the delivery of raw materials and finished products.

IMPACT OF GENERATIVE AI

Rising Adoption of Generative AI in RF Integrated Circuits (ICs) to Drive Market Growth

Generative AI stands at the forefront of revolutionizing RF front end integrated circuits design, profoundly impacting algorithm development through Large Language Models (LLMs). In algorithm development, generative AI’s capacity to develop novel approaches significantly enhances the creation of advanced chip design algorithms. This innovation also leads to the formulation of more efficient algorithms, bolstering RF front end integrated chip design performance and expanding their capabilities. For instance,

- In November 2023, Synopsis launched Synopsys.ai Copilot to strengthen design teams to achieve high-level productivity with its generative AI capability for chip designs.

RF Front End Integrated Circuits Market Trends

Advancements in Wireless Technologies in RF Front End ICs to Increase Market Demand

Advancements in wireless technologies are pushing the boundaries of RF front-end IC design in several ways. Technologies such as 5G and Wi-Fi 6 necessitate operation at millimeter-wave frequencies to achieve high data rates. RF front-end ICs are being designed to handle these higher frequencies effectively. With the growing demand for compact and multifunctional devices, there is a strong push to integrate various RF front-end components (filters, amplifiers, mixers) into a single chip. This miniaturization reduces size and improves efficiency.

Furthermore, RFICs are crucial in implementing beamforming and multiple input multiple output technologies essential for 5G networks. These technologies rely on complex RF front-end architectures to manage multiple antenna elements and optimize signal transmission and reception. Hence, this factor is expected to stimulate the global RF front end integrated circuits market growth.

Download Free sample to learn more about this report.

RF Front End Integrated Circuits Market Growth Factors

Proliferation of 5G Networks and Wireless Devices Driving Demand for Advanced RF Front End Integrated Circuits

5G networks enable significantly higher data rates than previous generations, necessitating RFICs to efficiently process and transmit these higher frequency signals. These networks operate across a wider range of frequencies, requiring RF front end integrated circuits to support a broader bandwidth and multiple frequency bands simultaneously. Additionally, 5G advances advanced beamforming and MIMO (Multiple Input Mobile Output) technologies for improved coverage and capacity, requiring sophisticated RFIC designs to manage complex signal processing. RFICs (Radio-Frequency Integrated Circuits) in 5G devices are expected to be more energy-efficient, extending battery life and reducing power consumption, while maintaining high performance. For instance,

- As per a survey conducted, as of 2023, over 175 operators have launched commercial 5G services globally.

RESTRAINING FACTORS

Complex Design and Integration of RF Front End Module to Restrain Market Growth

The production process of these RF modules is relatively complex due to the increase in frequency bands or frequencies, variation in multiplexing methods, smaller board sizes, and others. Therefore, experienced professionals must design these components with extreme precision and accuracy. This lengthens the production process. The demand for smaller and more compact devices, especially smartphones and IoT devices, necessitates highly integrated and miniaturized RF modules. Achieving this without compromising performance is technically challenging and resource-intensive. Modern RF front-end modules need to support multiple frequency bands, which requires a sophisticated design to ensure proper functionality across all bands without interference. This complexity increases design time and cost. Hence, these factors hinder market growth.

RF Front End Integrated Circuits Market Segmentation Analysis

By Type Analysis

Adoption of Low Noise Amplifiers in RF Front End Integrated Circuits to Propel Market Growth

On the basis of type, the market is categorized into power amplifiers, RF filters, RF switches, low noise amplifiers, and others.

The Low Noise Amplifier (LNA) segment dominates the market, capturing the largest market share of 30.39% in 2026, and is expected to continue its dominance during the forecast period. These amplifiers amplify weak RF signals received by the antenna without adding significant noise, making it easier to process these signals in subsequent stages. LNAs help improve the overall Signal-to-Noise Ratio (SNR) by minimizing the noise figure, crucial for clear and reliable signal transmission and reception. Moreover, LNAs enhance the receiver's sensitivity, allowing it to detect weak signals from distant or low-power sources.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Adoption of Consumer Electronics & Wireless Technologies in Integrated Circuits to Boost Market Growth

Based on the application, the market is categorized into consumer electronics, automotive systems, wireless networks, military, and others.

Consumer electronics dominated the market with the maximum global RF front end integrated circuits market share. The Consumer electronics segment is projected to dominate the market with a share of 32.66% in 2026. These advanced ICs offer superior signal amplification and filtering, making clearer and more stable communication. This is crucial for smartphones, tablets, and smart TVs. RF front end ICs support higher frequency bands and wider bandwidths, enabling faster data transmission and better performance for streaming, gaming, and video conferencing applications. Furthermore, these ICs facilitate the adoption of emerging technologies such as 5G, Wi-Fi 6, and IoT, enhancing device capabilities and future-proofing consumer electronics. Hence, this factor contributes to the growth of the market.

Furthermore, wireless networks are expected to grow at the highest CAGR during the forecast period. Integrating multiple RF components into a single IC reduces the size and complexity of wireless network hardware, allowing for more compact and portable devices. Higher integration levels decrease the number of discrete components needed, simplifying the design and manufacturing process and improving overall system reliability. Therefore, these factors drive the market’s growth.

REGIONAL INSIGHTS

On the regional ground, the market analysis is made across North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Furthermore, these regions are classified into countries.

North America RF Front End Integrated Circuits Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America contributed to having the highest market share in 2024. The persistent growth of wireless technologies drives the region’s market demand. Furthermore, the increasing prevalence of electronic gadgets in people's everyday routines, including smartphones, tablets, and smart home devices, is a significant factor driving the region's RF front end integrated circuits market growth. North america dominated the market with a valuation of USD 9.75 billion in 2025 and USD 10.43 billion in 2026. The U.S. market is projected to reach USD 6.48 billion by 2026.

Asia Pacific

Asia Pacific’s RF front-end integrated circuits market is expected to grow rapidly during the forecast period. Due to the increasing presence of major players and integrated circuit manufacturers in India, China, Japan, and South Korea, the region is expected to register the highest CAGR in the market during the forecast period. The use of amplifiers is increasing in various devices, such as smartphones, tablets, and wireless networks. RF components play a role in both increasing and decreasing frequency. The Japan market is projected to reach USD 1.58 billion by 2026, the China market is projected to reach USD 2.33 billion by 2026, and the India market is projected to reach USD 1.11 billion by 2026.

Europe

Europe is projected to exhibit steady growth over the forecast period. The demand for cellular Internet of Things solutions is rising, industrial automation is experiencing rapid transformation, industry players are engaged in aggressive R&D efforts, and similar developments are occurring. Therefore, these factors are driving the European market for RF front end ICs. The UK market is projected to reach USD 0.75 billion by 2026, while the Germany market is projected to reach USD 0.89 billion by 2026.

South America

Similarly, South America is experiencing substantial growth in this market. Countries such as Brazil and Argentina are seeing the rise of semiconductor industries or forming alliances with global semiconductor companies. It is important to grasp the local manufacturing capabilities and supply chain dynamics when seeking RF front end ICs. Moreover, the Middle East & Africa (MEA) market is projected to grow in the impending years due to augmented investment and government funding for digitization.

KEY INDUSTRY PLAYERS

Leading Companies Focus on Acquisitions and Collaborations to Extend Market Reach

Established companies are keen on unveiling customized strategies to offer tailored solutions to certain industries. These organizations are collaborating with regional companies and acquiring domestic firms to cement their market position in the region. Furthermore, several market strategies are developed to constantly increase their global market share. Thus, the mounting requirement for RF front end integrated circuits will create a positive market outlook.

List of Top RF Front End Integrated Circuits Companies

- Analog Devices, Inc (U.S.)

- Microchip Technology Inc. (U.S.)

- Qorvo, Inc. (U.S.)

- Infineon Technologies AG (Germany)

- Broadcom Inc. (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Skyworks Solutions, Inc. (U.S.)

- Murata Manufacturing Co., Ltd. (Japan)

- NXP Semiconductors (Netherlands)

- TDK Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS

- May 2024: Infineon Technologies introduced the PSoC 4 High Voltage Precision Analog (HVPA) 144K microcontroller for the automotive mobile management sector, incorporating high-voltage subsystems and high-precision analog on a particular chip. The deployment enables compact and secure intelligent battery detection and management in modern vehicles.

- May 2024: Murata Manufacturing Co., Ltd. announced that it has been licensed by Michelin to integrate state-of-the-art Radio Frequency Identification (RFID) tires into automotive tires, helping to advance tire management, durability, safety, and ultimate traceability during transport and beyond the automotive industry.

- February 2024: Qorvo, Inc. partnered with an active antenna IC company to strengthen the RF front ends. The acquisition enables users to provide highly integrated end-to-end solutions and System Packages (SiP) for defense, aerospace, and network infrastructure applications.

- January 2024: Qorvo acquired Anokiwave, a high-performance silicon Integrated Circuits (ICs) supplier. The collaboration provides complementary products worldwide and a significant market, creating new opportunities for superior efficiency, effectiveness, and customer integration.

- November 2023: Qualcomm Technologies Inc. announced it will increase the 5G ecosystem by allowing global mobile workers and OEMs to enable new devices, form features, and experiences. The collaboration will advance the 5G ecosystem, aiding an extensive range of high-end and entry-level use cases.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.19% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By Region

|

Frequently Asked Questions

The market is projected to record a valuation of USD 48.15 billion by 2034.

In 2025, the market was valued at USD 25.52 billion.

The market is projected to record a CAGR of 7.19% during the forecast period of 2026-2034.

By application, the consumer electronics sector captured the largest share in 2025.

Proliferation of 5G networks and wireless devices for advanced RF front end integrated circuits across the globe is the key factor driving the market growth.

Analog Devices, Inc, Microchip Technology Inc., Qorvo, Inc., Infineon Technologies AG, Broadcom Inc., Qualcomm Technologies, Inc., Skyworks Solutions, Inc., Murata Manufacturing Co., Ltd., NXP Semiconductors, and TDK Corporation are the top major players in the market.

North America holds the highest market share.

By application, the wireless networks segment is expected to grow at the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us