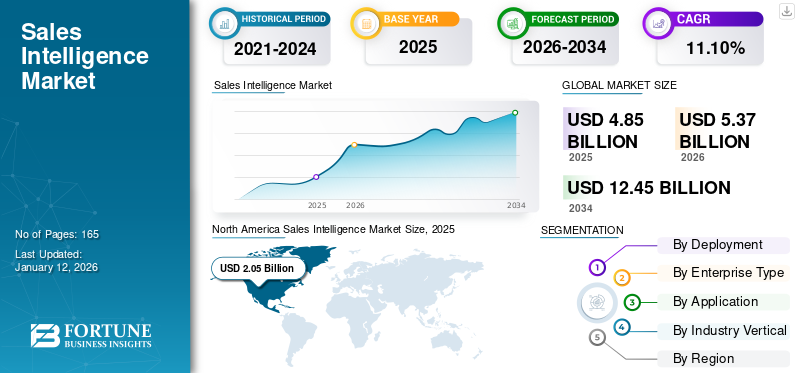

Sales Intelligence Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premises), By Enterprise Type (Small & Mid-sized Enterprises (SMEs) and Large Enterprises), By Application (Lead Management, Data Management, Analytics & Reporting, and Others), By Industry Vertical (BFSI, IT and Telecom, Healthcare and Life Sciences, Retail and E-Commerce, Media and Entertainment, and Others), and Regional Forecast, 2026–2034

Sales Intelligence Market Lates Insights 2026-2034

The global sales intelligence market was valued at USD 4.85 billion in 2025 and is expected to grow from USD 5.37 billion in 2026 to USD 12.45 billion by 2034, with a CAGR of 11.10% over the forecast period. In 2025, North America dominated the global market, accounting for 42.30% market share.

Furthermore, the U.S. sales intelligence market is expected to expand significantly, reaching a value of USD 2,855.0 million by 2032. The growing demand for real-time customer insights and competitive intelligence is propelling the sales intelligence market forward across developed economies.

Sales intelligence is a technology-based tool designed for sales teams in various organizations to gain a better understanding of the market and its potential customers, resulting in revenue growth. It is a part of business intelligence that provides crucial insights from market trends, growth opportunities, competitor trends, and customer behavior. The tool gathers and combines data from both internal and external sources to create meaningful insights that will help derive sales strategies.

The integration of artificial intelligence, machine learning, and big data analytics is changing the capabilities of sales intelligence platforms. These advancements enable automated lead scoring, intent-based targeting, and dynamic forecasting, which improves decision-making accuracy and accelerates revenue generation. As global digital transformation accelerates, organizations are increasing their investment in sales intelligence solutions to strengthen data-driven selling strategies and expand their market presence.

- In February 2023, LinkedIn included the latest intelligence elements in its sales navigator tool. This will help provide more sensible connections to sales representatives that result in optimum sales to the firm as per data insights.

- In December 2023, ZoomInfo, a leader in go-to-market software, data, and sales intelligence, achieved the top ranking among 150 competitors in G2’s Winter 2024 Grid Reports based on market presence and customer satisfaction in approximately 1,000 categories.

The COVID-19 pandemic brought several disruptions to businesses in every industry across the globe. As organizations recover, grow, and transform in the post-pandemic era, they are required to revisit their sales processes and build intelligence frameworks simultaneously. With the proliferation of the virtual and digital era, there is a fast flow of information and data sharing on both buyers' and sellers’ sides. This shift has reinforced the importance of intelligent automation in sales operations. Companies are leveraging advanced sales intelligence tools to navigate hybrid selling environments, manage remote sales teams, and personalize buyer engagement through digital channels. These trends are expected to sustain the upward trajectory of the sales intelligence market size over the next decade.

According to a survey conducted by prominent research firms, sellers can increase their profitability by 26% by adopting important techniques. This can be achieved by developing an in-depth understanding of the changing strategic focus of the target audience of various industries.

IMPACT OF AI

AI-Driven Sales Intelligence Tools Providing Guidance to Sales Professionals

With the introduction of Artificial Intelligence (AI) in the sales department, it is changing drastically year by year by overcoming unique challenges in the experience economy. According to the FeaturedCustomers Spring 2023 Customer Success Report, AI sales assistance software’s automating processes are helping sales agents perform various tasks using AI that include data entry, lead follow-up, meeting scheduling, pipeline management, and others.

The growing integration of AI within the sales intelligence market is enabling companies to achieve data-driven sales acceleration through automation and predictive analytics. AI-powered tools are transforming traditional sales functions by identifying high-value leads, optimizing customer engagement, and enhancing conversion rates. This continuous technological evolution is a major factor contributing to the overall expansion of the sales intelligence market size, as enterprises seek scalable, intelligent systems to improve sales efficiency and decision-making precision.

AI enhances sales intelligence by edging data analysis techniques and advanced algorithms to extract crucial insights from massive amounts of data. There are ample methods to enhance sales intelligence using AI, such as sales forecasting and predictive analytics, data analysis and pattern recognition, lead scoring and prioritization, personalized sales recommendations, sales process automation, sales pipeline visualization and forecasting, and sales performance analytics.

For instance, Oracle Corporation is providing ‘Oracle AI Apps’ for sales, which incorporate AI and ML, resulting in increased and accelerated sales for salespeople. These apps deal with lead score prediction, action recommendation for opportunities, and predict opportunity win probability.

Sales Intelligence Market Trends

Evolving Data-driven Trends to Expand Sales Intelligence Market Growth

Continuous evolution driven by emerging technologies is the future of this market. Advancements in Blockchain, promising heightened security, Internet of Things (IoT), expanded capabilities, and real-time insights are the trending factors of the market.

Moreover, the sales intelligence market is witnessing a surge in demand for cloud-based platforms that support advanced data visualization and omnichannel analytics. Businesses are increasingly adopting AI-integrated sales tools to unify customer data, track engagement across digital touchpoints, and enable hyper-personalized outreach. This shift toward intelligent automation is expected to drive sustained growth and further strengthen the competitive positioning of leading sales intelligence vendors.

Integration of Customer Relationship Management (CRM) with sales intelligence can be a strategic step to improve an organization’s sales strategies and results significantly. According to studies, more than 78% of sales professionals consider CRM as a code to enhance sales and marketing. This integration requires adjacent collaboration with CRM providers to deliver flawless data movement between the systems.

Artificial Intelligence (AI) and Machine Learning (ML) have made remarkable advancements in the past few years. AI, powered by complex algorithms, analyzes extensive datasets and provides valuable insights required for decision-making. According to HubSpot, 79% of salespeople using AI said it allows them to spend more time selling, 72% of sales professionals using AI said it helps them build reports faster, and 85% of sales representatives using this technology said it makes their prospecting efforts more effective.

- In February 2023, ZoomInfo, a leader in go-to-market software, data, and sales intelligence, announced that it would integrate GPT technology into its platform. This will help the sales and marketing teams connect with their customers better, reduce time, and deliver results more efficiently.

Download Free sample to learn more about this report.

Sales Intelligence Market Growth Factors

Rising Demand for Sales and Marketing Intelligence to Boost Market Growth

Nowadays, for B2B businesses to grow, it is crucial to generate meaningful data insights in markets for target customers. According to DiscoverOrg studies, only 1.2% of companies have achieved B2B sales and marketing intelligence maturity in the corporate space. Furthermore, approximately 8% of marketing representatives reveal that their sales and marketing data is 91%-100% accurate. However, leading companies with high-quality and quantity leads show 35% more leads in the pipeline and 45% high-quality leads, which results in higher revenue growth.

The sales intelligence market growth is further fueled by the increasing need for real-time, data-driven decision-making and the adoption of predictive analytics solutions. Enterprises are focusing on integrating cross-channel customer data to optimize marketing expenditure and improve sales efficiency. In addition, the rise of subscription-based software models and the growing accessibility of AI-driven analytics are expected to expand the sales intelligence market size across SMEs and large enterprises alike.

- In May 2022, Haptik, a Conversational AI company offering chatbot solutions, announced its strategic partnership with Zoho Sales IQ, an India-based smart software provider. With this partnership, Haptik’s virtual assistant will engage with various messaging channels, such as Facebook, WhatsApp, Telegram, and Instagram, for businesses that use Zoho SalesIQ.

- In July 2022, Oracle Fusion Sales, a sales automation application for sellers, upgraded its next-generation CRM with AI-powered Fusion Sales and Oracle Fusion Cloud Customer Experience (CX). This will help businesses build brand loyalty and improve customer experience.

RESTRAINING FACTORS

Complexity in Maintaining Data Integrity for Sales Intelligence May Hinder Market Growth

Data integrity is a critical aspect of data management that provides data consistency and reliability for the given market. In the current digital era, data is an important factor in business operations to design crucial strategies, and businesses, such as data security, data quality assurance, data governance, and regulatory compliance, face a few challenges. Moreover, companies handling critical data face challenges, such as the amount of transformation that data must go through to reach the representatives.

The growth of the sales intelligence market is often restrained by inconsistent data standards, privacy regulations, and the lack of unified frameworks for data validation. As datasets expand across multiple channels, maintaining accuracy, eliminating duplication, and ensuring compliance with laws such as GDPR and CCPA become increasingly complex. Vendors are addressing these limitations through the development of AI-powered data cleansing and governance tools, yet adoption remains gradual, particularly among small and mid-sized enterprises due to high implementation costs.

Furthermore, Small and Medium Businesses (SMBs) face challenges when deploying cloud-based deployment models or shifting from on-premise to cloud models. SMBs reveal that these processes are most time-consuming and costlier, which might hamper the capacity to meet customer requirements and gain future clients. Also, at present, there is less awareness about data integrity in developing and underdeveloped regions and in certain industries that are in the growing stage.

Sales Intelligence Market Segmentation Analysis

By Deployment Analysis

Growing Adoption of Automation and AI Boosted Demand for Cloud Deployment Model

Based on deployment, the market is bifurcated into cloud and on-premises.

The cloud segment accounted for the highest market share of 65.39% in 2026 and is expected to grow at a faster CAGR during the forecast period. In recent years, the market has become crucial for organizations to understand the large volumes of data they generate. A major trend in this market is the growing usage of AI, automation, and data management. Also, emerging technologies, such as Internet of Things (IoT) and Blockchain promise more security, real-time insights, and expanded capabilities for the market.

Cloud-based models provide seamless integration with CRM and ERP systems, enabling real-time access to sales data and analytics across distributed teams. This flexibility allows organizations to enhance operational efficiency, reduce IT overheads, and scale their operations dynamically, thereby significantly contributing to the overall growth of the sales intelligence market size.

- In July 2022, Demandbase, an account-based marketing, advertising, sales intelligence, and data company, announced the first-ever unified sales intelligence and account engagement platform. The platform is able to integrate with CRM directly and built to provide Account Intelligence in a single view.

The cloud-based deployment segment accounted for the highest market share in 2022. The flexibility and scalability of cloud-based deployment models make them the ideal choice for marketers. A multi-cloud deployment model acts as a robust foundation for market operations owing to its in-built elasticity and accessibility to low-cost storage.

Moreover, enterprises are increasingly adopting AI-driven cloud analytics platforms to gain predictive insights into buyer intent and market opportunities. This trend, coupled with the growing demand for remote collaboration tools and secure cloud data environments, is expected to further strengthen the dominance of the cloud deployment segment in the sales intelligence market over the forecast period.

By Enterprise Type Analysis

Multiple Marketing and Sales Solutions Adopted by Large Enterprises Boost the Overall Sales of the Market

Based on enterprise type, the market is segmented into Small and Mid-sized Enterprises (SMEs) and large enterprises.

The large enterprise segment accounted for the highest market share of 58.31% in 2026. The use of sales intelligence tools among SMEs is predicted to record the highest CAGR during the analysis period. Also, various open-source sales intelligence tools are available and easily accessible for SMEs, which will contribute toward the growth of their market share.

The growing affordability of cloud-based solutions and integration of AI-driven insights are encouraging SMEs to deploy sales intelligence tools for lead enrichment, customer segmentation, and market analysis. These factors are expected to contribute significantly to the overall expansion of the sales intelligence market size during the forecast period.

- In December 2023, HubSpot, Inc., a customer platform provider for scaling businesses, announced that it had completed the acquisition of Clearbit, a B2B data provider. Clearbit will now be a wholly owned subsidiary of HubSpot and will integrate its customer platform in the future.

The large enterprise segment held the highest market share in 2022. As these enterprises need to deal with greater volumes of data, the adoption of sales intelligence solutions among them is higher. These solutions offer large enterprises in-depth analysis and corrections in various sales and marketing models. Also, they help optimize production development with democratization and better decision-making on a larger scale.

Moreover, large enterprises are increasingly integrating sales intelligence tools with enterprise resource planning (ERP) and customer relationship management (CRM) systems to create a unified data ecosystem. This integration allows for improved forecasting accuracy, enhanced client engagement, and strategic allocation of marketing budgets, thereby strengthening their market presence and driving the growth of the global sales intelligence market.

By Application Analysis

Lead Management Segment Lead Market Share in 2023, Accelerates with AI and ML Adoption

Based on application, the market is segmented into lead management, data management, analytics & reporting, and others (messaging and alerting).

The lead management segment accounted for the highest market share of 37.63% in 2026 and is expected to record a faster CAGR during the forecast period. The major reason behind the segment’s growth is the quick adoption of AI and ML applications in this market, foreseeing future trends, and lead scoring, which is the process of ranking leads based on the likelihood of their conversion. This will help marketing and sales teams focus their efforts on great potential opportunities and refine their strategies.

Lead generation software helps market players generate and nurture key leads by saving time and valuable resources. According to studies, the lead management application has created around 20% more sales opportunities if leads are nurtured properly. Moreover, approximately 65% of B2B players have not established a lead nurturing process.

The data management segment is expected to record the second-highest CAGR of 11% after the lead management segment over the forecast period. In the era of modern data management, metadata management is an advanced tool that provides the latest insights and important perspectives for an organization to operate efficiently. Effectively managing and understanding the data allows organizations to enhance their operations and gain unprecedented insights.

- In July 2023, Data Axle, a data technology and marketing services provider, announced a 5% increase in the number of businesses included in its premium verified business database. This will enhance customers’ access to SMBs with high data accuracy and reliability.

Moreover, the analytics & reporting segment is expected to show competitive growth during the forecast period due to the rapid adoption of sales intelligence and related advanced solutions for improved customer targeting, which will propel the market growth in the future.

By Industry Vertical Analysis

Retail & E-Commerce Industry to Increase Use of Sales Intelligence Tools Owing to Rising Investments in IT

By industry vertical, the market is divided into BFSI (Banking Financial Services and Insurance), IT & telecom, healthcare & life sciences, retail & e-commerce, media & entertainment, and others (real estate).

The retail & e-commerce segment is expected to record a faster CAGR during the forecast period. Retail and e-commerce are fast-paced and dynamic industries that reflect enormous transformations and respond rapidly to changing customer behavior. The rising complexity of customer requirements and behavior makes these industries seamless. Sales intelligence plays a vital role in these developments. For instance,

- In May 2023, Demandbase, an account-based marketing, advertising, sales intelligence, and data company, announced that it would enhance its sales intelligence solutions to simplify the daily work of B2B sales representatives. The enhancement consists of prescriptive dashboards with personalized account and contact recommendations. Also, Demandbase will integrate ‘Outreach,’ a sales execution platform, into its solution that will help sellers find contact accounts and data insights with ease.

Currently, the IT & telecom segment is expected to lead the market, contributing 29.06% globally in 2026, owing to exclusive usage of these tools for various applications throughout the industry. Furthermore, the increasing development of new technologies and the availability of a huge amount of data in the IT sector, coupled with high investments and expansion of telco infrastructure, are expected to boost the segment’s growth in the coming years.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The market's coverage encompasses five distinct regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America

North America Sales Intelligence Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 2.05 billion in 2025 and USD 2.25 billion in 2026. The expansion of the market within can be credited to the early embracement of digitization and transformative technologies. It can also be due to the presence of major players in the market, such as LinkedIn Corporation, Oracle Corporation, Dun & Bradstreet Corporation, and ZoomInfo Technologies LLC. The U.S. market is projected to reach USD 1.67 billion by 2026.

The retail and e-commerce sectors in the region are growing at a rapid CAGR, which is helping to expand the regional market. This expansion is also fueled by a consistent increase in retail e-commerce sales in the United States, which reached USD 1.05 trillion in 2022. This figure is expected to rise to USD 1.7 trillion by 2026, reflecting a 6.2% increase in total retail sales across the country. Furthermore, the sector's growth is fueled by factors such as population growth, the expansion of communication services, and rising smartphone adoption, all of which contribute significantly to the market share in the region.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

India, South Korea, and Japan are actively implementing information-intensive Artificial Intelligence (AI) and Machine Learning (ML) technologies across various sectors, leading to an increased adoption of these tools. According to industry analysts, in 2022, 66% of marketers in the Asia Pacific region increased their investments in first-party data collection, compared to 60% in 2021. Whether it involves enhancing customer engagement, refining predictive analytics, or establishing robust data governance practices, the development and implementation of a well-defined data transformation and data science strategy are deemed essential for achieving long-term success. The Japan market is projected to reach USD 0.27 billion by 2026, the China market is projected to reach USD 0.3 billion by 2026, and the India market is projected to reach USD 0.23 billion by 2026.

Europe

There is a slight increase in the availability of specialized sales and marketing intelligence tools in Europe, resulting in the ample adoption of such solutions. Among various countries across the region, Germany is the largest economy in Europe, with a population that accounts for 19% of the European Union. Germany has been recognized as a stabilizing force within the European Union, consistently achieving higher growth rates compared to other member states. Moreover, due to the GDPR legislation in Europe from now on, it won't be easy to obtain relevant data, which means that it is expected to be different from other regions. The UK market is projected to reach USD 0.26 billion by 2026, while the Germany market is projected to reach USD 0.28 billion by 2026.

Middle East & Africa and South America

Numerous factors, such as the entry of big data, sales, and predictive analytics players, along with the growing implementation of AI/ML technologies across different industries, such as healthcare, banking, and retail in the Middle East & Africa and South America, led to the progress of the market in the region. Moreover, the increasing technological spending and rise in funding for startups involved in artificial intelligence, big data, data analytics, and many more will contribute to the market’s progress in these regions.

Key Industry Players

Strategic Collaborations and Enhancements in Sales Intelligence by Major Players Will Help Them Gain Competitive Edge

Prominent industry participants such as LinkedIn, Oracle, ZoomInfo, D&B, and additional entities are executing diverse business strategies and initiatives. They are broadening the scope of utilized data to augment their tools and technologies, innovate solutions, and enhance their proficiency in technological and analytical offerings through the integration of advanced technologies including Artificial Intelligence (AI), Machine Learning (ML), Natural Language Processing (NLP), and other cutting-edge innovations.

List of Top Sales Intelligence Companies:

- Clearbit (U.S.)

- Demandbase, Inc. (U.S.)

- Dun & Bradstreet Corporation (U.S.)

- Data Axle (U.S.)

- HG Insights (U.S.)

- InsideView (U.S.)

- LinkedIn Corporation (U.S.)

- Oracle Corporation (U.S.)

- ZoomInfo Technologies LLC (U.S.)

- Zoho Corporation (India)

KEY INDUSTRY DEVELOPMENTS:

- November 2023 – Data Axle, a data technology and marketing services provider, was recognized as a leading marketing and sales data provider in a report published by research firm ‘Forrster’ in Q4 2023. The report suggested that Data Axle was trained to solve the challenges of B2B sales and marketing professionals with the latest systems and technologies.

- August 2023 – HG Insights, a company providing data-driven insights for technology, announced the launch of HG Functional Area Intelligence in HG Platform’s layered technology intelligence approach with department data and location.

- June 2023 – Dun & Bradstreet, a business decision data and analytics provider, launched D&B.AI Labs, which will create a transformative hub for its consumers to pursue the co-development of groundbreaking solutions catered to their specific needs. D&B AI Labs is an expert in leveraging AI, Machine Learning (ML), and LLM with advanced analytics.

- May 2023 – Demandbase, an account-based marketing, advertising, sales intelligence and data company, announced major improvements in its ‘Smarter GTM’ sales intelligence solution with the latest functionality to simplify the daily work of B2B sales.

- February 2023 – LinkedIn Corporation launched its latest relationship intelligence tools for B2B marketing and sales professionals to identify the best-suited target audience according to their needs.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and top applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors listed above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.1% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment, Enterprise Type, Application, Industry Vertical, and Region |

|

Segmentation |

By Deployment

By Enterprise Type

By Application

By Industry Vertical

By Region

|

Frequently Asked Questions

The market is projected to reach USD 12.45 billion by 2034.

In 2025, the market was valued at USD 4.85 billion.

The market is projected to grow at a CAGR of 11.1% during the forecast period.

The IT and telecom industry segment is expected to lead the market.

Rise in SMEs investment in self-service analytics to drive market growth.

Microsoft Corporation, Oracle Corporation, IBM Corporation, SAP SE, SAS Institute, Zoho Corporation, Qlik Technologies, Inc., Microstrategy, Inc. are the top players in the market.

North America is expected to hold the highest market share.

By deployment, the cloud is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

- Data Analytics Market

- Advanced Analytics Market

- Analytics-as-a-Service Market

- Predictive Analytics Market

- Edge Computing market

- Business Intelligence (BI) market

- Customer Relationship Management (CRM) Market

- Machine Learning Market

- Data Integration and Integrity Software Market

- Artificial Intelligence Market

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us