Saudi Arabia Oilfield Service Market Size, Share & COVID-19 Impact Analysis, By Type (Equipment Rental, Field Operation, and Analytical Services), By Service (By Geophysical Service, By Drilling Service, Completion & Workover, Production, Processing & Separation), By Application (Onshore, Offshore {Shallow Water, Deep Water, and Ultra-deep Water}) and Forecasts, 2025-2032

Saudi Arabia Oilfield Service Market Size

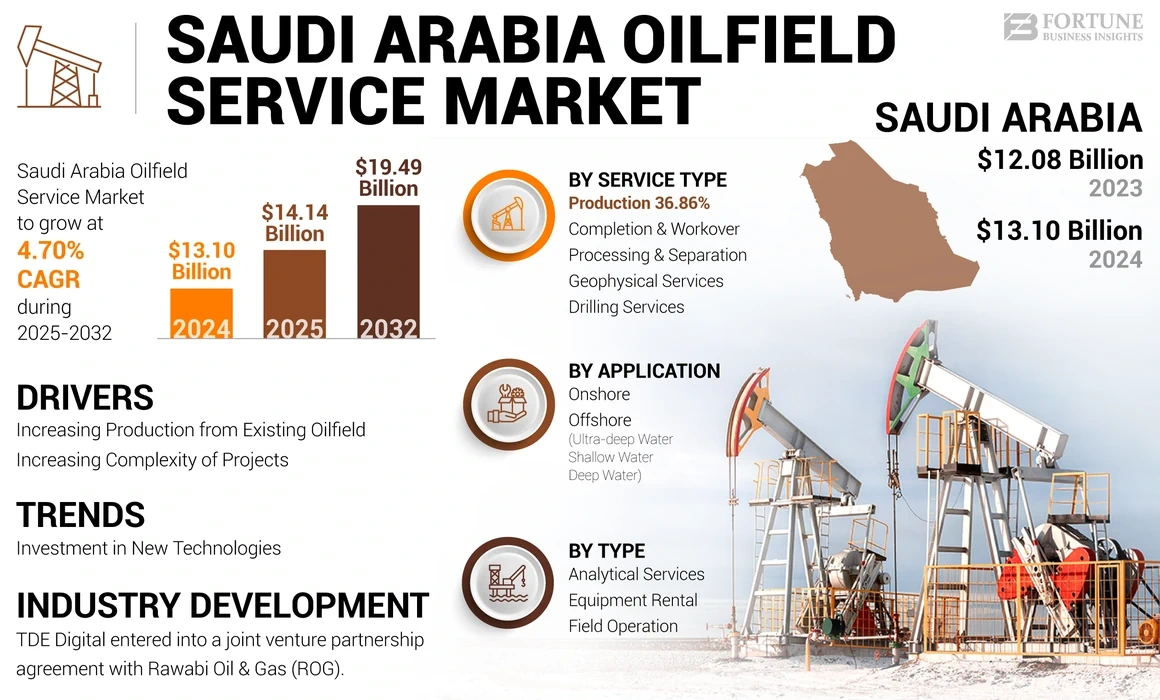

The Saudi Arabia oilfield service (OFS) market size was valued at USD 13.10 billion in 2024. The market is projected to grow from USD 14.14 billion in 2025 to USD 19.49 billion by 2032, exhibiting a CAGR of 4.70% during the forecast period.

Oilfield services refer to a range of specialized activities and equipment used in oil and gas exploration, extraction, and production. These services include drilling, well construction, well logging, seismic surveys, well stimulation, and production capacity optimization, playing a vital role in the efficiency and profitability of oil and gas operations.

COVID-19 IMPACT

COVID-19 Caused a Slowdown in Oil Production and Services

The COVID-19 pandemic had a significant impact on oilfield services in Saudi Arabia. As global oil demand plummeted due to lockdowns and travel restrictions, oil prices experienced a sharp decline. This led to a reduction in investments in oil gas exploration and production activities, resulting in decreased demand for oilfield services. Companies faced project delays, workforce reductions, and financial constraints. However, Saudi Arabia took measures to stabilize the oil market, including production cuts and implementing strict health and safety protocols to ensure the continuity of essential operations.

LATEST TRENDS

Download Free sample to learn more about this report.

Investment in New Technologies to Spur Market Opportunities

The transformation of the oil & gas sector will likely require massive increases in operational flexibility, enabling the opportunity for oilfield services. For instance, in March 2023, Saudi Arabia's upstream continued to invest in cutting-edge technologies and digital transformation programs. Aramco successfully deployed the Ghawar-1 supercomputer for reservoir simulation. The supercomputer is the second fastest in the MENA region after Aramco's Dammam-7. It is expected to increase the number of completed simulation runs, enabling the company to exploit more opportunities from its existing resources.

Moreover, companies operating in the region have been partnering with international oil and gas companies to develop their resources. This presents an opportunity for oilfield services companies that can work with these global partners to provide services. One recent development in this context occurred in August 2022, Saudi Aramco and Sinopec, a leading Chinese Petroleum & Chemical company, signed a Memorandum of Understanding (MoU), which included the potential scope for collaborating across upstream and downstream businesses, engineering, and construction, oilfield services, and others.

DRIVING FACTORS

Focus on Increasing Production from Existing Oilfield Propel Market Growth

The growth of oilfield services in Saudi Arabia is attributed to multiple factors, which include:

- Saudi Arabia is one of the largest oil producers, with many oil and gas fields.

- Saudi Arabia plans to develop its unconventional gas resources requiring specialized oilfield services.

Additionally, the strategic location & proximity to various oil-consuming countries/regions makes it one of the prominent region for the servicing companies to set up their presence & cater to the oilfield services demand. For example, in November 2022, Saudi Aramco signed a total of 59 corporate procurement agreements (CPAs) with almost 51 domestic as well as international oilfield service-related companies.

Increasing Complexity of Projects & Regional Demand to Drives the Market Growth

The oil and gas industry in Saudi Arabia is increasingly focused on unconventional resources, deep water exploration, and complex reservoirs. These projects require specialized expertise and advanced techniques, increasing the demand for oilfield services. The complexity of operations allows service companies to offer innovative solutions and tailored services. Furthermore, the Middle East market has significant demand due to the presence of major oil-producing countries. Saudi Arabia, being a key player in the region, also attracts demand for its services from neighboring countries. This regional demand contributes to the growth of the Saudi Arabian industry.

RESTRAINING FACTORS

Volatility in Oil Prices to Hamper Saudi Arabia Oilfield Service Market Growth

One major factor hampering the market growth is the global oversupply of oil, which has led to a decline in oil prices and a reduction in new exploration and production. For example, in April 2023, Saudi Arabia planned to cut oil production by 500,000 barrels per day i.e. 0.5 million barrels per day until the end of 2023. Thus, the volatility in oil prices and output will likely impact the market growth. In addition, other factors, such as diverging oil and gas projections and increasing climate change concerns, affect investment attractiveness in the oil and gas industry.

SEGMENTATION

By Type Analysis

Field Operation is the Dominating Segment Owing to Its Major Adoption During Oilfield Operations

The market is segmented into equipment rental, field operations, and analytical services based on the type. The field operation segment holds the dominating share of this market owing to the wide range of oilfield services deployed on the field for executing the service.

Furthermore, the equipment rental-related services are likely to experience substantial growth owing to continuous exploration & production of oil reserves as well as modernization & expansion of existing oilfields.

Furthermore, as the oilfield is matured over the period, it becomes difficult and expensive to extract, resulting in more advanced techniques and technologies, increasing the demand for various services such as OCTG, drilling tools, well servicing, wirelines services, and many other oilfields services.

By Service Analysis

To know how our report can help streamline your business, Speak to Analyst

Production Service is the Dominating Segment Owing to the Increase in Global Oil Demand

Based on the service type, the market is majorly segmented into geophysical, drilling, completion & workover, production, and processing & separation services. Production services accounted for the largest market share. Factors such as global oil demand and Saudi Arabia being one of the leading global oil exporters are driving the market need for oilfield production services.

The drilling services accounted for the second largest market share due to increasing oil production complexity.

Furthermore, the increasing complexity, stimulation, and workover activities, extending the life of oil wells, and optimizing oil production drive the demand for completion & workover services. Subsequently, the increasing demand for advanced exploration technologies to locate and extract new oil reserves drives the demand for geophysical oilfield services in Saudi Arabia. In addition, the need to improve production efficiency and reduce environmental impact is driving the processing & separation oilfield demand across the region.

By Application Analysis

Onshore Application Dominate the Market Due to High Onshore Oil Production

Based on the location, the market has been segmented into onshore & offshore applications. Onshore application to dominate market size owing to increasing oil & gas production activities and usage of major equipment. For context, in 2023, the average onshore rig count in Saudi Arabia was around 125, 10% higher than the previous year.

For example, in September 2022, Arabian Drilling, has forecasted that the country’s onshore rig contract is likely to grow at a pace of 14% per year whereas offshore will grow at 12%.

COUNTRY ANALYSIS

The industry in Saudi Arabia is a crucial component of the country's economy, as it provides essential support services for the exploration, development, and production of oil and gas resources. Saudi Arabia is one of the world's largest crude oil producers and has significant reserves of natural gas, making it a vital player in the global energy market. For context, as per the International Trade Administration, the U.S. Department of Commerce, Saudi Arabia possesses approximately 17% of the worldwide petroleum reserves.

In April 2023, Saudi Arabia launched four special economic zones offering companies financial and non-financial incentives to attract more foreign investment and position itself as a global business center. The new zones will focus on the critical growth sectors of advanced manufacturing, cloud computing, medical technology, and maritime. In addition, in January 2019, Saudi Arabia signed agreements worth USD 54.4 billion (204 billion riyals) to offer incentives to attract capital as part of a 10-year program that would help diversify the regional economy.

KEY INDUSTRY PLAYERS

Key Participants in the Market Witnessing Significant Growth Opportunities

This service is one of the most crucial parts of the country's economy and includes many companies operating in the market. Some major key players include Saudi Aramco, Arabian Drilling, SLB, and Halliburton.

Saudi Aramco is the largest player in Saudi Arabia's industry, followed by Arabian Drilling, SLB, and Halliburton. These companies' accounts are estimated to have a significant market share, with the remaining key players holding a smaller market share.

The market's competitiveness largely depends on the services the key players offer and the regions they serve. For instance, some companies are specialized in drilling services, whereas many others are specialized in production, geophysical types of oilfield services.

List of Top Saudi Arabia Oilfield Service Companies:

- SLB (U.S.)

- Saudi Aramco (Saudi Arabia)

- Halliburton (U.S.)

- Weatherford (U.S.)

- Baker Hughes (U.S.)

- Arabian Drilling (Saudi Arabia)

- National Energy Services Reunited Corp. (U.S.)

- KCA Deutag (Scotland)

- Arab Oilfield (Saudi Arabia)

- Proserv (United Arab Emirates)

- Shelf Drilling (United Arab Emirates)

- Sparrows Group (U.K.)

- Welltec (U.S.)

- Vallourec (France)

- OMS Oilfield Services Pte Ltd. (Singapore)

- TAQA KSA (Saudi Arabia)

- MB Petroleum Services (Oman)

- Midad Holdings (Saudi Arabia)

- PetroSAC (Saudi Arabia)

- Rawabi Oil & Gas (Saudi Arabia)

KEY INDUSTRY DEVELOPMENTS:

- January 2023 - TDE Digital entered into a joint venture partnership agreement with Rawabi Oil & Gas (ROG), a subsidiary of Rawabi Energy. This joint venture aims to significantly enlarge both companies' capabilities in their respective field and provide efficient and sustainable solutions to businesses in Saudi Arabia.

- January 2023 – TAQA announced the acquisition of artificial intelligence (Al) Mansoori Petroleum Services. The acquisition is likely to expand TAQA’s well-solution business at the global level.

- June 2022 - MariApps and Rawabi Energy, part of Rawabi Group, join hands to provide digital solutions to the Oil & Gas and Offshore Sector in Saudi Arabia. The joint venture aims to help local companies and businesses in the region deliver more cost-effective and operationally optimized services over digitalization to meet global demand for energy and supply.

- May 2022 – OMS Oilfield Services has officially open their newest facility of 86,400 sq. meter at the Dammam Industrial Area, Saudi Arabia. The new facility marks a milestone for the company’s steps in delivering integrated oilfield services to its customers.

- February 2022 - TAQA announced the acquisition of "Tendeka," a U.K.-based company specializing in reservoir monitoring and control well completions that deal in multiple regions.

REPORT COVERAGE

The report provides detailed market analysis and focuses on key aspects such as leading companies, market sizing, competitive landscape, product/service types, porters five forces analysis, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the above factors, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.70% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

|

|

By Application

|

Frequently Asked Questions

The Fortune Business Insights study shows that the market was USD 13.10 billion in 2024.

The Saudi Arabian market is projected to grow at a compound annual growth rate CAGR of 4.70% in the forecast period.

Based on the service, the production segment dominates the Saudi Arabia market.

The Saudi Arabia market size is expected to reach USD 19.49 billion by 2032.

The key market drivers are increasing oil & gas production and technological advancement in the oil field services offerings.

The top players in the market are SLB, Halliburton, Arabian Drilling, Shelf Drilling, and Weatherford, among others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us