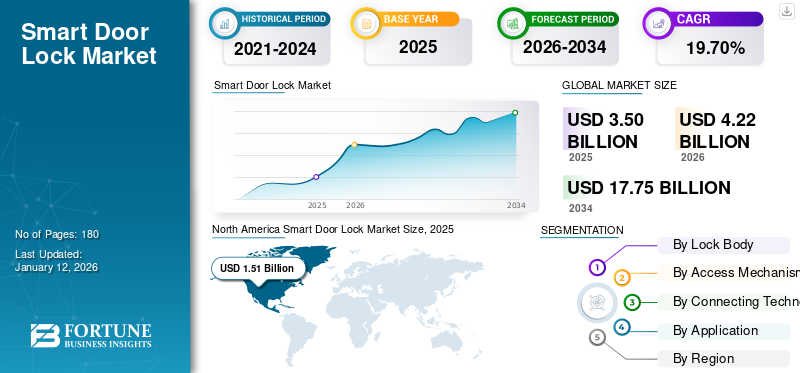

Smart Door Lock Market Size, Share & Industry Analysis, By Lock Body (Deadbolt, Lever Handles, Padlock, Mortise Lock, Sliding Door Lock, Retrofit Lock, and Others), By Access Mechanism (Keypad, Biometric, Smart Card, Mobile App Control, Voice Recognition, and Remote Access), By Connecting Technology (Wi-Fi, Bluetooth, Zigbee, Z-Wave, and Others), By Application (Residential, Commercial, and Critical Infrastructure), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global smart door lock market size was valued at USD 3.50 billion in 2025 and is projected to grow from USD 4.22 billion in 2026 to USD 17.75 billion by 2034, exhibiting a CAGR of 19.70% during the forecast period. North America dominated the global market with a share of 43.20% in 2025.

A smart door lock is a connected and electronic locking mechanism that helps users lock and unlock doors automatically or remotely, using wireless communication technologies such as Wi-Fi, Bluetooth, Z-Wave, or Zigbee. These locks are a part of smart home ecosystems and can be operated via keypads, smartphones, biometric authentication (e.g., face recognition or fingerprint), voice assistants, or integrated access management platforms.

These door locks offer a wide array of features, including keyless entry, remote lock & unlock, activity tracking, and integration with smart home technology, providing users with greater security and control over their premises. These locks represent a significant evolution from traditional mechanical locks, offering users enhanced security, convenience, and flexibility. They incorporate advanced security measures, such as encryption, tamper detection, and multi-factor authentication, to protect against unauthorized access attempts. Moreover, smart locks enable users to grant provisional access to visitors or service workers remotely, eliminating the need for physical keys and enhancing overall security.

As a part of their growth strategy, companies such as Assa Abloy, Dormakaba Group, Godrej Group, Xiaomi, Inc., Honeywell International Inc., Legrand, SALTO Systems, S.L, Onity Inc., Allegion plc (Schlage), and Shenzhen Kaadas Intelligent Technology Co., Ltd. aim to engage in mergers, partnerships, and acquisitions activities to expand their business and geographical footprint.

IMPACT OF TARIFF RECIPROCAL

The implementation of reciprocal tariffs had a significant impact on the market, mainly affecting global pricing structures, supply chains, and production strategies. When countries such as China and U.S. are involved in tariff exchanges, smart door locks, many of which depend on imported electronic items. This includes sensors, semiconductors, and communication modules, face major cost inflation. For instance, due to U.S. trade conflict, smart home products, including door locks, saw a 25% price increase, raising material costs for American brands sourcing from Chinese manufacturers. As a result, retail prices have risen (with brands like Yale and August's locks increasing by USD 30 to USD 50 per unit), affecting the profit margins for manufacturers.

IMPACT OF GENERATIVE AI

Integration of AI in Smart Door Locks Solutions to Drive the Market Growth

Generative AI is a revolutionary technology and will be a game changer for smart home security and automation as it is a unique and innovative solution for smart home systems. Furthermore, the potential of generative AI in door lock systems, which is a part of home automation, is significant as it will be able to inform homeowners about issues or security concerns quickly and efficiently. For instance,

- WELOCK, a smart home access solution provider from China, developed ‘AI.One’, a battery-operated AI-enabled smart lock that automatically locks and unlocks doors by validating the authorized or unauthorized access. The lock is fingerprint-enabled and can be accessed via phone/remote. It is able to handle all kinds of weather conditions or power outages. It also comes with a voice recognition feature that supports Google’s Assistant and Amazon’s Alexa. Moreover, the smart lock is compliant with the U.S. and European standards.

Thus, generative AI technology will revolutionize the market.

MARKET DYNAMICS

Market Drivers

Surging Investment in Smart City Initiatives and Industrial Projects to Accelerate Market Growth

The market is poised for significant growth due to increasing investment in smart cities and industrial projects globally. Smart locks, equipped with advanced technologies such as biometrics, RFID, and Bluetooth, offer enhanced security and convenience compared to traditional lock-and-key systems. As cities and industries embrace digitalization and automation, the adoption of smart locks is expected to rise. By leveraging features including remote access control and real-time monitoring, smart locks enable authorities to manage access more effectively and respond promptly to security threats or emergencies. For instance,

- In February 2023, Abode Systems introduced the Abode Lock, a device designed to convert latch-style deadbolts into smart locks effortlessly. This innovation aligns with Abode's smart home ecosystem and is compatible with standard deadbolts, facilitating an easy installation process without the need for replacing the key. Furthermore, users can benefit from the convenience and security features of a smart lock without altering their current setup.

Market Restraints

Interoperability, Compatibility, and Data Privacy Concerns to Impede Market Growth

Incompatibility between door locks and other connected devices such as smart hubs and security cameras, can limit their functionality and integration within the broader smart home ecosystem. For instance, a door lock lacking compatibility with popular smart home platforms, such as Amazon Alexa or Google Assistant, may restrict users' ability to control locks via voice commands or create personalized routines. Similarly, interoperability challenges between door locks and home security systems may compromise the effectiveness of integrated security solutions, reducing their appeal to consumers. Furthermore, concerns regarding cybersecurity and data privacy pose significant hurdles to the adoption of smart door locks. With increased connectivity and reliance on cloud-based services, these locks are vulnerable to cyber threats, including hacking and unauthorized access.

These barriers are expected to limit the widespread adoption of smart door locks during the forecast period.

Smart Door Lock Market Trends

Increasing Integration of Emerging Technologies in Door Lock Systems to Fuel Market Growth

Biometric authentication methods; fingerprint recognition and facial recognition, are at the forefront of this evolution. These advanced authentication mechanisms offer higher security by accurately identifying individuals based on their unique biological traits. Biometric smart lock manufacturers including Assa Abloy and Salto Systems, utilize sophisticated algorithms for scanning and matching fingerprint patterns or facial features, ensuring access control with utmost precision and reliability. For instance,

- In September 2023, Yale Home expanded its smart lock range with the release of the Yale Assure Lock 2 Touch and Yale Assure Lock 2 Plus. These locks include the brand's initial fingerprint smart lock and are compatible with the Apple home keys. Available in the U.S. via ShopYaleHome, Amazon, and Best Buy, they support up to 20 fingerprint registrations for effortless access, alongside touchscreen, app, voice assistant, Auto Lock, and traditional key functionalities (with keyed models).

Moreover, Artificial Intelligence (AI) is also making significant inroads into the door lock market, particularly in predictive analytics and behavior recognition. AI-powered door locks can analyze the user behavior patterns and detect anomalies to identify potential security threats or suspicious activities. Therefore, the increasing integration of biometrics, IoT, AI, and wireless communication technologies is accelerating the smart door lock market growth.

Market Opportunities

Growing Residential and Commercial Sectors will Offer Great Opportunity for Market Development

The combined growth in residential and commercial infrastructure, especially the post-pandemic digital transformation is creating a strong market pull for smart locks. As more buildings are constructed or retrofitted with smart features, the opportunity to embed smart access solutions becomes integral. For instance,

- In India, Godrej Locks reported a significant uptick in residential smart lock sales, especially in metro cities like Bengaluru and Mumbai, due to new apartment complexes offering integrated smart security solutions.

Further, commercial buildings, co-working spaces, and retail stores increasingly prefer smart locks for managing employee access, logging entry times, and remotely revoking or granting access. This is particularly useful in hybrid work environments, where access schedules need to be dynamically managed.

SEGMENTATION ANALYSIS

By Lock Body

Increasing Need for Robust Physical Security Features Fuels Adoption of Deadbolts

Based on the lock body, the market is analyzed into deadbolts, lever handles, padlocks, mortise locks, sliding door locks, retrofit locks, and others (cylindrical locks, etc.)

The deadbolt segment holds the highest share of the market with a 35.22% in 2026, due to its robust physical security features, including a solid metal bolt that goes deep into the door frame, providing superior resistance against forced entry. Additionally, deadbolt mechanisms often use advanced encryption and authentication protocols and enhance digital security measures, making them a preferred choice among consumers seeking comprehensive protection for their smart home entrances.

The lever handle segment exhibits the highest CAGR in the market due to its ergonomic design, catering to individuals with mobility limitations or those seeking convenient access options. Lever handle mechanisms often use advanced wireless connectivity and biometric authentication features, thereby enhancing accessibility and security and driving their adoption in residential and commercial settings.

By Access Mechanism

Increasing Need for Keypad Access Control in Budget-Conscious Consumers Fuels the Keypad Segment’s Growth

Based on access mechanism the market is analyzed into keypad, biometric, smart card, mobile app control, voice recognition, and remote access.

Keypad holds the highest share of the market with a share of 28.90% in 2026. Keypad smart locks are generally more cost-effective than biometric or advanced sensor-based alternatives, making them appealing to budget-conscious consumers and businesses. These locks can often be retrofitted onto existing doors without extensive modifications, and offer a straightforward upgrade path for enhanced security.

Biometric exhibits the highest CAGR in the market due to its advanced security features, leveraging biometric authentication methods, such as fingerprint recognition, facial recognition, palm recognition, and iris recognition for access control. These systems offer heightened protection against unauthorized entry, enhanced user convenience, and increased resistance to traditional security vulnerabilities, making them a preferred choice for consumers seeking cutting-edge security solutions for their homes and businesses.

By Connecting Technology

Need for Remote Managing and Monitoring Lock Status Boosts Demand for Bluetooth-Enabled Locks

Based on connecting technology, the market is studied into Wi-Fi, bluetooth, zigbee, Z-wave and other (thread, matter, etc.).

Bluetooth exhibits the highest CAGR in the market due to its widespread compatibility, low energy consumption, and seamless connectivity with smartphones and other smart devices. Utilizing the Bluetooth Low Energy (BLE) technology, these locks offer secure and convenient access control, allowing users to remotely manage and monitor their lock status via dedicated mobile applications.

Wi-Fi holds the highest share of the market with a 40.80% in 2026, due to its robust connectivity, enabling seamless integration with home automation systems and cloud-based platforms. Wi-Fi-enabled smart locks offer advanced features, such as remote access, real-time monitoring, and voice assistants, thereby catering to the increasing demand for interconnected smart home ecosystems and enhancing user convenience and security. These factors will drive their adoption among consumers.

To know how our report can help streamline your business, Speak to Analyst

By Application

Rising Adoption of Smart Home Technologies Surges Product Demand in Residential Applications

Based on application, the market is categorized into residential, commercial, and critical infrastructure (utilities and data centers)

The residential application holds the highest share in the market due to the increasing adoption of smart home technologies and growing emphasis on home security and convenience. Smart door locks offer features such as remote access, keyless entry, and integration with home automation systems, catering to the needs of homeowners seeking enhanced control and monitoring capabilities over their residential entrances. This factor is expected to drive their adoption and market dominance.

The commercial application demonstrates the highest CAGR in the market due to the rising demand for advanced access control solutions in commercial and institutional settings. The smart door locks offer features such as keyless entry, biometric authentication, and integration with access control systems, enhancing the security and operational efficiency of businesses, offices, and public facilities. This increased emphasis on security and access management will boost the demand for smart locks in commercial environments, thereby contributing to their high growth rate in the market.

SMART DOOR LOCK MARKET REGIONAL OUTLOOK

Based on the region, the market is studied across North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America

North America Smart Door Lock Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North American smart door lock market growth is driven by the increasing penetration of smart home automation systems and rising concerns regarding physical security. North America dominated the global market in 2025, with a market size of USD 1.51 billion. The region boasts a mature market ecosystem with a strong presence of key industry players and an advanced technological infrastructure.

Download Free sample to learn more about this report.

The U.S. holds the largest share of the North American market owing to the proliferation of Internet of Things (IoT) devices, integration with home automation platforms, and advancements in wireless communication technologies, including Bluetooth and Wi-Fi. Moreover, growing consumer awareness about the benefits of smart security solutions, such as remote access control, real-time monitoring, and voice assistants will fuel the adoption of smart door locks in the U.S. The U.S. market is projected to reach USD 1.31 billion by 2026.

Asia Pacific

The Asia Pacific market is expected to witness the highest growth due to the region's rapid urbanization, increasing disposable income, and growing adoption of smart home technologies. Key drivers include the proliferation of Internet of Things (IoT) devices, advancements in wireless communication technologies, such as Bluetooth and Zigbee, and rising concerns about home security. Moreover, the expanding middle-class population and surging demand for convenience and automation will contribute to the regional market's expansion. The Japan market is projected to reach USD 0.19 billion by 2026, the China market is projected to reach USD 0.43 billion by 2026, and the India market is projected to reach USD 0.15 billion by 2026.

Europe

The European market demonstrates steady growth driven by factors, such as the integration of door locks with home automation platforms, rise in smartphone penetration, and implementation of stringent security regulations and standards. Moreover, the region's emphasis on energy efficiency and sustainability will foster the development of eco-friendly smart door lock solutions. Additionally, the presence of established players and a well-developed infrastructure for technology adoption will further propel the market’s growth in Europe. The UK market is projected to reach USD 0.24 billion by 2026, while the Germany market is projected to reach USD 0.21 billion by 2026.

Middle East and Africa

Middle Eastern & African markets are exhibiting promising growth prospects driven by the gradual adoption of smart home technologies. Advancements in wireless communication technologies, such as Bluetooth and Wi-Fi, are propelling this adoption in Middle Eastern countries.

South America

South America region will grow at considerable CAGR owing to the need for enhanced access control solutions in residential and commercial buildings, coupled with rising consumer awareness about the benefits of smart security systems.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players to Launch New Products to Strengthen Their Market Positioning

The key market players such as Assa Abloy, Xiaomi, Honeywell are actively creating advanced solutions to cater to unique customer demands. They are also focusing on enhancing their existing product portfolio to deliver flexible solutions with unique attributes. Furthermore, these organizations are proactively pursuing collaboration, acquisitions, and partnerships to bolster their product offerings.

List of Companies Studied

- Assa Abloy (Sweden)

- Dormakaba Group (Switzerland)

- Godrej & Boyce Manufacturing Company Limited (Godrej Group) (India)

- Xiaomi, Inc. (China)

- Honeywell International Inc. (U.S.)

- Legrand (France)

- Allegion plc (Schlage) (Ireland)

- SALTO Systems, S.L (Spain)

- Onity Inc. (U.S.)

- Shenzhen Kaadas Intelligent Technology Co., Ltd. (China)

- Dahua Technology (China)

- AventSecurity (China)

- ZKTECO Co,Ltd. (China)

- Qrio, Inc. (Japan)

- Ozone Overseas Pvt. Ltd. (India)

- Jainson Lock Co. (India)

- Banham Group (U.K.)

- Croma Security Solutions Group PLC (U.K.)

- iLockey (China)

- And Other Companies

KEY INDUSTRY DEVELOPMENTS

- In March 2025, Nuki introduced the fifth-generation Smart Lock Pro, which includes the technologies developed for the Smart Lock Ultra into a retrofittable solution. This will help to exclude the need for a cylinder change.

- In February 2025, Resideo Technologies launched new smart solutions and app integrations at the International Builders’ Show. Resideo’s garage door and three new lock integrations will be available on the First Alert app. They will help users with Honeywell Home smart thermostats and outdoor/indoor/video doorbell cameras to control and monitor the home.

- In December 2024, Homey has launched a new, more affordable smart home hub called the Homey Pro Mini, priced at USD 200. It offers built-in support for Zigbee, Thread, and Matter, along with Ethernet connectivity. The Pro Mini runs on the same Homey OS software as the larger Homey Pro hub.

- In November 2024, ASSA ABLOY acquired Level Lock, a technology solutions business headquartered in Redwood City, California. The acquisition enables a seamless transition from traditional locking to digital access solutions with minimum effort.

- In December 2023, SALTO Systems introduced the DBolt Touch deadbolt, offering a smart locking solution for upgrading mechanical deadbolt locks in the multifamily residential market. The solution delivers the desired functionality required by residents, operators, and access managers in multifamily housing by incorporating advanced technology.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The smart home market is expected to continue strong growth driven by advancements in AI, 5G, and IoT technologies. Companies investing in automation, energy-efficient solutions, and smart security systems are well-positioned to capitalize on rising demand. AI-powered devices and voice assistants will enhance consumer experiences, while sustainability trends boost investments in energy-saving technologies. Key opportunities lie in expanding smart home hubs, voice-controlled devices, and smart appliances. However, the market faces risks from privacy concerns, regulatory challenges, and intense competition. Strategic investment in cybersecurity and cross-platform interoperability can further enhance growth potential for leading players.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on vital aspects, such as leading companies, product/service types, and top applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 19.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Access Mechanism

By Connecting Technology

By Application

By Region

|

| Companies Profiled in the Report |

• Assa Abloy (Sweden) • Dormakaba Group (Switzerland) • Godrej & Boyce Manufacturing Company Limited (Godrej Group) (India) • Xiaomi, Inc. (China) • Honeywell International Inc. (U.S.) • Legrand (France) • Allegion plc (Schlage) (Ireland) • SALTO Systems, S.L (Spain) • Onity Inc. (U.S.) • Shenzhen Kaadas Intelligent Technology Co., Ltd. (China) |

Frequently Asked Questions

The market value is projected to reach USD 17.75 billion by 2034.

In 2025, the market was valued at USD 3.50 billion.

The market is projected to record a CAGR of 19.70% during the forecast period.

The residential application segment led the market in 2025.

Surging investment in smart city initiatives and industrial projects is expected to accelerate market growth.

Assa Abloy, Dormakaba Group, and Allegion plc (Schlage) are the top players in the market.

North America held the highest market share in 2025.

By connecting technology, the Wi-Fi segment is expected to record a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us