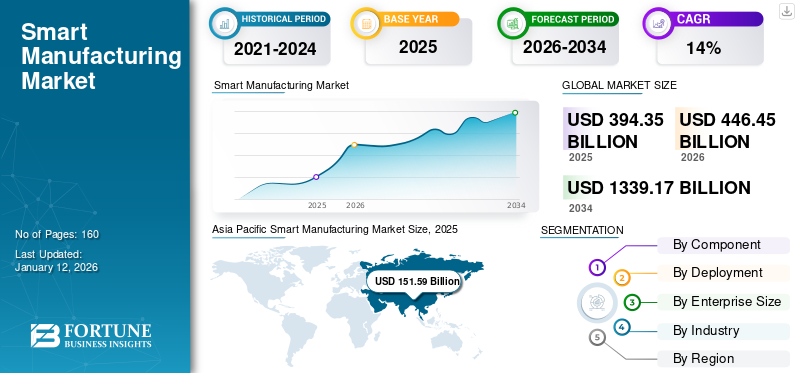

Smart Manufacturing Market Size, Share & Industry Analysis, By Component (Solution and Services), By Deployment (Cloud and On-Premises), By Enterprise Size (Large Enterprises and Small & Medium Enterprises), By Industry (Discrete Industry and Process Industry), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global smart manufacturing market size was valued at USD 394.35 billion in 2025 and is projected to grow from USD 446.45 billion in 2026 to USD 1,339.17 billion by 2034, exhibiting a CAGR of 14.70% during the forecast period. The Asia Pacific dominated global market with a share of 34.40% in 2025. Additionally, the U.S. smart manufacturing market is predicted to grow significantly, reaching an estimated value of USD 186.87 billion by 2032.

Emerging technologies, such as artificial intelligence, cloud, Big Data, and machine learning, are projected to enhance the smart manufacturing market growth. Additionally, the Internet of Things (IoT) is closely related to the concepts of Machine-to-Machine (M2M) communications and Wireless Sensor Networks (WSN) on the connectivity side, and Big Data in terms of the content outcomes produced. IoT also comprises the data produced and transmitted between machines (M2M), as well as between Machines & People (M2P). These technologies are expected to uplift the market.

In the market report scope, we have included component solutions and services offered by companies including ABB Ltd., Siemens, Robert Bosch, Honeywell International Inc., and Fanuc Corporation, among others.

The novel coronavirus pandemic is impacting the worldwide economy in every industry. The virus has developed critical gaps between manufacturing and supply chain units. To overcome the pandemic, organizations are reconstructing their business continuity models, investing in advanced manufacturing and supply chain models, and discovering automation opportunities to reduce the impact of COVID-19 on production lines in the upcoming years. For instance,

- According to Invest India.gov, key companies and governments worldwide invested around USD 17 billion in 2017 and are projected to invest around USD 60 billion by 2021. This investment is driven largely by electronics and the healthcare industry in countries such as Germany, Italy, the U.K., India, Japan, South Korea, China, and others.

- Furthermore, automation in the manufacturing industry in India is expected to reach around USD 3.50 billion by 2020 by creating approximately 90 million direct/indirect job opportunities.

Furthermore, to overcome these difficulties, the government of various countries, including India, Germany, the UK, and others, are focused on reconstructing their GDP by investing across multiple manufacturing projects to increase cash flow in the market and overcome financial challenges

- For instance, according to India.gov, in May 2020, the government of India invested around USD 265.0 million (20 lakh crore) as an “Economic Package.” The investment was completed to develop all types of enterprises across industries such as agriculture, manufacturing, healthcare, and many others. With this investment, several MSMEs and startups are likely to adopt automation software in their manufacturing units to expand their productivity and business.

- The International Trade Union Confederation (ITUC) stated that, in May 2020, the Government of Germany invested around USD 140 billion to cope with the COVID-19 pandemic.

Smart Manufacturing Market Trends

Expanding Perimeter of Big Data, Internet of Things, and 5G Network to Drive Market Growth

Big data is one of the key applications among them and is considered one of the emerging trends for market growth. The robust, increasing volume of structured and unstructured data and information creates a huge demand for big data applications. Similarly, the most crucial trend for the market is the Internet of Things (IoT). IoT includes smart devices, vehicles, sensors, and other connected components on a single platform backed by artificial intelligence.

All these devices generate a massive amount of data. This data is processed by artificial intelligence solutions. Some of the applications are self-driving/autonomous cars, smart homes, intelligent thermostats, pacemakers, and smart city solutions. According to our analysis, the global Internet of Things (IoT) market is expected to exhibit a fascinating growth rate of 24.9% during the forecast period.

Advances in sensor technology have given a wide range of measuring equipment that can be used in automatic feedback control systems as parts. These instruments include electromechanical probes that are extremely susceptible, laser beam scanning, electrical field methods, and machine vision. The above-mentioned aspects are expected to be the most prominent trends prevailing in the global market.

Download Free sample to learn more about this report.

Smart Manufacturing Market Growth Factors

Advancement in Connectivity Technologies (5G) and Investment in New Network Infrastructure to Support Market Growth

The emergence of the 5G era is likely to reform the current IoT-based applications leveraged in smart manufacturing. 5G has the potential to make a revolutionary impact on how future IoT ecosystems are designed, especially in the areas of scalability, latency, reliability, security, and the level of individual control of connectivity parameters. As the IoT application areas are broadening, more advanced use cases requiring enhanced network capabilities are also emerging. Examples of such capabilities include support for integrated sensors, more accurate device positioning, and device mobility at high speed.

5G has the capability to offer speeds measured in multiple gigabits per second, latency in single millisecond, and the capacity to handle 1,000 times more consumption than current network technologies. Thus, advancement in connectivity technologies such as 5G is a noteworthy factor driving global market growth. Moreover, the emergence of 5G access radio networks is expected to significantly impact the market.

- Huawei Technologies states that the fifth-generation wireless technology has the potential to grow global manufacturing Gross Domestic Product (GDP) by USD 740.00 billion or 4% by 2030.

Considering the aforesaid factors, there is a potential opportunity for manufacturing, robotics, and other industries to transform the traditional trajectory by working with the telecom industry to drive smart manufacturing technology adoption.

RESTRAINING FACTORS

High Initial Investment in Smart Manufacturing Solutions to Impede the Market Growth

High initial capital investments are seen to be the major factor impeding market expansion in the global markets. According to the report, the cost is the biggest roadblock, followed by a lack of information about which technology to invest in. Following the outbreak of the COVID-19 pandemic, the cost has become a real concern for many enterprises, resulting in investment cuts and other losses. As a result, large upfront capital expenditures are likely to stifle market growth.

Smart Manufacturing Market Segmentation Analysis

By Component Analysis

Rising Industrial 3D Printing Demand to Drive Smart Manufacturing Growth

Based on the component, the market is categorized into solution and services.

The solution segment is subdivided further into industrial 3D printing, programmable logic controller, product lifecycle management, manufacturing execution system, robotic process automation, remote monitoring software, supervisory controller and data acquisition, and others (energy management systems, fleet management solutions).

The solutions segment is projected to dominate the market with a share of 75.50% and a market size of USD 337.08 billion in 2026. The growth of industrial 3D printing is attributed to the increasing demand for IoT for advanced automation processes in manufacturing industries. In the centurion, demand for 3D printing will be majorly from heavy manufacturing followed by the electronics and automotive industry. Also, the discrete automation industry implements 3D printing for the self-optimization of production lines as well as customized product solutions.

Manufacturing Execution System (MES) segment captured the highest market share in 2024. It delivers optimized production processes across the enterprise. The driving factor for the growth of robotic process automation, PLC, and 3D printing includes increasing energy efficiency and streamlined operations. Additionally, advancements in automation technologies, such as the Industrial internet of things (IIoT), Industry 4.0, and others, and increasing demand for advanced hardware, such as SCADA, PLC, HMI, and others, from electronics, automotive, packaging, and other industries have aided the growth of the market.

To know how our report can help streamline your business, Speak to Analyst

The services segment is further bifurcated into professional services and managed services. The services segment is expected to witness considerable growth during the forecast period.

By Deployment Analysis

Cloud's Flexibility and Scalability to Fuel Market Growth

Based on deployment, the market is categorized into cloud and on-premises.

The cloud segment is projected to dominate the market with a share of 65.75% and a market size of USD 293.53 billion in 2026. The pandemic has created remote workforces and supports scalable infrastructure for their products and service offerings. As a result, cloud-based software is expected to gain traction with the highest CAGR over the forecast period. This trend is likely to persist, as the migration to virtual work emphasizes the urgency for reliable, secure, scalable, and off-premises technology services. These factors drive the market for cloud-based software.

By Enterprise Size Analysis

Extensive Geographic Operations of Large Enterprises Led to the Segment’s Dominance

Based on enterprise size, the market is segmented into large enterprises and small & medium enterprises.

During the forecast period, the large enterprise segment is projected to dominate the market with a share of 72.31% and a market size of USD 322.82 billion in 2026. Owing to its strong presence and extensive coverage of geography. Large organizations such as Honeywell, GE Electric, Rockwell Automation, and others, are primarily focused to expand their geographic operations internationally. These players are embracing advanced factory automation components to cater to the demand of a large customer base. These players are developing industrial components such as robots, servos, and others, integrated with new technology such as industrial IoT (IoT), Industry 4.0, 5G network, and others.

Small & medium enterprises segment is expected to witness high growth during the forecast period owing to optimized maintenance costs and less requirement of infrastructure.

By Industry Analysis

Increasing Adoption of Advanced Hardware Significantly Boosts the Process Industry Segment

Based on industry, the market is segmented into discrete industry and process industry.

The process industry segment is subdivided into pharmaceuticals, mining & metals, chemicals, pulp and paper, and others (cable). During the forecast period, the process industry segment is expected to grow at a considerable CAGR owing to the rising demand for advanced hardware among industries such as mining & metals, chemicals, and pharmaceuticals. For instance, in 2020,

- Automotive manufacturers such as Mahindra & Mahindra Limited automated about 70% of their manufacturing plant methods by deploying advanced automation hardware.

- Larsen & Toubro Limited digitally shifted around 60% of its construction commercial by deploying sensory hardware and gateways.

- The Indian Railways deployed MDCplus. MDCplus is a real-time machine monitoring and manufacturing data collection system. This system is developed by Zyfra, a Finnish-Russian digital solutions provider.

The discrete industry segment is subdivided further into automotive, transportation, industrial machinery, medical devices, semiconductor and electronics/high-tech, and others (aerospace and defense).

The discrete industry segment is expected to grow rapidly and is projected to dominate the market with a share of 60.47% and a market size of USD 269.96 billion in 2026.The demand for smart manufacturing solutions in discrete automation is predominantly from heavy manufacturing, electronics, and the automotive industry to ease the manufacturing process.

REGIONAL INSIGHTS

The market has been analyzed across five major regions, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Asia Pacific Smart Manufacturing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the largest smart manufacturing market share and is likely to grow rapidly during the forecast period owing to the vibrant ecosystem across countries such as Japan, India, and Australia; SMEs are expected to drive the adoption of smart type of manufacturing solutions. However, large enterprises operating in discrete industries are projected to generate the highest revenue in the market. Growing adoption of disruptive technologies such as Industry 4.0, artificial intelligence, augmented reality, Internet of Things (IoT), and others are driving the push toward cloud adoption across the region. Hence, cloud-based smart manufacturing solutions are likely to get more demand across the countries in the region. The Japan market is expected to reach USD 42.81 billion by 2026, the China market is projected to reach USD 66.45 billion by 2026, and the India market is expected to reach USD 33.62 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America stood as the second-largest market attributed to the rising expenditure on advanced manufacturing technologies by Canada and the U.S. Technical advances, availability of substitute printing material, and reduced equipment costs have further fueled the adoption of the smart manufacturing concept. The region is witnessing a set of investment initiatives in the North American health, aerospace and defense, manufacturing, and automotive sectors that are projected to expand considerably in future. Various government agencies, such as the National Aeronautics and Space Administration (NASA), have identified major 3D Printing R&D investments that can greatly contribute to space applications and create new technologies that drive business expansion. The U.S. market is expected to reach USD 91.47 billion by 2026.

- For instance, In July 2019, the National Aeronautics and Space Administration (NASA) awarded USD 73.7 million contract to a U.S.-based engineering and manufacturing company, Made in Space, to manufacture 3D-printed spacecraft products of a small spacecraft - Archinaut One.

Similarly, Europe is anticipated to observe a steady and moderate growth during the forecast period due to the increasing implementation of internet of things (IoT) across prominent countries such as Italy, Germany, Spain, and other countries. High expenditure on the wages of laborers in western countries is encouraging the manufacturing facility operators to opt for the automation and installation of smart facilities across the region. Increased productivity and better operations offered by automation and installation of smart solutions is another reason favoring market growth. The UK market is projected to reach USD 15.9 billion by 2026, and the Germany market is expected to reach USD 19.92 billion by 2026.

The digitization of business in the Middle East and Latin America has massive implications for the future development of regional economies, education, employment, and others. Gulf Cooperation Council (GCC) countries are leading the way toward technology adoption and digital transformation across the region. For instance, Saudi Arabia’s 2030 Strategy and National Transformation Program (NTP) 2020 prioritizes digital transformation to strengthen private sector employment and embrace partnerships. Such a rapidly developing economy is expected to hold unprecedented market opportunities in the near future. The Latin America market is projected to reach USD 37.09 billion by 2026, representing an 8.50% share in 2025.

KEY INDUSTRY PLAYERS

Key Players to Diversify their Product Portfolios through Strategic Acquisitions and Collaborations

Key market players, such as General Electric, Emerson Electric Co., Honeywell International, Inc., and Rockwell Automation, Inc., are concentrating on expanding their operations by providing creative and advanced solutions. These key players are investing in developing smart manufacturing solutions.

The market is identified as a fragmented market in terms of competition landscape with the presence of global market players as well as numerous local players trying to emerge as key stakeholders. The prominent manufacturers are also trying to venture into strategic mergers and acquisitions of the relatively smaller entities or local manufacturers to perform more effectively in diverse geographies. These companies are also interested to operate in joint ventures and collaborations to utilize the technical expertise and work on product diversification to increase their sales footprints in the market.

- April 2021 – Rockwell Automation, Inc. partnered with Comau to maximize manufacturing capabilities via unified robotic control solutions. This partnership offers an easier, smarter, and more productive way to carry out manufacturing activities across industries.

List of Top Smart Manufacturing Companies

- HP Development Company, L.P. (U.S.)

- ABB (Switzerland)

- Emerson Electric Co. (U.S.)

- General Electric (U.S.)

- Honeywell International, Inc. (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Robert Bosch GmbH (Germany)

- Rockwell Automation, Inc. (U.S.)

- Schneider Electric (Europe)

- Siemens AG (Germany)

KEY INDUSTRY DEVELOPMENTS

- December 2023 – Mitsubishi Electric Corporation has initiated its operations at a newly developed smart manufacturing facility for the development of advanced factory automation systems. This facility will prompt strong growth projections for the company in the market.

- Ocotober 2023 – ABB has announced launch of its smart manufacturing solutions for application in process industries and digital electrification products. This recent launches will help the company to have more product diversification and increase their presence in the market.

- August 2023 – Ericssion has decided to venture into a collaboration with Amazon Web Services (AWS) and Hitachi America to enhance manufacturing operations and improve productivity of the failities.

- June 2023 – Renishaw plc unveiled three industrial automation equipment which will help to achieve smart manufacturing facility. The products are supported by dedicated software suite which will simplify the setup and help to inculcate maximum automation in the facility.

- December 2022 - Emerson to collaborate with Petronas with an objective to drive decarbonization and digital transformation as well as enhance their remote operation capabilities and further strengthen their cybersecurity.

REPORT COVERAGE

The research report includes leading regions around the world to provide a deeper knowledge of the user. Furthermore, the research analyzes technologies that are being deployed at a rapid speed on a global scale and provides insights into the most industry trends. It also covers some of the market's growth-stimulating elements and restrictions, allowing the reader to acquire a comprehensive understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.70% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Deployment

By Enterprise Size

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 1,339.17 billion by 2034.

The market was valued at USD 394.35 billion in 2025.

The market is projected to grow at a CAGR of 14.70% during the forecast period.

The solution segment is predicted to lead the market.

Advancement in connectivity technologies (5G) and investment in new network infrastructure are expected to drive the market growth.

ABB Ltd., Emerson Electric Co., General Electric, Honeywell International, Inc., Rockwell Automation, Inc. are some of the top players in the market.

Asia Pacific is expected to grow with a significant growth rate.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us