Social Media Analytics Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premise), By Enterprise Type (Small and Medium-sized Enterprises and Large Enterprises), By Function (Sentiment Analysis, Competitive Analysis, Hashtag Analysis, Dashboard & Visualization, and Others), By Application (Sales & Marketing Management, Customer Experience Management, Risk Management & Fraud Detection, and Others), By End User (BFSI, Media & Entertainment, Retail, IT & Telecom, Healthcare, Government, and Others), and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

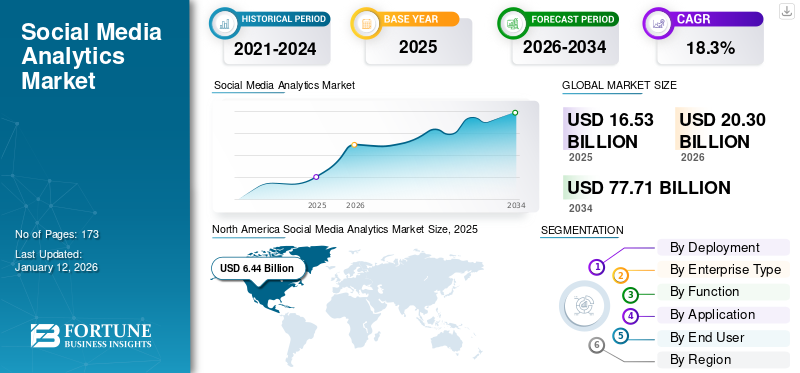

The global social media analytics market size was valued at USD16.53 billion in 2025 and is projected to grow from USD 20.3 billion in 2026 to USD 77.71 billion by 2034, exhibiting a CAGR of 18.3% during the forecast period. North America dominated the social media analytics market with a market share of 39% in 2025. Additionally, the U.S. social media analytics market is projected to grow significantly, reaching an estimated value of USD 16.96 billion by 2032.

The report's scope comprises various solutions and services offered by key players such as NetBase Quid, Inc., Hootsuite Inc., Meltwater, Sprout Social, Inc., Oracle Corporation, IBM Corporation, and others. Social media analytics can be defined as a technique to accumulate data from social media platforms and integrate that data to make essential business decisions. These analytical tools help businesses with product development, customer experience, market and competitive intelligence, and operational efficiency.

For instance, IBM Corporation provides IBM Watson for social analytics, enabling users with behavior, sentiment, and clustering analysis using machine learning and artificial intelligence. Similarly, Sprout Social, Inc. offers an integrated analytics platform that can integrate with social media networks, including Twitter, Instagram, Facebook, Pinterest, and others.

These solutions extract real-time data from all major social networks, discussion forums, blogs, consumer review sites, and podcasts using AI speech recognition. Furthermore, analytical tools serve various industries, including technology, retail, pharma, universities, banks, NGOs, governments, and others.

Companies worldwide are deploying these analytical tools to monitor, engage, understand, and analyze customers and company brand reputation. The increasing demand for cloud-based analytical solutions and the rising integration of emerging technologies are driving the social media analytics market growth. Several key market players are adopting these advanced solutions for better performance. For instance,

- In February 2022, Qualtrics launched XM Discover using Clarabridge technology to help companies better understand their customers. XM Discover enables companies to bring feedback from structured/unstructured data sources, including chat, social media posts, and review sites, onto one platform using artificial intelligence and machine learning.

The COVID-19 pandemic positively impacted the market owing to an increase in e-commerce activities and online shopping. Due to the outbreak, businesses thrived for survival and existence as many governments imposed shutdowns and lockdowns. To minimize the impact of the pandemic, companies relied on analytics to sustain their operations and revenue. Companies worldwide adopted advanced analytics to understand the real-time scenario of the pandemic through social interactions across various social media platforms.

In addition, social media platforms were used by many governments, hospitals, and public authorities to create awareness about the pandemic and to communicate with the people. They use these analytical tools to understand and analyze the pandemic. Post-pandemic, there was a massive rise in the merger & acquisition activity and adoption of emerging technologies such as artificial intelligence, machine learning, natural language processing, and augmented reality.

Social Media Analytics Market Trends

Rising Use of SaaS Model and Artificial Intelligence (AI) based Social Media Analytics to Propel Market Growth

Rising adoption of cloud-based and AI-driven social media analytics solutions among retail, hospitality, travel, and other sectors to aid the market growth. Artificial Intelligence (AI)-based services in analytics are gaining popularity and are increasing across developed countries, including the U.K., the U.S., France, Japan, and others.

Several players in the market are developing AI and cloud-based analytics to remain competitive. For instance,

- In March 2023: Digimind introduced the first Social Listening Solution. The solution is developed by integrating OpenAI ChatGPT and Digimind AI Sense. It provides a seamless way to analyze, collect, and act on online conversations.

Download Free sample to learn more about this report.

Social Media Analytics Market Growth Factors

Increased Penetration of the Internet and Number of Social Media Users to Drive the Market

Brands rely on social media platforms to understand and engage with their customers. The data extracted from social media interactions aids businesses in fueling their operations and generating revenue. The rising use of social media and increased internet penetration across regions worldwide are expected to drive the market. Social media network sites have been enormously used for online purchases, chat & messaging, entertainment, weather, health & fitness, and more.

Furthermore, the increasing use of smartphones among users is also expected to bolster the market. The audience’s keen interest in rich video content, short films, and TV series is pulling the demand for PCs, laptops, tablets, and mobile phones. According to a research survey, as of October 2023, over 4.95 billion people use social media across the world. A survey by the Pew Research Center states that around 81% of U.S. adults use YouTube.

Furthermore, increasing usage of smart devices, such as tablets, PCs, and mobile phones with internet access, has increased the amount of social media data generated in emerging markets. Hence, the increased penetration on the internet and growth in the number of social media users drive the market growth.

RESTRAINING FACTORS

Data Security Concerns Regarding the Services Might Hinder Market Growth

This solution benefits many businesses, including finance, retail, travel, and others. However, some obstacles and challenges for which users must be prepared for risks include phishing attacks, device faults, fraudulent messages, software, and network weakness. For instance,

- Cyber threats – There is a high chance of data being hacked in social media networks. Hackers can easily access the financials of customers, business accounts, and other essential data such as credit card details. Such mishaps and data leakage from social media platforms can result in substantial financial loss to businesses and can damage their reputation.

Thus, a lack of security and provision of secured networks might impede market growth.

Social Media Analytics Market Segmentation Analysis

By Deployment Analysis

Growing Popularity of Cloud-based Analytics among Organizations to Propel the Market Growth

Based on deployment, the market is bifurcated into cloud and on-premise. The cloud deployment model captures the largest social media analytics market share and is expected to hold the highest CAGR during the forecast period, owing to the growing popularity of cloud-based analytics. Companies have started incorporating the Software as a Service (SaaS) model in their analytics for business efficiency and ease.

However, the on-premise deployment model is expected to grow at a moderate growth rate owing to the prominent use of mobile devices, laptops, and PCs with internet access. Consumers are inclined toward digital technologies and use social media platforms for online shopping, communication, and other social connectivity activities.

By Enterprise Type Analysis

Large Enterprises to Hold Maximum Market Share Due to Huge Customer Base

On the basis of enterprise type, the market is divided into large enterprises and small and medium-sized enterprises. Large enterprises are expected to hold the maximum share in the market owing to a vast customer base and large scale of operations. Volumes of data are generated every minute across social media platforms, and large enterprises use analytical tools for monitoring and extracting the required data.

However, small and medium-sized enterprises are expected to grow at the highest CAGR during the forecast period, as the deployment of these analytics doesn't require huge capital and investment. Also, it is inexpensive as these analytics can be deployed over the cloud without any infrastructure.

By Function Analysis

Sentiment Analysis to Lead the Market due to Rising Need for Understanding Consumer Attributes

By function, the market is divided into sentiment analysis, competitive analysis, hashtag analysis, dashboard & visualization, and others. The sentiment analysis is expected to hold the largest share of 43.1% in the 2026, owing to its rising demand among the firms. It monitors the brand mentions and helps entities understand to reveal positive, negative, neutral, or ambivalent attributes by using natural language processing technology.

However, the dashboard & visualization is estimated to grow with the highest CAGR, followed by competitive analysis. Dashboards enable users to understand specific social findings more deeply without needing advanced technical skills. Firms can easily summarize their analytical findings with the help of charts, graphs, tables, and other presentation tools.

By Application Analysis

Increasing Use of Social Media by Businesses for Brand Promotions Led to the Segmental Growth

Based on application, the market is categorized into sales & marketing management, customer experience management, risk management & fraud detection, and others. The sales & marketing management is expected to hold the largest share of 49.16% in 2026, owing to the increase in the use of social media networks by many businesses for promoting their products. With the rise of e-commerce sales, brands are finding this an opportunity to promote and increase their customer base. Social media analytics tools aid companies in marketing and growing their brand mentions.

However, the customer experience management is estimated to grow at the highest CAGR in the coming years. Social media analytics solutions help companies listen to and monitor customer interactions over chat and other social media.

To know how our report can help streamline your business, Speak to Analyst

By End User Analysis

Retail to Hold Largest Share due to Rising Adoption of Social Media Analytics

On the basis of end users, the market is classified into BFSI, media & entertainment, retail, IT & telecom, healthcare, government, and others.

The retail is expected to hold the largest market share of 25.71% in 2026, owing to the increasing use of social media for online shopping and other e-commerce activities. Social media platforms are gaining popularity as retail businesses are making the most use of them by advancing their connections with customers. Using these analytics, retail brands can anticipate marketing trends, promotional efficiency, competitor ranking, and other advantages.

However, the media & entertainment is anticipated to hold the highest CAGR in the market share. While many media and entertainment businesses collect social data, a few have incorporated analytics to understand consumers' decision-making abilities. In addition, these analytics aid firms in developing timely strategies to capitalize on the current opportunities and identify new ones.

REGIONAL INSIGHTS

Geographically, the market is fragmented into five major regions, North America, Europe, Asia Pacific, Middle East & Africa, and South America. They are further categorized into countries.

North America

North America Social Media Analytics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 6.44 billion in 2025 and USD 7.84 billion in 2026. North America is estimated to hold the largest market share in the global market during the forecast period. The growth is accredited to the maximum number of social media users in this region. Companies in this region are using social media to enhance their customer experience. Most businesses are maximizing the benefits of data received from social media by tracking user interaction and online behavior. The U.S. market is projected to reach USD 5.33 billion by 2026.

According to the GlobalStats June 2022 report, around 72.29% of the population in North America used Facebook.

These analytics enable companies to tune into conversations that are already happening to build a richer understanding of their customers and brand mentions. They can gather information using structured and unstructured data sources, and analyze it with technologies such as AI and machine learning. The U.S. dominates the North American market with the presence of significant regional vendors.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe's market is driven by increasing smartphone penetration in the region. With the availability of smartphones at a lower price, access to social media has increased. This encourages the companies to promote business online for better customer reach, thus boosting the market growth. The World Bank states that Germany has the highest number of active internet users. According to Eurostat 2021, around 59% of EU enterprises used at least one type of social media. The UK market is projected to reach USD 1.31 billion by 2026, while the Germany market is projected to reach USD 1.1 billion by 2026.

Asia Pacific

The Asia Pacific market is expected to grow with the highest CAGR owing to the rising adoption of digitalization and the urge to opt for advanced analytics. The market is evolving rapidly in this region, with consumers inclining toward automation. China sees more than 61 million users of the Weibo social media platform daily. Similarly, India has more than 100 million Facebook and Twitter active users, making it a large marketplace. The Japan market is projected to reach USD 0.82 billion by 2026, the China market is projected to reach USD 1.49 billion by 2026, and the India market is projected to reach USD 0.68 billion by 2026.

The Middle East and Africa (MEA) region is tremendously adopting digital technologies. The growing number of social media users has attracted companies to use social media websites for advertising. Governments, retailers, consultants, and businesses depend on social media to enhance the customer experience. According to research, Brazil will be home to 152.4 million social media users in January 2023. The use of different social media platforms, such as Facebook, Instagram, Twitter, YouTube, and Pinterest, with an 84.3% internet penetration rate in Brazil, drives the demand for the adoption of social media analytics platforms in the region.

The South American market is rapidly growing due to various small & medium enterprises adopting these analytics. Brazil, Mexico, and Colombia have witnessed a significant increase in the use of social media for brand mentions. Furthermore, mass communication technology continues to penetrate the region, which is expected to bolster market growth.

Key Industry Players

Key Players Are Focused on Strengthening their Market Position with Continuous Developments

The global market is consolidated by leading players such as NetBase Quid Inc., Digimind, Hootsuite Inc., Meltwater, Sprout Social, Inc., Qualtrics, Oracle Corporation, IBM Corporation, Talkwalker, and Brandwatch. These key players incorporate strategies such as investing in research & developments, mergers, product launches, acquisitions, collaborations, and partnerships. For instance,

- March 2022: Brandwatch acquired Paladin, a comprehensive influencer marketing platform. With this acquisition, Brandwatch enabled complete influencer marketing functionality within its suite. Also, it helps brands in building meaningful connections with consumers. The Paladin platform offers campaign management, influencer discovery, and reporting across the world's leading social media.

- April 2022: Digimind partnered with Facelift to provide essential tools for successful social media growth. Facelift is a social media management tool company. This partnership helped both companies monitor their brand image and centrally manage all social networks. It helps to make business decisions and take real-time actions.

List of Top Social Media Analytics Companies

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- Sprout Social, Inc. (U.S.)

- Meltwater (Netherlands)

- Hootsuite Inc. (Canada)

- NetBase Quid, Inc. (U.S.)

- Brandwatch (Cision US Inc.) (U.K.)

- Digimind (France)

- Qualtrics (Australia)

- Talkwalker Inc. (Luxembourg)

KEY INDUSTRY DEVELOPMENTS

- June 2022: Louisville Athletics Department signed a multi-year agreement with the consumer intelligence platform, Talkwalker. The insights provided by Talkwalker aid Cardinal Athletics to learn, react, understand the impact, and help make strategic athletic decisions with social input from fans, influencers, celebrities, and news publications/blogs around the globe.

- June 2022: Digimind launched Digimind.org, a program to help charities and schools by giving them access to social media listening tools. Through this, the NGOs can monitor, analyze, and report on media developments free of charge. This program benefited more than 50 non-profit organizations around the world.

- May 2022: Brandwatch joined the TikTok marketing partners program to expand its analytical offerings. This partnership empowered Brandwatch clients to manage, optimize, respond to, and understand the content on TikTok while staying within the Brandwatch platform.

- March 2022: Sprout Social, Inc. partnered with Salesforce to help Salesforce customers to manage their social media presence through Sprout's social suite. Salesforce customers can manage activities such as engagement, analytics, publishing & scheduling, listening, advocacy, and platform integrations.

- January 2022: Netbase Quid, Inc. partnered with Twitter to provide insights and prepare a report on Twitter talks around personal care. NetBase Quid aided the power of Twitter’s public conversation through its suite of social media analytics tools to create a report on the CPG industry.

REPORT COVERAGE

The report on social media analytics offers qualitative and quantitative insights into the market and a detailed analysis of the size & growth rate for all possible segments in the market. It also provides an elaborative analysis of market dynamics, emerging trends, and the competitive landscape. Key insights offered in the report are the adoption of automation by individual segments, recent industry developments such as partnerships, mergers & acquisitions, consolidated SWOT analysis of key players, business strategies of leading market players, macro and micro-economic indicators, and key industry trends.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 18.3% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By Function

By Application

By End User

By Region

|

Frequently Asked Questions

The global market is predicted to reach USD 77.71 billion by 2034.

In 2025, the market value stood at USD 16.53 billion.

The market is projected to grow at a CAGR of 18.3% during the forecast period (2026-2034).

The cloud segment is expected to show the highest CAGR during the forecast period.

North America dominated the market due to the increasing number of social media users in the region.

By end user, the retail sector leads the market owing to the growing adoption of e-commerce and online sales.

Data security issues associated with social media information are restraining market growth.

Rising internet penetration across the globe and increasing penetration of smartphone devices are contributing to the market growth.

Some of the top players in the market are NetBase Quid, Inc., Digimind, Hootsuite Inc., Meltwater, Sprout Social, Inc., Qualtrics, Oracle Corporation, and IBM Corporation.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us