Software for Smart Manufacturing Market Size, Share & Industry Analysis, By Application (Digital Twin, ERP, Quality Management, Supply Chain Planning, Asset Performance Management, MES Automation and Orchestration, Predictive Management, 3D Printing/Modelling, Product Lifecycle Management), By Enterprise Type (Large Enterprises and SMEs)), By Deployment (Cloud & On-premises), By Industry (Process (Oil & Gas, Power & Energy, Chemicals, Pharmaceuticals) and Discrete (Automotive, Electronics and Manufacturing etc.)), Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

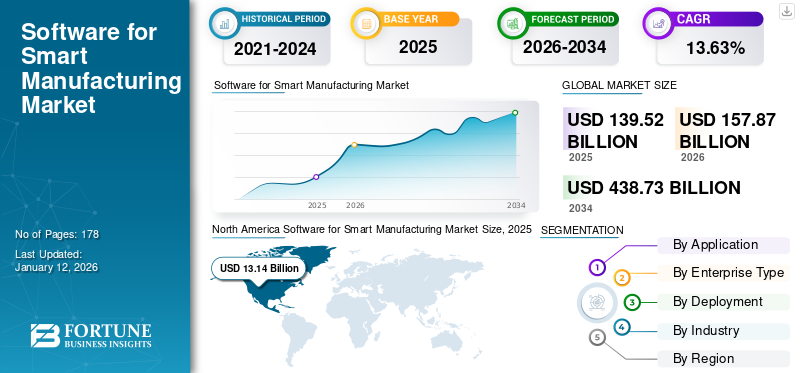

The global software for smart manufacturing market size was valued at USD 139.52 billion in 2025. The market is projected to grow from USD 157.87 billion in 2026 to USD 438.73 billion by 2034, exhibiting a CAGR of 13.63% during the forecast period. North America dominated the global market with a share of 28.41% in 2025.

Smart manufacturing is a modern production process that is interconnected, data-rich, and automated. It involves the collaboration of machines, big data, and people within an integrated and digitally connected system. This system collects and analyzes data to understand, make predictions, and derive insights. Smart manufacturing incorporates advanced technologies, such as cybersecurity, AI, blockchain, Industrial Internet of Things (IIoT), and robotics. These Industry 4.0 technologies optimize the manufacturing ecosystem and enhance overall performance.

The software market around the world is thriving and growing steadily. All the countries have been embracing digital transformation and adopting numerous software solutions across industries to improve productivity, streamline operations, and enhance customer experiences. Some of the key factors contributing to the market include supportive government policies, cloud penetration, increasing digitalization, e-commerce & online activities, and rise of emerging technologies.

- For instance, as per a report by the National Association of Software and Services Companies (NASSCOM), in 2022, it is expected that more than two-thirds of the Indian manufacturing sector intends to embrace Industry 4.0 by 2025.

The COVID-19 pandemic created remote workforces and supported scalable infrastructure for the companies’ products and service offerings. As a result, cloud-based software is expected to gain traction over the forecast period. This trend is likely to persist as the migration to virtual work emphasizes the need for reliable, secure, scalable, and off-premises technologies.

GENERATIVE AI IMPACT

Ability of Generative AI to Speed up Automation Process in Manufacturing to Augment Market Growth

The emergence of generative AI offers significant growth opportunities for software for smart manufacturing providers worldwide. This technology enables them to deliver more personalized, efficient, and human-like interactions. Machine learning is rapidly revolutionizing product manufacturing across various industries as manufacturers are harnessing the capabilities of Artificial Intelligence (AI) to complete tasks faster and more accurately than humans. Generative AI is reshaping smart manufacturing technologies by emphasizing the crucial role of open source software and communities in optimizing production lines, reducing waste, and enhancing supply chain logistics.

- According to industry experts, over 50% of the top manufacturers in Europe are presently integrating AI in some capacity. Germany is leading the way with 69% of manufacturers deploying AI, while in the U.S., it's 28%, and in Japan, that figure goes to 30%. China is at the lowest with 11%.

Software for Smart Manufacturing Market Trends

Rising Penetration of Internet of Things, 5G Network, and Big Data to Supplement Market Growth

Big data is an important emerging trend for the growth of smart manufacturing. The increasing volume of structured and unstructured data is creating a huge demand for big data applications. Additionally, the integration of IoT and 5G technologies represents a significant milestone in the advancement of smart manufacturing. Moreover, 5G, known for its low latency, widespread device connectivity, and high speed, is critical for real-time data processing and transmission. This capability is vital in manufacturing settings where instant decisions and actions majorly impact production efficiency and safety.

IoT, on the other hand, uses a network of interconnected devices, each with the capabilities to transmit, receive, and collect data. This means that every machine, device, and sensor is a source of critical data in the context of manufacturing. Once analyzed and applied, this data can help enable predictive maintenance, enhance quality control, and optimize production processes.

- In August 2023, Ericsson, Hitachi, and Amazon Web Services (AWS) joined forces to showcase the potential of existing 5G, automation, and Artificial Intelligence (AI) solutions in transforming manufacturing. Their aim is to improve efficiency, productivity, safety, and environmental impact while reducing costs. These companies collaborated to conduct a private 5G infrastructure trial at Hitachi Astemo Americas’ electric vehicle manufacturing plant in Kentucky, U.S.

Download Free sample to learn more about this report.

Software for Smart Manufacturing Market Growth Factors

Surging Demand for Software Systems that Reduce Time and Cost to Aid Market Growth

Manufacturers are greatly impacted by production waste and unplanned downtime. As a result, they are seeking systems that can identify potential defects and failures in advance to prevent future losses. Technologies, such as industrial 3D, digital twin, and Plant Asset Management (PAM) are being utilized to reduce the time and cost associated with manufacturing.

Furthermore, software solutions provide the foundation for implementing advanced technologies, such as Artificial Intelligence (AI), machine learning, and data analytics. As per industry experts, 80% of smart manufacturing software users practice green manufacturing to eliminate paper from their manufacturing processes. These factors are contributing toward the global software for smart manufacturing market growth.

RESTRAINING FACTORS

High Initial Investment in Smart Manufacturing Solutions to Impede Market Growth

The primary factor hindering the growth of the global market for software for smart manufacturing is the high initial capital investments. Research indicates that cost is the major obstacle, followed by lack of knowledge about which technology to invest in. The outbreak of the pandemic exacerbated this issue as many businesses experienced decrease in capital expenditure and other losses. Therefore, high initial capital investments are likely to restrict the market's growth. Also, implementing Industry 4.0 and smart investments can be costly, requiring significant upfront expenditure on technology, training, recruitment, and infrastructure.

Software for Smart Manufacturing Market Segmentation Analysis

Application Analysis

Industrial 3D Printing/Modelling to Experience Fastest Growth driven by the Rising Demand for IoT in Advanced Automation Processes

Based on application, the market is segmented into digital twin, Enterprise Resource Planning (ERP), quality management, supply chain planning, asset performance management, MES automation and orchestration, maintenance/preventive/predictive management, 3D printing/modelling, product lifecycle management, and others.

The 3D printing/modelling application segment is estimated to register the highest CAGR over the forecast period. The 3D printing/modelling segment is expected to lead the market, contributing 18.09% globally in 2026. The growth of the segment is driven by the rising demand for IoT in advanced automation processes in the manufacturing sector. The manufacturing sector will be the primary source of demand for 3D printing and modeling, followed by the electronics and automotive industries. Moreover, the discrete automation industry utilizes 3D printing and modeling for self-optimization of production lines and customized product solutions.

- In May 2024, The BMW Group enhanced the manufacturing process at its Munich plant by incorporating customized 3D printed gripper robots. This resulted in a significant improvement in production line efficiency, especially those dedicated to assembling the BMW i4. These novice bionic grippers can handle loads of up to 110 kg and are 30% lighter than traditional methods, increasing the load capacity and reducing carbon emissions.

In 2024, the Enterprise Resource Planning (ERP) application had the largest market share of 17.7%. Embracing Industry 4.0, ERP brings transformative improvements across the manufacturing process, revolutionizing material procurement, supply chain management, production, and maintenance. By integrating ERP systems with emerging technologies such as AI and Internet of Things (IoT) manufacturers are able to further optimize their productivity by creating more intelligent operations.

To know how our report can help streamline your business, Speak to Analyst

By Enterprise Type Analysis

Large Enterprises Adopted Software for Smart Manufacturing to Streamline Processes

By enterprise type, the market has been classified into large enterprises and small and mid-sized enterprises (SMEs).

The large enterprises segment held the largest market share of 72.43% in 2026.. Smart manufacturing is helping large enterprises succeed in many ways. It includes reduced material losses, increased production capacity, improved lead times, and enhanced employee satisfaction. Examples of intelligent factories include on-demand manufacturing and virtual inventories.

- For instance, according to industry experts, by 2026, the adoption of intralogistics smart robots is expected to reach at least 75% among large enterprises. This accelerated adoption is driven by the increasing need for automated processes to reduce costs and address labor constraints on the manufacturing floor.

Furthermore, the SMEs segment is projected to showcase the highest CAGR over the forecast period. The need for higher production, quality, and sustainability serves as a significant motivation for small and medium-sized enterprises (SMEs). With more businesses, including those in the automotive, aerospace, and electronics industries, adopting smart manufacturing solutions to stay competitive in a rapidly changing global market.

By Deployment Analysis

Surging Implementation of Cloud-based Solutions to Aid Demand for Cloud Deployment

By deployment, the market has been classified into cloud and on-premises. In 2024, the cloud deployment segment held the leading position in the market and is anticipated to observe the highest growth rate over the estimated timeframe. The cloud segment is expected to lead the market, contributing 69.71% globally in 2026. The segment’s growth is anticipated to the increasing importance of cloud-based services and technologies and services in businesses worldwide. Currently, cloud solutions are serving as a critical enabler, transforming manufacturing processes into highly efficient and well-optimized operations. Industry experts suggest that investing in the cloud can be a game-changer for businesses. Studies have shown that 60% of businesses investing in the cloud outperform their competition in supply chain transformations. Additionally, over half (53%) of them credit the cloud for their improved resiliency and sustainability.

In 2024, the on-premises segment accounted for a decent market share owing to the flexibility it offers to customers as transactions are only done once. Its costs are relatively lower compared to cloud expenditures. To have complete control over data, organizations can deploy on premises-software for smart manufacturing, which can help to mitigate or reduce unauthorized access and data breaches.

By Industry Analysis

Smart Manufacturing Software Capabilities in Process Industries to Achieve Digital Stability is Likely to Propel Market Growth

Based on industry, the global market is categorized into process industry (oil & gas, power & energy, chemicals, pharmaceuticals, food & beverages, metal & mining, and others) and discrete industry (automotive, electronics and manufacturing, industrial manufacturing, aerospace and defense, and others). The process industry segment accounted for the largest market share in 2024. In the domain of process industry manufacturing, many large companies in oil refining, pharmaceuticals, metals, and bulk chemicals have achieved various levels of digital maturity. They benefited from being early adopters of technologies, such as MES and advanced process control solutions.

- According to industry experts, the chemical industry spent approximately USD 4.4 billion on digital transformation technologies in 2023. By 2031, the industry is expected to invest USD 7.4 billion in the digitalization of its plants, with Asia Pacific taking the lead.

The discrete industry segment is expected to experience the highest growth rate over the forecast timeframe, spearheaded by the aerospace & defense sector. Smart factories involved in discrete manufacturing utilize machine vision, AI, real-time data analytics, and advanced robotics to enhance various processes, including parts inventories, labor scheduling, quality assurance, and testing. The aerospace & defense industry is leveraging advanced technologies to make production smarter and more effective.

- In March 2024, GE Aerospace planned to invest USD 650 million in its supply chain and manufacturing facilities to increase production, thereby improving support for commercial and defense customers.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Software for Smart Manufacturing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the highest share of the market with a share of 39.64% in 2025. The region is a well-established hub for industrial automation due to the adoption of advanced technologies and innovative manufacturing methods. Additionally, a favorable business climate in the U.S., along with substantial support packages for manufacturing and infrastructure, the presence of major tech companies, and government initiatives, such as tax code reforms will further speed up the adoption of software for smart manufacturing in the region. The U.S. market is projected to reach USD 35.45 billion by 2026.

- In September 2023, The U.S. Department of Energy's (DOE) Advanced Materials and Manufacturing Technologies Office (AMMTO) announced fresh funding for the Clean Energy Smart Manufacturing Innovation Institute (CESMII). The institute is dedicated to smart manufacturing innovation. CESMII received an initial investment of USD 6 million, with potential additional funding coming in the next four fiscal years.

Asia Pacific is expected to experience the highest CAGR in the global market. According to the State of Smart Manufacturing Report by Plex Systems (a Rockwell Automation company), there was a 50% global acceleration in smart manufacturing adoption in 2021. These new technologies are effectively addressing serious industry challenges. In Asia Pacific, 93% of organizations consider smart manufacturing extremely important for future success, compared to 84% in North America, and 75% in Europe, the Middle East, and Africa (EMEA). The implementation of cloud-based software for smart manufacturing has become crucial for companies across the region to remain competitive and thrive. Hence, to address and improve real business outcomes, companies in the region are placing significant value on these technologies. The Japan market is projected to reach USD 7.63 billion by 2026, the China market is projected to reach USD 8.28 billion by 2026, and the India market is projected to reach USD 7.56 billion by 2026.

Moreover, Europe’s software for smart manufacturing market share is being driven by the expansion of industry 4.0 and IoT. The regional market is expected to experience healthy growth due to the increasing use of omnichannel methods. Increasing adoption of smart manufacturing, especially in the German automotive industry, is driving the growth of Europe’s market. The automotive industry is the backbone of the German economy and the country has the largest concentration of OEM factories in Europe. Currently, about 30% of these factories can be described as smart. The UK market is projected to reach USD 9.55 billion by 2026, while the Germany market is projected to reach USD 8.44 billion by 2026.

The Middle East & Africa are witnessing a rise in the use of software for smart manufacturing. Manufacturing is gaining importance in the Middle East, particularly in the UAE and Saudi Arabia, where governments have recognized it as a crucial sector for development. In the UAE, national initiatives, such as the government’s “Operation 300bn” strategy intends to boost the industrial sector’s contribution to the country’s Gross Domestic Product (GDP) to USD 81.7 billion by 2031. Additionally, countries in South America, including Brazil, Argentina, and Chile, are working on new AI rules and strategic plans to enhance the utilization of cutting-edge technologies.

KEY INDUSTRY PLAYERS

Key Players to Leverage Strategic Collaborative Initiatives to Increase Profitability

The global market is competitive, and includes various SMEs and large businesses, such as Autodesk, Siemens, Rockwell Automation, and Aegis Software, among others. Agreements, acquisitions, mergers, and contracts are some the key strategies used by these companies. In addition, organizations have a keen focus on deployment of cutting-edge technologies in software for smart manufacturing applications.

- In June 2023, Schneider Electric partnered with ArcelorMittal Nippon Steel India to offer advanced training in smart manufacturing. The partnership also involved the development of training facilities and smart labs for NAMTECH, an educational initiative by AM/NS India, to be undertaken by Schneider Electric.

List of Top Software for Smart Manufacturing Companies

- Autodesk Inc. (U.S.)

- ABB (Switzerland)

- SAP SE (Germany)

- AVEVA (Schneider Electric) (U.S.)

- Rockwell Automation (U.S.)

- Siemens AG (Germany)

- GE Vernova (GE Digital) (U.S.)

- Oracle Corporation (U.S.)

- Aegis Software (Cyprus)

- PTC (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2024 – Paperless Parts and Hexagon’s Manufacturing Intelligence division, formed a strategic partnership to accelerate the adoption of modern quoting software by progressive custom part manufacturers. Through this partnership, Paperless Parts and Hexagon aim to provide tech-forward manufacturers with the tools to drive operational efficiency, increase revenue, and utilize modern software solutions. Using these tools will also help them enhance the competitiveness and profitability of American manufacturing.

- June 2023 – Advantech, a leading industrial edge and automation solution provider, had announced a collaboration with Axiom Manufacturing Systems, a systems integration and digital manufacturing consulting firm specializing in serving midmarket customers across various applications. This collaboration aimed to support the manufacturing market in the U.S. with advanced technology, combining Advantech’s WISE software platform with Axiom's proficiency in manufacturing systems to provide end-to-end and comprehensive solutions.

- May 2023 – Rockwell Automation Inc. partnered with Autonox Robotics to expand and innovate robot mechanics, bringing together Rockwell's Kinetix motors and drives with Autonox’s robot mechanics to unlock new manufacturing possibilities.

- April 2023 – Siemens Digital Industries introduced Industrial Operations X, an open and interoperable portfolio aimed at automating and managing industrial production. This initiative is part of Siemens Xcelerator, which is an open digital business platform consisting of connected hardware, software, a marketplace, and a partner ecosystem.

- April 2023 – Stratasys, a company providing polymer 3D printing solutions, launched the GrabCAD Print Pro software. This software integrates quality assurance features from Riven, a company recently acquired by Stratasys. The advanced software streamlines the process of print preparation for Stratasys’ 3D printers, making it ideal for manufacturers looking to efficiently produce end-use parts at scale.

REPORT COVERAGE

The research report includes prominent regions across the globe to get a better knowledge of the industry. Furthermore, it provides insights into the most recent industry trends and an analysis of technologies that are being adopted quickly on a global scale. It also emphasizes on the market’s drivers and restrictions, allowing the reader to obtain a thorough understanding of the industry.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026–2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 13.63% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Application

By Enterprise Type

By Deployment

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 157.87 billion in 2025.

Fortune Business Insights says that the market is expected to reach a valuation of USD 438.73 billion by 2034.

The market is projected to record a CAGR of 13.63% during the forecast period of 2026-2034.

By application, the 3D printing/modelling segment dominated the market share in 2026.

Surging demand for software systems that reduce time and cost will aid the market growth.

Autodesk Inc., ABB, SAP SE, AVEVA (Schneider Electric), and Rockwell Automation, among others, are the top players in the market.

Asia Pacific is expected to record the highest CAGR.

The discrete industry is likely to register the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us