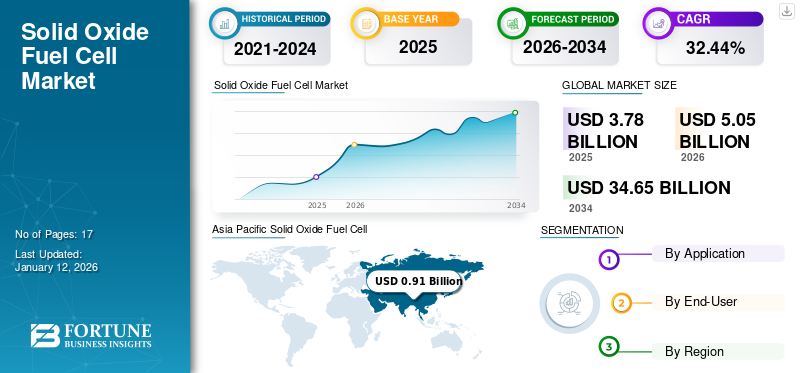

Solid Oxide Fuel Cell (SOFC) Market Size, Share & Industry Analysis, By Application (Stationary, Transport, and Portable), By End-User (Commercial, Data Centers, Military & Defence, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global Solid Oxide Fuel Cell (SOFC) market was valued at USD 3.78 billion in 2025 and is projected to be worth USD 5.05 billion in 2026 and reach USD 34.65 billion by 2034, exhibiting a CAGR of 32.44% during the forecast period. The Asia Pacific dominated the solid oxide fuel cell market with a share of 72.87% in 2025.

Solid Oxide Fuel Cells (SOFCs) are advanced electrochemical devices that convert fuel directly into electricity with exceptional efficiency, operating at high temperatures between 500-1,000°C. These fuel cells offer remarkable advantages, including high power generation efficiency, fuel flexibility across hydrogen, natural gas, and biomass, and substantially reduced carbon emissions. The SOFC market is projected to grow, driven by increasing demand for decentralized power generation, technological advancements in ceramic materials, and global investments supporting sustainable energy transitions.

Bloom Energy is one of the leading players in the market, with a major share in the global market and dominating the stationary fuel cell sector. The company has established a significant presence in key markets such as the U.S. and South Korea, with over 700 installations and strategic partnerships driving its growth.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Clean Energy Solutions and Sustainability to Fuel Market Growth

Governments and organizations worldwide are increasingly mandating and investing in clean energy technologies to combat climate change. According to the International Energy Agency (IEA), the global demand for renewable energy is expected to rise dramatically, with renewables accounting for nearly 80% of the increase in energy supply by 2030. This trend is pushing industries to adopt cleaner alternatives, such as SOFCs, which utilize hydrogen fuel and other low-carbon fuels to produce energy with minimal emissions.

Furthermore, solid oxide fuel cells have demonstrated excellent efficiency compared to traditional energy conversion systems, which makes them attractive for energy-intensive sectors. A report by the Department of Energy (U.S.) indicates that SOFCs can achieve electrical efficiencies of over 60% when using hydrogen, and total system efficiencies can exceed 85% when waste heat is utilized. Additionally, the increasing pressure to reduce carbon emissions has resulted in greater research and investment in SOFC technologies, leading to advancements that are reducing costs and improving performance.

Increasing Demand for High Fuel Efficiency Equipment Across Different Applications to Drive Market Growth

The Solid Oxide Fuel Cell (SOFC) market is experiencing a transformative phase driven largely by the growing demand for better fuel efficiency and reduced dependency on fossil fuels. Traditional energy generation methods, particularly those reliant on fossil fuels, are increasingly becoming unsustainable due to their negative environmental impacts and resource depletion. Solid oxide fuel cells offer an alternative that can operate efficiently with a variety of fuels, including hydrogen, natural gas, and renewable biofuels.

The collaborations between industry players and academic institutions have accelerated research into solid oxide fuel cell applications, particularly for renewable energy integration. For example, partnerships such as that of FuelCell Energy with the University of Connecticut formed in 2021 aim to explore how SOFC technology can support independent energy generation and complement renewable sources such as solar and wind power. This is crucial for grid stability and energy security, aligning well with globally outlined climate targets.

MARKET RESTRAINTS

High Initial Investment Costs Coupled with Availability of Other FC Systems to Hamper Market Growth

The high cost of initial manufacturing and the significant increase in operational expenditure of fuel cell systems are expected to hamper market Solid Oxide Fuel Cell (SOFC) market growth. The price of a SOFC unit also depends substantially on the area of application, such as distributed generation or combined heat and power systems, to maintain effectiveness and economic feasibility. For instance, the National Energy Technology Laboratory (NETL), a division of the U.S. Department of Energy (DoE), stated that the total operational cost for a solid oxide fuel cell unit installed in a distributed generation application reaches up to about USD 1,000 per kilowatt of electric power.

Additionally, the availability of other fuel cell options, which also hold certain advantages, can hamper the growth of the Solid Oxide Fuel Cell (SOFC) market. For instance, the proton-exchange membrane fuel cell (PEMFC) is preferred for stationary and transport applications as it has the advantage of the capability of operating at low temperatures, elimination of electrode corrosion as there is no liquid electrolyte, high efficiency, and quick start-up times.

MARKET OPPORTUNITIES

Growing Trend Toward Decentralized Energy Generation and Microgrid Systems to Generate Lucrative Opportunities

The increasing shift toward localized energy production is being fueled by the rising need for energy resilience, reliability, and autonomy, particularly in regions prone to natural disasters or grid instability. As communities and businesses look for ways to enhance their energy security, SOFC technology, which operates efficiently and can utilize a variety of fuels, presents an attractive solution for generating electricity on-site.

According to a report by the U.S. Department of Energy, microgrids are becoming increasingly popular, with many systems utilizing renewable energy sources integrated with Solid Oxide Fuel Cell (SOFC) solutions. SOFCs can play a critical role in these systems by providing a consistent and reliable energy backbone, particularly as they offer the flexibility to operate on various fuels, including natural gas, biogas, and hydrogen. As the push for integrated renewable systems continues, SOFCs are expected to bolster the reliability of decentralized energy systems over the forecasted period.

MARKET CHALLENGES

Oxygen Reduction Reaction (ORR) Challenge Efficiency of Solid Oxide Fuel Cells to Hinder Market Development

The Oxygen Reduction Reaction (ORR) represents the most critical technical challenge in Solid Oxide Fuel Cell (SOFC) development, fundamentally constraining the electrochemical performance and efficiency of the entire energy conversion system. At intermediate temperatures between 600-800°C, the ORR demonstrates extraordinarily sluggish kinetics, creating significant barriers to electron transfer and power generation capabilities.

Researchers are actively exploring sophisticated mitigation strategies to address these challenges, focusing on developing novel catalyst materials. For instance, in June 2024, a Korean research team led by Dr. Yoonseok Choi unveiled a revolutionary catalyst coating technology for Solid Oxide Fuel Cells (SOFCs), dramatically improving performance through nanoscale praseodymium oxide (PrOx) catalysts. The innovative approach achieved a remarkable peak power density of 418 mW/cm², tripling previous performance metrics and demonstrating significant potential in addressing Oxygen Reduction Reaction (ORR) challenges through an electrochemical deposition method operating at room temperature.

Download Free sample to learn more about this report.

SOLID OXIDE FUEL CELL (SOFC) MARKET TRENDS

SOFC being Opted as Efficient Option for Smart-grid Infrastructure Development is a Significant Trend

The Solid Oxide Fuel Cell (SOFC) technology is rapidly emerging as a transformative solution in smart grid infrastructure, demonstrating exceptional power generation efficiency ranging from 55-65%, significantly outperforming traditional combustion engines. Market leaders such as Bloom Energy, Sunfire, and Mitsubishi Power are driving innovation, with strategic investments targeting distributed power generation systems ranging from 0.35 to 300 kW. These advanced systems enable seamless integration into DC microgrids, offering unprecedented fuel adaptability and remarkable energy conversion capabilities that position SOFCs as critical components in next-generation energy networks.

Governments and energy companies are increasingly recognizing the potential of SOFCs to create more intelligent, efficient, and technologically sophisticated energy networks in smart-grid infrastructure. For instance, in July 2024, the U.S. Department of Energy SOFC Research Funding announced a USD 4 million investment to advance solid oxide fuel cell technology, focusing on expanding the versatility and applicability of SOFC systems for smart grid infrastructure.

IMPACT OF COVID-19

The COVID-19 pandemic severely disrupted the Solid Oxide Fuel Cell (SOFC) market, causing dramatic production slowdowns with manufacturing capacities reduced by 40-55%. Research and development investments plummeted by 35%, while venture capital funding dramatically declined. Supply chain breakdowns, component shortages, and global lockdowns led to project cancellations and significant delays in industrial and utility-scale SOFC implementations. The cumulative impact resulted in a market contraction of 18-22%, representing a substantial setback for this emerging technology sector that had been experiencing robust growth before the pandemic.

SEGMENTATION ANALYSIS

By Application Analysis

Stationary Segment Dominates Market Due to its Extensive Applications Across Residential, Commercial, and Industrial Sectors

Based on application, the market is segmented into stationary, transport, and portable.

Stationary is the dominant segment in the solid oxide fuel cell market. Due to continuous technological progress, enhanced efficiency, and substantial governmental support, the stationary segment is anticipated to uphold its dominant role during the projected timeframe. For instance, in March 2024, Nissan Motor Co. Ltd. declared that it had created a stationary, bio-ethanol-powered system capable of generating power with high efficiency. Testing has commenced at Nissan's Tochigi Plant in Japan with the objective of enhancing power generation capacity in preparation for full-scale operations starting in 2030.

Transport is the second dominating segment in the solid oxide fuel cell market. Considerable funding in research and development is propelling SOFC technologies forward, rendering them more efficient and economical for use in transportation. These advancements encompass improved energy conversion efficiencies and lowered manufacturing expenses, which boost their competitiveness relative to conventional internal combustion engines.

By End-User

To know how our report can help streamline your business, Speak to Analyst

Commercial Segment Dominates Market, Driven by Increasing Energy Demands

Based on end-user, the market is divided into commercial, data centers, military & defence, and others.

Commercial is the dominant segment in the solid oxide fuel cell market. The commercial sector faces rising energy needs due to urban expansion and industrial development. Solid oxide fuel cells offer a dependable and effective power supply that satisfies these requirements while lowering carbon emissions, making them appealing to companies pursuing sustainability.

Data centers are the second leading segment due to the high capability of SOFC to deliver dependable, effective, and eco-friendly energy solutions that satisfy the increasing energy requirements of contemporary IT infrastructure. Their scalability, waste heat recovery, and autonomy from conventional power sources establish them as a tactical option for data center managers seeking to improve operational durability and sustainability.

The expansion of the military and defense sector within the solid oxide fuel cell market is propelled by the necessity for portable, effective, silent, and adaptable power solutions that correspond with contemporary military operations and technologies. As these requirements keep changing, SOFC technology is anticipated to assume a progressively crucial role in enhancing military capabilities.

SOLID OXIDE FUEL CELL (SOFC) MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Solid Oxide Fuel Cell (SOFC) Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Ambitious Zero-Carbon Strategies, Substantial Green Investments, and Strategic Commitment to Renewable Energy Drive Market

The Asia Pacific currently holds the largest share in the global solid oxide fuel cell market, and this trend is projected to increase over the forecast period owing to rising investment across different countries in the region. Japan is anticipated to lead the industry volume in the long term due to its humongous FCEV goals and the government's favorable inclination to achieve a zero-carbon society. For instance, in December 2020, the Prime Minister of Japan confirmed that the country is planning to eradicate gasoline-powered vehicles over the next 15 years and advised utility companies to adopt renewable and hydrogen power, along with a carbon-free auto industry by the mid-2030s. The administration further stated that it is likely to produce about USD 2 trillion in progress in green investment and business to go carbon-free by 2050. The Solid oxide fuel cell market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.42 billion by 2032.

China

Technological Frontier Drives China's Market for Clean Energy Transformation using SOFC

China's Solid Oxide Fuel Cell (SOFC) market represents a rapidly emerging landscape of technological innovation driven by substantial energy infrastructure development and strategic national objectives. For instance, on September 23rd, 2024, the Chinese Academy of Sciences achieved a groundbreaking breakthrough in Solid Oxide Fuel Cell (SOFC) technology by developing a revolutionary Direct Internal Reforming SOFC (DIR-SOFC) model that successfully uses ethanol as a renewable fuel source operating at high temperatures between 600°C and 1,000°C. This innovative research enables direct internal reforming of ethanol within the fuel cell, producing hydrogen, carbon monoxide, and carbon dioxide during reformation.

North America

North America Market Growth is Driven by Innovation in Critical Infrastructure Sectors Such as Data Centers

The North America Solid Oxide Fuel Cell (SOFC) market share represents a rapidly evolving landscape of clean energy innovation, and is currently dominating the global market with a major share. The region has developed a unique ecosystem that seamlessly integrates advanced SOFC technologies with critical infrastructure, particularly in data centers, emergency backup systems, and resilient power generation. The U.S. Department of Energy's strategic investments of around USD 34 million boosted the research that positions North America at the forefront of SOFC technological development.

U.S.

U.S. Leads Market by Investing in Technological Innovation Through Strategic Government Support

The U.S. market represents a pioneering ecosystem of technological innovation, distinguished by its decentralized energy solutions and unprecedented government support through the Department of Energy. For instance, in June 2024, FuelCell Energy, Inc. and the University of Connecticut (UConn) revealed that UConn will implement FuelCell Energy's solid oxide fuel cell technology for its Innovation Partnership Building (IPB) at the UConn Tech Park located on its Storrs Campus. Such initiatives and investment projects are promoting the expansion of SOFC in the U.S. market.

Europe

Technological Innovation Driven by Collaborative Decarbonization Initiatives Expands Europe SOFC Market

Europe's Solid Oxide Fuel Cell (SOFC) market emerges as an ecosystem of technological innovation characterized by unprecedented collaborative approaches and strategic decarbonization initiatives. Countries such as Germany, the U.K., France, and Italy are projected to hold the dominating portion of the market share owing to the presence of advanced infrastructure, along with complimentary government targets. For instance, according to the Fuel Cell & Hydrogen Energy Association (FCHEA), the government of France aims to inaugurate up to 1,000 hydrogen stations (HRS), around 50,000 light-duty fuel cell vehicles, and an additional 2,000 heavy-duty FCEVs by 2028.

Rest of the World

Growing Energy Demands in Emerging Countries Drive Market in Rest of the World

The Rest of the World market emerges as a promising technological landscape characterized by gradual but strategic development across Latin America and Middle East & African regions. While currently representing a small fraction of the global SOFC market, these emerging economies demonstrate increasing potential through targeted investments in clean energy infrastructure and sustainable power generation technologies. The market's growth trajectory is driven by rising energy demands, decarbonization objectives, and a growing recognition of SOFC technology's versatility in addressing complex power generation challenges.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Competition Dynamics is Characterized by Collaborations Among Key Market Players, Offering Versatile and Advanced SOFCs

The global solid oxide fuel cell market has observed key players operating at the national and global levels, with a focus on manufacturing different components, materials, and final SOFC stacks suitable for numerous applications.

Bloom Energy stands out as a dominant player in the global SOFC market and holds around 55-65% of the market due to its strong presence in the stationary application segments. The company has a presence in the SOFC industry and a propriety technological edge over its competitors. In 2023, the company reported significant growth in installation, driven by its ability to reduce carbon emissions and improve energy efficiency by up to 60%. It has recently expanded its business in South Korea and Europe through partnerships with SK Ecoplant and EDF.

Some of the Key Companies Profiled in the Report:

- Mitsubishi Heavy Industries (Japan)

- Bloom Energy (U.S.)

- Ceres Power (U.K.)

- Bosch (Japan)

- Convion (Finland)

- Elcogen (Estonia)

- SOLIDpower (Italy)

- Sunfire GmBH (New Enerday) (Germany)

- Catator (Sweden)

- Nexceris, LLC (U.S.)

- FuelCell Energy, Inc. (U.S.)

- Suzhou Huatsing Power Energy (China)

- AVL (Austria)

- General Electric (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2024- Mitsubishi Heavy Industries (MHI) began operating a 400 kW test module of its Solid Oxide Electrolysis Cell (SOEC) technology at the Takasago Hydrogen Park in Japan. Based on Solid Oxide Fuel Cell (SOFC) technology, the SOEC offers high efficiency and operates at high pressures using MHI's proprietary tubular cell stack. The module, developed at the Nagasaki Carbon Neutral Park, will support advancements in output and capacity for future hydrogen production systems.

- February 2024- Bosch announced that it is developing a stationary solid oxide fuel cell (SOFC) system that can efficiently generate electrical energy from natural gas, biomethane, or green hydrogen. The system is designed to run on green hydrogen, making it an environmentally friendly energy solution. The product is expected to have a payback time of between five and six years, making it an attractive investment for the future.

- January 2024- Ceres Power and Delta Electronics signed a long-term license agreement and manufacturing collaboration for solid oxide electrolysis cell (SOEC) and solid oxide fuel cell (SOFC) stack production. The agreement includes revenue of USD 54.5 million to Ceres through technology transfer, development license fees, and engineering services.

- October 2023- Ceres and Alma Clean Power, which provides clean power systems for ocean industries, collaborated to work on the demonstration of a solid oxide fuel cell (SOFC) system for the marine market. Ceres will provide SOFC stacks for the development and validation of the power system, whereas Alma will develop and manufacture the 80kW system.

- June 2022- Mitsubishi Power's first hybrid solid oxide fuel cell (SOFC) in Europe began operations at the Gas- and Wärme-Institut Essen e.V. (GWI). This SOFC serves as a public demonstration of low-emissions, clean energy systems for Europe's future. Capable of operating with various fuels, including natural gas, biogas, and hydrogen, the hybrid SOFC is integrated with GWI's power and heat supply, showcasing its versatility in real-world conditions.

REPORT COVERAGE

The global solid oxide fuel cell market report delivers a detailed insight into the market. It focuses on key aspects such as leading companies and their operations offering Solid Oxide Fuel Cell (SOFC). Besides, it offers insights into market trends and technology and highlights key industry developments. In addition to the factors above, it encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 32.44% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (MW) |

|

Segmentation |

By Application

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 3.78 billion in 2025.

The market is likely to grow at a CAGR of 32.44% during the forecast period.

The commercial segment leads the market.

The Asia Pacific market size stood at USD 2.76 billion in 2025.

Increasing demand for clean energy solutions and sustainability drives the market growth.

Bloom Energy, FuelCell Energy, AVL, and others are some of the markets top players.

The global market size is expected to record a valuation of USD 34.65 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us