Squalene Market Size, Share & Industry Analysis, By Source (Animal, Plant, and Biosynthetic), By End-Use Industry (Cosmetics, Food, Pharmaceuticals, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global squalene market size was valued at USD 169.6 million in 2024. The market is projected to grow from USD 185.03 million in 2025 to USD 359.5 million by 2032, exhibiting a CAGR of 9.9% during the forecast period. Europe dominated the squalene market with a market share of 47.88% in 2024.

Squalene is a naturally occurring organic compound primarily found in shark liver oil. However, it is also present in smaller amounts in some plant sources such as olive oil, wheat germ, and amaranth seed. Chemically, it is a triterpene hydrocarbon with a molecular formula of C30H50. Recently, the product has gained attention for its potential health benefits and applications in various industries. It is commonly used in cosmetic and personal care products due to its moisturizing properties and ability to improve skin hydration and elasticity.

The COVID-19 pandemic has had a varied impact on the market, influenced by shifts in consumer behavior, supply chain disruptions, and changes in demand across different sectors. Initially, there was a decrease in demand for luxury skincare products due to economic uncertainty and reduced consumer spending on non-essential items. However, as people spent more time at home and prioritized self-care, there was a resurgence in demand for skincare products as consumers sought ways to maintain healthy skin amid stress and lifestyle changes. Moreover, squalene is used as an adjuvant in some vaccine formulations to enhance immune responses. With the development and mass production of COVID-19 vaccines, there was a surge in demand from pharmaceutical industries.

Global Squalene Market Overview

Market Size & Forecast

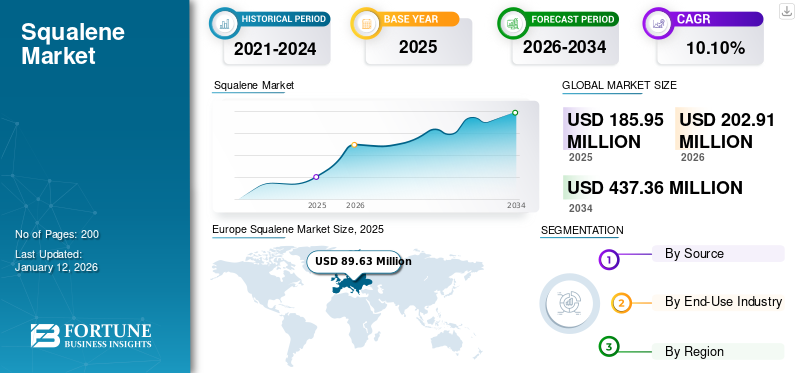

- 2025 Market Size: USD 185.95 million

- 2026 Projected Size: USD 202.91 million

- 2034 Forecast Size: USD 437.36 million

- CAGR (2026–2034): 10.10%

Market Share

- Europe led the global market with a 48.00% share in 2025

Regional Insights

- Europe (Largest Market) Market Size (2025): USD 89.63 million

- North America: Strong cosmetic sector demand

- Asia Pacific: Rapid growth driven by pharmaceutical expansion

- Latin America: Rich in natural resources for plant-based extraction

- Middle East & Africa: Increasing demand for sustainable and clean-label cosmetics

Squalene Market Trends

Increasing Demand for Sustainably Sourced Products to Foster Market Development

One of the latest trends in the market is the growing demand for sustainably sourced and plant-based products. This trend has been driven by increasing consumer awareness of environmental sustainability, animal welfare concerns, and the desire for ethically sourced ingredients in skincare and cosmetic products.

Consumers are increasingly seeking out skincare products formulated with squalene derived from plant sources such as olives, sugarcane, and amaranth seed. These plant-derived alternatives offer a cruelty-free and environmentally friendly option compared to traditionally sourced products from shark liver oil.

Moreover, many companies in the cosmetics and skincare industry are incorporating sustainability initiatives into their business models, including commitments to using sustainably sourced ingredients. This shift is driven by both consumer demand and corporate responsibility goals to reduce environmental impact.

Download Free sample to learn more about this report.

Squalene Market Growth Factors

Increasing Demand from the Skincare & Cosmetics Industry to Propel Market Growth

The cosmetics and skincare industry is a crucial driver for the market growth. Its inclusion in skincare and cosmetic formulations stems from its remarkable moisturizing properties and its ability to enhance skin hydration and elasticity. As consumers are increasingly prioritizing skincare and grooming routines, propelled by rising disposable incomes and a growing focus on personal well-being, the demand for products containing squalene is growing. Moreover, it aligns well with the prevailing trend toward natural and organic ingredients in beauty products, as it is often derived from plant sources such as olives and amaranth seeds. This natural origin appeals to health-conscious consumers seeking safer alternatives for their skincare regimen.

In addition, the anti-aging properties of the product further enhance its attractiveness in a market where anti-aging solutions remain in high demand. As skincare trends evolve and consumer preferences continue to shape product development, the demand in the cosmetics and skincare industry is poised for sustained growth.

Growing Demand as Adjuvant to Drive Market Progress

Pharmaceutical applications of the product represent a fundamental driver for the market growth, particularly with its role as an adjuvant in vaccine formulations. Its adjuvant properties have been extensively studied and utilized in vaccine development to enhance the body's immune response to antigens. Adjuvants are substances added to vaccines to stimulate a stronger and longer-lasting immune response, potentially leading to improved vaccine efficacy. The significance of the product in vaccine development has been highlighted in recent years, particularly amid the global COVID-19 pandemic. Several COVID-19 vaccines, including those developed by Pfizer-BioNTech and Novavax, utilize squalene-based adjuvants in their formulations to enhance the immune response and improve vaccine effectiveness. The surge in the demand for COVID-19 vaccines has consequently driven increased demand from pharmaceutical companies globally.

In addition, ongoing research into the immunomodulatory properties of the product holds promise for its application in novel vaccine adjuvant formulations. Studies have suggested that it may possess innate immunostimulatory effects, further enhancing its potential as a critical component in future vaccine development efforts. With advancements in vaccine technology and ongoing research into the immunological properties of the product, the pharmaceutical sector is slated to continue to drive squalene market growth.

RESTRAINING FACTORS

Environmental and Ethical Concerns Associated with Traditional Shark-Derived Products May Hamper the Market Growth

The environmental and ethical concerns associated with the product’s traditional source, shark liver oil, may act as a restraint. Historically, sharks have been a primary source of the product due to the high concentration of the product found in their livers. However, the unsustainable harvesting of sharks for extraction has alarmed about the depletion of shark populations and its impact on marine ecosystems.

The overexploitation of sharks threatens biodiversity and disrupts marine food chains and ecosystems. Sharks play a crucial role in maintaining the balance of marine ecosystems as apex predators, and their decline can have cascading effects on other species and marine habitats. Furthermore, the fishing methods used to catch sharks often result in significant bycatch of non-target species, further exacerbating environmental damage.

Squalene Market Segmentation Analysis

By Source Analysis

Animal Segment Led Owing to Effective Properties

Based on source, the squalene market is segmented into animal, plant, and biosynthetic.

The animal segment accounted for the largest market with a share of 55.42% in 2026 and is expected to remain the largest during the review period. The product obtained particularly from shark liver oil has been used for decades in various applications, including cosmetics, skincare, and pharmaceuticals. Its effectiveness in moisturizing the skin and enhancing product formulations has established it as a staple ingredient in many formulations.

On the other hand, the plant segment is expected to be the fastest-growing segment during the forecast period. With increasing awareness of the environmental impact of traditional sources of the product, such as shark liver oil, consumers and companies are seeking more sustainable alternatives. Companies are increasingly adopting sustainable sourcing practices and demonstrating corporate responsibility by sourcing ingredients from renewable and ethical sources.

By End-Use Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Cosmetics Segment Held Largest Share Owing to Increased Product Adoption in Skincare Industry

Based on end-use industry, the market is segmented into cosmetics, food, pharmaceuticals, and others.

The cosmetics segment held the largest squalene market with a share of 70.51% in 2026. The cosmetics and skincare industry's shift toward squalene reflects broader trends toward clean beauty, sustainability, and ethical sourcing. As consumer demand for natural and environmentally friendly skincare formulations continues to grow, plant-derived product is poised to remain a sought-after ingredient in the industry.

The pharmaceuticals segment held a significant share in 2024. The pharmaceutical industry is experiencing a surge in product demand owing to its versatile applications in vaccines and drug delivery systems. This has further helped research and development to harness its therapeutic potential, fueling its demand.

REGIONAL INSIGHTS

By region, the market is divided into Latin America, Asia Pacific, North America, the Middle East & Africa, and Europe.

Europe

Europe Squalene Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Europe accounted for the largest share in the global market in 2025. The market size in Europe stood at USD 89.63 million in 2025. In the region, squalene plays a significant role in various industries, particularly in cosmetics, skincare, pharmaceuticals, and functional foods. Europe has been at the forefront of sustainability initiatives, including efforts to promote sustainable sourcing. With concerns about the environmental impact of deriving products from sharks, there has been a shift toward plant-derived sources such as olive oil, wheat germ, and amaranth seed. European companies are increasingly investing in sustainable sourcing practices and certifications to meet consumer demand for ethically sourced ingredients. The UK market is projected to reach USD 13.67 billion by 2026, while the Germany market is projected to reach USD 22.78 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

Squalene is a popular ingredient in cosmetics and skincare products in North America. Its moisturizing and emollient properties make it an excellent choice for moisturizers, serums, lotions, and lip balms. Many skincare brands in North America incorporate the product into their formulations to offer hydration and nourishment to consumers. The U.S. market is projected to reach USD 35.15 billion by 2026.

Asia Pacific

The Asia Pacific is expected to show considerable growth during the forecast period due to the high demand for vaccine adjuvants. The pharmaceutical industry in the region is expanding rapidly, driven by factors such as population growth, rising healthcare expenditures, and increasing prevalence of diseases. The product is used as an adjuvant in vaccine formulations to enhance the immune response to antigens. The Japan market is projected to reach USD 5.82 billion by 2026, the China market is projected to reach USD 14.38 billion by 2026, and the India market is projected to reach USD 13 billion by 2026.

Latin America

Latin America is rich in natural resources such as olive oil, soybean oil, and palm oil. This provides opportunities for regional production and sourcing, supporting local economies and reducing dependence on imports. Companies in Latin America are increasingly investing in the extraction and production from local plant sources to meet domestic and international demand.

Middle East & Africa

The Middle East & Africa market is expected to grow considerably by the end of the forecast period. The surging demand for sustainable and plant-based products from food and cosmetics industries will drive the market growth in the region.

KEY INDUSTRY PLAYERS

Major Players to Engage in Product Development Strategies to Widen their Market Presence

Leading players such as Amyris, Sophim, Avanti Polar Lipids, and Evonik Healthcare hold a significant share of the market. In order to enhance their market presence, these players have used various strategies, including product development and are forming alliances with different companies. The companies in the market are focusing on development of sustainable products to serve customer needs and gain competitive edge in the market. Further, companies are adopting expansion strategy to increase their geographic presence.

LIST OF TOP SQUALENE COMPANIES:

- Amyris (U.S.)

- Sophim (France)

- Kishimoto Special Liver Oil Co., Ltd (Japan)

- Empresa Figueirrense de Pesca, Lda (Portugal)

- Matrix Life Science Private Limited (India)

- Croda International Plc (U.K.)

- Aasha Biochem (India)

- Evonik Healthcare (Germany)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 – Sophim, a company dedicated to producing natural ingredients for personal care and cosmetics, completed a USD 21.5 million funding round which is expected to double the company's production capacity at two its industrial sites —located in Peyruis, in the south of France, and in Almeria, Spain further accelerating its international expansion.

- October 2023 – Evonik launched a GMP-quality plant-based squalene for commercial and clinical use. This product can be used as an adjuvant component for parenteral drug delivery applications.

- May 2023 - Croda International Plc signed an exclusive license agreement with Amyris, a top synthetic biology company, for the supply of biotechnology-derived, pharmaceutical-grade squalene used in adjuvants to boost immune responses.

- December 2022 – Evonik Industries launched amaranth oil–derived squalene as an alternative to shark-liver oil-based product. This new product is used as an adjuvant to boost vaccine efficiency.

- August 2022 – Amyris, the U.S.-based biotechnology ingredients manufacturer, announced the starting of industrial-scale production of 13 molecules including squalene, in Brazil.

REPORT COVERAGE

The global market research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, products, and raw materials. Besides this, the report offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the market's growth in recent years. This report also includes historical data & forecasts revenue growth at global, regional, and country levels and analyzes the industry's latest market dynamics and opportunities.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.10% from 2026 to 2034 |

|

Unit |

Value (USD Million) and Volume (Tons) |

|

Segmentation |

By Source

|

|

By End-Use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 185.95 million in 2025 and is projected to reach USD 437.36 million by 2034.

In 2025, the Europe market size stood at USD 89.63 million.

Growing at a CAGR of 10.10%, the market is slated to exhibit steady growth during the forecast period.

By end-use industry, the cosmetics segment held the largest share in 2026.

The increasing product demand from the cosmetics sector is set to propel market growth.

Amyris, Sophim, Avanti Polar Lipids, and Evonik Healthcare are significant players in the global market.

Europe dominated the squalene market with a market share of 47.88% in 2024.

The increasing demand for sustainably sourced products is expected to foster the market development, boosting squaelene adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us