Sterilization Containers Market Size, Share & COVID-19 Impact Analysis, By Type (Perforated and Non-perforated), By Material (Aluminum, Stainless Steel, and Others), By End User (Hospitals & Specialty Clinics, Pharmaceutical & Medical Device Manufacturers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

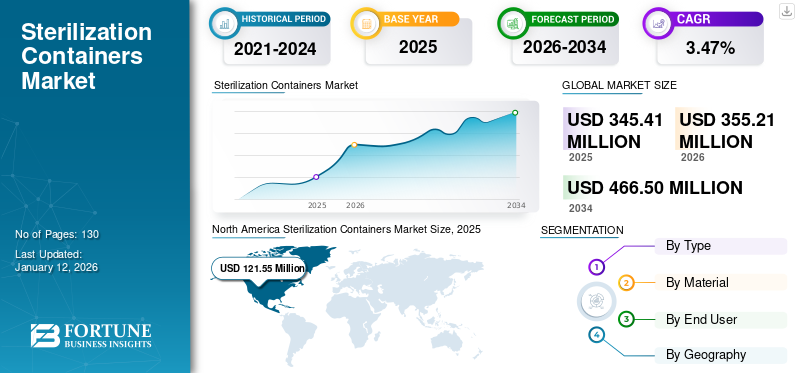

The sterilization containers market size was valued at USD 345.41 million in 2025. The market is projected to grow from USD 355.21 million in 2026 to USD 466.5 million by 2034, exhibiting a CAGR of 3.47% during 2026-2034. North America dominated the global market with a share of 35.19% in 2025.

Based on our analysis, the global sterilization containers market exhibited a decline of -10.6% in 2020 compared to 2019. These containers play a crucial role in the packaging, sterilization, transportation, and storage of medical equipment. In recent years, these types of containers have witnessed a significant demand owing to the ever-growing need for effective sterilization of medical instruments.

These products have a considerable edge over several other alternative products due to the advantages offered, which include a rigid structure eliminating the chances of package compression & damage, longer lifespan, and reusability, making it a preferred solution for the sterilization of medical instruments.

Rise in the prevalence of hospital-acquired infections and life-threatening diseases, which necessitate surgical intervention is one of the key factors driving the market growth. Additionally, factors such as increase in the number of hospitals & specialty clinics as well as surgical procedures across the globe supplemented the sterilization containers market growth. Moreover, growing awareness about hospital safety protocols and stringent regulations for sterilization of medical instruments have also contributed to market growth. In addition, development of innovative products with respect to design and material is anticipated to impact the market growth throughout the forecast period positively.

Global Sterilization Containers Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 345.41 million

- 2026 Market Size: USD 355.21 million

- 2034 Forecast Market Size: USD 466.5 million

- CAGR: 3.47% from 2026–2034

Market Share:

- North America dominated the global sterilization containers market with a 35.19% share in 2025, driven by a high volume of surgical procedures, stringent sterilization regulations, and strong healthcare infrastructure.

- By Type, perforated containers are expected to retain the largest market share throughout the forecast period due to reduced sterilization time and minimal accessory requirements, increasing their adoption in hospitals and surgical centers.

Key Country Highlights:

- Japan: Increasing healthcare expenditure, adoption of infection control technologies, and government-backed improvements in hospital sterilization practices are propelling demand for advanced sterilization containers.

- United States: Market growth is supported by a high number of surgical procedures and emergency visits, stringent CDC sterilization guidelines, and increasing demand for reusable, cost-effective, and regulatory-compliant sterilization systems in hospitals and clinics.

- China: Rapid expansion of hospitals, growing number of surgeries, and increased focus on reducing hospital-acquired infections (HAIs) are boosting the adoption of sterilization containers, especially in urban healthcare facilities.

- Europe: Growth is supported by the rising prevalence of HAIs, increased hospital admissions, and adoption of RFID-based sterile tracking systems. Key countries such as Germany and the U.K. are leading innovation in reusable medical sterilization solutions.

COVID-19 IMPACT

Cancellation and Postponement of Elective Surgeries during COVID-19 Pandemic Negatively Impacted Market Growth

The negative impact of the COVID-19 pandemic resulted in a drastic decline in surgical procedures volume, thereby decreasing the usage and demand for these products. The negative impact of the pandemic on the number of surgical procedures was demonstrated. For instance, as per an article published in October 2020, on an average, hospitals in the U.S. witnessed a decrease of around 35.0% in operating room volumes during March 2020-July 2020. Similarly, the number of emergency department visits declined by 40.0% in April 2020 compared to 2019, leading to fewer patients needing surgical interventions.

Furthermore, other factors such as imposition of widespread lockdown measures, strict travel restrictions, and supply chain disruption leading to delays in the delivery of surgical care also impacted the demand for these containers during early 2020. In addition, closing down of cosmetic surgery clinics and offices leading to the cancellation of elective procedures also impacted the market growth during the pandemic.

- For instance, according to the American Society of Plastic Surgeons, 14% decline was observed in cosmetic surgical procedures as compared to 2019.

However, in 2021, the market regained its pace shortly after the first global surge, leading to a significant revenue generation. Higher vaccination coverage across the globe, implementation of rigorous protocols for infection prevention, and reopening of surgery departments in hospitals are some of the factors that supported the market in reaching the pre-pandemic level. For instance, an article published in December 2021 stated that since late 2020, hospitals have ramped up their surgical operations with improved safety protocols. Thus, the market witnessed a growth of 10.6% in 2021 and returned to its pre-pandemic growth in 2022.

LATEST TRENDS

Download Free sample to learn more about this report.

Increasing Burden of Medical Wastes to Propel Market Growth

The increasing number of surgical procedures worldwide is responsible for the rising burden of medical waste associated with sterilization such as disposable wraps, plastics, and other associated hospital wastes. For instance, according to a research study published in MDPI in February 2021, up to 90.0% of waste generated from operating rooms is not sorted properly and sent for costly and unneeded hazardous waste processing. An article published by DePuy Synthes stated that one facility that switched to recycling rather than disposing of the sterilization wraps demonstrated cost-saving of USD 544.0 in one year.

The same article also further stated that the potential cost saving of a hospital from the adoption of reusable sterilization containers totals USD 10,721.0 in five years, and the savings might increase to USD 21,358.0 after 10 years. These statistics support the end users’ shifting focus from sterilization wraps/pouches to these products. In recent years, the usage of these products over sterilization wraps and pouches has been preferred. Such increasing inclination of end users toward these containers is likely to positively influence the market growth in developed markets.

STERILIZATION CONTAINERS MARKET GROWTH FACTORS

Rising Incidences of Hospital Acquired Infections (HAIs) and Surgical Procedures to Drive Market Growth

The increasing number of chronic and infectious disease patients is leading to a rise in the number of hospital admissions across the globe. This increase in the number of hospital admissions is directly proportional to the rising incidence of hospital-acquired infections. Serious issues surrounding the usage of unsterile equipment highlight the importance of effective infection control in hospitals.

- For instance, according to a report published by the Centers for Disease Control and Prevention (CDC) in November 2022, there was a significant rise in Hospital Acquired Infections (HAIs) among patients between 2020 and 2021.

- The report also depicted a rise in Surgical Sites Infections (SSI) following colon surgeries such as Methicillin-resistant Staphylococcus aureus (MRSA) by 14.0%, Ventilator-Associated Events (VAE) by 12.0%, Central Line-Associated Bloodstream Infection (CLABSI) by 7.0%, and catheter-associated urinary tract Infection (CAUTI) by 5.0% between 2020 and 2021.

Such statistics indicate the need for effective sterilization of medical instruments used during surgeries. Due to various advantages offered, the demand for these products is increasing among hospitals, driving the market growth.

Furthermore, the number of surgical procedures across the globe is also increasing every year. For instance, according to an article published by the National Library of Medicine (NLM) in July 2020, around 310.0 million major surgeries are performed each year globally, with an estimated 40.0-50.0 million procedures occurring in the U.S., and an estimated 20.0 million occurring in Europe. This substantial volume of surgeries implies the repetitive use of various surgical instruments, thereby increasing the usage of these products.

Increasing Adoption of Sterilization Containers to Drive the Market Growth

Owing to increasing adoption of these products amongst end users, the key operating players are focusing on developing new, advanced products to boost the market growth.

- For instance, in March 2022, Aesculap, Inc., a B. Braun company, introduced the AESCULAP Aicon Sterile Container System. This product aims to aid in the streamlining of processes and reduce the possibility of wet sets. In addition, it also offers Enhanced Drying System (EDS), resulting in up to 47.0% less dry time, increased sterile aseptic area, and 100% container and basket synchronization.

Furthermore, key market players are adopting strategies such as product launches, mergers & acquisitions, joint ventures, and partnerships to develop and increase the sales of these containers in various hospitals and clinics globally.

- For instance, STERIS announced the complete acquisition of Cantel Medical, a company engaged in providing infection prevention products and services. The acquisition extended STERIS’ product and service offerings in endoscopy, dental, dialysis, sterilization, and life sciences.

Such initiatives by operating players are anticipated to drive the market during the forecast period.

RESTRAINING FACTORS

Usage of Alternative Sterilization Products Over Sterilization Containers Expected to Hinder Market Growth

The need for highly sterilized equipment is increasing with the surge in the number of surgical procedures. Thus, to fulfill this demand, end users are using comparatively less expensive alternative sterilization products such as wraps and pouches. As the initial cost of these alternative products is less, the end users tend to use these products. This is expected to impede the growth of the market over the forecast period.

In addition, the initial price of sterilization wraps is comparatively affordable to smaller medical facilities compared to these products. Despite the one-time usage instruction of plastic pouches, studies showed that the effects were the same even after the reuse of the pouches for sterilization. For instance, in March 2020, a study was conducted to check the reuse of sterilization pouches. The research was aimed to discover the level of microbial contamination after the reuse of plastic/paper sterilization pouches in a dental clinic. These pouches were stored in a closed environment for around six months. The results stated that under careful inspection and monitoring, these plastic/paper pouches can be reused for sterilization purposes. Such studies may contribute to the continued usage of sterilization wraps in the forecast period.

SEGMENTATION

By Type Analysis

Perforated Containers Segment to Dominate Market Owing to Increased Adoption in 2021

Based on type, the sterilization containers market is bifurcated into perforated and non-perforated.

The perforated segment captured the largest global market share in 2021 and is anticipated to exhibit a significant CAGR during the forecast period. The dominance of this segment is associated with the advantages offered by these containers, such as the requirement of relatively lesser time for sterilization and limited requirement of accessories leading to high adoption. The perforated segment is projected to dominate the market with a share of 74.67% in 2026.

The non-perforated segment is likely to witness comparatively lesser growth as compared to perforated containers over the forecast period. However, some of the factors contributing to the market growth include characteristics offered by the non-perforated containers such as filter technology, mechanical reprocessing, shorter drying time, and no filter change for a lifetime.

By Material Analysis

To know how our report can help streamline your business, Speak to Analyst

Aluminum Segment Held Major Market Share in 2021 Due to Various Advantages

Based on material, the market is classified into aluminum, stainless steel, and others.

The aluminum segment accounted for a considerable market share in 2021. Key factors such as advantages offered by anodized aluminum material, such as versatility, durability, excellent drying properties, and ease of maintenance, have primarily contributed to the dominance of the segment. Additionally, the long-lasting nature of aluminum containers that can be used up to 10 years and reduction in the total usage cost as compared to sterilized wraps and pouches are also driving the segment growth. The aluminium segment will account for 49.13% market share in 2026.

On the other hand, the stainless steel segment is anticipated to witness fastest growth throughout the forecast period. High adoption of stainless steel products is mainly due to the properties they exhibit. It includes ease of sterilization as compared to plastic trays, smooth surface of containers making contaminants difficult to adhere to the surface, resistance to chemical-based sterilization, and ability to withstand high temperature and pressure.

By End User Analysis

Large Surgical Procedure Volumes in Hospitals & Specialty Clinics to Drive Segmental Expansion

In terms of end user, the market is categorized into hospitals & specialty clinics, pharmaceutical & medical device manufacturers, and others.

The hospitals & specialty clinics segment captured the highest share of the global market in 2021. The increasing number of surgical procedures, emergency department visits, high prevalence of HAIs, and growing patient population are some of the factors driving the segment’s growth. The hospital & specialty clinic segment is expected to account for 61.23% of the market in 2026.

- For instance, as per the Centers for Disease Control (CDC), each year, an estimated 1.7 million infections and 99,000 associated deaths occur due to HAI. Out of all the hospital-acquired infection patients, 32% are diagnosed with urinary tract infections.

The pharmaceuticals & medical device manufacturers segment accounted for a considerable market share in 2021. This can be attributed to the rising need for maintaining the sterilization of the medical equipment during transportation to medical facilities. Other end users include Outpatient Departments (OPDs) and ambulatory surgical Centers (ASCs).

REGIONAL INSIGHTS

Based on geography, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East Africa.

North America

North America Sterilization Containers Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The North America market size was valued at USD 109.3 million in 2021. This region dominated the global sterilization containers market share in 2021 and is expected to continue its dominance throughout the forecast period. The market growth across the region is primarily due to the increasing number of surgical procedures. Furthermore, other supplemental factors such as large number of hospitals, implementation of favorable government initiatives, stringent regulations for sterilization & disinfection, and presence of advanced healthcare infrastructure have also contributed to the regional market growth. The U.S. market is estimated to reach USD 117.95 billion by 2026.

Europe

In Europe, the market is projected to grow with a significant CAGR due to factors such as increasing number of key players operating in the Europe market coupled with the growing adoption of the containers in medical facilities are likely to contribute to the growth of the market in the region. The UK market is expected to reach USD 18.51 billion by 2026, while the Germany market is anticipated to reach USD 24.38 billion by 2026.

Asia Pacific

The Asia Pacific market is anticipated to witness the fastest growth during the forecast period. This growth is driven by the increase in healthcare expenditure and enhancement of healthcare policies across different countries, leading to improved product adoption. Also, the higher incidence of hospital-acquired infections and supportive government measures would also propel the market growth in the region during the forecast period. The Japan market is forecast to reach USD 21.95 billion by 2026, the China market is set to reach USD 27.03 billion by 2026, and the India market is likely to reach USD 15.85 billion by 2026.

Rest of The World

The markets in Latin America and the Middle East & Africa regions are expected to expand at a moderate CAGR compared to other regions during the forecast period. However, the market is anticipated to witness future growth prospects. This growth is attributable to factors such as high number of hospital-acquired infections and increasing awareness regarding sterilization of medical instruments.

KEY INDUSTRY PLAYERS

Diverse Portfolio of B. Braun SE and KLS Martin Group Elevated these Companies to Peak Position in 2021

In terms of the competitive scenario, the market depicts a highly fragmented structure with the presence of several well-established, small, and mid-sized players operating in the market. No single organization influences singularly to determine the market's growth trajectory. Some global market characteristics include the availability of several product variations through multiple manufacturers and a strong product portfolio to fulfill end user’s specific demands.

However, some of the well-established players in the market include B. Braun SE, STERIS, Symmetry Surgical Inc., Integra LifeSciences, and KLS Martin Group. The broad product offerings and strong distribution network across the globe make B. Braun Melsungen AG (B. Braun SE) one of the leading companies opening in this market. For instance, STERIS has a broad product portfolio in this market, including the Amsco Sterilization Container System.

Furthermore, the other leading players are undertaking various strategic initiatives to maintain their market presence. For instance, in October 2019, KLS Martin Group announced a new cooperation with the Danish innovators, Caretag Surgical, at the World Federation for Hospital Sterilization Sciences (WFHSS) conference. The cooperation brings Radio Frequency Identification (RFID) technology to surgical assets, such as surgical instruments or sterilization containers, which serve hospitals globally. Some players operating in the market include Case Medical, Jewel Precision, Symmetry Surgical Inc., Ace Osteomedica, and others.

LIST OF KEY COMPANIES PROFILED IN STERILIZATION CONTAINERS MARKET:

- BD (Becton, Dickinson and Company) (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- STERIS (U.K.)

- Integra LifeSciences (U.S.)

- KLS Martin Group (Germany)

- Gpcmedical.com (India)

- MELAG Medizintechnik GmbH & Co. KG (Germany)

- B. Braun SE (Germany)

- SHARPLINE Surgical Technologies GmbH (Germany)

- Medline Industries, LP (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2022 - Medline Industries, LP announced its partnership with the Nebraska, U.S.-based Bryan Health to simplify supply chain operations of essential medical supplies, including sterilization containers.

- October 2022 – Case Medical received the FDA 510k approval for its SteriTite Universal Container System. This system is used to enclose instrument sets & medical devices during sterilization, transport, and storage.

- September 2022 - Medline Industries, LP collaborated with Inspire Specialty Hospital to offer clinical education and products such as sterilization containers through the Medline Post-Acute Care Infection Prevention Program.

- October 2020 – Aesculap Inc. partnered with Ascendco Health (U.S.) to offer solutions for perioperative workflows by the latter company’s proprietary technology, providing an innovative solution for modernizing surgical operations.

- October 2019 - KLS Martin Group announced a new cooperation with the Danish innovators Caretag Surgical to bring RFID technology to surgical assets including sterilization containers.

REPORT COVERAGE

The sterilization containers market report provides an in-depth analysis of the market. It focuses on market segments such as type, material, and end user. Besides this, it offers insights related to the market overview, the impact of COVID-19, market trends, and pricing analysis in key regions. Additionally, the report consists of several factors that contributes to the global market growth. The report also provides the competitive landscape of the global market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Type

|

|

By Material

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global sterilization containers market size was valued at USD 345.41 million in 2025 and is projected to reach USD 466.5 million by 2034, growing at a CAGR of 3.47% during the forecast period.

The market is projected to grow at a CAGR of 3.47% during the forecast period (2026-2034).

Aluminum dominates the materials segment in the sterilization containers market due to its durability, excellent drying properties, and long lifespan, making it more cost-effective compared to disposable sterilization wraps.

By type, the perforated segment will lead the market.

The rising incidence of hospital-acquired infections and surgical procedures, increasing focus on new developments by key players owing to the high adoption of these products, and growing demand for cost-effective sterilization products are some factors driving the market.

STERIS, Symmetry Surgical Inc., B Braun SE, and Integra Lifesciences are the major players in the market.

North America dominated the market with a share of 35.19% in 2025.

The surge in demand for effective sterilization of medical instruments, increasing number of surgical procedures, and a considerable patient population base requiring surgeries are some of the factors expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us