Subperiosteal Dental Implants Market Size, Share & Industry Analysis, By Material (Titanium, Zirconium, and Others), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

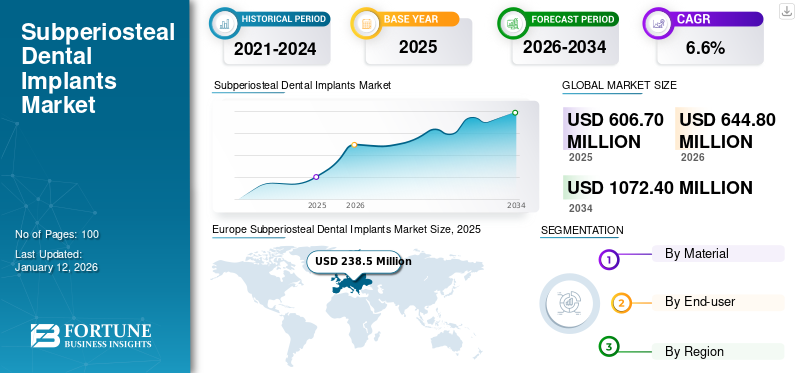

The global subperiosteal dental implants market size was valued at USD 606.7 million in 2025 and is projected to grow from USD 644.8 million in 2026 to USD 1072.4 million by 2034, exhibiting a CAGR of 6.6% during the forecast period. Europe dominated the subperiosteal dental implants market with a market share of 39.3% in 2025.

Subperiosteal dental implants are custom-made to fit the contours of the individual’s jawbone and placed on top of the jawbone under the periosteum. Subperiosteal dental implants are typically used when the natural bone is insufficient for endosteal dental implants. Severe bone resorption caused by advanced periodontal disease and trauma often requires the use of these implants as treatment. These implants are considered stable and durable for patients with severe bone loss as they are anchored to the jawbone with some posts to increase stability for teeth replacements. This is particularly beneficial for elderly patients with severe jawbone atrophy, providing an effective and secure treatment choice.

Subperiosteal implants, which are based on traditional techniques, are known for their technical complexity and associated risks due to challenging placement and a high rate of complications, limiting their widespread adoption. Currently, subperiosteal implants have been revolutionized with advancements in procedure and modern technologies. These improvements offer a practical and expedited way to achieve initial implant stability, even in individuals with bone loss who do not require extensive bone grafting. This advancement allows for immediate loading of the prosthetic structure through the direct contact between the implant and cortical bone, along with the use of locking screws for potential surgical adjustments.

The market is expected to grow in the coming years. This growth can be attributed to implant technology advancements, increasing dental health awareness, and a growing aging population. Additionally, the rising adoption of digital dentistry and computer-aided design/computer-aided manufacturing (CAD/CAM) technology is expected to further drive the market growth.

The market in 2020 was adversely affected by COVID-19, leading to a decrease in restorative procedures performed globally. However, in 2021, there was an increase in patient visits to dental clinics and hospitals as government restrictions were lifted. The market has now rebounded to pre-pandemic levels in 2022, with expectations of steady growth in the future.

Global Subperiosteal Dental Implants Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 606.7 million

- 2026 Market Size: USD 644.8 million

- 2034 Forecast Market Size: USD 1072.4 million

- CAGR: 6.6% from 2026–2034

Market Share:

- Europe dominated the subperiosteal dental implants market with a 39.3% share in 2025, driven by advancements in manufacturing, established healthcare systems, and a strong presence of key implant manufacturers.

- By material, Titanium implants are expected to retain the largest market share owing to their superior biocompatibility, mechanical stability, and suitability for 3D additive manufacturing.

Key Country Highlights:

- United States: Rising prevalence of periodontal diseases, coupled with rapid adoption of customized dental implants and a robust network of solo practitioners, is driving demand for subperiosteal implants.

- Europe: The market benefits from established healthcare infrastructure, growing adoption of digital dentistry, and advancements in subperiosteal implant manufacturing by regional players.

- China: Increasing focus on improving dental healthcare access, coupled with a growing elderly population prone to alveolar bone loss, is enhancing demand for subperiosteal implants.

- Japan: High adoption of advanced dental technologies, combined with rising awareness regarding dental aesthetics among an aging population, is supporting market growth for subperiosteal implants.

Subperiosteal Dental Implants Market Trends

Increasing Adoption of 3D Printing to Augment the Market Growth

The increasing adoption of direct metal laser sintering (DMLS) for 3D printing of subperiosteal dental implants is expected to augment market growth significantly. The key advantage of DMLS for 3D printing these implants lies in its ability to offer highly customized implants tailored to individual anatomy. It is an additive manufacturing technique that uses a high-power laser to melt metallic powders together, which allows the fabrication of complex objects with high precision and customization.

Furthermore, DMLS enables the fabrication of implants with intricate surface designs and features, such as porous structures, textured surfaces, and bioactive coatings, that can promote osseointegration and enhance the long-term success of the implants for patients with severe jaw bone degeneration and atrophic ridges. This customization can result in better fit, function, and aesthetics of the implants, improving patient outcomes.

- For instance, a pilot study conducted in Romania between October 2021 and February 2022, reported that custom-made DMLS titanium subperiosteal implants reduce complications associated with these implants.

Download Free sample to learn more about this report.

Subperiosteal Dental Implants Market Growth Factors

Increasing Prevalence of Periodontal Disease and Alveolar Bone Loss to Boost Market Development

Periodontal disease, or periodontitis, is a progressive inflammatory condition affecting the gums and surrounding bones. Advanced periodontal disease leads to irreversible gum recession and eventual destruction of the bone around the teeth. As the prevalence of advanced periodontal disease and bone loss continues to rise, the demand for subperiosteal implants is expected to increase in the coming years.

- According to data updated by WHO in March 2023, it is estimated that severe periodontal diseases impact approximately 19% of adults globally, totaling over 1 million cases globally.

Additionally, advancements in digital dentistry and materials used in subperiosteal implants have made them more durable, safe, and functional. These factors and the growing awareness among patients and dentists about the benefits and durability of subperiosteal implants, are also expected to drive market growth.

Technological Advancements and Use of Digital Dentistry to Propel the Market Development

CAD/CAM (Computer-Aided Design and Computer-Aided Manufacturing) and Cone Beam Computed Tomography (CBCT) technology enhance the implant manufacturing process by improving precision, efficiency, and customization. Furthermore, CAD/CAM technology streamlines the production process, reducing the time required for subperiosteal dental implant manufacturing.

- For instance, an article published in Clinical Case Reports in November 2023 stated that the concept of subperiosteal implants has been reemerging in the past decade. The resurgence has been significantly influenced by the utilization of computed tomography (CT) and cone beam computed tomography (CBCT) scans, which have become integral techniques in this field.

Additionally, with these technologies, key players are introducing new designs for subperiosteal dental implants, increasing implant survival rates and increasing the utilization of these implants for severe alveolar bone loss patients.

RESTRAINING FACTORS

Complexity and High Costs of Subperiosteal Dental Implants to Impede the Market Development

These implants are custom-made to fit beneath the gum and onto the jawbone, making them an alternative for patients with insufficient bone volume for traditional implants. However, these implants are 3-4 times more expensive than the endosteal implants.

This implantation requires more intricate oral surgery, especially for complex cases that require extensive custom fabrication. These implants increase the chances of infection, bone loss, and implant failure. Based on the amount of bone present in the jaw, the condition of the surrounding gum tissue, and any other oral health issues further increases the complexity of these procedures.

Additionally, newer, less invasive implant treatments have become more popular and widely available, offering alternative solutions with better predictability and effectiveness. These factors are anticipated to hamper the subperiosteal dental implants market growth.

- For instance, Deserts Hill Dental Care stated that advancements in bone grafting procedures have made endosteal implants possible for patients with insufficient jawbone density, reducing the necessity for subperiosteal implants.

Subperiosteal Dental Implants Market Segmentation Analysis

By Material Analysis

Titanium Segment Dominated the Market due to Excellent Biocompatibility and Stability of Titanium Implants

Based on material, the subperiosteal dental implants market is segmented into titanium, zirconium, and others.

The titanium segment held the highest subperiosteal dental implants market share of 65.54% in 2026 due to its excellent biocompatibility and success rates. Extensive research has shown titanium implants integrate well with the surrounding bone, resulting in long-term stability and functionality. As a result, the adoption of these implants is constantly increasing globally. Titanium is the highly preferred material for additive manufacturing, 3D printing enabling the production of porous structures that mimic human bone properties, enhancing mechanical properties, nutrient flow, and blood vessel growth for improved bone integration and attachment.

- For instance, an article published in Biomimetics in January 2024 stated that laser-sintering titanium implants are a viable treatment choice for restoring edentulous patients with atrophic jaws in cases where traditional dental implants are not feasible.

The zirconium segment is anticipated to grow with considerable CAGR. The rising adoption of zirconium due to its mechanical properties is driving the segment growth.

The others segment, including materials such as cobalt-chromium, the growth is attributed to its higher strength and corrosion resistance. These implants need support for dental prosthetics patients with a smaller jawbone structure, thereby anticipated to witness growth in the global market.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices Dominated Due to Large Practitioners Using This Mode

Based on end-user, the market is divided into solo practices, DSO/group practices, and others.

The solo practices dominated the market share of 60.89% in 2026. Globally, solo practices accounted for most dental procedures due to the high prevalence of solo practitioners. Moreover, the preferences for personalized care among patients drive the demand for customized implants, contributing to the growth of the market.

- For instance, the data from the American Dental Association (ADA) Health Policy Institute (HPI) indicates that in 2019, about 50.3% of all dentists were in solo practice. Such a high prevalence of solo practitioners is anticipated to drive the segment growth.

Conversely, the DSO/group practices segment is expected to experience the highest CAGR as a result of the increasing DSO affiliation in developed countries. Additionally, collaborations between dental labs and DSO are expected to boost the market share of the segment in the coming years.

In 2024, the others segment held a significant share in the market. The others segment includes dental hospitals, community healthcare centers. The segment growth is attributed to increased accessibility to specialized dental care, catering to increasing patient demand for innovative implant solutions.

REGIONAL INSIGHTS

Based on region, the market for subperiosteal dental implants is divided into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

Europe

Europe Subperiosteal Dental Implants Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Europe led the market in 2025, with a revenue of USD 238.5 million, and is expected to continue its dominance in the forecast period due to the well-established healthcare systems. Moreover, the presence of major players such as Avinent Implant System S.L.U, and advancements in subperiosteal manufacturing in the region is anticipated to drive market growth. The UK market is projected to reach USD 13.4 million by 2026, while the Germany market is projected to reach USD 59 million by 2026.

North America

North America held the second largest share in the market, driven by a high prevalence of dental disorders such as periodontal disease, and advancements in dental procedures. The region’s faster adoption of customized and patient specific dental implants is anticipated to increase the demand for new-generation implants during the forecast period. The U.S. market is projected to reach USD 180.7 million by 2026.

Asia Pacific

The Asia Pacific region is projected to experience significant market growth due to the increased dental implant adoption, driven by factors such as periodontitis and alveolar bone loss. The aging population in many countries in the Asia Pacific region is resulting in a higher incidence of tooth loss, creating a strong demand for these implants. As per the study published in BMC Oral Health in November 2019 stated that the Asian race group is highly prone to mean alveolar bone loss. The Japan market is projected to reach USD 12.5 million by 2026, the China market is projected to reach USD 31.9 million by 2026, and the India market is projected to reach USD 8.7 million by 2026.

The subperiosteal dental implants market is expected to experience considerable growth in both the Middle East and Latin America regions in the coming years. In Latin America, countries such as Brazil, Mexico, and Argentina are experiencing a rise in the number of dental clinics and hospitals offering advanced dental implant procedures, including subperiosteal implants. The growing geriatric population and rising prevalence of dental disorders are also contributing to the market growth in this region.

Similarly, the Middle East & Africa countries are witnessing a surge in dental tourism for dental implants and procedures. The increasing disposable income and awareness about oral health among the population are also driving the growth of the subperiosteal dental implants market in this region.

KEY INDUSTRY PLAYERS

Leading Players are Collaborating to Develop Advanced Implant Design

In terms of the competitive landscape, the subperiosteal dental implant industry market has very few players across the globe. The Avinent Implant System S.L.U, AB Dental Devices Ltd, and BoneEasy held the major share of the market. These players are focusing on launching innovative design concepts to enhance implant survival rate. Additionally, constant R&D initiatives, along with collaboration for 3D manufacturing, aim to develop more advanced and effective implant designs, are anticipated to be a driving factor for the market growth of these players.

Moreover, regional players have a significant subperiosteal dental implants market share. The increasing number of regional players in the 3D additive manufacturing of titanium implants is potentially transforming dentists to rely on locally produced these implants. Moreover, collaboration between regional players and dental practitioners are leading to the production of highly customized dental implants for the subperiosteal procedures is expected to drive the market further in the near future.

LIST OF TOP SUBPERIOSTEAL DENTAL IMPLANTS COMPANIES:

- Avinent Implant System S.L.U (Spain)

- BoneEasy (Portugal)

- AB Dental Devices Ltd (U.S.)

- Dutton Dental Concepts, Inc. (U.S.)

- Marver Med (U.S.)

- Panthera Dental (Canada)

- INCREDIBLE AM PVT LTD. (India)

- BonashMedical (Iran)

KEY INDUSTRY DEVELOPMENTS

- March 2024 - BoneEasy launched tailored implant including tailed subperiosteal implants. The implant uses 3D software to develop a model for personalized implant manufacturing

- May 2023 – Avinent Implant System S.L.U organized the consensus day on customized subperiosteal implants with industry experts from the field of maxillofacial surgery and dentistry.

- May 2022 - AB Dental Devices Ltd collaborated with Trucare Group to launch its dental business in the UAE. AB dental offers implants systems including subperiosteal dental implants.

- April 2022: BoneEasy launched Implantize Compact, a new concept of subperiosteal implant with perforations in the implant plate to allow passage of fibers for the soft tissue integration.

- September 2018 - Panthera Dental launched Panthera Implant division to offer customized implants. The division offers CAD/CAM Subperiosteal implants and personalized CMF solutions.

REPORT COVERAGE

An Infographic Representation of Subperiosteal Dental Implants Market

To get information on various segments, share your queries with us

The global subperiosteal dental implants market report provides an in-depth industry analysis. The report focuses on company profiles, market segments, material, and end-user. Besides, it offers the global subperiosteal dental implants industries forecast in relation to the current market dynamics, the impact of COVID-19, and the latest market trends. Furthermore, the report provides regional insights, key drivers, competitive landscape, and the factors affecting the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.6% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Material

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 644.8 million in 2026 and is projected to reach USD 1072.4 million by 2034.

In 2025, the market value stood at USD 238.5 million.

The market will exhibit a steady CAGR of 6.6% during the forecast period of 2026-2034.

By material, the titanium segment led the market in 2026.

Rising prevalence of periodontal disease and technological advancements are the key factors driving market growth.

AVINENT Science and Technology, AB Dental Devices Ltd, and BoneEasy are the major players in the market.

Europe dominated the market in 2026.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic