Subsea Trencher Market Size, Share & Industry Analysis, By Type (Jet and Mechanical), By Application (Pipeline Burial, Cable Burial, and Umbilical Burial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

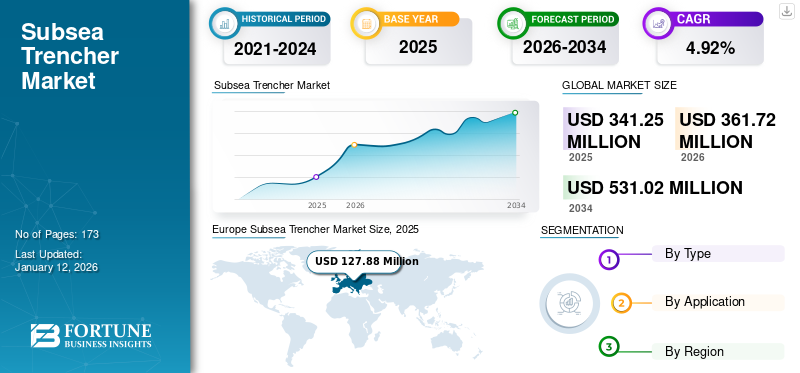

The global subsea trencher market size was USD 341.25 million in 2025. The market is projected to grow from USD 361.72 million in 2026 to USD 531.02 million by 2036 at a CAGR of 4.92% during the forecast period. Europe dominated the subsea trencher industry with a market share of 37.48% 2025. The Subsea Trencher market in the U.S. is projected to grow significantly, reaching an estimated value of USD 87.24 million by 2032, driven by the growing infrastructure development in offshore areas supported by rising consumption of oil & gas products.

Subsea trenchers are used to dig trenches on the seabed to ease the safe burial of subsea pipelines, cables, and umbilicals. The growing demand for fast and secure connections will boost the subsea trencher market. Moreover, activities and operations such as exploration, cable networking, quantum looping study, and advanced infrastructure engagements are crucial factors to this expansion.

The remarkable development in offshore oil & gas activities worldwide has led to the need for burial of subsea pipelines. Revolution in fields, such as renewable energy, has led to the development of offshore wind potential, thereby increasing the demand for offshore cable burial. The growth of the telecommunication sector has further propelled offshore cable installations to facilitate digitalization across the world. Subsea trenching machines or marine trenchers dig trenches on the seabed to facilitate the burial of these pipelines, cables, and umbilicals. The burial of these pipelines, cables, and umbilicals prevents them from getting damaged due to various activities such as fishing, and anchorage of ships.

The COVID-19 pandemic had a critical effect on every sector, with businesses undergoing substantial losses due to the imposition of strict rules, such as countrywide lockdowns to limit the spread of the virus. Consequently, the outbreak of the virus altered the demand for marine trenchers. As the market is majorly dependent on offshore activities, the collapse in the offshore oil and gas industry, also impacted investments in the market. The surplus supply and low demand led leading oil and gas companies to temporarily stop offshore production activities, which in turn triggered a surge in oil prices. This has directly impacted the demand for subsea pipeline installations and reduced the demand for subsea cable, including the use of the equipment.

Subsea Trencher Market Trends

Rising Adoption of Clean Energy Along With Stringent Emission Norms to Increase Subsea Cable Burial

Various national governments and organizations have set vast targets to deploy green energy technologies such as solar, wind, and others to diminish fossil fuel dependency. The devotion of various nations to exceed these objectives will likely provide a great opportunity for the market. The lack of land space to set up wind turbines and solar farms has increasingly led to the growth of offshore technologies. According to the IRENA, the offshore wind electricity capacity of the world has risen from 28,355 MW in 2019 to 34,367 MW in 2020, portraying a 21.21% year-on-year growth. Moreover, solar PV has been installed on water instead of land in recent years, and it is called floating PV. The floating PV system is fixed on floating platforms, anchored in water bodies, and is connected by subsea power cables.

The offshore wind turbines are connected to power cables that need to be buried in the seafloors to transmit power from offshore wind turbines to onshore users. Further, subsea umbilical cables, required for constant maintenance of wind turbines, also need to be buried in the seabed for protection against hazards. The requirement for burying power cables and umbilical cables on seabeds has risen due to growing offshore wind energy technologies. This trend is expected to continue growing rapidly, making marine trenchers imperative to every project.

Download Free sample to learn more about this report.

Subsea Trencher Market Growth Factors

Cumulative Offshore Operations for Oil & Gas Production to Enhance Demand for Subsea Trenchers

As the number of offshore projects increases, operations such as mining, exploration, and production is growing rapidly. As subsea activity increases, the demand for subsea wells is likely to increase in the coming years. In January 2024, Norwegian ocean service provider DeepOcean completed the burial of a fuel support pipe in the Gulf of Mexico on behalf of Genesis Energy. This was achieved by bringing its jet dredging system to the U.S. market. DeepOcean's UT-1 excavation system was used to bury a part of High Island's A5 fuel line. With specified six-inch pipeline sections, UT-1 met the burial requirements, which included a three-mile section extending to Sabine Pass that required pipeline installation at a depth of 10 feet. The excavation was carried out by the underwater construction vessel Volantis, marking its first work in U.S. waters.

Mounting Internet Usage across Globe to Enhance Market Growth

With the rapid growth of internet usage, the telecom sector has witnessed a boom over the last two decades. According to research by the International Telecommunication Union (ITU) and The Nielsen Company, around 65.6% of the total world population were active internet users till March 31, 2021. Since 2000, internet penetration rate has increased by an impressive 1,331.9%.

The increasing internet usage has made it necessary to connect continents by submarine cables. These fiber-optic cables transmit signals across the world, making it possible for users to use the internet and websites of various regions. Submarine cables are laid and buried along ocean seabeds to connect continents.

RESTRAINING FACTORS

High Initial and Operating Cost of the Equipment to Hinder Growth

Subsea trenchers are used to make trenches on the seabed for the installation of underwater pipes, cables, and umbilicals. These trenchers require complex technologies to work at high underwater pressures and have to exert a massive force to dig trenches. The complex conditions increase the requirement for robust and high-quality subsea trenchers.

The superior quality design requirement of the subsea trencher increases its initial cost. Furthermore, the requirement of consistent maintenance of the subsea trencher due to its adverse operational conditions increases its maintenance costs. The requirement for skilled operators also adds to the operational cost of the subsea trencher. Altogether, the high expenditure is a major hindrance to the subsea trencher market growth.

Subsea Trencher Market Segmentation Analysis

By Type Analysis

Jet Trencher Segment Dominated owing to High Power Capabilities

Based on type, the market is segmented into jet and mechanical. The jet segment accounted for a significant subsea trencher market share. Jet trencher systems are primarily designed for shallow water operations (up to 100 m) and enable continuous mining from the shoreline to deeper waters. These systems include dual jet blades that operate with up to 1.1 megawatts of surface water power. The modular design includes hydraulically actuated track assemblies, a trench tool water supply and deployment systems, and a world-class ROV docking interface. The jet segment is projected to dominate the market with a share of 57.12% in 2026.

In April 2023, the AssoJet III Mk2 was introduced as a newly built jet trencher based entirely on internal design. With more than 1.5MW of power, the trencher can dig depths of up to 3.2 meters and features an independent training system for cleaning except for sword filling.

The mechanical segment is driven by its low cost and high efficiency compared to other types of subsea trenchers, which have made it popular among customers in various regions.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Subsea Pipeline Projects Will Lead to Domination of Pipeline Burial Segment

Based on application, the market is divided into pipeline burial, cable burial, and umbilical burial. Pipeline burial is considered as the dominating segment globally driven by its applications. Moreover, with increasing offshore oil & gas production, combined with increasing global oil and gas imports, has led to a rise in large offshore pipeline projects, driving demand for subsea pipeline burial. For instance, in September 2021, the Nord Stream 2 pipeline installation, one of the longest subsea pipelines, was completed. This pipeline starts from the coast of Russia and travels through the Baltic Sea to reach landfall near Greifswald in Germany. The pipeline burial segment is expected to lead the market, contributing 56.75% globally in 2026.

Government initiatives to invest in clean energy will propel offshore wind power cable burial activities in various regions. As per the International Energy Agency (IEA), a geospatial analysis to assess offshore wind technical potential by country revealed that the best offshore wind power sites could deliver almost 36,000 TWh globally per year. This amount is nearly equivalent to the anticipated global electricity demand in 2040. Therefore, the cable burial segment is growing at an exceptional rate globally.

REGIONAL INSIGHTS

Based on geography, the global subsea trencher market has been analyzed across major regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe

Europe Subsea Trencher Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Europe holds the largest market share for subsea trenchers, owing to the region's great offshore oil and gas production potential. The growing demand for power and application of industrial gases in the steel industry, oil & gas, metal & mining, and manufacturing & processing industries boost the demand for offshore pipelines across Europe. According to the European Commission's (EC) report on the gas market, Europe imported the largest volume of LNG in 2020, around 85 billion cubic meters (bcm). The gas consumption in Europe is owing to the spot market dynamics and no capital expenditure from small players, which has accelerated the demand for subsea pipeline burial activities, and marine trenchers in the region. Europe is also a leading region with the highest offshore wind capacity in the world. According to the International Renewable Energy Agency (IRENA), Europe accounted for 24,920 MW of electricity capacity by offshore wind power by 2020, showing a 13.12% year-on-year growth. The high investment in offshore wind power further propels the demand for subsea cable burial. The UK market is expected to reach USD 36.40 billion by 2026, while the Germany market is anticipated to reach USD 21.13 billion by 2026.

Asia Pacific

In Asia Pacific, a significant increase in power demand and growing awareness of renewable power generation propels the need for oil and gas transport pipelines, which drives the demand for offshore pipelines and cable burial activities. This trend is anticipated to enhance the demand for subsea trenchers in the region rapidly. The region is also undergoing a digital transformation in all the sectors, which demands for telecom cables. Increasing application of submarine telecom cables drives the demand for subsea cable burial, which further drives the demand for marine trenchers. In August 2021, Google announced a subsea cable Apricot that will connect Japan, Singapore, the Philippines, Taiwan, Guam, and Indonesia and is expected to be ready for service in 2024. China accounted for the second-largest offshore wind energy capacity of 8,990 MW in 2020, an almost 51.6% year-on-year growth, contributing to the increased demand for subsea power cable burial. The Japan market is forecast to reach USD 10.78 billion by 2026, the China market is set to reach USD 17.80 billion by 2026, and the India market is likely to reach USD 7.70 billion by 2026.

North America

In North America, the U.S. is a potential market for oil and gas transportation, with rising energy demand driving market growth. As per the International Renewable Energy Agency (IRENA), the U.S. accounted for 29 MW of electricity capacity by offshore wind power by 2020. The Biden administration, in 2021, pledged to grow the country's use of offshore wind energy, doubling use by 2030 to 30 GW. The U.S. market is estimated to reach USD 67.55 billion by 2026.

Latin America

Latin America presents growth opportunities for oil and gas transportation due to new investment projects on construction, expansion, and modernization of offshore oil and gas production. The future scope of the offshore pipeline burial in Latin America is massive and is anticipated to enhance market prospects in the forecast period. Furthermore, there is a growing penetration of internet usage in the region. According to the World Bank, 68.3% of the population of Latin America used the internet in 2019, compared to 65.7% in 2018. On August 10, 2021, Telxius, a digital telecommunications infrastructure operator, announced the launch of Mistral submarine cable. The system travels along the Pacific coast of Latin America, connecting Guatemala with Chile and linking Ecuador and Peru along its route. The growing internet penetration in the region has given rise to subsea cable installations, propelling the marine trencher demand.

Middle East & Africa

The Middle East & Africa is the noticeable region indulged in the business of oil & gas. The GCC countries such as Saudi Arabia, UAE, Qatar, Bahrain, Kuwait, and Oman, in the Middle East, are experiencing growing energy demand. Hence, it has driven offshore oil & gas activities, increasing offshore pipeline burial activities in the Middle East & Africa. In September 2021, the Italian company Eni made a major discovery of offshore oil in the sedimentary basin of Côte d'Ivoire. Such efforts likely enhance subsea pipeline burial in the region, paving the way for the equipment. The World Bank Group's 2019 'Going Global Report' valued South Africa's technical offshore potential at 646 GW. The high potential is anticipated to create a demand for subsea cable burial and marine trenchers in the forecast period.

KEY INDUSTRY PLAYERS

Global Marine and Helix Energy Solutions Group to Lead with Wide Geographical Reach

The market has several key players who are focused on providing advanced equipment and services. The market players are developing various technological advancements such as marine trenchers designed for increased depths and various attachments for enhancing performance characteristics. Majority of players in the market, especially Global Marine and Helix Energy Solutions, focus on subsea trenching service and solution contracts globally. As subsea pipeline, cable, and umbilical installations expand due to growing offshore activities, the market presents lucrative opportunities for companies.

LIST OF TOP SUBSEA TRENCHER COMPANIES:

- Helix Energy Solutions (U.S.)

- Royal IHC (Netherlands)

- Mastenbroek Limited (U.K.)

- Deepocean Group Holding AS (Norway)

- Osbit (U.K.)

- Seatools BV (Netherlands)

- Barth Hollanddrain (Netherlands)

- Soil Machine Dynamics (U.K.)

- Allseas Group SA (Switzerland)

- Global Marine (U.K.)

- Seatrench AS (Norway)

- CSS Subsea SA (Switzerland)

- Modus Subsea Services Limited (U.K.)

- Trident Group (Russia)

- IKM Subsea AS (Russia)

- Jan De Nul (Netherlands)

- Sea SRL (Italy)

- Forum Energy Technologies Inc. (U.S.)

- Oceaneering International (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2023: U.S. offshore services company Helix Energy Solutions signed a decommissioning contract for 39 wells on the US Gulf of Mexico. The project, awarded to Helix's Louisiana subsidiary, Helix Alliance, is expected to begin in mid-2023.

- March 2023: Helix Robotics Solutions, the robotics division of Helix Energy Solutions, won an excavation services contract with a major renewable cable installation contractor in Taiwan. The contract involves intercompany and export cable excavation for a 640 MW wind farm in Taiwan.

- June 2022: Royal IHC announced the acquisition and recapitalization of Royal IHC. The newly established Foundation Continuiteit IHC took over all the shares of IHC Merwede Holding BV. This capital investment enhanced Royal IHC's liquidity, strengthened its balance sheet, and improved its future prospects.

- April 2022: DeepOcean Group signed an agreement to acquire Norwegian engineering and technology company Installit AS and its subsidiaries to strengthen the group's offer in the field of offshore renewable energies. Installit provides project management and engineering services for the installation and repair of submarine cables, including high voltage cables and underwater installation and decommissioning, and marine operations for the marine and renewable energy industries.

- September 2021: DeepOcean was awarded a frame agreement contract by Equinor for provision of contingency equipment and services related to high voltage subsea cables. This three year contract includes the provision of handling equipment and personnel for subsea high voltage cable contingency operations such cable repair, subsea cutting, retrieval, and cable handling.

REPORT COVERAGE

The global market research report highlights provide regional and country-level analysis to offer a better understanding of the user. Furthermore, the market research reports provide insights into the latest market trends and market analysis of technologies deployed rapidly globally. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the industry.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.92% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to grow from USD 361.72 million in 2026 to USD 531.02 million by 203.4

In 2025, the Europe market was valued at USD 127.88 million.

The market is likely to grow at a CAGR of 4.92%, exhibiting substantial growth during the forecast period (2026-2034).

The pipeline burial segment is the dominant application segment and is anticipated to maintain its position in the forecast period.

The increasing energy demand and the expansion of offshore energy activities are key factors driving this market.

Global Marine Group and Helix Energy Solutions Group are some of the key players operating across the industry.

Europe dominated the market with a share of 37.48% in 2025.

Subsea fiber-optic cables help achieve the internet connectivity of various continents in the world. With the rapidly rising internet usage, subsea cable burial activities have massively grown, giving rise to the usage of subsea trencher for cable burial, further augmenting the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us