Supply Chain Analytics Market Size, Share & Industry Analysis, By Deployment (On-premise and Cloud-based), By Enterprise Type (SMEs and Large Enterprises), By Application (Demand Planning, Inventory Analytics, Procurement Analytics, Logistics Analytics, and Others), By Industry (Healthcare, Retail & E-commerce, Transportation & Logistics, Automotive, Manufacturing, Oil & Gas, Chemical, and Others), and Regional Forecast, 2026-203

KEY MARKET INSIGHTS

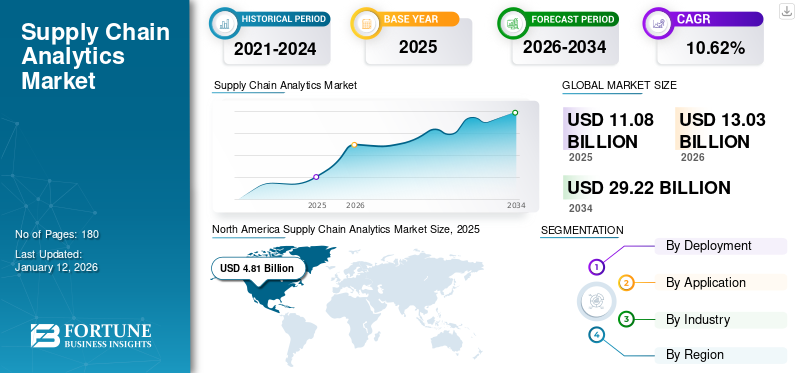

The global supply chain analytics market was valued at USD 11.08 billion in 2025. The market is projected to grow from USD 13.03 billion in 2026 and reach USD 29.22 billion by 2034, exhibiting a CAGR of 10.62% during the forecast period. North America dominated the global market with a share of 43.86% in 2025.

Industries are using innovative supply chain analytics technology to save costs, drive business growth, and improve customer satisfaction. Increased supply chain visibility, reduced inventory costs, changing consumer preferences, and the need for predictability are driving the demand for supply chain analytics solutions. Many companies are implementing solutions to improve supply chain visibility and achieve higher productivity. The need for increased visibility of supply chain operations such as deliveries, orders, and inventory levels is expected to expand the global market significantly.

Global Supply Chain Analytics Market Overview

Market Size:

- 2025 Value: USD 11.08 billion

- 2026 Value: USD 13.03 billion

- 2034 Forecast Value: USD 29.22 billion

- CAGR: 10.62% (2026–2034)

Market Share:

- Regional Leader: North America is expected to hold the largest market share during the forecast period.

- Fastest-Growing Region: Asia Pacific is projected to register the highest growth rate.

Industry Trends:

- Retail and e-commerce segment is expected to witness the fastest growth among end-use industries.

- Increasing integration of big data technologies with supply chain analytics platforms to enhance operational efficiency.

Driving Factors:

- Growing need for data-driven visibility, planning, and decision-making in complex and volatile supply chains.

- Rising adoption of analytics solutions by enterprises to reduce costs, improve forecasting, and optimize operations.

- Increasing focus on digital transformation and real-time insights to enhance supply chain resilience.

The key factors driving the expansion of the global market include the need to improve operational efficiency and supply chain efficiency and rapid growth in the amount of business data across various industries such as manufacturing, transportation, retail, and others. On the other hand, increasing demand for cloud-based supply chain analytics solutions and advanced knowledge regarding the benefits of supply chain analytics are predicted to generate profitable growth prospects during the study period. However, a lack of skilled IT personnel and inaccurate data could restrict the market expansion.

The COVID-19 pandemic has certainly demonstrated the vulnerability of global supply chains, which temporarily disturbed the flow of raw materials and finished goods. Disruptions in the supply chain management (SCM) process in the e-commerce industry during COVID-19 resulted in labour shortages and logistics backups, which has also increased the complexities of business. To overcome these challenges, various e-commerce organizations adopted supply chain analytics solutions to monitor SCM processes that require immediate attention or products.

Supply Chain Analytics Market Trends

Blockchain Integration to Offer Data Transparency to Boost Market Growth

The growing integration of blockchain with supply chain analytics tools helps to optimize the performance of the SCM process. It helps automate inventory and warehouse management tasks in order to develop the IT infrastructure and analytics capabilities of the organization. The rising penetration of blockchain technology helps to enhance the efficiency of the SCM process by reducing disruptions faced by suppliers, manufacturers, and customers. It also helps to improve business productivity and increase data transparency by predicting the manufacturing and inventory risks.

Integrating blockchain technology helps to improve accountability, traceability, and coordination during inventory and procurement transactions. Hence, the integration of blockchain enhances end-to-end data transparency to propel supply chain analytics market growth.

Download Free sample to learn more about this report.

Supply Chain Analytics Market Growth Factors

Integration of Big Data Technologies with Analytics Solutions to Drive Market Growth

An increase in the adoption of Artificial Intelligence (AI) and big data technologies helps to improve demand forecasts and streamline manufacturing processes by implementing new SCM strategies for the long-term growth of the organization. Integration of big data with data analytics solutions enables the predictive maintenance of raw materials and brings improvement in demand-driven operations by identifying business operability issues.

For instance,

- In June 2023, Jaguar Land Rover (JLR) entered into a partnership with Everstream Analytics, a supply chain mapping and risk analytics solution provider that uses artificial intelligence (AI) technology to resolve real-time supply chain issues to deliver better customer experience.

The usage of big data analytics solutions reduces the communication gap between suppliers and manufacturers to optimize the performance of the organization's supply chain activities. Hence, the integration of big data technologies with SCA solutions boost the market demand during the forecast period.

RESTRAINING FACTORS

Inadequate Knowledge about Structured Supply Chain Process Restricts Market Growth

Despite the growing popularity of the SCA tools, poor development in the SCM process, delivering uncertain results, leads to disturbing organizational growth. This factor generates risks and vulnerability issues across the development of the organization's supply chain.

These SCA analytics tools collect real-time data from various sources using ERP systems, Customer Relationship Management (CRM) systems, and warehouse management systems (WMS), which increase the supply chain risks that directly impact the performance of logistics and inventory operations.

Thus, the lack of understanding about the structured supply chain process hinders the market growth.

Supply Chain Analytics Market Segmentation Analysis

By Deployment Analysis

Increase in Mobility of Supply Chain Process Boost the Cloud-based Segment Growth

Based on type, the market is divided into on-premise and cloud-based.

Among these, the cloud-based segment is expected to grow with the highest CAGR with a share of 55.83% in 2026. The improved mobility and ease of use of cloud services led to the aggressive deployment of cloud-based SCA solutions. The usage of cloud-based SCA solutions helps to address various issues related to supply chain management by analyzing and optimizing the supply chain performance. Whereas, companies using on-premise SCA solutions generate the demand for investment in servers and other equipment to manage the supply chain operations.

Thus, demand for the adoption of cloud-based solutions is high as compared to on-premises solutions during the forecast period.

By Enterprise Type Analysis

Availability of Cost-Effective Analytics Solution for SMEs to Aid SMEs Segment Growth

Based on enterprise type, the market is segmented into SMEs and large enterprises.

The small & medium enterprise (SMEs) segment is expected to showcase a significant growth rate due to the availability of cost-effective and scalable analytics solutions designed mainly for SMEs, which are supported by various favorable government initiatives. It significantly helps to streamline the operational process and aims to improve business productivity.

Furthermore, the large enterprises segment dominates the market with a remarkable share with a share of 51.23% in 2026 due to increasing spending on the integration of advanced technologies, such as AI and ML to improve the decision-making capability of the organization.

By Application Analysis

Increase in Need of Analyzing Data to Boost Inventory Analytics Segment Growth

By application, the market is divided into demand planning, inventory analytics, procurement analytics, logistics analytics, and others.

The inventory analytics segment to grow with the highest CAGR owing to the need for analyzing & managing data, managing the inventory costs using smart demand sensing, and enabling the increased demand for transport logistics. The usage of SCA solutions can assist with risk management in addition to cost reduction and inventory control.

The procurement analytics segment to grow with the second-highest CAGR due to accurate, timely, and deep business insights to make strategic decision-making about the procurement data. The logistic analytics segment holds a remarkable market share due to the rising need for analytical and logistical functions to streamline logistic operations in a cost-effective manner.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Need for Inventory and Procurement Management in Retail to Capture Highest Growth

Based on industry, the market is segmented into healthcare, retail & e-commerce, transportation & logistics, automotive, manufacturing, oil & gas, chemical, and others.

The retail & e-commerce segment is projected to grow with a high CAGR among these industries during the forecast period.with a share of 27.78% in 2026 The emergence of edge computing technologies, increasing usage of smartphones, and the integration of cloud technologies to improve the inventory management and procurement functions of the retail & e-commerce sector boost the demand for the market.

Furthermore, the manufacturing and transportation & logistics segments hold remarkable CAGR due to the integration of artificial intelligence (AI) and the rise in digital transformation across the logistics industry, boosting the performance of business operations. Similarly, the healthcare industry is expected to increase investments in digital operations and analytics to manage the SCM process for improving business continuity operations.

REGIONAL INSIGHTS

The global market is studied across the regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Supply Chain Analytics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is estimated to hold the largest supply chain analytics market share due to the presence of a large number of supply chain analytics companies across the region.dominated the market with a valuation of USD 4.81 billion in 2025 and USD 5.52 billion in 2026. Increasing spending on digitalizing the SCM operations in order to overcome the supply chain crises that occurred during the pandemic situation and boost the demand for SCA solutions. The presence of large-sized logistics and manufacturing enterprises in countries such as the U.S. and Canada drove the demand in the market during the forecast period.The U.S. market is projected to reach USD 3.17 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific region is projected to grow with the highest CAGR due to rising spending on artificial intelligence (AI) in countries, such as China and India. This factor helps to drive market growth during the forecast period. Furthermore, rise in investments in small and medium-sized companies of different industries to enhance business performance and to build high-performing business models. Thus, these factors are responsible for the rise in the adoption of supply chain analytics tools in the Asia Pacific region.The Japan market is projected to reach USD 0.6 billion by 2026, the China market is projected to reach USD 0.81 billion by 2026, and the India market is projected to reach USD 0.62 billion by 2026.

Europe is projected to hold a significant CAGR during the forecast period due to the increasing adoption of SCA solutions to enhance the visibility of supply chain operations of different industry verticals. According to the State of European Supply Chains 2023 report, there will be huge investments in supply chain monitoring and tracking and analytics technologies in the next few years. The investments are about 68% and 37% respectively in both technologies in order to resolve the ongoing issue of low labor availability in the region.The UK market is projected to reach USD 0.04 billion by 2026, while the Germany market is projected to reach USD 0.12 billion by 2026.

The market in Middle East & Africa and South America regions are in a growing phase due to increasing awareness about the benefits of analytics solutions among different businesses. Rising acceptance of automation and advanced digital technologies in manufacturing and the oil & gas industry helps to optimize the supply chain performance.

Key Industry Players

Key Players Investing in Partnership Propel the Market Growth

The key market players are forming partnerships to bring innovation in supply chain analytics solutions in order to enhance their supply chain operations. Advancements to the product portfolio are helping major players to maintain their competitive edge. These companies are also engaging in strategic partnerships, acquisitions, product launches, and collaborations to expand their business and distribution network to maintain their market growth.

- January 2023 – Brain Corporation entered into a partnership with Google Cloud and developed “BrainOS Inventory Insights,” an analytics solution for retailers to deliver accurate inventory insights to improve the customer experience.

List of Top Supply Chain Analytics Companies:

- Mecalux, S.A. (Spain)

- IBM Corporation (U.S.)

- Analytics8, LLC (U.S.)

- SS Supply Chain Solutions Pvt. Ltd. (3SCSolutions) (Netherlands)

- Sigmoid Analytics (U.S.)

- Accenture (Ireland)

- Oracle Corporation (U.S.)

- SAP SE (Germany)

- SAS Institute Inc. (U.S.)

- Manhattan Associates (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2023 – SAP SE formed a partnership with Microsoft Corporation and developed an AI-powered solution named SAP Business AI, which helps customers expand their logistics capabilities to handle future supply chain difficulties.

- January 2023 – SAS entered into a partnership with Project44, a supply chain visibility platform provider, to reduce the disruptions impacting the customer experience by providing real-time visibility of the business operations.

- November 2022 – 3SC, a SCA software provider, launched SCAI, a supply chain planning and execution platform for businesses to synchronize their supply chain of products and services. This SCAI solution is used to enhance business efficiency and to provide significant opportunities for enterprises to boost their revenue.

- October 2022 – o9 Solutions, an enterprise AI software provider, developed Supply Sensing, a next-generation solution to help enterprises predict supply chain disruptions. It also generates strategies to avoid the adverse effect of the distributed supply chain on business operations. The Supply Sensing solution monitors the internal and external impacting factors responsible for the supply chain disruption, which includes transportation issues, weather patterns, agricultural yields, employment, and many more.

- May 2022 – Moody’s Analytics, a financial analytical and intelligent tool provider, launched Supply Chain Catalyst, a data and analytics platform for identifying enterprises' supply chain risks. This platform is used to manage disruptions by delivering a 360-degree view of suppliers across various financial and operational risk factors of the business.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the advanced market over the recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.62% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By Application

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 29.22 billion by 2034.

In 2025, the market size stood at USD 11.08 billion.

The market is projected to grow at a CAGR of 10.62% over the forecast period.

Retail & e-commerce is expected to have the highest CAGR in the market

Integration of big data technologies with analytics solutions to drive market growth

Mecalux, S.A., IBM Corporation, Analytics8, LLC, SS Supply Chain Solutions Pvt Ltd. (3SCSolutions), Sigmoid Analytics, Accenture, and Oracle Corporation are the top players in the market.

North America is expected to hold the highest market share.

Asia Pacific is expected to grow with a highest CAGR over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us