U.S. Home Healthcare Services Market Size, Share & Industry Analysis, By Type (Physician Care, Nursing Care, Physical, Occupational & Speech Therapy, Medical Social Services, and Others), By Payor (Public Health Insurance and Private Health Insurance/Out of Pocket), and Country Forecast, 2025-2032

U.S. Home Healthcare Services Industry Overview

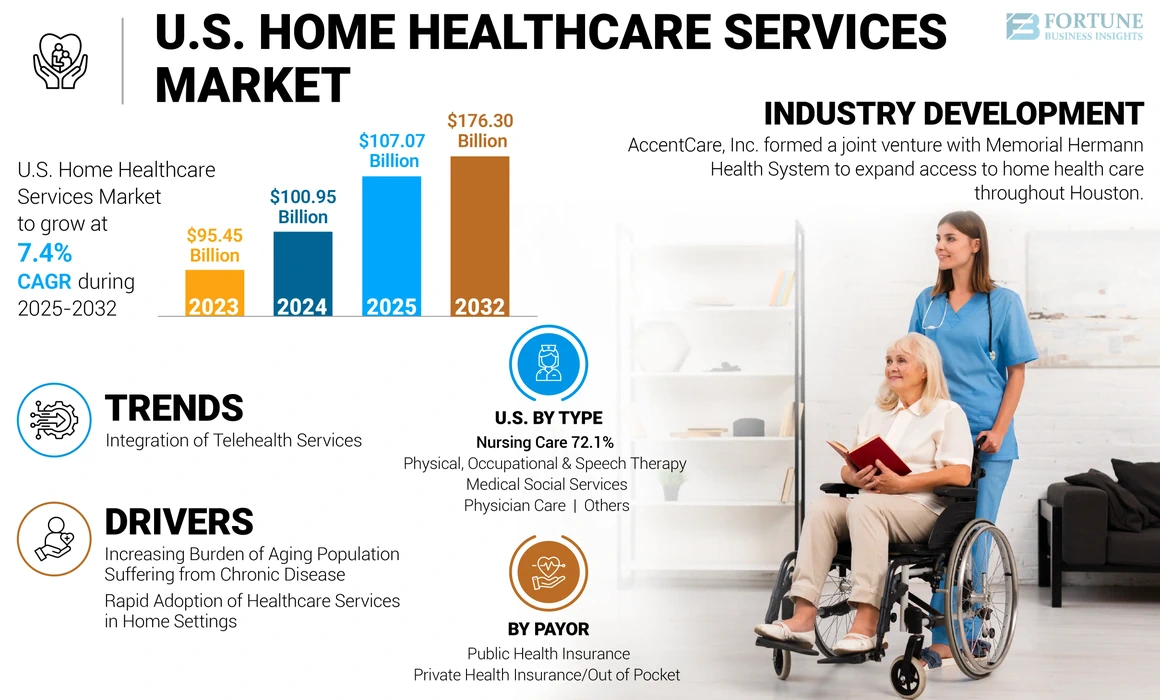

The U.S. home healthcare services market size was valued at USD 100.95 billion in 2024. The market is projected to grow from USD 107.07 billion in 2025 to USD 176.30 billion by 2032, exhibiting a CAGR of 7.4% during the forecast period.

Home healthcare services comprise a wide range of medical care services provided to patients in the comfort of an individual’s residence. These services are affordable and offer effectiveness similar to hospitals or skilled nursing facilities with greater convenience. These services are beneficial for patients who are homebound and old. The rising burden of the geriatric population in the country is one of the predominant factors boosting the demand for these services.

- For instance, according to the United Health Foundation 2022 data, about 17.5% of the total population is aged 65 years and above in the U.S. These services are beneficial for older people as they provide security and comfort by ensuring that geriatric patients receive proper treatment by living close to their family members.

With the increasing geriatric population, the prevalence of age-related disorders, such as osteoarthritis, diabetes, and dementia, is also rising. The growing incidence of chronic conditions, such as cardiac disorders, stroke, dementia, and cancer, creates a large patient pool requiring these services.

- For instance, according to the Alzheimer’s Association report, about 6.7 million of the U.S. population aged 65 years and above were living with Alzheimer’s dementia in the year 2023.

Along with these factors, the shifting preference for these services among the patient population contributes to market growth. Furthermore, robust efforts of key players to introduce portable devices with advanced technologies suitable for home health settings are anticipated to increase the adoption of these services in the U.S.

The United States home healthcare services market witnessed a negative impact during the COVID-19 pandemic. The market's growth declined due to decreased demand for these services due to patients’ apprehension regarding acquiring the COVID-19 infection. Moreover, the reduced frequency of visits by professionals specializing in healthcare services at home due to the redirection of medical resources toward managing COVID-19-positive patients also contributed to the declining revenue margins for home healthcare service providers.

However, the number of elective surgeries and hospital discharges started increasing during 2021 as the situation gained normalcy, which increased the demand for home healthcare solutions. Key players in the market also experienced a gradual increase in their revenue in 2021 from the home healthcare segment.

U.S. Home Healthcare Services Market Trends

Integration of Telehealth Services to Augment Market Growth

Incorporating telecommunications into the home healthcare industry offers lucrative growth opportunities in the market. Telehealth provides various advantages by increasing adherence to specific treatments and reducing hospital readmissions. Additionally, the introduction of new reimbursement codes covering telehealth in home healthcare solutions is increasing the adoption of these services.

- For instance, in January 2023, the Centers for Medicare & Medicaid Services (CMS) introduced three new codes for reporting the use of telecommunications technology in offering home healthcare services.

Additionally, companies are integrating telehealth to launch new categories of home health facilities. Such initiatives are raising the adoption of these services, thereby propelling the U.S. home healthcare services market growth.

- In October 2022, Panda Health launched remote patient monitoring, telehealth, and hospital-at-home solutions, enabling more in-depth acute care services within the home.

Download Free sample to learn more about this report.

United States Home Healthcare Services Market Growth Factors

Increasing Burden of Aging Population Suffering from Chronic Disease to Fuel Market Growth

The U.S. is witnessing a steep increase in its old-age population, which is more prone to chronic diseases, such as diabetes, dementia, cardiac disorders, and others. The rising geriatric population in the country is increasing the need for daily assistance and continuous monitoring, thus increasing the demand for healthcare services at home.

- For instance, according to the 2023 Senior Report published by the United Health Foundation, approximately 16.8% of the U.S. population, or USD 55.8 million Americans, were aged 65 years old and above. The report also mentions that the elderly population is anticipated to increase in the coming years.

The rise of various chronic diseases among the geriatric population is increasing the need for daily assistance and continuous monitoring. Home healthcare exhibits various advantages for older adults over hospitals and nursing facilities, such as quality treatment at home, low cost, reduced risk of infections, and others. Thus, all factors will increase demand for home healthcare services.

- For instance, according to a 2023 article by the National Council on Aging, approximately 95.0% of adults aged 60 years or older have at least one chronic condition, while 80.0% have two or more.

Thus, the increasing elderly population and rising prevalence of chronic conditions are expected to boost the demand for and adoption of these services in the U.S. during the forecast period.

Rapid Adoption of Healthcare Services in Home Settings to Foster Market Growth

The increasing healthcare expenditure in the U.S. is another key factor driving the adoption of healthcare services in home settings. This is attributed to the fact that these services are comparatively less expensive than in-patient services.

- For instance, according to a 2021 article published by the American Journal of Managed Care (AJMC), there was a 19% cost reduction in home healthcare management in a recent randomized trial that evaluated patients being treated in a hospital setting and patients treated in a hospital-at-home setting.

Furthermore, the growing patient preference for respiratory and infusion therapy services at home is expected to boost market growth. The increasing utilization of home healthcare services can substantially reduce the overall treatment cost. The abovementioned factors are anticipated to augment the market progress during the forecast period.

RESTRAINING FACTORS

Vulnerability to Fraud, Waste, and Abuse Might Restrict Market Expansion

Home healthcare services have long been vulnerable to waste, fraud, and abuse. For instance, according to a 2022 report published by Home Health Care News, as per the Centers for Medicare and Medicaid Services (CMS), the estimate of improper payments for home healthcare amounted to approximately USD 1.84 billion, resulting in an improper payment rate of 10.2% in 2022.

- Also, as per a press release published by the U.S. Department of Justice in February 2023, 23 Michigan residents were charged for their alleged involvement in two illegal schemes. These schemes aimed to defraud Medicare over USD 61.5 million by paying kickbacks and bribes and billing Medicare for unnecessary home health services that were never provided.

- Also, in January 2024, a home healthcare company owner was sentenced for Medicare fraud, where Medicare paid about USD 2.8 million to the company for services that were never provided.

The nature of fraud varies, although most frauds involve home health agencies billing for services that are not medically necessary or not provided. These services are quite exposed to fraud, which might act as a growth hindering factor for the market.

U.S. Home Healthcare Services Market Segmentation Analysis

By Type Analysis

Nursing Care Segment to Dominate Market Owing to Rising Demand for Skilled Nursing Care at Home

The market is categorized by type into physician care, nursing care, physical, occupational, and speech therapy, medical social services, and others.

The nursing care segment dominated the U.S. home healthcare services market share in 2024. This dominance is attributed to the increasing demand for skilled nursing care at home. People above 65 years of age mostly require these services, including nursing care. The increasing percentage of the geriatric population across the U.S. has surged the demand for skilled nursing at home, augmenting the segment’s growth.

Furthermore, the launch of new facilities and the introduction of a variety of home healthcare facilities by key players will also contribute to the segment's growth. For instance, in August 2022, Mount Sinai Health System and Contessa, an Amedisys company, extended their partnership by merging Mount Sinai South Nassau’s home health agency. The home health agency will be known as Mount Sinai at Home and offer home health services, including Skilled Nursing Facilities (SNF at home), palliative care, and others.

The physical, occupational & speech therapy segment is expected to witness the highest CAGR during the forecast period. The segment’s high growth is attributed to the rising launch of various home-based physical therapy services nationwide.

- For instance, in January 2023, Hinge Health, a musculoskeletal service provider, expanded its clinical capabilities by launching a physical therapy house call service.

Furthermore, various players are entering the home healthcare services market and offering occupational, physical, and speech therapy services to increase access to these services, leading to market growth.

- In August 2021, Best Life Brands, a U.S.-based company offering care continuum, launched a new home health offering under the brand name “Boost Home Healthcare.” The company aimed to provide older adults with skilled nursing and occupational and speech therapy.

To know how our report can help streamline your business, Speak to Analyst

By Payor Analysis

Increasing Spending from Government to Boost Demand for Public Health Insurance

Based on payor, the market is classified into public health insurance and private health insurance/out of pocket.

The public health insurance segment held the largest market share in 2024 owing to the increasing government spending on home care services in the U.S. For instance, according to the Kaiser Family Foundation, most European countries spend between 1% and 5% of their healthcare budget on these services. In the U.S., home healthcare accounts for 3% of total healthcare expenditures. Additionally, public insurance services are affordable compared to their private counterparts, increasing their preference among the population. This is projected to help the segment grow steadily in the coming years.

- For instance, according to the 2023 data published by the U.S. Census Bureau, in 2022, approximately 92.1% of the U.S. population was covered under health insurance, of which 36.1% had public insurance. According to the data, the percentage of the population covered under public insurance increased by 1.1% in 2022 compared to the previous year.

The private health insurance/out-of-pocket segment is poised to witness a lucrative growth rate during the forecast period. This is due to the increasing treatment costs for chronic diseases in the U.S. The rising prevalence of chronic ailments, such as cancer, has increased the requirement for post-hospital home health treatment services, thereby surging out-of-pocket expenditure.

- For instance, according to a 2021 article published by the American Society of Hematology, the monthly average cost of cancer treatment per patient in the U.S. was USD 11,755. Treatment costs in European countries, such as Germany (USD 8,300), Switzerland (USD 6,950), and Asia Pacific countries, were significantly lower than those in the U.S.

- Similarly, according to a 2020 report published by the American Cancer Society on the costs of cancer, the amount Americans spent on cancer-related healthcare in 2015 was approximately USD 183 billion. This amount is projected to rise by 34% to USD 246 billion by 2030.

Moreover, private health insurance/out-of-pocket spending contributed more to home healthcare services.

- According to the U.S. Centers for Medicare & Medicaid Services 2022 data, the expenditure for services provided by freestanding home health agencies rose 6.0% in 2022 to reach USD 132.9 billion. As per the data, private health insurance, out-of-pocket, and Medicaid spending contributed to the faster growth of home health.

List of Key Companies in the U.S. Home Healthcare Services Market

Strong Focus to Strengthen Market Positions to Augment Market Share of Key Players

The U.S. home healthcare services market is highly fragmented, with few players leading the market by capturing a prominent market share. CenterWell Home Health, Amedisys Inc., Optum, Inc., and Enhabit Home Health & Hospice accounted for a significant market share in 2024 in revenue. Optum, Inc. is one of the leading players in the market since the company has entered into several business activities, such as mergers, acquisitions, and partnerships, to strengthen its geographical presence.

- For instance, in February 2023, Optum, Inc. acquired the home health company LHC Group with USD 5.4 billion. Through this acquisition, both companies will harness their expertise to provide value-based home care services to the target population.

LIST OF TOP U.S. HOME HEALTHCARE SERVICES COMPANIES:

- Amedisys (U.S.)

- LHC Group, Inc. (UNITEDHEALTH GROUP) (U.S.)

- Enhabit Home Health & Hospice (U.S.)

- Brookdale Senior Living Inc. (U.S.)

- Trinity Health (U.S.)

- CenterWell Home Health (Humana) (U.S.)

- AccentCare, Inc. (U.S.)

- BAYADA Home Health Care (U.S.)

- ELARA CARING (U.S.)

- Interim Healthcare Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 - ELARA CARING acquired American Family Home Health, a privately owned skilled home healthcare company in Illinois. ELARA CARING aimed to expand its geographical footprint in the Midwest through this acquisition.

- April 2023 - AccentCare, Inc. formed a joint venture with Memorial Hermann Health System. Through this partnership, the company aimed to expand access to home health care throughout Houston.

- December 2022 - Enhabit Home Health & Hospice acquired Southwest Florida Home Care, Inc.’s home health agency in Fort Myers, Florida. Through this acquisition, the company strengthened its footprint in Florida and expanded its services.

- December 2021 – Aveanna Healthcare, LLC acquired Comfort Care, a leading adult home health and hospice company, to expand its footprint in the country by adding operations in Tennessee and Alabama.

- June 2021 – Amedisys announced the acquisition of Contessa Health, a hospital-at-home and skilled nursing facility leader, to expand its capabilities in in-home healthcare services with the addition of a higher-acuity hospital and skilled nursing facility services at home, advanced analytics platform, and network management.

REPORT COVERAGE

An Infographic Representation of U.S. Home Healthcare Services Market

To get information on various segments, share your queries with us

The U.S. home healthcare services market research report provides a detailed market analysis. It focuses on key aspects such as industry trends, leading companies, market dynamics, service type, and payor groups. Additionally, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.4% from 2025-2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By Payor

|

Frequently Asked Questions

Fortune Business Insights says that the market value stood at USD 100.95 billion in 2024 and is projected to reach USD 176.30 billion by 2032.

The market will exhibit a steady CAGR of 7.4% during the forecast period of 2025-2032.

By type, the nursing care segment is leading the market.

The growing geriatric population and increasing chronic disease prevalence drive market growth.

1) Who are the top players in the market? CenterWell Home Health, Amedisys Inc., and Optum, Inc. are the top players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic