U.S. Medical Devices Market Size, Share & Industry Analysis, By Type (Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging Devices, In-vitro Diagnostic Devices, Minimally Invasive Surgery Devices, Wound Care Devices, Diabetes Care Devices, Ophthalmic Devices, Nephrology Devices, Dental Devices, General Surgery Devices, Drug Delivery Devices, Respiratory Devices, and Others), By End-User (Hospitals & Ambulatory Surgery Centers (ASCs), Clinics, and Others), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

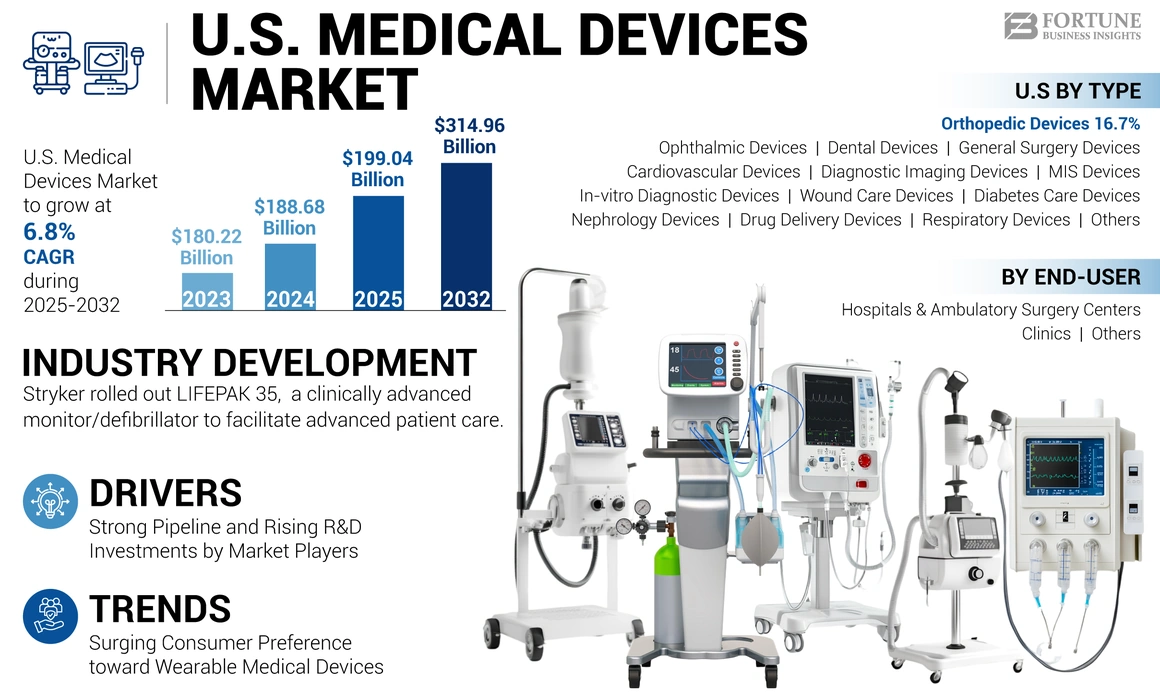

The U.S. medical devices market size was valued at USD 188.68 billion in 2024. The market is projected to grow from USD 199.06 billion in 2025 to USD 314.96 billion by 2032, exhibiting a CAGR of 6.8% during the forecast period.

The U.S. has witnessed substantial growth in the geriatric population over the years. A demographic research projection published by the University of Washington in July 2021 anticipates that, starting from the 21st century, every second individual born in the United States is expected to live up to 100 years. The rising geriatric population is leading to the increasing prevalence of age-related disorders, such as cataracts, chronic obstructive pulmonary disease, hypertension, osteoarthritis, diabetes, depression, and dementia.

- According to the U.S. Department of Health and Human Services (HHS), in 2020, approximately 14.8 million adults were diagnosed with COPD in the U.S.

The rising prevalence and increasing cost burden of lifestyle and chronic diseases have led to the growing emphasis of healthcare providers, healthcare agencies, and government on the timely and routine treatment of patients. Thus, through awareness programs and campaigns, several national and regional healthcare agencies have actively promoted the diagnosis and treatment of common diseases.

This factor increased awareness among the geriatric population toward various products and services for diagnosing and treatment, which has led to a large patient pool undergoing treatment. In addition, high treatment rates are driving the product demand in clinics, hospitals, and other healthcare settings.

Furthermore, to cater to the growing demand for advanced devices, market players are investing in R&D initiatives to introduce healthcare devices with various advanced capabilities, such as AI (Artificial Intelligence), 3D imaging, wearable heart rate trackers, and others. Thus, rising approvals of such advanced devices and their increased presence across the globe have further propelled market growth.

The COVID-19 pandemic led to negative impact on the U.S. medical devices market owing to disruptions in the supply chain and the reduced number of patient visits for elective procedures. This resulted in a decline in the demand for several devices in the country.

U.S. Medical Devices Market Trends

Increasing Preference Toward Wearable Medical Devices Among Consumers in the U.S.

The increasing emphasis on fitness among adults in the U.S. and the rising focus on the diagnosis and real-time monitoring of patients by regional and national healthcare agencies have played a pivotal role in generating the higher demand for wearable devices. Similarly, the growing number of adults and children participating in leisure and competitive sports activities such as cycling, running, and other sports have splurged the demand for activity trackers.

- According to a 2023 study published by the American Heart Association, approximately 29% of the U.S. adults used wearable devices in the country. Additionally, 17% of people with cardiovascular disease aged 50 to 64 years reported the use of wearables and 33% of those in the 18 to 49-year age group with diagnosed cardiovascular disease used wearable medical devices.

The growing demand for these devices among the population is resulting in a rising focus of market players on collaborating with other players to develop advanced products with novel technology and increase the penetration of these devices among the population. In August 2022, Medtronic partnered with BioIntelliSense for the U.S. distribution of multi-parameter wearables for continuous remote patient monitoring at home.

This factor presents enormous opportunities for new entrants, domestic players, and established global market players to focus on this segment and introduce new devices to cater to the ever-increasing demand. Thus, the sheer size of the population and the potential consumer market in the country aids entrants in providing wearable devices at competitive pricing.

Download Free sample to learn more about this report.

U.S. Medical Devices Market Growth Factors

Robust Pipeline and Increasing Investments in R&D by Industry Players Propel Product Demand

Major industry players are actively investing in the research and development of advanced devices. The presence of potential devices in the end stage of development is expected to boost the demand for these devices.

- In March 2023, Medtronic collaborated with NVIDIA Corporation to build an AI platform for medical devices. The companies would integrate NVIDIA healthcare and edge AI technologies into Medtronic’s GI Genius intelligent endoscopy module, developed and manufactured by Cosmo Pharmaceuticals. GI Genius is the first FDA-cleared, AI-assisted colonoscopy tool to help physicians detect polyps that can lead to colorectal cancer.

Medical device manufacturers with a strong emphasis on R&D are shifting their strategies to introduce smart medical devices enhanced with new technologies. Thus, rising investments in R&D and breakthrough technologies to accelerate the manufacturing of these devices are expected to drive the market growth.

- In April 2024, Boston Scientific Corporation initiated the NAVIGATE-PF study of the FARAVIEW Software Module, which is used to visualize and track the FARAWAVE Nav Pulsed Field Ablation (PFA) Catheter for the treatment of patients with paroxysmal and persistent Atrial Fibrillation (AF).

Therefore, such a robust pipeline of advanced devices and high investments by medical device manufacturers are anticipated to fuel the adoption of these devices, further propelling the growth of the market.

RESTRAINING FACTORS

High Cost of Devices to Limit their Adoption in Small & Mid-Sized Facilities

Medical devices have witnessed significant developments in the last decade regarding the implementation of new technologies and modifications in design, integration of nanotechnology in medical devices, and other parameters. However, the overall cost of ownership of these devices is higher, which includes a comparatively higher acquisition cost and subsequent maintenance costs. Some advanced healthcare devices are associated with various components, including batteries, chips, sensors, and other accessories that need periodic replacement.

- For instance, in the U.S., an insulin pump costs around USD 4,500 to USD 6,500 per device. In addition, the total per year cost of the accessories of this device, which include batteries, syringes, and others, is around USD 1,500. This factor leads to a comparatively higher price to the patient.

Similarly, medical device utilization and price are cited as significant cost drivers of hospital care in small & mid-sized facilities such as health clinics, Ambulatory Surgical Centers (ASCs), and imaging centers. Device costs increase substantially owing to new equipment purchases and its latest innovations to support high-value care delivery. Thus, compared to independent hospitals, rising medical device costs in these facilities further restrain the U.S. medical devices market growth.

- For instance, according to data published by Definitive Healthcare, in 2020, Integrated Delivery Network (IDN) operated hospitals reported an average of USD 16.2 million in medical (including medical and implantable medical devices) and surgical supply costs compared to an average of USD 5.5 million at independent hospitals. Moreover, between 2016 and 2020, medical and surgical supply expenses increased by about 5.0% yearly for IDN-operated hospitals compared to 5.7% for independent hospitals.

Thus, such high medical device costs and rising episodes of product recalls by market players will limit the adoption of these devices, further hampering the demand for these devices.

U.S. Medical Devices Market Segmentation Analysis

By Type Analysis

Increasing Demand for Real-time Diagnostics to Drive the In-vitro Diagnostics (IVD) Segment Growth

Based on type, the market is segmented into orthopedic devices, cardiovascular devices, diagnostic imaging devices, in-vitro diagnostic devices, minimally invasive surgery devices, wound care devices, diabetes care devices, ophthalmic devices, nephrology devices, dental devices, general surgery devices, drug delivery devices, respiratory devices, and others.

The orthopedic devices segment dominated the market in 2024. Rising prevalence of musculoskeletal conditions among the population, the increasing number of orthopedic procedures, and the growing focus of companies to launch technologically advanced medical devices are driving the segment’s growth.

- In May 2023, Stryker launched its Ortho Q Guidance system, enabling advanced surgical planning and guidance for hip and knee procedures, easily controlled by the surgeon from the sterile field.

The dental devices segment is expected to grow at a significant growth rate during the forecast period. The growing prevalence of dental disorders among the population, along with rising awareness regarding dental treatments for oral health, are some of the major factors supporting the growth of the segment.

The in-vitro diagnostic devices segment is anticipated to register a steady growth rate owing to the increasing uptake of real-time diagnostic tests to diagnose chronic diseases such as diabetes and cancer. Similarly, growing R&D investments by industry players to launch new IVD products such as disease-specific markers and tests further propel the segment growth.

- According to an article published by the PEW Charitable Trusts in October 2021, an estimated 3.3 billion IVD tests, including both FDA-reviewed and Lab-Developed Tests (LDTs), are performed in the U.S. every year.

In addition, the cardiovascular devices segment is projected to grow significantly due to a rising patient pool suffering from orthopedic and cardiac-related disorders.

- According to an article published by the Centers for Disease Control and Prevention (CDC), about 54.4 million U.S. adults have some form of arthritis. This prevalence is projected to reach 78.0 million by the year 2040.

The minimally invasive surgery devices and general surgery devices segments are projected to grow at a considerable rate during the forecast period. The rising number of surgical procedures in the country for various conditions is a prominent factor augmenting the growth of these segments in the country. The shifting preference toward minimally invasive procedures among the population is a crucial factor supporting the growth in the number of procedures.

- According to the 2023 statistics published by the American Academy of Facial Plastic and Reconstructive Surgery (AAFPRS), around 83% of the total number of procedures performed in the U.S. in 2023 were minimally invasive.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Rising Number of Admissions to Drive the Growth of Hospitals & Ambulatory Surgery Centers (ASCs) Segment

On the basis of end-user, the market is subdivided into hospitals & ambulatory surgery centers (ASCs), clinics, and others.

The hospitals & ambulatory surgery centers (ASCs) segment registered the highest U.S. medical devices market share in 2024. The increasing patient population with chronic and life-threatening diseases resulting in a higher hospitalization rate in the U.S. is primarily responsible for the growing demand and adoption of healthcare devices in these settings. Further, the growing number of hospitals in the country is another major factor attributing to the growth of the segment.

- According to the 2023 statistics published by the American Heart Association, the number of hospitals in the U.S. increased from 6,093 in 2022 to 6,120 in 2023. In addition, the number of hospital admissions in the U.S. in 2022 was around 33.5 million, which increased to 33.7 million in 2023.

The others segment is anticipated to expand at a substantial CAGR over the analysis period. An increasing number of healthcare facilities, such as nursing homes, long-term care centers, and others, in the U.S. offering treatment for different diseases, is slated to boost the demand and adoption of these devices and will subsequently drive the growth of these segments during the projection period.

KEY INDUSTRY PLAYERS

Mergers and Acquisitions by Key Players to Propel Market Progress

The market for medical devices is fragmented, with a large number of players operating in the market with a wide range of product portfolios. Medtronic, Johnson & Johnson Services, Inc., Stryker, and BD are some of the prominent players in the market, operating with a diversified product portfolio catering to the rising product demand.

The top market players are adopting strategies such as joint ventures and start-ups to develop novel devices for patients suffering from chronic diseases. The rising focus of the major companies to acquire other companies with an aim to strengthen its product portfolio and geographical reach is another significant factor contributing to the growing shares of these companies.

- In April 2024, Johnson & Johnson Services, Inc. entered into a definitive agreement to acquire Shockwave Medical with an aim to strengthen its cardiovascular medical devices product portfolio.

Other prominent market players are Boston Scientific Corporation, Siemens Healthineers, Roche, GE Healthcare, Danaher, Cardinal Health, and 3M. A significant upsurge in the prevalence of chronic diseases, extensive device approvals, and favorable reimbursement scenarios for high-end instruments is projected to increase the number of emerging players in the market by 2029.

LIST OF TOP MEDICAL DEVICES COMPANIES IN U.S./ LIST OF TOP MEDICAL DEVICES COMPANIES:

- Medtronic (Ireland)

- Abbott (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Stryker (U.S.)

- BD (Becton, Dickinson, and Company) (U.S.)

- Boston Scientific Corporation (U.S.)

- Siemens Healthineers AG (Germany)

- F. Hoffmann-La Roche AG (Switzerland)

- Danaher (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2024 – Stryker launched LIFEPAK 35, a clinically advanced monitor/defibrillator offering advanced technology and built on an intuitive, modern platform, to help advance patient care.

- April 2024 – Abbott received the U.S. FDA approval for its TriClip G4 transcatheter edge-to-edge repair (TEER) system for the treatment of tricuspid regurgitation.

- March 2024 – BD increased the domestic production of syringes and needles to cater to the rising demand among healthcare providers.

- September 2022 - Abbott acquired Walk Vascular, LLC, and a medical device company with a minimally invasive mechanical aspiration thrombectomy system designed to remove blood clots to broaden its cardiovascular portfolio segment.

- January 2022 - Medtronic announced the acquisition of Affera, Inc., Boston-based medical technology company, to expand the cardiovascular portfolio.

REPORT COVERAGE

The report provides detailed market analysis and focuses on crucial aspects, such as manufacturers, products, and end-users. Additionally, it offers insights on market trends, key industry developments such as mergers, partnerships, and acquisitions, and the impact of COVID-19 on the market. In addition to the factors mentioned above, the report includes the factors that have contributed to the market growth in recent years with a regional analysis of different segments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 6.8% from 2025-2032 |

|

Segmentation |

By Type

By End-User

|

Frequently Asked Questions

Fortune Business Insights says that the market size was USD 188.68 billion in 2024 and is projected to reach USD 314.96 billion by 2032.

The market will exhibit a CAGR of 6.8% over the forecast period (2025-2032).

Based on end-user, the hospitals & ambulatory surgery centers (ASCs) segment is the leading segment as it held a dominant market share in 2024.

The rising R&D investments across the U.S. are the key factors driving the growth of the market.

Medtronic, Abbott Laboratories, Stryker, and Johnson & Johnson Services, Inc., are major players in the global market.

Technological advancements, rapid diagnostics, and product approvals globally are expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us