U.S. Physician Groups Market Size, Share & Industry Analysis, By Number of Physicians (2 to 10, 11 to 24, 25 to 50, and More than 50), By Ownership (Physician-owned, Hospital-owned, and Others), By Specialty (Primary Care, Pediatrics, OB/GYN, Ophthalmology, Orthopedics, Psychiatry, Cardiology, Dermatology, and Others), By Payor (Public Health Insurance and Private Health Insurance/Out-of-pocket), By Type (Single-specialty and Multi-specialty), By Region (Northeast, Southeast, Southwest, Midwest, and West), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

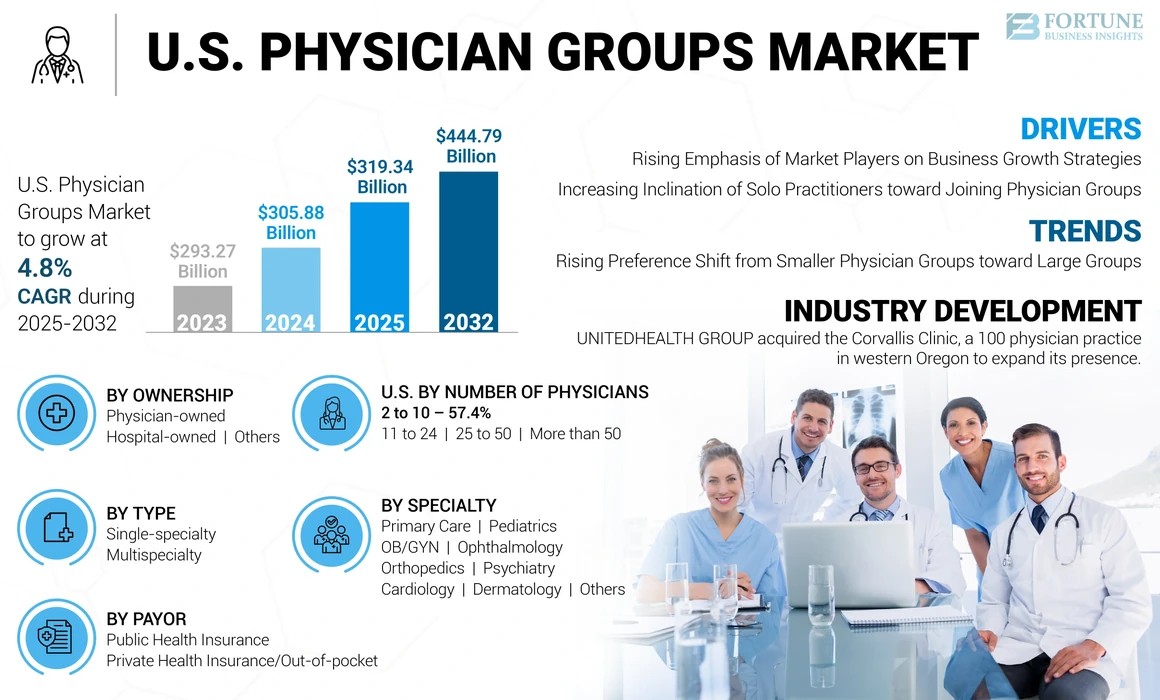

The U.S. physician groups market size was valued at USD 305.88 billion in 2024. The market is anticipated to grow from USD 319.34 billion in 2025 to USD 444.79 billion by 2032, exhibiting a CAGR of 4.8% during the forecast period.

Physician groups are referred to organizations where two or more than two physicians work and provide care to patients in order to improve healthcare outcomes. These groups are classified as physician-owned, where a solo physician or group of physicians own and manage the office, or hospital-based practices, where large healthcare organizations employ physicians. A private/solo practitioner entails more financial risk compared to group practitioners, which is one of the predominant reasons for the increasing number of these groups in the U.S.

Moreover, various benefits associated with physician groups practices over solo physician practice, such as increased financial security, special training, expertise, and job security, are some factors that tend to shift the solo practitioner toward larger groups. In addition, owing to the increase in healthcare expenditure and the availability of adequate reimbursement policies, patients are poised to opt for earlier treatment for various chronic diseases, which is slated to increase the demand for various groups of physicians to cater to a large patient pool, supporting the market growth.

Furthermore, the growth of the market can be primarily attributed to the burgeoning prevalence and incidence of various medical conditions. In addition, the growing need for early diagnosis, management, and treatment among patients is leading to an increasing number of patient visits to physician offices in the country.

- According to the American Cancer Society, Inc., in 2023, about 2.0 million new cancer cases were diagnosed in the U.S. Moreover, as per the American Cancer Society, an estimated 18.04 million patients who have cancer in the U.S. had sought treatment and survived as of January 2022, representing approximately 5.4% of the population. Furthermore, the number of cancer patient survivors is anticipated to increase by 24.4% to reach 22.5 million by the end of 2032. Thus, the growing patient population surges the demand for treatment, thereby propelling the U.S. physician groups market growth.

Moreover, the willingness of small groups of physicians to join larger groups for various benefits provided by larger groups, coupled with the increase in the number of acquisitions of a small group of physician practitioners by hospitals and private equity firms, is anticipated to boost market growth.

- For instance, in April 2023, Optum, Inc. acquired a New York-based multi-specialty physician group, Crystal Run Healthcare. Through this acquisition, the company strengthened its position in the market by adding 400 providers over 30 locations.

The COVID-19 pandemic had a significant impact on the market in 2020. Various factors, such as the decrease in the number of patients and revenue among physicians and an increase in the expenses related to COVID-19, posed a challenge to the market growth in 2020. However, the market regained normalcy during the post-pandemic owing to the rise in the adoption of telehealth services by physicians and the gradual opening of hospitals & clinics after the ease in pandemic regulations. In addition, the market players observed a substantial increase in their revenue and patient visits, which contributed to the normal growth of the market in the post-pandemic era.

U.S. Physician Groups Market Trends

Rising Preference Shift from Smaller Physician Groups toward Large Groups

Over the past few years, physicians have been moving from smaller to larger group practices in the U.S. This is driven by various factors, including significant financial and technical challenges in running smaller groups and increasing preference among younger physicians to work in larger groups. Moreover, smaller physician groups tend to join larger, hospital-owned group practices in order to have more negotiation power with payers. Thus, the administrative, economic, and regulatory burdens have driven the smaller groups to shift toward larger groups. According to the findings published by the Annals of Internal Medicine, more physicians are entering large practices and leaving small group practices.

- For instance, according to the 2023 data published by the American Medical Association, the share of physicians working in a group of 10 or fewer physicians declined from 61.4 % to 51.8% between 2012 and 2022.

This shift of smaller groups of physicians into larger groups is expected to lead to better patient care and lower costs, thereby spurring market growth. Moreover, large groups of physicians have better administrative support, which influences more physicians to move toward these groups.

Download Free sample to learn more about this report.

U.S. Physician Groups Market Growth Factors

Rising Emphasis of Market Players on Business Growth Strategies to Propel Market Growth

The current U.S. market is witnessing a steep increase in mergers and acquisitions activities. The high administrative costs, increase in workload, and less financial stability faced by smaller groups are factors tending to shift their focus to associate and merge with larger groups. Moreover, the growing focus of larger physician groups on expanding their services in the country and strengthening their position is leading to a high number of mergers and acquisitions.

- For instance, in October 2023, Ascension entered a joint venture agreement with Henry Ford Health to expand and improve its integrated healthcare services across mid-Michigan and Southeast Michigan.

- In addition, in October 2022, Gastro Health inked a deal with Springfield Gastroenterology, which is joining with one advanced practice provider and three physicians. The company aimed to offer personal attention and superior care through this deal.

Furthermore, the heavy investments by private equity firms to acquire different smaller physician practices to offer financial security through partnerships are poised to surge the U.S. physician groups market growth.

Increasing Inclination of Solo Practitioners toward Joining Physician Groups to Drive Market Growth

Physicians practicing solo/privately are seeking to join larger groups, which is one of the prominent factors contributing to the market growth. Physician group practices provide certain advantages, such as increased financial stability and decreased physician burnout. Moreover, group practices also improve the efficiency of physicians within a given system due to better quality of care and reduced timeliness.

In addition, the administrative cost of physicians has increased after the adoption of the Health Information Technology for Economic and Clinical Health (HITECH) Act. As per this act, the implementation of electronic health records (EHR) and other digital technology is mandatory for the maintenance of patient information along with increasing data security, which increases the expenses on solo physicians. Thus, solo practitioners seek to join large physician groups due to all these factors.

- For instance, according to the study conducted by the Physicians Advocacy Institute in collaboration with Avalere Health, the number of physicians employed by the hospital or corporate-owned practices was 484,100 in January 2022 compared to 375,400 in 2019 and witnessed an increase of 28.9%. Thus, solo practitioners are declining rapidly due to the increased employment of physicians in hospitals and corporate entities.

Hence, the acquisition of independent practices by hospital and corporate-owned groups and shifting focus on joining larger groups are expected to drive the U.S. physician groups market growth in the coming years.

RESTRAINING FACTORS

Surge in Employment of Physicians by Hospitals May Restrain Market Growth

Numerous physicians are struggling to maintain their groups and opt for hospital employment. Hospital employment has various advantages, such as a reduction in the cost of support services, no administrative burden, and financial stability. These advantages are expected to increase the number of employed physicians across the globe.

- For instance, according to the recently published data by the Physicians Advocacy Institute, in June 2021, about 70% of U.S. physicians were employed by hospitals or corporate entities.

Moreover, policies, such as the Health Care Financing Administration (HCFA), allow hospitals to treat acquired physician practice as either provider-based or free-standing, increasing the number of physicians joining hospitals.

Thus, increasing physician employment by hospitals means the number of physicians working in the groups is expected to decrease, thereby hampering market growth.

U.S. Physician Groups Market Segmentation Analysis

By Number of Physicians Analysis

2 to 10 Segment Dominated Owing to the Preference of Traditional Physicians to Work in Small Groups

Based on number of physicians, the market is categorized into 11 to 24, 25 to 50, more than 50, and 2 to 10.

The 2 to 10 segment held the largest part of the U.S. physician groups market share in 2024 and is estimated to dominate the market during the forecast period. Traditional physicians who are over 40 years of age are more likely to work in small groups, which is anticipated to drive the segment growth. Moreover, physicians who prefer not to change their groups due to their desire to work autonomously or in small groups further support segment growth.

- For instance, according to a report published by the California Health Care Foundation in March 2022, an estimated 57.6% of physicians were working in 2 to 10 groups.

Furthermore, the more than 50 segment is anticipated to grow at the fastest-growing CAGR during the forecast period. Various benefits, such as financial security, improved quality of care, and fewer administration costs, lead physicians to join larger groups. In addition, the increasing focus of the larger groups operating in the market toward acquisitions and mergers with the other smaller groups boosts segmental growth.

- According to the American Medical Association 2023 data, the share of physicians working in a group of 50 or more physicians increased from 12.2% to 18.3% between 2012 and 2022.

On the other hand, the 11 to 24 and 25 to 50 segments are anticipated to have considerable growth during the forecast period owing to the preferential shift of health physicians to working for large groups due to distinct advantages such as fewer working hours, less workload, improved quality of patient care, and others.

To know how our report can help streamline your business, Speak to Analyst

By Ownership Analysis

Physician-owned Segment Dominated the Due to Increasing Number of Physician Practices

By ownership, the market is divided into physician-owned, hospital-owned, and others.

The physician-owned segment held a dominating share in 2024. The hospital-owned segment is poised to register the highest CAGR during the forecast period. Over the years, hospitals have increased their ownership stake in physician groups in the U.S. In addition, there has been an increase in the acquisition of physician practices during the pandemic, as physicians struggled to maintain groups, which boosted the segmental growth.

- In August 2021, a report published by the Primary Care Collaborative stated that the percentage of hospital-owned practices increased from 6% to 11% from 2019 to 2021.

- In addition, according to the American Medical Association AMA 2023 data, approximately 61.2% of physicians providing primary care work in hospital-owned practices.

On the other hand, the physician-owned segment is poised to exhibit considerable growth during the forecast period owing to physicians' struggle to maintain their practices due to administrative burden and shift toward hospital-owned groups of physicians.

By Specialty Analysis

Growing Demand for Chronic and Acute Care to Boost the Growth of Primary Care Segment

Based on specialty, the market is categorized into pediatrics, primary care, OB/GYN, orthopedics, psychiatry, dermatology, ophthalmology, cardiology, and others.

The primary care segment accounted for the lion’s market share in 2024 and is projected to grow significantly in the upcoming years. The growing prevalence of chronic and acute diseases is increasing the demand for primary care facilities, including general internal medicine, family medicine, and others. In addition, the rising primary physician care in the country, which meets the growing demand for these practitioners, bolsters the segment growth.

- For instance, according to the 2023 data published by the Health Resources and Services Administration (HRSA), 268,297 primary care physicians worked in the U.S. in 2021. According to the report, primary care physicians increased by 3.6% from 2016 to 2021. In addition, as per the report, the full-time equivalent (FTE) primary care physician in the U.S. will increase to 79.8 per 100,000 population by 2036 compared to 79.1 per 100,000 population in 2021.

The OB/GYN segment is expected to observe the highest growth rate during the forecast period. The segment growth can be attributed to the growing number of OB/GYN-associated disorders among women, such as endometriosis, reproductive health disorders, infertility, and others. Furthermore, the increasing number of older women in the U.S., the rise in pregnancy rate, and the growing number of patient visits for proper disorder management are expected to promote segmental growth.

- For instance, as per the 2022 Centers for Disease Control and Prevention (CDC) data, Polycystic Ovary Syndrome (PCOS) affects around 6.0% to 12.0% of U.S. women of reproductive age.

The ophthalmology segment is projected to grow at the second-highest CAGR during the forecast period due to an increase in the prevalence of various ophthalmic disorders in the country. In addition, a rise in patient visits for regular eye check-ups and various ophthalmic surgeries, among others, further augment the segmental growth.

- For instance, according to the Centers for Disease Control and Prevention 2022, more than 3.0 million Americans suffer from glaucoma, and the number of patients is projected to rise to 6.3 million by 2050.

- In addition, according to the 2021 report published by the American Academy of Ophthalmology IRIS Registry, an increase of 80% was observed in glaucoma surgeries over a period of 8 years from 2013-2021.

By Payor Analysis

Private Health Insurance/Out-of-pocket Segment Dominated Due to Better Health Plans

Based on payor, the market is divided into private health insurance/out-of-pocket and public health insurance.

The private health insurance/out-of-pocket segment dominated the market share in 2024 and is predicted to record a significant CAGR from 2025 to 2032. The surging uptake of private health insurance in the U.S. owing to comprehensive health plans is one of the predominant factors contributing to the segment growth. Moreover, benefits such as no waiting period, coverage of pre-existing illnesses, and others also bolster the segment growth.

- For instance, according to data published by the U.S. Census Bureau, in 2022, 65.6% of the U.S. population was covered by private health insurance, and about 36.1% were insured by public health insurance. Thus, private insurance coverage was more prevalent than public coverage in the country.

Moreover, the public health insurance segment is also growing with a considerable CAGR. The availability of public insurance at a considerably lower price for physician services than private health insurance increases their adoption among patients. In addition, broad coverage of healthcare costs in public insurance policies makes them affordable for low-income and middle-class families and individuals, poised to fuel the segment’s growth in the forthcoming years.

By Type Analysis

Multi-specialty Segment Led Due to Superior Quality of Care

Based on type, the market is bifurcated into single specialty and multi-specialty.

The multi-specialty segment accounted for the largest market share in 2024 and is expected to register the highest CAGR from 2025 to 2032. The high-quality care at lower cost provided by groups with multi-specialty facilities and a preferential shift among solo practitioners owing to unique benefits in multi-specialty services, including offering more financial stability, support the segment growth. Moreover, lower administration pressure, improved quality care for patients, the establishment of new multi-specialty physician group hospitals, and a smaller workload are also contributing to the segment's growth.

- For instance, in July 2022, Northwell Health opened a multi-specialty physician group medical practice in Yonkers dedicated to cardiology and primary care to fulfill patients' requirements.

The single-specialty segment will experience a moderate CAGR in the projected period due to decreased patient volume, reduced patient visits, and financial instability of the single-specialty groups.

By Region Analysis

Northeast Segment Dominated Owing to the Presence of a Large Number of Physician Groups

Based on region, the market is segmented into northeast, southeast, southwest, midwest, and west.

The northeast segment accounted for the largest share in 2024 and is anticipated to continue its dominance in the forthcoming years. The presence of various physician groups in the region, rising collaborations, and partnerships among the physician groups and others are a few factors contributing to the segment's growth.

- For instance, in February 2023, Privia Health partnered with Community Medical Group to launch Privia Quality Network of Connecticut, one of the largest clinically integrated networks (CIN). The CIN comprises about 1,100 multi-specialty providers, including more than 430 primary care providers, caring for patients in over 450 practice locations.

On the other hand, the southeast segment is anticipated to grow at the fastest-growing CAGR during the forecast period. Increasing initiatives by these groups to expand their geographical footprint, availability of cost-effective treatment, and others are a few factors contributing to the regional growth.

- For instance, in November 2023, BayCare Health System, based in Florida, acquired Gessler Clinic, a physician-owned medical group, to add 20 specialties with more than 40 providers.

Key Industry Players

Permanente Medical Group, Inc. Dominates Due to Different Strategic Business Activities

The U.S. market is fragmented due to many large and small groups. However, Permanente Medical Group, Inc., Optum, Inc., and Ascension are some of the leading players in the market, with Permanente Medical Group, Inc. holding the dominant position. The company's dominance is attributed to various strategic business activities such as market share expansion and strengthening of its market position.

- In April 2023, the Permanente Medical Group, Inc. announced to acquire Geisinger Health to form a new non-profit community health system, Risant Health. Through this acquisition, the company aimed to expand its reach nationwide.

On the contrary, Optum, Inc. held the second-largest market share in 2024. The company is actively expanding its services and strengthening its brand presence through various collaborations, mergers, acquisitions, and other strategies.

- For instance, in October 2022, Optum, Inc. collaborated with Change Healthcare to connect and simplify the core clinical, payment, and administrative processes that healthcare providers and payers depend on to serve patients. The collaboration aims to increase efficiency and reduce the cost of the services.

Other key players, such as Mayo Foundation for Medical Education and Research (MFMER), Beaumont Health, Brigham and Women's Hospital, and Advocate Aurora Health, held a considerable market share owing to diversified services, an established network, new facilities, and a strong focus on acquisitions and mergers.

- For Instance, in December 2022, Advocate Aurora Health collaborated with Atrium Health to form Advocate Health to improve patient needs and strengthen its presence in the country.

LIST OF TOP U.S. PHYSICIAN GROUPS COMPANIES:

- The Permanente Medical Group (U.S.)

- Optum, Inc. (U.S.)

- Brigham and Women’s Hospital (U.S.)

- Cleveland Clinic (U.S.)

- HealthCare Partners IPA (U.S.)

- Ascension (U.S.)

- Northwell Health (U.S.)

- Mayo Foundation for Medical Education and Research (MFMER) (U.S.)

- Beaumont Health (U.S.)

- Advocate Aurora Health (U.S.)

- NYU Langone Hospitals (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: UNITEDHEALTH GROUP, the parent organization of Optum Health, announced the acquisition of the Corvallis Clinic, a 100 physician practice in western Oregon. Through this acquisition, the company aims to expand its presence.

- October 2023: Ascend Capital Partners, a private equity firm, acquired a majority stake in physician-run independent physician associations operating in seven states. The firm joined with Seoul Medical Group (SMG), comprising about 400 primary care physicians and 4,400 specialists serving patients in Georgia, California, Hawaii, New York, New Jersey, Virginia, and Washington.

- November 2022: Mayo Foundation for Medical Education and Research (MFMER) announced the addition of physicians to increase the provision of services among patients.

- November 2022: Northwell Health opened a USD 10.0 million multidisciplinary clinic in Bay Shore to focus on patients for musculoskeletal care and rehabilitative services.

- August 2022: Cleveland Clinic expanded radiology services, with Cleveland Clinic Imaging Institute intending to expand access to radiology services.

REPORT COVERAGE

The research report provides a detailed market analysis. It focuses on key aspects such as leading physician group, types of specialties, competitive landscape of key players, and the comparative analysis of the average cost of key services. Moreover, it offers insights into the market trends and highlights key industry developments. The report further includes the reimbursement and regulatory overview, number of groups by state, prevalence/incidence of key medical conditions, and COVID-19 impact analysis on the primary care physicians market and specialty care physicians market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.8% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Number of Physicians

|

|

By Ownership

|

|

|

By Specialty

|

|

|

By Payor

|

|

|

By Type

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market stood at USD 305.88 billion in 2024 and is projected to reach USD 444.79 billion by 2032.

The market is expected to exhibit steady growth at a CAGR of 4.8% during the forecast period.

By type, the multi-specialty segment led the market in 2024.

The increasing shift from smaller groups of physicians to larger groups, the increasing prevalence of chronic diseases, establishment of new facilities by these groups, and the surge in mergers & acquisitions are the key factors driving market growth.

The Permanente Medical Group, Optum, Inc., Cleveland Clinic, Ascension, Mayo Foundation for Medical Education and Research (MFMER), and Northwell Health are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us