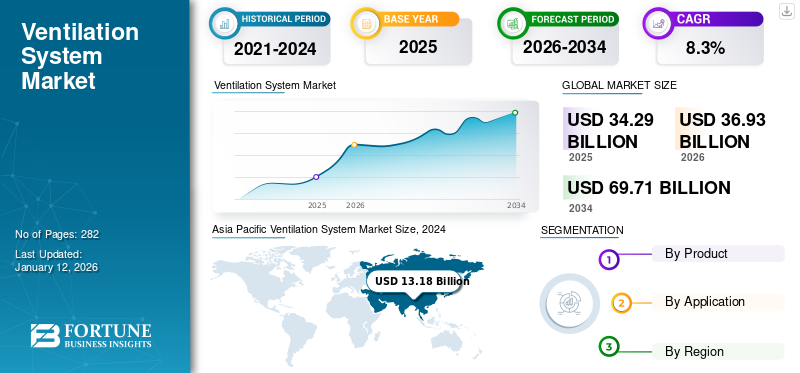

Ventilation System Market Size, Share & Industry Analysis, By Product Type (Data Center Cooling, Centralized Ventilation, Decentralized Ventilation, and Range Hood), By Application (Commercial, Residential, and Industrial), and Regional Forecast, 2026-2034

Ventilation System Market Size

The global ventilation system market size was valued at USD 34.29 billion in 2025. The market is projected to grow from USD 36.93 billion in 2026 to USD 69.71 billion by 2034, exhibiting a CAGR of 8.3% during the forecast period. The Asia Pacific dominated global market with a share of 41.6% in 2025.

Ventilation systems are used to control and circulate the Indoor Air Quality (IAQ) by displacing and diluting pollutants. Ventilation and air conditioning systems improve indoor air quality by exchanging both indoor and outdoor air. Ventilation units are essential for maintaining thermal comfort control with respect to changing weather and atmosphere. They are installed in applications, such as residential, commercial and industrial.

The surging popularity of decentralized systems to reduce the number of interconnections and ducts in office buildings or multi-family residential projects will result in a sudden increase in the sales of ventilation equipment. Moreover, government initiatives regarding sustainable products among industrial and commercial sectors drive market growth. Additionally, government investments in installing and replacing such products in residential, commercial, and industrial spaces will drive market growth.

For instance, in August 2021, according to the U.S. Environmental Protection Agency (EPA), the U.S. government mandated installing ventilation units in data centers. The basic aim of these initiatives is to reduce carbon emissions by around 20%, and about 30%-60% of energy-efficient products are included in these applications. Such initiatives boost the demand for ventilation units, which fuels the growth of the market.

The global market registered a moderate drop in net sales in COVID-19 pandemic in 2020. Rising awareness among population about improving indoor air quality across residential and commercial spaces, which enhancing the demand for ventilation systems drastically after COVID-19 pandemic that drives the growth of the market.

Ventilation System Market Trends

Technological Advancements in Ventilation Systems to Trigger Market Growth

Key market players, such as Carrier, Daikin Industries Ltd, and Johnson Controls International Plc, among others, are engaged in developing new systems with advanced technologies, such as AI-enabled & IoT-enabled machines, and integration of sensors in these systems, to drive the market growth. For instance, in April 2022, Zeco Aircon Ltd introduced a smart air handling unit that is equipped with an integrated control system. It is used in the residential, commercial as well as industrial sectors. It provides a 24X7 indoor quality management solution, and it also saves up to 25% of the energy consumption in Heating, Ventilation, and Air Conditioning (HVAC) systems. It operates through a remote control or smartphone. It has an airflow capacity of 1,000 M3/h to 60,000 M3/h. All the factors above are the key trends for the market.

Download Free sample to learn more about this report.

Ventilation System Market Growth Factors

Government Initiatives Regarding Sustainable Ventilation Systems is Proliferating Market Growth

The federal government is investing in ventilation equipment systems to improve indoor air quality due to proper ventilation, which can be pivoted to maintain healthy environments, out of all other preventive measures. For instance, in October 2020, the government of Germany invested approximately USD 614.1 million in installing such systems in public offices, universities, schools, and museums. The basic aim behind the installation of such systems is to stop the spread of the COVID-19 pandemic. Additionally, Energy in Buildings and Communities (EBC) countries planned programs supporting green buildings. For instance, in September 2023, the Singapore government planned to invest around USD 100 million in the construction of new data centers in Adelaide with a capacity of 10 MW. All such factors drive the market growth.

RESTRAINING FACTORS

High Operating and Maintenance Costs and Shortage of Skilled Technicians to Hinder Market Growth

Traditional mechanical ventilation eliminates congestion in the room. Modern residential and commercial buildings, which are compact and airtight, reduce internal pressure by expelling air. This causes problems with conventional fans, which require a positive force to remove the combustion from the room. The problem can be most effectively solved by ensuring regular maintenance of these systems. However, examining the system and identifying and fixing the error is only sometimes easy; it requires professional technicians. Due to these factors, the costs of operation and maintenance of such products are high. Key market players are engaged in the development of innovations and technologies to solve operational and maintenance problems.

In addition, the heating, ventilation, and air conditioning industry is concerned about the lack of skilled technicians. The current workforce will retire within the next 10 years, leading to job shortage concerns. For these reasons, the ventilation system market share can be affected globally.

Ventilation System Market Segmentation Analysis

By Product Type Analysis

Centralized Ventilation Segment Dominated the Market Due to Rising Demand from Residential and Commercial Sectors

Based on product type, the market is categorized into centralized ventilation, decentralized ventilation, data center cooling, and range hood.

The centralized ventilation segment dominated the market in 2023 and is set to maintain its dominance throughout the forecast period. This is due to a surge in demand for fresh air systems and air handling units from residential and commercial spaces. Moreover, it has advantages, such as energy-efficient systems and robust and technologically advanced products.

The data center cooling segment held a 35.41% of market share in 2026 due to rising demand from various industry sectors. The increase in the efficiency of server centers and the growing consumption of data centers increase the demand for these systems. In addition, precision air conditioners in data centers that maintain indoor temperatures and improve indoor air quality are driving the market growth.

Decentralized ventilation are growing moderately during the forecast period. This is due to the increasing demand for the products in the industrial and commercial sectors due to various features, such as durability, energy efficiency, and ease of installation.

By Application Analysis

Commercial Segment Led Due to Growing Product Adoption

Based on application, the market is further segmented into residential, commercial, and industrial.

The commercial segment dominated the market in 2026 and is expected to maintain its CAGR at 43.97% throughout the forecast period. It is owing to rising demand for such products across airports, educational institutions, hotels & restaurants, and private workplaces to provide a healthy workplace that helps in escalating work efficiency. Moreover, rising investments in the building construction sector helps to dominate the market growth.

Further, the residential segment held a 37% of market share in 2024 and expected to grow at a moderate CAGR during the forecast period. It is owing to factors such as an increase in the disposable income of end users, an increase in the number of residential projects and government initiatives in housing-related activities to drive market growth.

The industrial segment is also expected to register significant demand over the forecast period for air handling units, precision air conditioners, fresh systems, air purifiers, and other products. These types of systems are also installed in many industries, such as food and beverage, chemical and pharmaceutical, oil and gas fields, and other end users.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Regionally, the market is analyzed across North America, Europe, Asia Pacific, the Middle East and Africa, and South America.

Asia Pacific Ventilation System Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is expected to dominate the market during the forecast period due to rising demand for ventilation systems to keep temperatures cool and improve indoor air quality on the premises. An increase in awareness among end users about pollution's impact on human health and fresh indoor air quality in industrial and commercial spaces is anticipated to drive market growth.

Government initiatives, such as the “Make in India” initiative and Pradhan Mantri Awas Yojana in India increase the spending on commercial and residential properties, which, in turn, increases the demand for such systems for residential and commercial premises, which fuels the growth of the market. The anticipated market value of India is USD 2.12 billion for 2026.

In June 2022, as per the Union Budget of India, the government planned to invest around USD 6,443.5 million in providing affordable houses for both rural as well as urban areas. Such investment creates the demand for such products for residential and commercial spaces, driving the growth of the market across Asia Pacific.

China Dominates the Market Due to Rising Construction Activities

China dominates the market owing to the rising disposable income of end users, stable economic growth, and government investment in the construction of new residential, commercial, and industrial spaces, which needs more systems to improve indoor air quality, fueling the market growth. The anticipated market value of China is valued at USD 6.24 billion for 2026, highlighting the country’s strong position in global landscape. For instance, according to Trading Economics, the net disposable income of end users in China is expected to grow by approximately 9.3% during the year 2022 to 2024. Additionally, in August 2022, the Chinese government planned to invest around USD 1,000 billion for the construction of megaprojects. Such factors create the demand for such products, which fuels the ventilation system market growth.

Moreover, the market in Japan is projected to hit a value of USD 3.55 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America is projected to grow decently over the forecast timeframe as the second largest regional market, valued at USD 10.2 billion, with a CAGR of 27.6%. This is due to the increasing demand for residential indoor air quality systems due to severe weather conditions, such as snowfall, hail, hurricanes, and others. Growing investments in the residential sector would increase the need for these systems to ensure a safe and healthy indoor environment across the region. The U.S. market is expected to attain a valuation of USD 7.47 billion in 2026.

Europe is projected to be the third-largest market, with a value of USD 8.84 billion during the forecast period due to the growth of new residential areas in Western Europe. The U.K. market continues to expand, projected to reach USD 2.42 billion in 2026. The demand for energy and heat recovery systems is owing to concerns of end users for the increasing pollution levels in developed countries, such as France and Germany, which had significant pollution levels due to growth in industrial areas, which fuels the ventilation system market expansion. France is expected to reach a market value of USD 1.74 billion, while Germany is projected to be valued at USD 2.09 billion in 2026.

The Middle East & Africa and South America regions are projected to grow steadily during the forecast period. The Middle East & Africa market value stood at USD 1.53 billion in 2026. This is owing to the rising disposable income of end users and the rising construction of high skyscraper buildings across Dubai, Brazil, and GCC countries. The GCC market value is estimated to hit USD 0.92 billion in 2025.

Key Industry Players

Key Market Players Engaged in Adopting Acquisition and Product Launch as Key Strategic Developments

Key players, such as Johnson Controls, Honeywell International Inc., and Greenheck Fan Corporation, among others, are engaged in opting for product launch, acquisition, and business expansion as key developmental strategies to enhance the product portfolio of ventilation products and intensify the market competition across diversified geographic locations. For instance, in January 2022, Munters acquired EDPAC, an air handling equipment and data center cooling equipment manufacturer, to increase its presence in the European market.

List of Top Ventilation System Companies:

- Carrier (U.S.)

- Daikin Industries Ltd (Japan)

- Honeywell International Inc. (U.S.)

- Johnson Controls (Ireland)

- Komfovent (Lithuania)

- Lennox International Inc (U.S.)

- LG Electronics (South Korea)

- Midea Group (China)

- Munters AB (Sweden)

- Trane Technologies (Ireland)

KEY INDUSTRY DEVELOPMENTS:

- December 2023- Komfovent opened a new manufacturing facility at Newcastle Upon Type based in the U.K. The basic aim of this business expansion was to improve the production capacity of air handling units.

- July 2023- Greenheck Fan Corporation introduced a new XG TH 500 air terminal unit. It is an air distribution unit that regulates the airflow capacity for variable and constant volume applications. It found applications in both commercial and industrial spaces.

- November 2022 - Carrier upgraded the Hourly Analysis Program (HAP) v6, an HVAC system design software, to reduce the time and effort needed to make high-quality building models.

- May 2022: Daikin invested in Wlab Ltd., also known as Sensio Air, with an objective to strengthen its partnership with the company further and initiate its new air conditioning solutions business.

- January 2022 - Munters acquired EDPAC, an air handling equipment and data center cooling equipment manufacturer, to increase its presence in the European market.

REPORT COVERAGE

The research report offers a detailed analysis of the numerous factors affecting the global market. These include opportunities, growth drivers, threats, key industry developments, and restraints. It further helps in analyzing, segmenting, and defining the market based on different segments, such as products and applications. It strategically examines several strategies such as product innovations, mergers, alliances, joint ventures, and acquisitions adopted by players to gain a competitive edge in the market and attract high market revenue during the forecast period.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 88.3% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type, Application, and Region |

|

Segmentation |

By Product Type

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the size of the market was USD 34.29 billion in 2025.

The market is projected to reach USD 69.71 billion by 2034.

The market will grow at a CAGR of 8.3% over the forecast period.

Asia Pacific is expected to witness the highest growth rate, with a revenue generation of USD 15.46 billion in 2026.

The commercial segment is led the market in 2026.

Government initiatives for installing sustainable ventilation systems to drive market growth.

Johnson Controls, Greenheck Fan Corporation, and Honeywell International Inc. are the top players in the market.

Asia Pacific is projected to witness the highest market growth owing to the increasing number of commercial and residential construction activities in developing countries.

The centralized ventilation segment is expected to lead the market during the forecast period.

The market currently exhibits the trend of technological advancements in ventilation systems.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us