Veterinary Imaging Market Size, Share & Industry Analysis, By Product Type (X-ray, Ultrasound, Computed Tomography Systems, Magnetic Resonance Imaging Systems, and Others), By Application (Neurology, Oncology, Cardiology, Gynecology, Orthopedics, and Others), By Type (Instruments/Systems, Imaging Reagents, and Imaging Software), By Animal Type (Livestock Animals and Companion Animals), By End-User (Veterinary Hospitals, Diagnostic Imaging Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

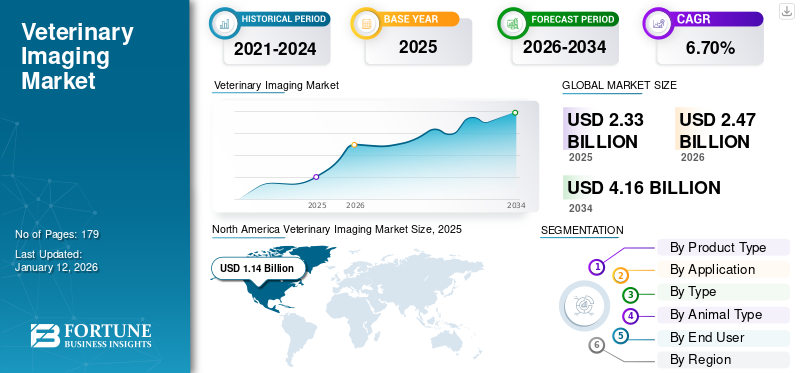

The global veterinary imaging market size stood at USD 2.33 billion in 2025. The market is expected to grow from USD 2.47 billion in 2026 to USD 4.16 billion by 2034, exhibiting a CAGR of 6.70% during the forecast period. North America dominated the veterinary imaging market with a market share of 49.10% in 2025.

Veterinary imaging includes instruments, reagents, and software essential for diagnosing various diseases such as fractures, arthritis, and pneumonia. Veterinary radiology and ultrasound are very useful in diagnosing critical disease conditions. The rising prevalence of veterinary diseases, growing pet ownership, and increasing spending on pet wellbeing are significant factors that spur market growth.

- As per the study published by BioMed Central Ltd. in 2022, canine cutaneous tumors were found in Northern Portugal over a seven-year period (2014-2020). Through this study, 1,185 tumor cases were diagnosed, with 62.9% classified as benign and 37.1% as malignant. Among these, the most frequently occurring tumor was the mast cell tumor, with 22.7% cases.

Moreover, suitable reimbursement policies for pet diagnosis and growing veterinary healthcare expenditure in various countries are propelling market growth. Veterinary radiology equipment manufacturers are collaborating with government and private veterinary hospitals and clinics to upgrade their facilities with highly advanced diagnostic equipment. Such factors are expected to drive market expansion.

The COVID-19 pandemic negatively affected the market across the globe due to the cancellation/postponement of non-essential services. Major players in the market reported a decline in revenue for veterinary imaging in the second quarter of the financial year 2020. However, the easing of COVID-19 guidelines and the resumption of veterinary hospital visits for imaging procedures improved the situation of the market in late 2021. Moreover, in 2022, the market initiated a return to pre-pandemic levels with an increasing number of procedures and rising adoption of these devices and software.

Furthermore, in 2023, the increasing number of veterinary appointments helped the global market fully rebound to pre-pandemic levels. This market is projected to experience sustained growth from 2024-2032.

Global Veterinary Imaging Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.33 billion

- 2026 Market Size: USD 2.47 billion

- 2034 Forecast Market Size: USD 4.16 billion

- CAGR: 6.70% from 2026–2034

Market Share:

- North America dominated the veterinary imaging market with a 49.10% share in 2025, driven by high pet adoption, substantial pet healthcare expenditure, and strong presence of advanced diagnostic imaging facilities.

- By product type, X-ray segment held the largest market share due to their widespread usage for veterinary diagnosis, coupled with a surge in product launches by key manufacturers to meet clinical demand.

Key Country Highlights:

- United States: Growth is propelled by increased spending on pet care, high adoption of diagnostic imaging procedures, and supportive reimbursement policies for veterinary imaging.

- Europe: Expansion is driven by a rising number of veterinary clinics, increasing prevalence of animal diseases, and higher acceptance of advanced imaging techniques in clinical practices.

- China: Growing awareness of zoonotic diseases, coupled with increasing investments in veterinary healthcare infrastructure and technological adoption, is fostering market growth.

- Japan: Market growth is influenced by rising pet ownership trends, a strong focus on companion animal wellness, and increasing deployment of digital radiography systems in veterinary clinics.

Veterinary Imaging Market Trends

Shift Toward Digital X-Ray Systems is a Prominent Trend

Veterinary care is gradually shifting from traditional X-ray films to digital radiography in order to reduce diagnosis turnaround time and offer higher convenience to pet owners and animals. Digital radiography differs from traditional projection radiography as it uses digital X-ray detectors instead of photographic film.

The main advantage associated with digital detectors is that the Picture Archiving and Communication System (PACS) can be fully implemented, allowing images to be stored digitally and access anytime and anywhere. Market players in the veterinary imaging industry are focusing on partnerships/acquisitions to develop new digital radiography systems in order to meet the increasing demand for these systems.

- For instance, in January 2020, Heska Corporation acquired CVM Diagnostico Veterinario, a leading provider of veterinary imaging (digital radiography) in Spain.

- North America witnessed a veterinary imaging market growth from USD 1.14 Billion in 2025 to USD 1.21 Billion in 2026.

Download Free sample to learn more about this report.

Veterinary Imaging Market Growth Factors

Increasing Prevalence of Veterinary Diseases to Drive Growth

Frequent episodes of disease outbreaks among animals have drastically increased the demand for veterinary imaging products. Increasing awareness about veterinary diseases and methods for early diagnosis to prevent outbreaks are likely to favor global market growth during the forthcoming period. The spread of animal diseases results in the potential loss of lives and economies. For countries whose economies are majorly dependent on animals, livestock disease outbreaks can be a severe economic burden. Thus, the timely diagnosis of livestock animals is necessary.

Rising concerns about veterinary diseases such as cardiovascular disease, cancer, and orthopedic disorders are expected to contribute to the expansion of the global market during the forecast period. For instance, a study published by Oxford University Press in 2022 found that osteoarthritis is prevalent in more than 50% of horses older than 15 years, and in 80%-90% of horses above 30 years of age in Brazil. Diagnostic imaging is commonly recommended in osteoarthritis cases and the rising incidence of such cases is expected to augment market growth.

RESTRAINING FACTORS

Shortage of Skilled Veterinary Health Providers in Some Regions to Hamper Growth

The presence of highly advanced diagnostics tools for animals requires trained and well-qualified professionals to operate and use them. The lack of skilled professionals is one of the critical factors hindering the demand for veterinary imaging equipment in some regions of the world. Both developed and emerging nations face a shortage of skilled and qualified labor, which poses a barrier to the adoption of such equipment. According to an article published by Frontiers Media S.A. in 2021, the most commonly reported challenges in providing diagnostic laboratory services are insufficient or lack of supplies, equipment, and reagents, costly reagents, inadequate or lack of laboratory staff to perform tests, and insufficient training of laboratory staff. Developed and emerging nations face the problem of skilled and qualified labor, which poses a barrier to adopting veterinary diagnostics imaging procedures.

Veterinary Imaging Market Segmentation Analysis

By Product Type Analysis

Robust Product Launches Enable X-ray Segment to Hold Significant Share of Global Market

Based on product type, the market is segmented into X-ray, ultrasound, computed tomography systems, magnetic resonance imaging systems, and others. The X-ray segment held the dominant share 29.15% in 2025, attributable to growing pet ownerships, increasing prevalence of animal diseases, rising disposable income, and numerous product launches by market players. It is the most common imaging procedure for diagnosing various veterinary disorders.

- For instance, in February 2021, FUJIFILM Medical Systems introduced its first complete VXR Veterinary X-Ray Room. The innovative design of this new X-ray room targets veterinarians who want to transition to high-quality, low-dose X-rays with an affordable, versatile, easy-to-use, and easy-to-install system.

Moreover, computed tomography systems and magnetic resonance imaging systems held a significant share in 2024. The growing prevalence of diseases such as cancer and increased veterinary healthcare expenditure by key countries are expected to propel the growth of the segment during the forecast period.

By Application Analysis

Rising Prevalence of Orthopedic Diseases Promote Orthopedics Segment Growth

Based on application, the market is categorized into neurology, oncology, cardiology, gynecology, orthopedics, and others. The orthopedic segment held the largest share 26.32% in 2026. This dominance is primarily due to the high adoption of imaging procedures for orthopedics disorders, which are increasingly prevalent in companions and livestock animals. For instance, according to a study published by John Wiley & Sons, Inc. in 2022, approximately 38.0% (188 out of 500) of dogs were suffering from osteoarthritis, and this condition is underdiagnosed in dogs in the U.S.

-

- The Orthopedics segment is expected to hold a 26.32% share in 2026.

The oncology segment held the second-largest share in 2024. Accurate diagnosis is crucial for detecting cancer in animals, and increasing prevalence of cancer in companions and livestock animals, coupled with the growing spending on veterinary care, and favorable reimbursement scenarios. These factors are likely to drive the oncology segment growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Type Analysis

Growing Number of Diagnostic Imaging Procedures Contribute to Instruments/Systems Growth

Based on type, the market is segmented as instruments/systems, imaging reagents, and imaging software. The instruments/systems segment held the largest veterinary imaging market share 63.56% in 2026. This growth is due to increased frequency of veterinary imaging tests and veterinary radiology services. For instance, according to an article published by Allianz Global Investors in 2021, veterinary care, including diagnostics, is the second largest area of spending for pet parents, following food.

The imaging reagents segment held a substantial share of the market. The segment’s growth is attributed to the rising number of veterinary hospitals and research initiatives for companion and livestock animals. Moreover, the increased prevalence of animal diseases, growing disposable income, and a strong emphasis on developing advanced reagents and kits by leading players are contributing to market growth on a global level.

The imaging software segment holds a notable share of the market and is expected to grow at a significant CAGR during the forecast period. The rising imaging diagnostic procedure and significant product launches by key players are promoting the market growth.

By Animal Type Analysis

Companion Animals Segment Dominated due to Rising Expenditure on Pet Care

On the basis of animal type, the market is fragmented into companion animals and livestock animals. The companion animal segment held a dominating share 70.45% of the global market in 2026 and is likely to grow with a higher CAGR during the forecast period. This growth is driven by increasing urbanization and a heightened recognition of the importance of human-animal companionship. Loneliness due to nuclear families, migration of youth from their homes to work locations, a growing number of bachelors living without their families, and increasing spending capacity on pet care are some of the significant factors contributing to the dominance of the companion animal segment in the global market. According to a Forbes article, in 2023, approximately 66.0% of U.S. households (86.9 million homes) own a pet, with owners ready to spend on their pet's health and wellbeing. This, in turn, favors the veterinary diagnostics market by driving demand for pet disease testing. Additionally, pet owners’ tendency to be extra cautious and opt for regular check-ups and diagnoses further support the veterinary imaging market growth.

By End-User Analysis

Stronger Preference for Veterinary Hospitals Enabled its Market Dominance in 2024

On the basis of end-user, the market is segregated into veterinary hospitals, diagnostic imaging centers, and others. The veterinary hospital segment accounted for the highest share of the market. The growth is driven by the increasing number of veterinary care professionals in hospitals and the availability of comprehensive imaging equipment to detect various diseases in animals.

Additionally, the growing initiatives by prominent market players to improve patient care and easy workflow in hospitals by launching several software contributes to market growth. In July 2021, IDEXX Laboratories, Inc. acquired ezyVet to offer a full range of cloud-based PIMS options to improve customer service and fulfill the needs of veterinary hospitals, corporate groups, universities, and others.

The diagnostic imaging centers segment held the second-largest share of the global veterinary imaging market. This is attributable to the rising number of diagnostic imaging centers in developed and developing regions, the increasing number of vet imaging specialists, and the growing preference for these centers due to their accurate results.

REGIONAL INSIGHTS

Based on geography, the market is divided into Latin America, North America, Asia Pacific, Europe, and the Middle East & Africa.

North America Veterinary Imaging Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The veterinary imaging systems market size in North America stood at USD 1.14 billion in 2025. High adoption of pet animals in the U.S. and Canada, massive spending on pet care, growing employment in the veterinary sector, and favorable reimbursement scenarios are some of the significant factors contributing to the dominance of the region. Pet insurance facilities are growing in emerging nations, with policies including diagnostic tests, such as imaging and clinical procedures. The region’s growth is further supported by the high penetration of technologically advanced imaging products due to the intense focus of leading players on launching innovative products.The U.S. market is projected to reach USD 1.14 billion by 2026.

Europe is anticipated to be the second-largest leading region in terms of revenue. This is attributable to the increasing adoption of pet animals, rising prevalence of veterinary diseases, a growing number of veterinary clinics, and improved healthcare infrastructure in the European countries. These factors are boosting the adoption of advanced diagnostic imaging techniques in the region. For instance, as per the study published by Frontiers Media SA in 2022, the prevalence of idiopathic epilepsy and structural epilepsy in Boxer dogs was more than or close to 8.4% (90 out of 1,072).The UK market is projected to reach USD 0.07 billion by 2026, while the Germany market is projected to reach USD 0.17 billion by 2026.

Asia Pacific market is anticipated to grow with the highest CAGR, driven by growing awareness of zoonotic diseases risks and increasing spending on animal care in emerging countries such as China and India.The Japan market is projected to reach USD 0.1 billion by 2026, the China market is projected to reach USD 0.12 billion by 2026, and the India market is projected to reach USD 0.04 billion by 2026.

Latin America & the Middle East & Africa accounted for a comparatively lower share of the market owing to lower adoption of diagnostic imaging procedures for livestock and companion animals.

KEY INDUSTRY PLAYERS

Diverse Product Portfolios by Siemens Healthineers AG & GE Healthcare to Upscale Growth

The veterinary imaging market features key players competing to gain a leading position in the market. Siemens Healthineers AG, GE Healthcare, FUJIFILM Holdings Corporation, and Koninklijke Philips N.V. are a few companies that are well-positioned in the global market. Siemens Healthineers, for instance, has leveraged its comprehensive range of products and services to replicate its successful strategies. Additionally, key players are strengthening their market positions through various collaborations and acquisitions,

- For instance, in December 2021, Fujifilm India Pvt Ltd collaborated with A’alda Vet India Pvt Ltd to boost healthcare facilities for pets. Fujifilm India provided innovative medical and screening devices to the DCC (Dogs, Cats & Companions) Animal Hospital, an initiative by A’alda Vet aimed at improving veterinary care in India.

Other players in the market, such as Heska Corporation, Agfa-Gevaert Group, and Onex Corporation (Carestream Health), are continuously engaging in the development of novel diagnostic imaging technology. They are also widening their distribution channels across the globe to establish their footprints in emerging regions.

LIST OF TOP VETERINARY IMAGING COMPANIES:

- GENERAL ELECTRIC COMPANY (U.S.)

- Agfa-Gevaert Group (Belgium)

- Esaote SpA (Italy)

- Siemens Healthineers AG (Germany)

- Heska Corporation (U.S.)

- IDEXX Laboratories, Inc. (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- Carestream Health (U.S.)

- Canon Medical Systems Corporation (Japan)

- Koninklijke Philips N.V. (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: IONETIX partnered with Provision Diagnostic Imaging in Knoxville, which utilizes N-13 Ammonia manufactured on-site by IONETIX. Provision Diagnostic Imaging is a leading outpatient diagnostic center in the East Tennessee region, known for pioneering advanced medical diagnostics technology.

- January 2024: SignalPET launched SignalSTAT, a cutting-edge Artificial Intelligence (AI) technology with human expertise to offer pets with the fastest and most thorough care. This advanced veterinary X-ray interpretation solution can assess most critical or urgent cases with both advanced AI technology and expert human oversight with a guaranteed 45-minute turnaround time, available 24/7.

- March 2023: Zoetis Services LLC announced the expansion of its multi-purpose diagnostics platform, “Vetscan Imagyst,” by adding two new applications, AI dermatology and AI equine FEC analysis. This development increased the company’s testing capabilities.

- August 2020: IDEXX Laboratories launched the ImageVue DR30 Digital Imaging System (Digital Radiography) with the aim of expanding its portfolio.

- January 2020: Heska Corporation acquired scil animal care company GmbH with the aim of expanding its veterinary point-of-care laboratory and imaging diagnostics.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, applications, type, animal type, product type, and end user. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the advanced market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 6.70% from 2026-2034 |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By Type

|

|

|

By Animal Type

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 2.33 billion in 2025.

In 2025, the North America’s market size stood at USD 1.14 billion.

The market will exhibit steady growth at a CAGR of 6.70% during the forecast period (2026-2034).

By application, the orthopedics segment led the market in 2025.

North America region dominated the market in 2025.

The increasing prevalence of veterinary disorders, growing pet ownership, and increasing willingness of pet owners to spend on pet wellbeing are the key factor driving market growth.

The introduction of advanced product offerings and the shift toward digital X-rays are the key trends in the market.

Siemens Healthineers AG, GE Healthcare, and Koninklijke Philips N.V. are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us