Well Testing Service Market Size, Share & Industry Analysis, By Service (Real Time Testing, Downhole Testing, Reservoir Sampling, Surface Well Testing, and Others), By Application (Onshore and Offshore), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

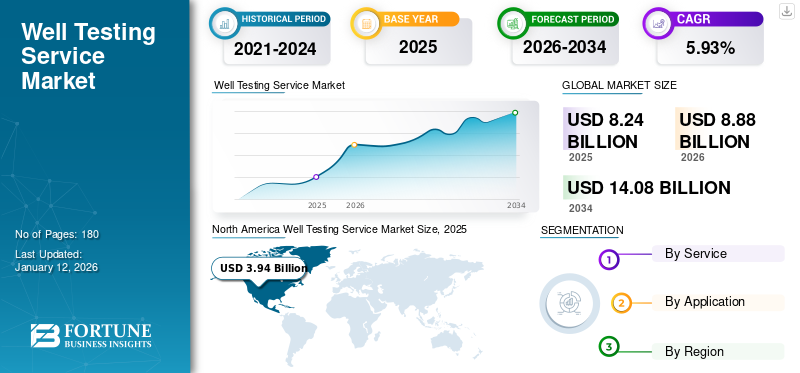

The global well testing service market size was valued at USD 8.24 billion in 2025. The market is projected to grow from USD 8.88 billion in 2026 and is expected to reach USD 14.08 billion by 2034, exhibiting a CAGR of 5.93% during the forecast period. North America dominated the global market with a share of 47.81% in 2025.

Well testing services can be described as the process of data acquisition to increase the understanding of the reservoir characterization and the fluid properties. Due to the increase in energy demand, there has been a surge in exploration activities. New wells need to be economically viable and should help produce enough profit for the companies. This viability check is performed by the well testing process, which is performed during all three phases of the well, i.e., exploration, development, and production. Growing demand for energy across the globe and an increase in E&P spending are significant factors driving the growth of the market.

The market growth is attributed to increasing global energy demand, rising oil & gas exploration activities, and advancements in digital monitoring technologies. Strict environmental regulations and the need for reservoir optimization are also driving adoption. Additionally, offshore and unconventional resource developments are boosting market expansion.

Schlumberger Limited is one of the major companies playing a leading role in the well-testing services industry by providing advanced solutions for reservoir characterization, flowback testing, and production optimization. The company leverages cutting-edge digital technologies, real-time data analytics, and automated systems to enhance performance assessment. SLB’s expertise in pressure, temperature, and flow rate measurement helps operators make informed decisions for reservoir management. Additionally, its services support efficient hydrocarbon recovery while ensuring compliance with environmental and safety regulations.

MARKET DYNAMICS

MARKET DRIVERS

Rise in Offshore E&P Activities to Drive Growth of the Market

Growing population and industrial developments are fueling the global demand for energy. Global fuel consumption increased in 2023. According to the World Energy Statistics, the global consumption of oil products increased by around 2.4%, whereas natural gas consumption increased by 1.3% from 2022. This rise in the demand for fossil fuels is prompting companies to increase their fuel production. With fewer easy-to-access oil fields remaining, oil & gas companies have moved toward new areas, including operations in more remote and deeper offshore areas. As a result, the demand for well testing services is high in deep-water E&P activities. Thus, the rise in offshore E&P activities is estimated to drive the growth of the global well testing service market.

Growth in New Oil & Gas Discoveries is Propelling Market Growth

According to the International Energy Agency (IEA), spending on the oil and gas sector rose by around 5.21% in 2023. The total investment in 2023 was around USD 1,090 billion, compared to USD 1,036 billion in 2022.

Off the coast of Mauritania, BP's Orca gas field was only the largest single discovery and also the deepest-water find of 2019. It holds about 1.3 billion barrels of oil equivalent of recoverable resources. In Russia, Gazprom announced two discoveries in the Rusanovsky block and in the Nyarmeysky block, which holds combined recoverable resources of around 1.5 billion barrels of oil equivalent. These discoveries are expected to boost the development of wells and oil & gas production in the near future. Thus, an increase in the discovery of oil & gas fields is estimated to drive the well testing service market growth during the forecast period.

MARKET RESTRAINTS

Fluctuating Oil & Gas Prices Hinders the Market Growth

Fluctuating oil and gas prices pose a major challenge for the well testing services industry by creating uncertainty in investment and operational planning. During price downturns, oil and gas companies reduce capital expenditures, leading to fewer exploration and drilling activities, which directly impacts the demand for well testing services. Service providers may face project delays, budget constraints, and increased pressure to offer cost-effective solutions. Additionally, volatility in prices makes long-term planning difficult, affecting workforce stability and technology investments. To navigate these challenges, well testing companies must focus on efficiency, digital innovations, and flexible service models to sustain operations during market fluctuations.

MARKET OPPORTUNITIES

Regulatory and Environmental Compliance to Play a Key Role in Market Growth

Government and industry bodies enforce stringent guidelines to ensure safe, efficient, and environmentally responsible hydrocarbon extraction. Regulations govern multiple aspects of well testing, including emissions control, waste management, fluid disposal, and pressure monitoring, to minimize environmental risks such as groundwater contamination, air pollution, and oil spills. Stringent policies, such as the European Union’s methane emissions reduction strategy and the U.S. Environmental Protection Agency (EPA) regulations, mandate the use of advanced real-time well testing technologies that lower carbon footprints, reduce flaring, and prevent uncontrolled gas releases. Operators are increasingly adopting real-time monitoring, automated well testing systems, and zero-flaring technologies to ensure compliance with these evolving regulatory frameworks while optimizing production efficiency. Additionally, regulatory compliance influences operational decision-making, as companies must obtain permits and adhere to environmental impact assessments before conducting well testing. Thus, the mandatory adherence to the rules and regulations framed by the government and industry organizations is expected to provide opportunistic growth to the market.

MARKET CHALLENGES

Focus on Clean Energy to Constrain Market Expansion

The growing focus on renewable energy to reach zero emission targets is leading to a slowdown in the consumption of fossil fuels. Global investments in clean energy are much higher than those of fossil fuels, which is expected to constrain the growth rate of the well testing services market. According to the International Energy Agency (IEA), the global investment in clean energy in 2023 was around USD 1884 billion, representing about 72% more investments than fossil fuels in 2023. Increased solar, wind, and hydrogen energy investments reduce funding for oil and gas exploration, leading to lower demand for well testing services. Additionally, stricter environmental policies and carbon reduction targets put pressure on fossil fuel operations, encouraging companies to transition toward greener alternatives. This shift forces well testing service providers to adapt by integrating more sustainable practices, exploring digital innovations, and diversifying their offerings to remain competitive in a changing energy landscape.

WELL TESTING SERVICE MARKET TRENDS

Rise in Unconventional Oil & Gas Production to Positively Impact Market Growth

Unconventional oil & gas has been an important breakthrough for the global oil industry. According to the U.S. Energy Information Administration (EIA), the shales and tight gas formations accounts around 79% of the U.S. dry natural gas production in 2024. Advanced technologies are needed to extract unconventional fuels. Companies are investing significantly in research and development activities to come up with economical methods for extraction. Thus, the production of unconventional fuels is expected to rise shortly. Advance well testing service is needed to extract unconventional oil and gas. Hence, the rise in the production of unconventional oil and gas is anticipated to drive the well testing service market growth during the forecasted period.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The spread of the COVID-19 pandemic posed a significant threat to the global oil and gas industry. The unprecedented restrictions on travel, work, and industry due to the coronavirus had cut down billions of barrels of oil, trillions of cubic meters of gas, and millions of tonnes of coal from the global energy system in 2020 alone. More than 15 of the world's largest public oil and gas companies by market value had announced specific cuts to their 2020 capital spending programs. In April 2020, ExxonMobil Corporation announced its plan to reduce 2020 capital expenditure by 30 percent to USD 23 billion, down from the previously announced USD 33 billion, in response to low commodity prices resulting from oversupply and demand weakness from the COVID-19 pandemic. Thus, the outbreak of COVID-19 led to the downfall in the investments in the global oil & gas industry, subsequently negatively impacting the global well-testing services market growth.

SEGMENTATION ANALYSIS

By Service

Monitoring Solution Offered by Real Time Testing Service to Dominate the Market

Based on service, the market is segmented into real time testing, downhole testing, reservoir sampling, surface well testing, and others.

The real time testing segment held a dominant share of the market in 2024. Real time helps to monitor all the data and trends as the operation unfolds. This is used to make real-time decisions, ensure safe operations, quality check and validate the data, and optimize the processes, leading to less flaring and lower costs. Furthermore, companies are also investing in R&D activities to design and develop innovative well testing methods. The segment is set to capture 34.27% of the market share in 2026.

In terms of growth rate, the market demand is likely to move toward surface well testing and reservoir sampling services during the forecast period to optimize the operation and production output with minimum cost.

The downhole testing segment is expected to grow with a considerable CAGR of 6.77% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Application

Vast Presence of Onshore Activities to Lead the Onshore Segment Growth

Based on application, the well testing services industry is divided into onshore and offshore, each playing a distinct role.

The onshore segment holds a larger share in terms of project volume, supported by widespread land-based drilling in regions such as North America, the Middle East, and Asia Pacific. Lower operational costs and easier accessibility drive its growth. The segment dominated with market with a share of 77.11% in 2026.

In contrast, the offshore segment accounts for a smaller but higher-value share due to the complexity and cost of deep-water and ultra-deepwater exploration. Offshore well testing demand is rising at the fastest rate due to its global oil & gas drilling, particularly in South America and Africa, as investments in deep-water reserves continue to grow despite operational challenges.

WELL TESTING SERVICE MARKET REGIONAL OUTLOOK

Geographically, the global market has been studied across five major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America

North America Well Testing Service Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Rising Oil & Gas Production in the Region to Foster Market Growth

North America dominated the market with a valuation of USD 3.94 billion in 2025 and USD 4.26 billion in 2026. According to the BP Statistical Review, the region was the second-largest producer of oil and the largest producer of gas in the world in 2024. According to the International Energy Agency (IEA), the region produced around 48.6 million Tj of crude oil in 2022, representing around 26% of the global share. In addition, the rising efforts to discover additional oil & gas wells for sustainability are expected to drive the market in the forecasted period.

U.S.

High Rate of Drilling Activities to Augment Market Growth

The market in the U.S. is driven by extensive onshore drilling activities, particularly in shale plays such as the Permian Basin, Eagle Ford, and Bakken formations. The U.S. market is also influenced by technological advancements such as digital well monitoring and automation, which improve testing accuracy and efficiency. As the energy landscape evolves, well testing services in the U.S. increasingly focus on optimizing production from mature wells and managing unconventional resources such as shale gas and tight oil. The U.S. market is set to be worth USD 3.74 billion in 2026.

Asia Pacific

Huge Oil & Gas Consumption in the Region to Fuel Market Growth

Asia Pacific is expected to hold the second-largest share of the market valued at USD 2.16 billion and is expected to grow at the highest CAGR of 24.21% during the forecast period (2026-2034). The region is the net importer of energy and the most rapidly growing consumer of crude oil and natural gas. This has resulted in a significant rise in expenses for the region's crude oil imports. According to the International Energy Agency (IEA), the Asia Pacific region's crude oil imports account for around 45% of the total crude oil consumption in the region. Thus, the rise in oil & gas imports is leading to the growing focus on developing new oil & gas wells in the region to diminish the value of imports and become del-dependent. India is estimated to grow with a value of USD 0.23 billion in 2026, while Indonesia is predicted to stand at USD 0.18 billion in 2025.

China

Huge Investment in Advanced Technologies to Beef up the Market

The China well testing services market is driven by the country's efforts to boost domestic production, particularly in shale gas and offshore reserves. In August 2024, China announced the discovery of the world’s first large shallow gas field in the South China Sea, with an estimated gas reserve of over 100 billion cubic meters. Moreover, the growing focus on energy security, along with advancements in technology and the recovery of oil and gas markets, are driving further investment in well testing solutions. China is poised to hold USD 1.26 billion in 2026.

Europe

High Adoption of Advanced Technologies for Oil & Gas Production to Push Market Growth

Europe is estimated to be worth USD 1.02 billion in 2026. The region is expected to show positive growth in the coming years as the region has a robust regulatory framework that ensures compliance with environmental and safety standards, driving the demand for high-quality well testing services. The U.K. market is expanding, projected to reach a market value of USD 0.3 billion in 2026. Companies in the region are increasingly focusing on advanced data analytics, automation, and digital technologies to improve operational efficiency and reduce costs. The ongoing transition to renewable energy sources also influences the well testing market, as operators seek to optimize production from existing reserves while balancing new energy initiatives. Geopolitical uncertainties and fluctuating oil prices add complexity to the market dynamics. Norway is expected to gain USD 0.16 billion in 2025, while Russia is set to reach USD 0.22 billion in the same year.

Latin America

Presence of Untapped Hydrocarbons in the Region to Provide Opportunistic Growth to Market

Latin America is projected to show steady growth in the well testing services market due to its vast oil and gas reserves, particularly in Brazil, Mexico, and Venezuela. The market is driven by both conventional and unconventional hydrocarbon exploration, with a growing emphasis on deep-water drilling and offshore production. In addition to the continued international investments in the region due to its significant reserves, the well-testing companies are increasingly leveraging advanced technologies such as real-time data monitoring and reservoir analysis to enhance production efficiency and safety.

Middle East & Africa

Presence of Matured Oil & Gas Wells to Necessitate Well Testing Services Demand

The Middle East & Africa is likely to grow with a value of USD 0.83 billion in 2026. The region is expected to witness considerable growth in the global well testing service market, with huge oil and gas-producing countries such as GCC countries, Iraq, Egypt, Nigeria, and others having mature fields. Well testing services are vital in these areas for maintaining and enhancing oil recovery, particularly in aging fields and challenging environments such as deeper reservoirs and offshore sites. High-end technologies, including downhole monitoring and real-time data analytics, are crucial for improving efficiency while meeting sustainability and safety goals. The GCC market is anticipated to reach a value of USD 5.41 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Participants are Concentrating on Increasing their Presence and Securing New Contracts

The global market is consolidated owing to the strong product portfolio and a remarkable global network of major companies in developed and emerging countries. Slb, Weatherford, and Halliburton Inc. lead the market, accounting for a dominant share in 2024. However, strong barriers to entry are projected to limit the number of domestic players entering the global market. This makes the market more competitive in the future.

The companies are expanding their presence by adopting strategies such as mergers & acquisitions and focusing on new contracts. Moreover, SLB enhances well testing with advanced technologies for accurate reservoir evaluation and production optimization. Their automated well testing trailer improves efficiency and safety while reducing emissions. SLB's zero-flaring solutions also align with sustainability goals by minimizing environmental impact. These innovations reinforce their commitment to efficient and eco-friendly well testing operations.

List of Key Well Testing Service Companies Profiled

- Slb (U.S.)

- Halliburton Inc. (U.S.)

- Weatherford (U.S.)

- Expro Group (U.K)

- TechnipFMC plc (U.K)

- Baker Hughes (U.S.)

- SGS SA (Switzerland)

- China Oilfield Services Limited (COSL) (China)

- Oil States International, Inc. (U.S.)

- TETRA Technologies, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2024: MCF Energy reported significant progress in production testing of the Welchau-1 well in the ADX-AT-II license area, Upper Austria. The well completion process included tubing, a packer, and a perforating system. Two intervals in the Steinalm Formation (1,452.5–1,463.5m MD and 1,474.5–1,480m MD) were perforated with high-density casing guns. A well clean-up flow revealed gas at the surface and an unassisted stable liquid flow, including drilling mud, contaminated formation water, and oil traces. The unstimulated interval showed productivity of 240–290.

- September 2024: LSU College of Engineering announced a partnership with Halliburton, ExxonMobil, Shell, Chevron, and H&P to drill a third research well at its PERTT Lab in early 2025. This unique well will allow the study of CO2 in all three phases under field conditions, focusing on safety technologies, CO2 flow behavior, and model validation. The well will be non-operational and solely dedicated to research.

- March 2023: National Energy Services Reunited Corp (NESR) secured a long-form well testing contract with Saudi Aramco, expanding its services using advanced technology. Earlier this year, NESR also won a nine-year wireline services contract in Saudi Arabia, enabling the introduction of new technologies. The company’s wireline business has established a strong presence in Saudi Arabia, Egypt, and Iraq.

- February 2020: Halliburton Inc., unveiled the SPIDRlive Self-Powered Intelligent Data Retriever, an unconventional well testing and fracture interaction monitoring technology. The SPIDRlive retriever combines quartz-based hardware and proprietary modeling software to capture high-resolution, high-accuracy, and high-frequency data from the wellhead without running downhole equipment.

- July 2019: Kuwait Oil Company (KOC) and Halliburton Inc. signed an integrated offshore drilling services contract for six high-pressure, high-temperature (HPHT) exploration wells on two jack-up rigs in the Arabian Gulf. Under the contract, the company would provide and manage drilling, fluids, wireline and perforating, well testing, coring, cementing, coiled tubing, and all offshore logistical services.

REPORT COVERAGE

The global well testing service market report delivers a detailed insight into the industry and focuses on key aspects such as leading companies. Besides, it offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, it encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.93% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service, By Application, and By Region |

|

Segmentation |

By Service

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 8.24 billion in 2025.

The market is likely to grow at a CAGR of 5.93% during the forecast period of 2026-2034.

Based on application, the onshore segment is expected to lead the market during the forecast period.

The market size of North America stood at USD 3.94 billion in 2025.

The rise in offshore E&P activities is one of the key factors driving market growth.

Some of the top players in the market are Slb, Halliburton Inc., Weatherford, Baker Hughes, Expro Group, and others.

The global market size is expected to reach USD 14.08 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us