Inorganic Coagulants Market Size, Share & Industry Analysis, By Type (Aluminium Based, Iron Based, and Others), By Application (Municipal, Pulp & Paper, Textiles, Oil & Gas, Power Generation, Mining & Metallurgy, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

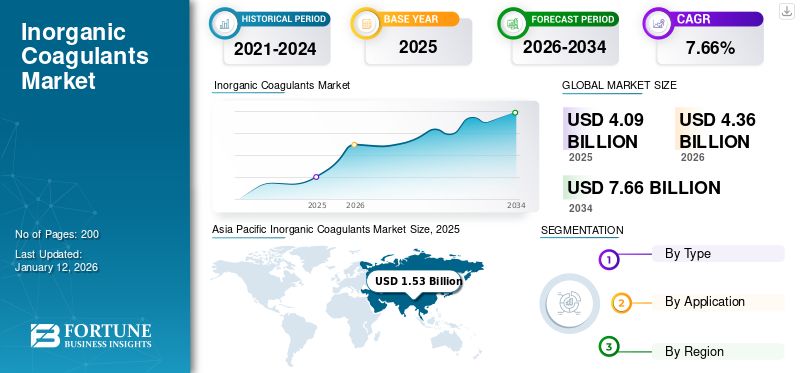

The global inorganic coagulants market size was valued at USD 4.09 billion in 2025 and is projected to grow from USD 4.36 billion in 2026 to USD 7.66 billion by 2034, exhibiting a CAGR of 7.10% during the forecast period. Asia Pacific dominated the inorganic coagulants market with a market share of 37% in 2025.

Inorganic coagulants are chemical agents, such as aluminium sulfate or ferric chloride, extensively employed in water treatment to induce coagulation, a vital process for removing impurities. By destabilizing charged particles, these coagulants facilitate the formation of larger, settleable flocs, allowing efficient removal of contaminants through sedimentation or filtration. Factors, such as population growth, industrial expansion, and stringent water quality regulations fuel the widespread use of products. As global demand for clean water rises, these coagulants play a crucial role in meeting water treatment needs, driven by ongoing technological advancements and the imperative to adhere to environmental standards for sustainable and effective water purification. Hence, such factors will drive the market growth during the forecast period.

However, the COVID-19 pandemic significantly impacted the market. Initially, the market experienced disruptions in the supply chain due to lockdown measures, travel restrictions, and labor shortages, leading to challenges in raw material procurement and production. However, the increased emphasis on hygiene and sanitation, particularly in water treatment processes to ensure safe drinking water and maintain public health standards, drove demand for inorganic coagulants.

Global Inorganic Coagulants Market Overview

Market Size:

- 2025 Value: USD 4.09 billion

- 2026 Value: USD 4.36 billion

- 2034 Forecast Value: USD 7.66 billion, with a CAGR of 7.1% from 2026–2034

Market Share:

- Asia Pacific led the inorganic coagulants market with a 37% share in 2025 and remains the fastest-growing region due to rapid industrialization, urbanization, and strict environmental regulations.

- By type, the aluminium-based segment is projected to hold a 49.31% share in 2026.

Key Country Highlights:

- The inorganic coagulants market in Japan is expected to reach USD 0.05 billion by 2026.

- China is forecast to witness a strong CAGR of 7.90%, while Europe is anticipated to grow at a CAGR of 6.4% during the forecast period.

Inorganic Coagulants Market Trends

Growing Advanced Water Treatment Technologies to Propel Market Growth

The trend toward advanced treatment technologies in the field of water treatment, including the use of inorganic coagulants, reflects a dynamic shift toward more efficient, sophisticated, and environmentally friendly methods. Traditional water and wastewater treatment processes have long relied on coagulants such as ferric chloride and aluminium sulfate to induce coagulation and facilitate the removal of impurities. However, technological advances have spurred the development of novel and more effective treatment methods.

Advanced treatment technologies encompass a range of innovative approaches, such as electrocoagulation, membrane filtration, and Ultraviolet (UV) disinfection. These technologies often offer enhanced precision, allowing for the removal of a broader spectrum of contaminants, including microorganisms, organic compounds, and trace pollutants. Additionally, they may contribute to reduced chemical usage, lowering the reliance on traditional coagulants and minimizing the generation of sludge or by-products. Additionally, incorporating smart sensors and automation in water treatment processes enables real-time monitoring and adjustment of coagulant dosages based on changing water quality parameters. Hence, this level of precision will help optimize coagulation efficiency and reduce the overall environmental impact.

Download Free sample to learn more about this report.

Inorganic Coagulants Market Growth Factors

Increasing Global Demand for Clean and Safe Water to Drive Market Growth

Increasing global demand for clean and safe water is expected to fuel the adoption of inorganic coagulants during the forecast period. The growing population, rapid urbanization, and industrialization have led to heightened water pollution and contamination challenges. Coagulants, such as aluminium sulfate and ferric chloride, play a crucial role in the water treatment industry by inducing coagulation and facilitating the removal of suspended particles, organic matter, and other impurities from water.

The expanding need for reliable water treatment solutions is driven by several factors. These factors include stringent environmental regulations, rising awareness about waterborne diseases, and a growing emphasis on providing access to clean water for both domestic and industrial purposes. In many regions, water treatment facilities and industries rely on inorganic coagulants to meet regulatory standards and quality requirements for various industrial processes. Moreover, as water scarcity becomes a global concern, the efficient use of water resources is paramount. Inorganic coagulants contribute to water conservation efforts by improving the efficiency of water treatment processes, reducing the need for extensive filtration, and minimizing the environmental impact of water discharges. Hence, such factors and the growing need for clean and safe water would augment the market growth.

RESTRAINING FACTORS

Growing Focus Toward the Ecological Impact on Aquatic Life and Ecosystems to Restrict Market Growth

Growing focus on the ecological impact of inorganic coagulants on aquatic life and ecosystems is expected to impede market growth. The use of certain coagulants may affect the pH levels of treated water, potentially influencing the bioavailability of metals and posing risks to aquatic organisms. Also, the growing efforts by governments and companies to reduce the ecological footprint of water treatment processes are driving the exploration of alternative coagulant formulations and the development of more sustainable practices. Moreover, environmental concerns related to using certain coagulants, regulatory pressures, and economic considerations represent restraining factors influencing the market.

Inorganic Coagulants Market Segmentation Analysis

By Type Analysis

Aluminium Based Segment to Remain Dominant due to Effective Coagulation and Flocculation Properties

By type, the market is segmented into aluminium based, iron based, and others.

The aluminium based segment accounted for the highest inorganic coagulants market share in 2025. Aluminium based coagulants, such as aluminium sulfate (alum) and polyaluminium chloride, are widely used in water treatment processes for their effective coagulation and flocculation properties. These coagulants play a pivotal role in purifying water by destabilizing charged particles, promoting the formation of larger aggregates, and facilitating the removal of impurities through sedimentation or filtration. The growing population growth, urbanization, and industrial expansion contribute to necessitating robust water and wastewater treatment solutions, which are expected to boost the segment’s growth.

- By type, the aluminum based segment is expected to hold a 49.31% share in 2026.

The iron based coagulants is expected to register significant growth during the forecast timeline. The iron based coagulants, mainly ferric chloride, and ferrous sulfate, are widely employed in water treatment processes due to their effective coagulation and flocculation capabilities. The growing stringent water quality standards and regulations coupled with necessitating robust water treatment solutions are expected to boost the segment growth.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Municipal Segment to Hold Dominant Share Owing to Rising Demand for Drinking Water

By Application, the market is segmented into municipal, pulp & paper, textiles, oil & gas, power generation, mining & metallurgy, and others.

The municipal segment leads the global market with a 41.97% share. Inorganic coagulants play a crucial role in municipal water treatment applications, where the goal is to provide safe and clean drinking water to communities. Municipal water treatment facilities utilize aluminium sulfate (alum) and ferric chloride as part of the coagulation and flocculation process.

- By application, the oil & gas segment is projected to generate USD 505.4 million in revenue by 2025.

Power generation segment holds the second leading position in the global market. The growing product demand in power generation applications, such as cooling water treatment, boiler feed water treatment, wastewater treatment, and coal ash pond management, is expected to boost the segment growth. In the oil and gas industry, the growth of product consumption is propelled by their pivotal role in treating produced water. These coagulants efficiently aid in separating and removing impurities, such as oil and suspended solids, from produced water. As a result, ensures compliance with stringent environmental regulations and enables cost-effective water treatment solutions.

REGIONAL INSIGHTS

By region, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Inorganic Coagulants Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific was valued at USD 1.53 billion in 2025 and will continue to be the largest and fastest-growing region in the market. The growth of the inorganic coagulants market in Asia Pacific is propelled by the region's rapid industrialization, urbanization, and population growth, leading to increased water pollution and the imperative for robust water treatment solutions. Additionally, strict environmental regulations, investments in water infrastructure, and technological advancements drive product adoption for effective wastewater treatment. The China market is projected to reach USD 1.08 billion by 2026, and the India market is projected to reach USD 0.24 billion by 2026.

- The inorganic coagulants market in Japan is expected to reach USD 0.05 billion by 2026.

- China is projected to witness a strong CAGR of 7.90% during the forecast period.

North America

North America is expected to grow at a significant rate during the forecast timeline. The growing focus on sustainable practices and the increasing demand for potable water fuels the product addition in addressing diverse water quality challenges and supporting the region's commitment to environmental stewardship and resource conservation.

Europe

The rapid growth of power generation and mining & metallurgy industries in Europe would propel the inorganic coagulants market growth. Additionally, the rising living standards and increasing focus on public health drive the demand for high-quality drinking water in the region, as a result fueling the product demand.The UK market is projected to reach USD 0.13 billion by 2026, while the Germany market is projected to reach USD 0.17 billion by 2026.

- Europe is anticipated to grow at a CAGR of 6.4% during the forecast period.

Latin America and the Middle East & Africa

In Latin America and the Middle East & Africa, the market is growing at a sustainable rate due to the increasing awareness of environmental issues and implementing stringent water quality standards will drive the market growth in these regions. Additionally, investments in modernizing water treatment infrastructure and adopting advanced technologies enhance product efficiency in addressing the diverse water purification needs across the region. The U.S. market is projected to reach USD 1.52 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Key Industry Players

Key Players Adopted Product Innovation Strategy to Maintain Their Position in the Market

Currently, the market for inorganic coagulants is fragmented, owing to the participation of numerous global players. Key industry players have dedicated their resources to pioneering product advancements. The strengths of these major market players are bolstered by a diverse array of product offerings, production capabilities, and the development of secure and innovative technologies for floor applications. Companies are employing strategies, such as new product development, expansion, joint ventures, and acquisitions to expand their regional influence and product portfolios.

LIST OF TOP INORGANIC COAGULANTS COMPANIES:

- AKKİM (Istanbul)

- Alumichem (Denmark)

- Kemira (Finland)

- ChemREADY (U.S.)

- BASF SE (Germany)

- Feralco AB (Sweden)

- Holland Company Inc. (U.S.)

- Chemtrade Logistics Inc. (Canada)

- Aries Chemical, Inc. (U.S.)

- INCOPA (Belgium)

REPORT COVERAGE

This report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, leading applications and regional analysis. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.1% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 4.36 billion in 2026 and is projected to reach USD 7.66 billion by 2034.

In 2025, the Asia Pacific market size stood at USD 1.53 billion.

Registering a significant CAGR of 7.1%, the market will exhibit considerable growth over the forecast period (2026-2034).

The aluminium-based type is expected to be the leading segment in this market during the forecast period.

Increasing global demand for clean and safe water will drive the market growth.

China held the highest share of the market in 2024.

AKKIM, Alumichem, Kemira, ChemREADY, and BASF SE are the major players operating in this market.

Rising government regulations and growing technological innovations are few factors supporting product adoption during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us