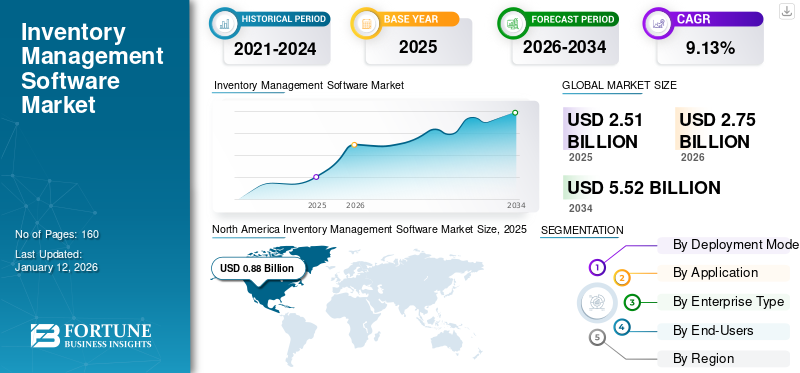

Inventory Management Software Market Size, Share & Industry Analysis, By Deployment Mode (On-Premise and Cloud), By Application (Inventory Control and Tracking, Order Management, Scanning and Barcoding, Asset Management, and Others), By Enterprise Type (Large Enterprises and Small & Medium Enterprises (SMEs)), By End-Users (Manufacturing, Retail and Consumer Goods, Healthcare and Life Sciences, Energy and Utilities, Automotive, and Others), and Regional Forecast, 2026 – 2034

Inventory Management Software Market Size

The global inventory management software market was valued at USD 2.51 billion in 2025 and is projected to be worth USD 2.75 billion in 2026 and reach USD 5.52 billion by 2034, exhibiting a CAGR of 9.13% during the forecast period. North America dominated the global market with a share of 35.01% in 2025.

Inventory management software automates inventory management, simplifies the tasks required to track inventory effectively, manages reorders, and updates accounting data. Companies use this software to minimize product overstocks and interruptions. It is a tool to organize inventory data that used to be stored in traditional formats, such as copies or spreadsheets.

Inventory management software market growth is expected to be fueled by several factors, such as ease in integration with other business systems, such as accounting software or Point-of-Sale (POS) systems. During the pandemic, the need to manage companies’ inventories more efficiently, the rise in investments in inventory management systems proved to positively influence the market.

Further, in the coming years, the growing demand for inventory management systems is also due to rising automation in warehouses for inventory control. This factor is driving the global market share. According to a survey by Zebra Technologies, 87% of industrial decision makers are in the process of or planning to expand their warehouses by 2024.

Inventory Management Software Market Trends

Growing Adoption of Business Process Automation for Seamless Inventory Control to Propel Market Growth

Business process automation can be extensively implemented for the automation of warehouse processes. With minimal human involvement, it focuses on moving the inventory into, out of, and around the warehouses. With reduced human error, this technology also helps streamline the production processes. The most reliable way for end users to monitor changing supply costs, recalculate stock levels, and have a knowledge of the whole process is to move toward real-time analytics.

Download Free sample to learn more about this report.

Inventory Management Software Market Growth Factors

Adoption of Easy Integration Software for Transformation of Inventory Processes to Aid Market Growth

The inventory management system should be integrated with other systems, such as accounting and e-commerce platforms seamlessly. This allows the processes to be run more efficiently, without having to enter data manually. Organizations have started adopting integrated inventory management solutions to minimize costs, improve cash flow, and boost profitability.

Therefore, due to the emergence of various companies offering solutions integrated with technologies that have the potential to transform inventory processes, there is an enormous growth in this market.

RESTRAINING FACTORS

Lack of Visibility in Inventory Processes to Hinder Market Growth

There are two fundamental concerns about the lack of visibility in inventory processes. Firstly, the difficulty of finding objects in a large space, such as a warehouse. The second one is to find ordered items and update the stock of outdated listing systems, such as spreadsheets and paper-based databases. Delays in either of the two scenarios could result in a lack of orders, unsatisfactory buyers, or loss of customers. Other factors limiting the market's growth over the forecast period are high investment costs and lack of consumers' acceptance of legacy systems.

Inventory Management Software Market Segmentation Analysis

By Deployment Mode Analysis

Ease of Accessibility and Controllability by On-Premise Inventory Management Software to Increase Its Demand

Based on deployment mode, the market is segmented into on-premise and cloud. In terms of market share, on-premise dominated the market in 2024. An on-premise installation strategy enables users to monitor their site through desktops or additional systems has increased the use of on-premise deployment. The on-premise inventory management systems give users complete control or administrative access to their inventory management software when a program is installed at the company premises. The On-premises segment is expected to account for 53.61% of the market in 2026.

The cloud segment is expected to register the highest CAGR during the forecast period. The backup capacity of an enterprise is enhanced by a cloud-based inventory management model. The use of cloud platforms brings flexibility and stability to a business. The segment’s growth can be attributed to the rise in e-commerce and the various methods of order fulfillment. Organizations are moving from traditional on-premise systems to cloud models due to rising adoption of SaaS and cloud-based solutions in inventory management.

By Application Analysis

Reducing Risk of Overstocking of Goods to Fuel the Demand for Inventory Control & Tracking

Based on application, the market is segmented into inventory control & tracking, order management, scanning & barcoding, asset management, and others. The inventory control & tracking segment dominated the market in 2023. The growth of the segment is due to the fact that organizations can use this type of management software to ensure that stock levels of their inventory are kept at optimal levels, reducing the risk of overstocking or shortage. In 2026, the Inventory Control and Tracking segment is projected to lead the market with a 31.02% share.

The scanning & barcoding segment is expected to record the highest CAGR during the forecast period. Barcode scanners are being extensively used for tracking inventory movements throughout a supply chain as customer’s demand more, and are looking for solutions that satisfy their needs. These scanners enable organizations to process a large quantity of goods with Point of Sales (POS) systems and retrieve data directly from the cash register. A GS1 study in 2023, conducted by a worldwide group of barcode standards organizations, shows that using barcodes have resulted in a 76% drop in medication errors as well as a 43% decrease in stock levels across the healthcare sector.

By Enterprise Type Analysis

Easy Availability and Storage Capacity of Goods by Inventory Management Software in Large Enterprises to Aid Market Expansion

Based on enterprise type, the market is segmented into large enterprises and Small & Medium Enterprises (SMEs). The large enterprises segment dominated the market in 2023. Large enterprises have vast inventories that are difficult to manage. Moreover, inventory management in such a way so as to ensure that the products are not out of stock or unavailable is essential. The development of this software is being encouraged by large enterprises to respond to the growing and unique needs of customers. The Large Enterprises segment is forecast to represent 54.77% of total market share in 2026.

The Small & Medium Enterprises (SMEs) segment is expected to record the highest CAGR during the forecast period. SMEs have a lower level of inventory. This has reduced the total cost of installing inventory management software. Moreover, companies are developing SMEs dedicated solutions. For instance,

- August 2023 - BoxHero Inc., which provides inventory management tools that are focused on helping SMEs, introduced two solutions that provide greater convenience and integration for end users.

By End-Users Analysis

To know how our report can help streamline your business, Speak to Analyst

Software Use to Increase in Manufacturing Due to High Need for Time Management While Producing Goods

Based on end-user, the market is categorized into manufacturing, retail & consumer goods, healthcare & life sciences, energy & utilities, automotive, and others. The manufacturing segment dominated the market in 2023. Inventory management is an essential part of modern production to guarantee the timely manufacturing of goods and help businesses properly forecast their inventory levels. The data derived from the inventory management software informs a company on its purchase, production, and sales decisions. The Manufacturing segment is poised to account for 25.58% of the market share in 2026.

The healthcare and life sciences segment is expected to register a higher CAGR during the forecast period. To ensure the efficient administration of healthcare organizations, effective medical inventory management is essential. The medical inventory of hospitals involves the management of stock for use by healthcare professionals. Moreover, to improve communication between departments, increase productivity, maintain compliance, and reduce the time taken in inventory control by medical personnel, a simplified inventory management system makes it easier to track equipment and supplies.

REGIONAL INSIGHTS

Regionally, the market is fragmented into North America, South America, Europe, Middle East & Africa, and Asia Pacific.

North America

North America Inventory Management Software Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America held the highest market share in 2023. The market for inventory management systems in the region is expected to grow due to the rising demand for efficient supply chain management in combination with the rapid adoption of this technology. In addition, the regional market is expected to grow at a considerable pace during the forecast period due to the increasing presence of key market players and a growing focus on multichannel inventory integration platforms. The U.S. market is estimated to reach USD 0.6 billion by 2026.

Asia Pacific

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is anticipated to record the highest growth rate during the forecast period. In this region, automation is enhancing the operations of governments and businesses. The market growth in the region is also supported by increasing private and public investments in inventory and supply chain activities to boost the usage of automation. The Japan market is forecast to reach USD 0.19 billion by 2026. The China market is poised to reach USD 0.18 billion by 2026. The India market is set to reach USD 0.13 billion by 2026.

Middle East & Africa

The Middle East & Africa is expected to register the second-highest growth rate in the global market during the forecast period. In this region, a strong proliferation of inventory management software has resulted from reduced inventory costs and increased cash flow in the healthcare sector. This is mainly by ensuring that their goods are stored to the level of usage.

Key Industry Players

Market Players Announce Mergers & Acquisitions, Partnerships, and Product Development Strategies to Promote Customer Reach

Leading players operating in the market are entering into relevant business strategies, such as collaborations, partnerships, and acquisitions, with the aim of enhancing their services. In addition, these companies implement these strategies to align their future goals of providing scalable, advanced and efficient all-in-one inventory management services for their end users. Moreover, small-scale companies operating in the market have been raising funds with the objective of using the funds to expand their employee size and technological expertise.

List of Top Inventory Management Software Companies:

- Zoho Corporation Pvt. Ltd. (India)

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- Lightspeed (Canada)

- CIN7 Ltd. (New Zealand)

- Linnworks (U.K.)

- Intuit Inc. (U.S.)

- Acumatica, Inc. (U.S.)

- Fishbowl (U.S.)

- Brightpearl (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Syrup raised over USD 17.5 million in a Series A round of funding with the objective to expand its AI-based tool. This tool enables its end users to optimize its inventory for omnichannel commerce.

- October 2023: Shipsy completed the acquisition of Stockone, which is a cloud-based warehouse management tool and inventory management tool provider. This acquisition was based on an attempt to expand the company’s product portfolio.

- July 2023: ABF (Automation Builds Future) and Primetals Technologies collaborated to focus on inventory management solutions at the METEC trade fair for the manufacturing industry. The partnership aims at jointly developing and marketing intelligent solutions for the automatic storage of finished or unfinished products.

- June 2023: Unicommerce, a SaaS enablement platform, launched its inventory management solution with real time inventory synchronization. This launch aims to help brands receive maximum orders and further accelerate the processing of orders.

- May 2023: Avantor, Inc., entered a partnership with Labguru, a research-to-creation platform of choice for global pharma companies, to integrate Avantor's Inventory Manager eCommerce platform into Labguru's LabLIMS Information Management Software and Electronic Lab Notebook. With the combination of Avantor and Labguru's solution, an entire range of top quality products is available to researchers when they need them on a laboratory bench.

REPORT COVERAGE

The report offers the reader a complete study of the market, focusing on the major factors, such as market leaders and other players operating in the market, their dedicated solutions and related services, and the leading applications of their solutions. In addition, the report provides valuable insights into the inventory management software market trends and highlights key recent developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.13% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment Mode

By Application

By Enterprise Type

By End-Users

By Region

|

Frequently Asked Questions

The market is projected to reach USD 5.52 billion by 2034.

In 2025, the market value stood at USD 2.51 billion.

The market is projected to record a CAGR of 9.13% during the forecast period.

The manufacturing segment is the leading the market.

Adoption of easy integration software for the transformation of inventory processes will aid the market growth.

Zoho Corporation Pvt. Ltd., IBM Corporation, Oracle Corporation, Lightspeed, CIN7 Ltd., Linnworks, Intuit Inc., Acumatica, Inc., Fishbowl, and Brightpearl are the top players in the global market.

North America held the largest market with a share of 35.01% in 2025.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us