IoT in Warehouse Management Market Size, Share & COVID-19 Impact Analysis, By Application (Asset Tracking, Inventory Optimization, Warehouse Automation, Workforce Management, Predictive Maintenance, and Others), By Enterprise Type (Small & Medium Enterprises and Large Enterprises), By End-user (Retail & E-commerce, Manufacturing, Transportation & Logistics, Food and Beverages, IT & Telecommunication, Healthcare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

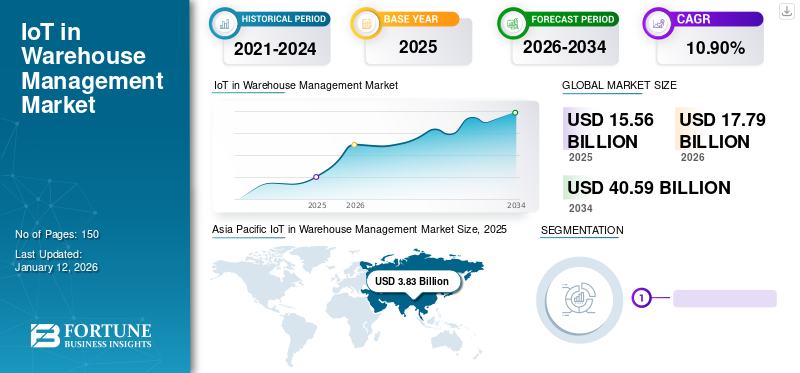

The global IoT in warehouse management market size was valued at USD 15.56 billion in 2025 and is projected to grow from USD 17.79 billion in 2026 to USD 40.59 billion by 2034, exhibiting a CAGR of 10.90% during 2026-2034. Asia Pacific dominated the global IoT in warehouse management market with a share of 24.60% in 2025.

Connected devices embedded with sensors and software can give users deep insights into their warehouse operations. A warehouse’s IoT system is used to transmit data over the network without the need for human interaction. It exchanges data on a real-time basis for tracking, monitoring, and maintaining a wide range of warehouse management operations, which significantly improves the warehouse's efficiency.

In the last few years, it has been observed that IoT has contributed substantially to the manufacturing sector as compared to other industry verticals to automate large warehousing operations. It has caused a major boost in IoT investments in the manufacturing industry to improve warehouse management processes. Increasing penetration of IoT in warehouse management can greatly improve the accuracy of warehouse management operations, facilitate space optimization, and enable better allocation of goods.

The growing adoption of IoT in warehouse management operations can also transform traditional warehouses into smart ones by automating the inventory and asset tracking processes and save the operational costs incurred by warehouse management processes across various industry verticals.

COVID-19 IMPACT

Decrease in Industrial Product Manufacturing Severely Impacted IoT in Warehouse Management Market Growth

The COVID-19 situation had a major impact on the supply chain of various industries, resulting in logistics disruptions, shortages of material and labor, and sudden changes in product demand. Since retail & e-commerce businesses were growing at a robust pace during this period, the demand for implementing advanced technologies, such as IoT, RFID, and beacons increased to introduce automation in warehouse management operations. This prompted several companies to introduce digitization in their warehouses. For instance, Zebra Technologies, a reputed company in the global market, boosted the digitization of warehouse operations by implementing the RFID technology. The firm also aimed to install wearable mobile computers to automate the inventory management and order picking processes. Even though the outbreak slowed the market expansion, it is predicted to grow in terms of its impact on the global business.

LATEST TRENDS

Download Free sample to learn more about this report.

Adoption of Digital Twin Technology to Build 3D Model of Warehouses to Enhance Market Expansion

A warehouse digital twin technology feeds data into a virtual system. A digital twin improves the efficiency of manufacturing processes, boosts productivity, and decreases the total production time. A single warehouse digital twin can virtually design, simulate, and test new warehouse processes and product movements without changing the existing, increasingly complex locations. Integration of IoT in warehouse management plays an important role in the deployment of digital twin technology.

For instance, in November 2021, Microsoft launched a digital twin service, Microsoft Cloud, for the manufacturing industry to bring flexibility in supply chain operations, which are disturbed due to COVID-19 situation.

Increasing establishment of retail & e-commerce businesses can generate huge demand for advanced warehouse operation technologies. The growing usage of the digital twin solution can bring automation in warehouse management. These solutions use IoT and other automation technologies, including automated guided vehicles and drone-based stock counting systems to improve the performance of warehouse automation systems.

Since the digital twin solution uses 3D technologies to construct a lifelike model of warehouses, it can create significant opportunities to increase the market share.

DRIVING FACTORS

Surge in Wearable Device Usage in Warehouse Management Operations to Propel Market Growth

Wearable devices deliver real-time precise information on various assets and provide instant notifications to improve process efficiency and eliminate non-compliance. Integrating IoT techniques with warehouses can also improve the accuracy of tracking inventory and boost the performance of human operators. The growing use of wearable technology increases the productivity of warehouses, which significantly enhance process transparency.

Various wearable devices, such as smart glasses, smart gloves, smart safety helmets, and voice control headsets facilitate communication between operators and tech support and automate the packaging and scanning processes by providing worker safety. Penetration of digital technologies in Industry 4.0 has affected every aspect of the supply chain network, adding immense value to business. These aspects will help the IoT in warehouse management market growth.

RESTRAINING FACTORS

Lack of Skilled Workforce for Operating Smart Warehouses to Restrict Market Development

The usage of IoT connected devices and software in warehouses help the warehouse operators communicate over the network. However, these innovative technologies have also raised concerns regarding privacy and cybersecurity among warehouse operators.

Moreover, lack of skilled labor force can cause a major slowdown in logistical activities, which ultimately has a negative influence on an organization’s revenue margins.

According to Inmarsat Study, it has been observed that shortage of in-house skills can hamper the productivity of warehouses across various industries, thereby impeding the digital transformation of traditional warehouses. Lack of knowledge about data science and connectivity skills to develop, deploy, and manage IoT projects in manufacturing and logistics sectors can hinder an organization’s potential to grow. These factors may negatively impact the market development.

SEGMENTATION

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Demand for Inventory Optimization to Boost Adoption of IoT in Warehouse Management Systems

Based on application, the IoT in warehouse management market is divided into inventory optimization, asset tracking, workforce management, warehouse automation, predictive maintenance, and others. The inventory optimization segment holds the largest share of the market and is slated to rise at the fastest CAGR during 2025-2032. The warehouse automation segment is expected to lead the market, contributing 21.51% globally in 2026.

The integration of IoT with inventory optimization processes can considerably improve these operations and optimize the warehouse space.

By Enterprise Type Analysis

Small & Medium Enterprises to Hold Dominant Market Share with High Investments in E-commerce

Based on enterprise type, the market is divided into large enterprises and Small & Medium Enterprises (SMEs). Many SMEs are increasing their technological investments in e-commerce and manufacturing industry verticals to automate the warehouse operations and improve their efficiency. The large enterprises segment will account for 52.98% market share in 2026.

The adoption of IoT technologies also reduces operational and labor costs incurred by warehouses as they can automate the storage solutions. This leads to better delivery of supply chain experiences to customers. Hence, small and medium enterprises will dominate the market over 2025-2032.

By End-user Analysis

Manufacturing to Generate High Revenue with Increased Demand for IoT in Warehouses

In terms of end-user, the market is divided into manufacturing, retail & e-commerce, food & beverages, transportation & logistics, healthcare, IT & telecommunication, and others. The manufacturing segment is anticipated to capture the largest market share over the analysis timeline. Using IoT in manufacturing warehouses can increase the reliability and accuracy of packing & picking processes and minimize inventory errors. This will improve the overall performance of the company. The manufacturing segment is expected to account for 18.64% of the market in 2026.

REGIONAL INSIGHTS

In the scope of the study, the IoT in warehouse management market is analyzed across North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific

Asia Pacific IoT in Warehouse Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the highest market share in 2022. The increasing penetration of manufacturing and e-commerce industries in countries, such as India and China, has bolstered the adoption of advanced analytical tools. The Japan market is forecast to reach USD 0.7 billion by 2026, the China market is set to reach USD 0.71 billion by 2026, and the India market is poised to reach USD 1.34 billion by 2026.

Growing integration of industrial software and hardware with e-commerce companies in India and China can augment the adoption of IoT in warehouse management to bring digital transformation in the manufacturing and retail industries across the region.

North America

North America is expected to capture the second largest market share due to the rising number of retail & e-commerce businesses in countries, such as the U.S. and Canada, innovations in warehouse management technologies, and the vast presence of smart warehouse vendors will expand the market share in the region. The U.S. market is expected to reach USD 2.43 billion by 2026.

South America

The South America market will also showcase commendable growth over the coming years owing to the increasing penetration of manufacturing industries in countries, such as Argentina and Brazil. This scenario has generated the need for warehouse automation among small as well as large enterprises, further improving the usage of IoT in warehouse management.

Europe

To know how our report can help streamline your business, Speak to Analyst

The Europe market will be positively impacted by the introduction of digital technologies in manufacturing and retail sectors. For example, in November 2021, Honeywell opened smart factories in Eastern Europe to establish a new warehouse automation hub. The construction of smart warehouses in Europe might boost the regional market growth during 2023-2030. The UK market is anticipated to reach USD 1.12 billion by 2026, while the Germany market is estimated to reach USD 0.8 billion by 2026.

KEY INDUSTRY PLAYERS

Key Players Focus on Adopting IoT in Warehouse Management to Strengthen their Market Position

Leading IoT in warehouse management companies operating in the IoT in warehouse management market are implementing advanced technologies to boost their market share. Expansion of product portfolios, mergers & acquisitions, and research & development are some of the key strategies adopted by these service providers.

List of Top IoT in Warehouse Management Companies:

- PTC, Inc. (U.S.)

- Tecsys, Inc. (U.S.)

- HCL Technologies Limited (India)

- IBM Corporation (U.S.)

- Software AG (Germany)

- Oracle Corporation (U.S.)

- Zebra Technologies Corp. (U.S.)

- Zyter, Inc. (U.S.)

- Suntist Labs Pvt. Ltd. (India)

- Argos Software (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2021: Zyter entered a partnership agreement with Qualcomm to develop an IoT-based smart warehouse solution for OneScreen, a smart school technology provider in San Diego. It includes implementing a digital twin, robust warehouse management system, AR/VR technologies, IoT sensors, and Autonomous Mobile Robots (AMR) to enhance workers' safety and security.

- July 2021: Safecube launched a new IoT asset tracking solution named ‘Locatrack’ to track and monitor assets and provide visibility over supply chain flows.

- August 2022: Sensolus partnered with Deutsche Telekom AG to launch an asset tracking solution to manage non-powered assets. This partnership might help the company expand its IoT-based solution portfolio and offer it to organizations across Germany.

- July 2021: Zebra Technologies completed the acquisition of warehouse automation firm Fetch Robotics to expand its logistics-equipment services portfolio to manage the warehouse operations and improve the supply chain operations.

- June 2022: Surgere launched a brand-new RFID-based application for a warehouse management system for Hutchinson North America. This application tags and tracks the OEM containers, which eliminates the risk of asset loss and provides real-time inventory visibility to Hutchinson.

REPORT COVERAGE

The study on the IoT in warehouse management market includes analyzing prominent areas to get a better knowledge of the industry. Furthermore, the research report provides insights into the most recent market trends and an analysis of technologies that are being implemented globally. It also highlights some of the growth-stimulating restrictions and elements, allowing the reader to obtain a thorough understanding of the industry.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.90% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Application, Enterprise Type, End-user, and Region |

|

By Application |

|

|

By Enterprise Type |

|

|

By End-user |

|

|

By Region |

|

Frequently Asked Questions

The market is projected to reach USD 40.59 billion by 2034.

In 2025, the market stood at USD 15.56 billion.

The market is projected to grow at a CAGR of 10.90% in the forecast period (2026-2034).

By application, the inventory optimization segment is likely to lead the market.

Growing usage of wearable devices in warehouse management operations might boost the market growth.

PTC, Inc., Tecsys, Inc., HCL Technologies Limited, IBM Corporation, Software AG, Oracle Corporation, Zebra Technologies Corp., Zyter, Inc., Eurotech S.p.A., and Argos Software are the top players in the market.

Asia Pacific is expected to hold the largest market with a share of 24.6% in 2025.

The manufacturing segment is expected to capture the largest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us