Life Science Analytics Market Size, Share & Industry Analysis, By Type (Software & Solutions and Services), By Delivery (On-premise and On-demand), By Application (Commercial Analytics, Personalized Therapy, Clinical Research Analytics, and Supply Chain Analytics), By End Users (Medical Device Companies, Pharma & Biotech Companies, Contract Research Organizations, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

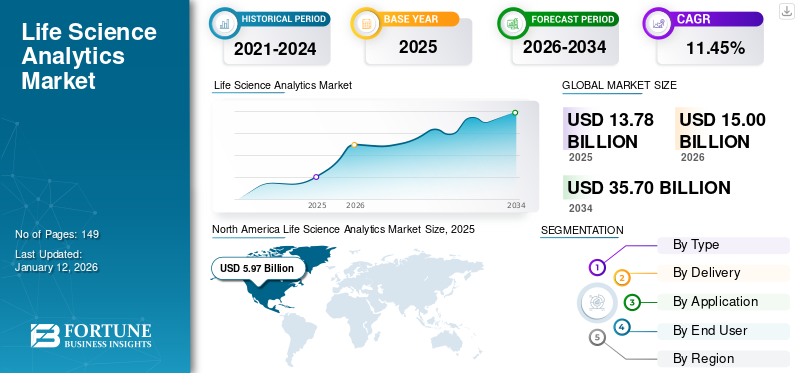

The global life science analytics market size was valued at USD 13.78 billion in 2025. The market is projected to grow from USD 15 billion in 2026 to USD 35.7 billion by 2034, exhibiting a CAGR of 11.45% during the forecast period. North america dominated the life science analytics market with a market share of 43.30% in 2025.

Life science analytics is a field that uses advanced data analysis techniques such as data analytics, machine learning, and other computational techniques to help make strategic decisions in the life sciences industry. The market includes software, solutions, or analytical applications that are majorly used for the research and development of new drug therapy by pharma and biotech companies and contract research organizations. These analytical applications are used for the early detection of treatment patterns, developing personalized therapies, analyzing the company's revenues, and achieving operational excellence in the patient's journey.

Some of the prominent players operating in the market include Oracle Corporation, SAS Institute Inc., Accenture, among others. The growing technological advancements in software and the rising adoption of these tools and solutions by these companies for better decision-making and clinical and diagnostic purposes are some of the major factors supporting the growth of the global market.

- In October 2024, Oracle Corporation launched AI-powered Oracle Analytics Intelligence for life sciences. The platform can streamline and accelerate insight generation with the use of a broad range of data sources to help advance therapies with speed and precision.

Life Science Analytics Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 13.78 billion

- 2026 Market Size: USD 15 billion

- 2034 Forecast Market Size: USD 35.7 billion

- CAGR: 11.45% from 2026–2034

Market Share:

- North America dominated the life science analytics market with a 43.30% share in 2025, driven by high R&D investment, strong healthcare IT infrastructure, widespread adoption of advanced analytics in clinical trials, and robust presence of major players such as Oracle, IQVIA, and SAS Institute.

- By Type, Services held the largest market share in 2024 due to their widespread use in managing drug development operations, clinical trials, regulatory compliance, and real-time data analysis for pharma and biotech companies. Strategic partnerships, such as Accenture with 1910 Genetics and IQVIA’s tech launches, are further accelerating demand for analytics services in life sciences.

Key Country Highlights:

- Japan: The market is expanding due to strong government support for precision medicine, increasing R&D investments, and adoption of AI-powered platforms for drug discovery and clinical decision-making. Initiatives under Japan’s Society 5.0 vision are promoting digital transformation in healthcare.

- United States: Market growth is driven by robust adoption of AI and cloud-based analytics platforms in drug development, major investments by tech players like Google Cloud and Oracle, and the rise in precision medicine initiatives. Federal support for real-world evidence (RWE) integration is further fueling market penetration.

- China: Rapidly advancing pharmaceutical R&D ecosystem, surge in clinical trials, and government-backed programs to digitalize healthcare and life sciences are key contributors. China's inclusion in early-stage global drug launches and investments in AI and analytics platforms support continued growth.

- Europe: Growth is supported by regulatory initiatives for digital health, increasing adoption of cloud-based analytical tools, and expanding presence of companies such as Indegene and SAS. Germany, the U.K., and France are leading adopters, with growing public-private partnerships fueling demand.

MARKET DYNAMICS

Market Growth Factors

Increasing Use of Analytical Solutions for a Comprehensive and Flexible Research Study to Spur Market Growth

The rising use of data analytics tools and solutions in the field of clinical trials is resulting in improving real-time insights, recruitment, safety monitoring of patients within the trials, and the development of more personalized medicines and therapies.

A certain number of preclinical studies demonstrating efficacy, toxicity, and safety information of the drug for the patients are conducted before the launch of any drug product. These studies are aimed at understanding the chemistry of how a medical treatment affects biological systems.

Developing novel drugs is costly and time-consuming and has a minimal clinical trial success rate. For instance, according to an article published by Cancer Research U.K. in February 2022, it may take over 10 to 15 years or more to complete three phases of clinical trials. However, using analytical tools in drug development can be promising and potentially accelerate different stages of the research and development process by significantly reducing the cost. Different analytical tools, such as SAS Life Science Analytics Framework, ClinACT, Veeva Vault EDC, and others, assist research professionals in identifying new potential candidates that can be screened and validated. The growing mergers and collaborations among the players to develop and introduce advanced analytics tools and solutions for research and drug development is a vital factor driving the global market expansion.

- In December 2023, Clarivate expanded its partnership with VeriSIM Life to launch the VeriSIM Life Transitional Index, an integrated workflow with a diverse array of predictive drug safety and efficacy insights.

Moreover, the rising focus of analytics solution providers to develop and introduce new and advanced platforms to help the clinical trial data analysis easier and faster is another major factor expected to increase the adoption of these tools and solutions globally during the forecast period.

- In June 2024, IQVIA Inc. launched 'One Home for Sites,' a new technology platform as a single sign-on and dashboard to enable the integration of all the clinical applications for the pharmaceutical companies that sponsor clinical trials.

Increasing Adoption of Healthcare Data Management Platforms in Hospitals to Propel Market Growth

The rising prevalence of various diseases has contributed to an increase in healthcare expenditure by many governments. For instance, according to an article published by Investopedia in April 2023, the U.S. national healthcare expenditure (NHE) is estimated to reach USD 6.3 trillion by 2028. The main contributors to the rise in expenditures are an increase in the prescription rate of drugs for treatment and the increased cost of physician and clinical services.

Therefore, it has become necessary for hospitals to efficiently measure the cost-effectiveness of different therapies for health technology assessment (HTA) and regulatory purposes. Moreover, the growing need for technology to analyze and transform unstructured patient data contributes to its growing demand. The escalating adoption of analytical tools and solutions among healthcare settings in developed and emerging countries globally is a significant factor boosting the demand for these software and tools, fostering the growth of the market.

- According to a 2023 survey conducted by the Global Healthcare Exchange (GHE), nearly 70% of the U.S. hospitals and health systems are likely to adopt a cloud-based approach to supply chain management by 2026 to improve efficiency, reduce overall cost, and enhance operational performance.

- Similarly, in January 2023, Singapore's National Precision Medicine Programme selected BC Platform to analyze and manage data collected from the Health for Life in Singapore (HELIOS) study.

The increasing patient population suffering and seeking treatment for diseases and the vision of regulatory authorities of reducing the medical expenditure of a person undergoing that treatment is expected to spur market growth during the forecast period.

RESTRAINING FACTORS

High Cost of Implementation and the Concerns Related to Data Breaching May Limit Market Penetration

Life science analytical software and solutions play a major role in turning up the wheels of the business by allowing commercial teams to scale across portfolios and build new revenue-generating strategies. Therefore, they have witnessed considerable growth in the demand for these solutions and platforms. However, the costs associated with these solutions, including procurement, implementation, maintenance, and other costs, result in a high cost, leading to lesser adoption within the companies with fewer resources. For instance, according to an article published by Itrex Group in September 2022, 63.0% of businesses spend their money on analytical tools to improve the efficiency of their business.

The cost of analytical tools depends on factors such as the amount and quality of the corporate data, the organization's analytical needs, the choice of analytical tools, and the customization efforts.

- According to an article published by the ScienceSoft USA Corporation, the implementation cost of an analytical tool to a firm, depending on various factors, can cost around USD 100,000 to USD 1,250,000.

- For instance, according to an article published by Itrex Solution in September 2022, companies that opt for SaaS-based analytical products pay USD 10,000 to USD 25,000 every year as a part of maintenance fees.

Although technological advances have contributed to economic growth, they have also led to increased incidences of cyberattacks resulting in data breaches. The growing trend of using cloud computing's analytical tools for research purposes has contributed to the increased risk of data breaches. Healthcare companies are not different from the usual, as clinical data plays an essential role in the development of new drug molecules and is a future asset for the company.

- For instance, according to an article published by IBM Security in 2022, the average cost of a mega breach increased to USD 241 million in 2022, compared to USD 230 million in 2021, demonstrating a growth of 4.8%. The report also stated that around 45.0% of the organizations using cloud models experienced a data breach.

Therefore, the outflow of confidential information from the end user is also a growing concern among operating players, limiting the growth of the market.

MARKET OPPORTUNITIES

Rising Healthcare Infrastructure in the Emerging Countries to Present a Lucrative Opportunity for the Market Growth

The rising healthcare expenditure in emerging countries, along with increasing digitalization in the healthcare industry, is leading to a rising demand for analytical tools and platforms among developing countries such as India, China, and others. The growing number of clinical trials, rising demand for these solutions among pharmaceutical companies and the life science industry, and increasing investment for healthcare infrastructure development in these countries presents the market players with a lucrative opportunity for market expansion.

The rising focus of market players providing various analytical tools for the life science companies toward funding and investment to introduce their products to the untapped regions is expected to fuel the life science analytics market growth.

- In December 2024, PBR Life Sciences secured USD 1.0 million in first-round funding for the expansion of healthcare analytics tools in Africa.

Therefore, the growing adoption of these tools among healthcare facilities, companies, and the life science industry in emerging countries presents a significant opportunity for players operating in the market.

MARKET CHALLENGES

Limitations Related to Data Integration and Privacy to Hamper the Market Growth

Issues Related to Data Integration: Life science organizations handle diverse data sources, such as real-world data (RWD), market data, patient data, and others. The integration of this data into a unified analytical platform becomes a challenging factor for the adoption of these tools in the industry.

Other Challenges

Shortage of Skilled Professionals: The limited availability of data scientists, analysts, and skilled professionals in emerging countries such as Vietnam, Thailand, and Brazil, among others, is a major barrier to the adoption of these tools and solutions in these countries.

Regulatory Compliance: Data integration and management in the life science industry are crucial, and there are strict guidelines and regulations for these analytical tools and platforms to ensure data privacy and enhance the operational workflow. Strict adherence to the regulations can be a challenging factor for a new entrant to the market.

Life Science Analytics Market Trends

Rising Advancements in Data Science and Increasing Adoption of Cloud Services

The life science industry is undergoing enormous changes in terms of clinical data management, medication discovery, and analytical capacities. The advantages, such as increased speed & agility, improved customer insights, and enhanced decision-making, have encouraged pharma & biotech companies to make large amounts of investments in cutting-edge technologies to speed up the drug discovery process. These advantages and the ultimate need to accelerate the drug discovery process have led to the adoption of cloud infrastructures in the life science industry as they effectively control healthcare expenditures and monitor the rising prevalence of chronic diseases.

- For instance, according to an article published by SOUTHERN METHODIST UNIVERSITY in September 2022, the healthcare spending made on deciding the test and treatment of particular patients can be reduced by 80% using artificial intelligence.

The lower cost associated with cloud infrastructures, their effective way of managing large data, and the added advantage of strong security majorly contribute to its growing adoption.

- According to a 2023 article published by Amazon Web Services (AWS), the adoption of cloud services life sciences can result in a 19% reduction in time spent initiating the clinical trial sites and around 20% reduction in time to analyze the post-trial data.

Rising Shift Toward Personalized Medicine: The rising collaborations between market players and research organizations for developing innovative and effective gene therapies using cloud infrastructures are contributing to its growing adoption in the market.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The overall impact of COVID-19 on the global market was positive. The importance of digitalization and adoption of analytical tools and services among the life science companies during the pandemic owing to lockdown restrictions was one of the major factors that supported the growth of the market in 2020. Furthermore, the increased number of patients suffering from COVID-19 prompted manufacturers to focus on the research and development of new vaccines.

- For instance, the healthcare segment of Cognizant generated a revenue of USD 4,852 million in 2020 and witnessed a growth of 3.3%, compared to USD 4,695 million in 2019. This revenue growth was due to an increased demand for the company's services by pharmaceutical firms and robust software license sales.

Several market players registered a significant growth in their revenue during the pandemic owing to increased demand and adoption of these software and solutions globally.

- Veeva Systems Inc. generated a revenue of USD 1,465.0 million in 2020, registering a growth of nearly 32.7% as compared to 2019.

There was an increase in the demand for life science analytical solutions among the medical device and pharmaceutical sectors in 2021. This was due to their ability to improve operational efficiency in pharmaceutical and medical device companies, owing to which the market witnessed significant growth in 2021.

Segmentation Analysis

By Type

Rising Adoption of Life Science Analytics Services across Healthcare Settings Pushed the Dominance of the Services Segment

By type, this market is segmented into software & solutions and services.

The services segment dominated the market with a share of 61.70% in 2026. The growing adoption of these services across numerous facilities, along with an increasing number of service providers in the market, are some of the major factors supporting industry expansion. Moreover, the rising collaborations among market players for the implementation of advanced services is another major factor fostering segmental growth.

Moreover, many key players are providing services for managing supply chain operations. They provide medtech consulting services that can put scientific health data in a structured format and aid organizations in building appropriate solutions.

- For instance, in August 2020, Biosymetrics collaborated with Accenture's partner ecosystem to accelerate the company's drug discovery efforts. This ecosystem is integral to Accenture's INTIENT platform, designed to improve end-to-end productivity and efficiency in drug discovery through clinical and patient services.

The software & solutions segment is projected to grow at a nominal rate during the forecast period. The rising investment by major providers to develop and introduce technologically advanced software and solutions for various life science companies is a crucial factor boosting segment growth.

- In March 2024, Axtria Inc., one of the global cloud-based software and data analytics service providers, launched its largest innovation center in India with an aim to boost life science analytics and AI-driven solutions and capabilities.

Global Life Science Analytics Market Share, By Type, 2026

To get more information on the regional analysis of this market, Download Free sample

By Delivery

On-Demand Segment Dominated Owing to the Rising Adoption of Cloud Services

In terms of delivery, the market is divided into on-premises and on-demand.

The on-demand segment held the largest market share with a share of 53.08% in 2026. The dominance of the segment can be attributed to its growing adoption in the pharmaceutical industry and contract research organizations for the drug development process. Additionally, growing strategic mergers and acquisitions among key players to introduce novel platforms for cloud-based services is another major factor contributing to the segment growth.

- In December 2024, TetraScience partnered with Snowflake to increase the accessibility of scientific data through the companies' capabilities and Snowflake AI Data Cloud.

Therefore, the introduction of cloud technology has enabled the life sciences industry to speed up the tech-enabled business transformations, which majorly contributed to the increase in the adoption of services offered by life science analytics companies. Moreover, cloud computing technology offers streamlined information sharing, ensuring safety and compliance, supporting AI and machine learning, enabling faster IT growth, and making digital resources more flexible.

The on-premise segment is expected to register steady growth during the forecast period. The growing adoption of these platforms and solutions in emerging countries owing to their reduced cost and infrastructure requirements is one of the major factors supporting the growth of the segment.

By Application

Range of Services Offered by Service Providers to Fuel Clinical Research Analytics Segment Growth

By application, the market is segmented into commercial analytics, personalized therapy, clinical research analytics, and supply chain analytics.

The clinical research analytics segment dominated the market with a share of 53.44% in 2026. The growing adoption of analytical tools in drug development, clinical trials, and research activities by pharmaceutical companies, biotechnology companies, CROs, and others is one of the major factors driving the dominance of the segment. The growing mergers and collaborations among companies for clinical trial data management is another contributing factor to the growth of the segment.

- In December 2024, eClinical Solutions LLC collaborated with Snowflake with the aim of enabling the optimization of clinical data in a regulated environment with the Snowflake AI Data Cloud.

The commercial analytics segment is projected to grow at a significant CAGR rate during the forecast period. The increasing demand for different tools for examining target customers, building cost reduction strategies, and fraud detection analytics with proper data visualization is primarily driving the segment growth. The growing focus of companies on introducing solutions and platforms for commercial analytics is an important factor driving the growth of the segment.

- In November 2023, Axtria Inc. launched Axtria DataMAx Emerging Pharma for emerging biotech and pharmaceutical companies to help reduce their commercialization and marketing costs through various strategies.

- Similarly, in December 2021, Aktana demonstrated an increase of 45.0% in Artificial Intelligence (AI)-driven omnichannel actions, which impacted the customer experience of 700,000 healthcare professionals in 2021, aiding pharmaceutical companies to scale their capabilities and build marketing campaigns and sales strategies for their brands across different geographies.

The personalized therapy segment is anticipated to grow owing to rising demand for precision medicine among the patients due to their key features, and benefits. The growing R&D activities among the pharmaceutical and biotech companies and research institutes to develop various precision medicine for genetic conditions, chronic disorders, and others is another factor supporting the growth of the segment.

The supply chain analytics segment is also expected to grow at a slower growth rate during the forecast period. The rising adoption of analytical tools by the life science industry for effective management of their supply chain operations, as well as the development of personalized medicines and therapies, are some of the major factors fueling the segment growth.

By End Users

Pharma & Biotech Companies Segment Dominated due to Continuous Investment in the R&D of New Drug Molecules

On the basis of end users, the market is segmented into medical device companies, pharma & biotech companies, contract research organizations, and others.

The pharma & biotech companies segment dominated the market with a share of 40.09% in 2026. The rising investment by these companies for drug research and development for various therapies owing to its several advantages is one of the main factors contributing to the segment growth.

Moreover, factors such as improvement in the existing production process, assisting in meeting regulatory compliances, and building sales and marketing strategies for their upcoming products also contribute to segment growth.

This rising adoption of analytical tools in the pharmaceutical and biotech industry has encouraged many players to bring new products to the market.

- In May 2023, Google Cloud launched AI-powered solutions to accelerate drug discovery and precision medicine for biotechnology and pharmaceutical companies at the Bio-IT World Conference.

The contract research organizations segment is projected to grow at a significant growth rate during the forecast period. The rising prevalence of cancer and rare diseases among the general population has led to growth in the preference of healthcare professionals to prescribe personalized medicines. This growing demand for personalized medicines has emphasized manufacturers adopting tools and systems that can accelerate the speed of their development process.

- For instance, according to an article published by Bio.IT world in October 2022, The American Heart Association launched a precision medicine platform to build new computational models aiding researchers in discovering oncology drugs.

The medical device segment is projected to grow at a significant CAGR over the analysis period. The growth of the segment is due to the increasing adoption of these analytical tools in the medical device industry to gain insights about targeted sales. These tools also aid manufacturers in logistics organizations by preventing human errors, offering machine data analysis for making timely service decisions, and providing improved quality control of the devices.

LIFE SCIENCE ANALYTICS REGIONAL OUTLOOK

On the basis of region, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Life Science Analytics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America market dominated the global life science analytics market share and was valued at USD 5.97 billion in 2025. The dominance of the region is owing to the rising incidence of various diseases and high diagnosis and treatment rates. Moreover, as the region has well-established R&D centers, analytical tools are more prominently adopted. The U.S. market is projected to reach USD 5.95 billion by 2026.

- For instance, in December 2022, U.S.-based Discovery Life Sciences launched its new proteomic services division for pharma & biotech companies. The company offers exploratory and targeted proteomics that use the Seer Proteograph Product Suite.

The U.S. market is expected to grow at a faster growth rate in the region owing to the increased adoption of analytical tools and solutions among life science companies and developed healthcare infrastructure among the facilities. The soaring number of software launches in the country by major players is another factor supporting the growth of the U.S. market.

- In March 2023, Mathematica, a partner to federal health agencies in evaluation, data analytics, and advisory services for the public sector, launched new analytics services for commercial health care and life science companies.

Europe

The region is expected to grow during the forecast period owing to its rising funding for healthcare analytics and research activities in countries such as the U.K., Germany, and others. Moreover, the rising focus of the regulatory bodies to support the adoption of these tools and solutions in the region is another vital factor bolstering the regional market growth. The UK market is projected to reach USD 0.86 billion by 2026, while the Germany market is projected to reach USD 1.01 billion by 2026.

- For instance, in January 2023, Indegene, a life science commercialization company, launched its new center in Germany to expand its client-focused management team in the region.

Asia Pacific

The region is forecasted to grow at the highest rate during the study period. The growth of the region can be attributed to several factors, such as emerging healthcare infrastructure in countries such as India, Thailand, Malaysia, and others, the rising number of patient populations suffering from various chronic conditions, and the increasing number of clinical trials across various countries, among others. The Japan market is projected to reach USD 0.97 billion by 2026, the China market is projected to reach USD 0.5 billion by 2026, and the India market is projected to reach USD 0.32 billion by 2026.

- For instance, according to a news published by CHINADAILY.COM in October 2022, China's upgrading and developing pharmaceutical industry has launched some early clinical development programs, ensuring it becomes one of the first-tier countries to launch new drugs to the market.

Latin America

The market in the region is expected to register a steady growth rate during the forecast period. The growing adoption of these tools among the life science industry, including pharmaceutical companies, biotechnology companies, and others, and increasing healthcare expenditure in countries such as Brazil, Mexico, and others, are some of the major factors driving the industry growth in the country.

- According to 2023 statistics published by the International Trade Administration (ITA), Brazil spent nearly 9.5% of its GDP on healthcare in 2022.

Middle East & Africa

The market is projected to grow at a slower pace owing to the limited adoption of analytical services and solutions, as well as data security and breach issues among healthcare companies in the region. However, the rising focus of providers on introducing novel solutions is expected to fuel the growth of the market in the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Increasing Focus on Technological Development by Major Companies to Strengthen Market Outlook

The global market is semi-consolidated, with several players operating in the market with a wide range of solutions, services, and software.

Oracle and Accenture are some of the prominent players in the market and they offer a wide range of services to the life science industry. The continuously growing investment of pharma & biotech companies for research and development of new drug molecules is one of the major factors contributing to the Accenture’s growing market share. Accenture’s continuous effort to upgrade its technology by focusing on delivering a productive analytics platform for the transformation of data into valuable insights is another factor contributing to its higher market share.

- In October 2024, Accenture invested in 1910 Genetics, a biotechnology company, with an aim to collaborate and combine tailored solutions to help biopharmaceutical companies accelerate drug target identification, reduce costs, and deliver affordable therapies for patients.

SAS Institute Inc., IQVIA Inc., and others, are some of the other major players with a range of product and service offerings for the pharmaceutical and life science companies. The growing focus on collaborations among these companies is one of the factors leading to their increasing capabilities and market shares.

- In April 2023, SAS Institute Inc. collaborated with Duke Health, one of the renowned medical centers, aiming to develop a cloud-based product to improve business operations, delivery outcomes, and healthcare services approach.

The growing investment of life science industry players in analytical tools for the improvement of their production process, product efficiency, and building their sales and marketing strategy is expected to mainly contribute to growth in the market share of other companies in the future.

- For November 2022, Veeva Systems collaborated with Merck, also known as MSD outside the U.S., to build a strategic pricing approach and accelerate its digital strategy to maximize its technical capacity for delivering value to its patients.

LIST OF KEY LIFE SCIENCE ANALYTICS COMPANIES PROFILED:

- SAS Institute Inc. (U.S.)

- Accenture (Ireland)

- Veeva Systems Inc. (U.S.)

- IBM (U.S.)

- Oracle (U.S.)

- Analytics8 (U.S.)

- IQVIA Inc (U.S.)

KEY INDUSTRY DEVELOPMENTS

- December 2024 – Axtria Inc., a data analytics company for the life sciences industry, launched two new comprehensive benchmarking studies: U.S. Incentive Compensation Benchmarking Study and Global (Ex-U.S.) Incentive Compensation (IC) Benchmarking Study. These studies are aimed to offer critical insights for life sciences organizations to facilitate the designing and implementation of effective incentive programs.

- September 2024 – Oracle introduced CancerMPact Treatment Architecture Trends, a new cloud-based service for analyzing the global trends in cancer treatment. The service will enable pharmaceutical companies to analyze historical and global treatment patterns.

- August 2024 – Accenture announced the acquisition of consus.health, one of the leading German healthcare management consultancy companies, to expand its services in the country.

- September 2023 - SAS Institute Inc., collaborated with AstraZeneca, a global pharmaceutical company. The collaboration is aimed at increasing the company's clinical research innovation and driving automation for the delivery of statistical analysis via the SAS Life Science Analytics Framework and SAS Viya.

- August 2023 – Veeva Systems Inc., announced the first customer win for its VaultCRM, the next generation of CRM for the life science industry. The company had its first customer win with an innovative oncology biotech company.

Facts and Figures

In 2024, North America held 42.8% of the global market.

Based on type, the services segment dominated the global market.

The clinical research analytics segment is expected to register a CAGR of 11.4% during the forecast period.

The market is poised for substantial growth, owing to the rising technological innovations and an increasing focus on data-driven decision-making in healthcare. While challenges such as data integration and regulatory compliance persist, ongoing advancements and strategic collaborations are expected to address these issues, paving the way for a more efficient and effective life sciences industry.

REPORT COVERAGE

The global market report covers an overview and a detailed analysis of the market. It focuses on key aspects such as competitive landscape and market analysis on the basis of type, delivery, application, end users, and region. Besides this, it offers insights into the market drivers, market trends, market dynamics, COVID-19 impact on the market, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.45% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Delivery

|

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 15 billion in 2026 and is projected to reach USD 35.7 billion by 2034.

In 2025, the North America market value stood at USD 5.97 billion.

The market is expected to exhibit steady growth at a CAGR of 11.45% during the forecast period.

Based on application, the clinical research analytics segment dominated the market in 2024.

Increasing use of analytical solutions for comprehensive and flexible research study is the key driving factor.

SAS Institute Inc., Accenture, and Veeva Systems are some of the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us